As the manic rhythm of the ASX begins to settle into its annual summer slumber, it’s a good time to step back from the screens and recharge our batteries.

To that end, we’ll be taking a short break from our regular weekly correspondence over the coming weeks as we look to refresh and prepare for the year ahead. While the emails will pause, the platform itself remains very much alive for those who find their best ideas during the quietude of the holidays (or for those who simply wish to share a funny meme or two).

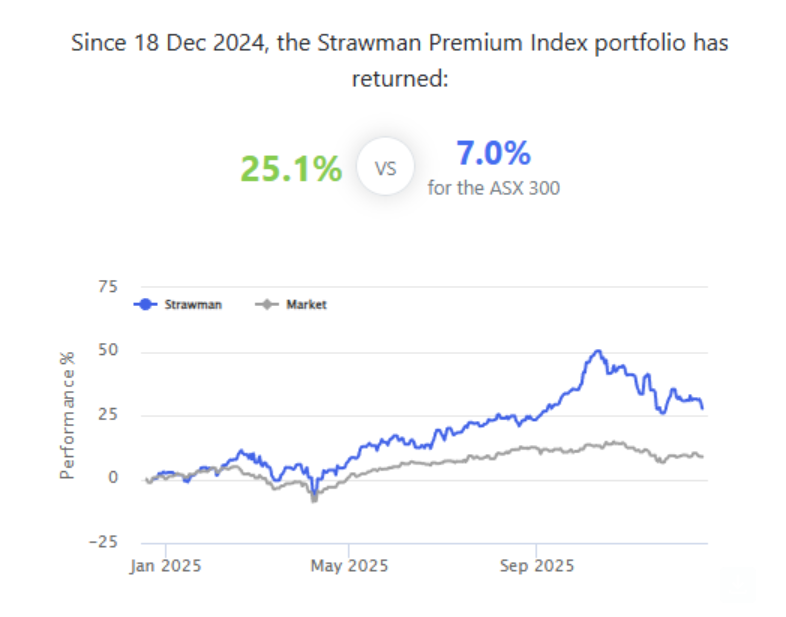

Looking back over 2025, it is worth pausing to acknowledge the remarkable success achieved by our rag-tag band of capital allocators. Although the year is not technically over just yet, the scorecard reveals the immense value of disciplined, independent thinking.

While the broader market has managed a respectable return of approximately 7% year to date, the Strawman index has significantly outpaced it, sitting on a decidedly tidy 25% return.

It’s a result that deserves a collective pat on the back, even if we need to approach it with a degree of humility. Things wont always be so rosy. The market is extremely good at humbling us investors after a good run, regressing to the mean just when we feel most confident.

Still, you’ve got to celebrate the good times when they arrive. Especially when they result form a commitment to sensible process, discipline and hard work. Even if there’s always a degree of luck involved too.

Our outperformance in 2025 was anchored by some truly exceptional individual business stories that our community identified and backed. Stealth Group (ASX:SGI) led the charge with a staggering gain of approximately 200%, serving as a potent reminder of what can happen when a small-cap business begins to find its operating leverage and the market finally wakes up to its potential.

We also saw strong contributions from Energy One (ASX:EOL) which rose 148%, Codan (ASX:CDA) which gained 72% and Smart Parking (ASX:SPZ) which delivered a solid 39% return. These are the kinds of stocks that rarely get a mention in the mainstream financial press, but that tend to put most of the ‘blue chip’ names to shame.

Finding such hidden gems requires the ability to look beyond headline metrics and market prices to understand the underlying “engine” of a business. We strive for this through our regular CEO meetings, which provide first-hand insight into the leadership and human capital that drive long-term value. When you combine this field research with the collective expertise of our brain trust, it creates what feels like an almost unfair edge.

As we look toward 2026, our focus remains unchanged. We have no desire to pivot toward the latest financial fads or to chase momentum. Instead, we plan to stay firmly within our circle of competence, fostering a space where investors can share insights, challenge each other’s perspectives, and grow together. The goal remains to compound our capital at above-market rates, but to do so with humility and a commitment to lifelong learning.

Indeed, while the prudent management and growth of our portfolios is our primary focus, it is worth remembering that money is merely a tool to facilitate a well-lived life. True wealth is a far more expansive and nuanced concept than numbers on a screen; it is found in the time we spend with family, the strength of our friendships, and the pursuit of meaningful work and personal happiness.

The philosopher Henry David Thoreau put it well when he remarked that wealth is the ability to fully experience life. If our portfolios grow but our ability to enjoy the world around us shrinks, we have not truly prospered.

To that end, as you enjoy the holidays, I wish you and your family not just continued prosperity, but more importantly, the good health and peace of mind to enjoy the fruits of your labor.

We look forward to returning in the new year to continue this journey of compounding both our capital and our collective wisdom.

Until then, stay safe, stay curious, and happy investing.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2025 Strawman Pty Ltd. All rights reserved.