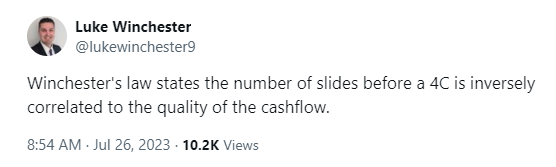

I was fortunate enough to join Luke Winchester (aka Wini) from Merewether Capital on Ausbiz last week, and he made a rather good point.

Well, he made many, but the following stood out to me. To paraphrase:

“If you can’t easily figure out exactly what a business does, it’s usually best to move on.”

It’s a good heuristic. Right up there with this other nugget of wisdom:

Luke’s not saying that a difficult-to-understand business can’t be a good investment, but it does add an extra layer of complexity for investors. And in this game, you don’t get any extra points for the degree of difficulty.

Indeed, it just ups the odds of making a (potentially costly) mistake.

It’s not just complexity alone per se; that at least can be mitigated to a good extent if you’re willing to dig into the weeds. The more worrying element is when the communication from management is vague, full of jargon and tries to hitch itself to whatever the current ‘hot thing’ is.

If that’s the case, it could just be an affinity gambit whereby the company tries to ride the coattails of whatever is in vogue. At the moment, that is most certainly A.I. Before that it was ‘blockchain’, SaaS, IoT etc. Sure, there is often legitimacy to these technologies, but the real question is whether or not the company can leverage it for its own unique advantage.

If not, it should raise some red flags. It may be that management is simply trying to obfuscate the fact they don’t really have any genuine competitive edge, or worse, no real business at all.

That’s why it’s always important to get at least some validation in the form of sales traction — ideally that which isn’t just bought with excessive, poor return marketing. (I bet I could sell loads of Strawman Subscriptions if every new subscriber got a Lamborghini!)

This all probably sounds fairly obvious, but the truth is that there are plenty of companies that have a sexy story and the potential for greatness. It’s kind of a must have if ever you’re going to manage an ASX listing. And deep down we want to believe in the story.

I’m sure all of us have been lured by the siren song of a silver tongued executive promising big things.

But if you can’t quickly get at exactly what the business is about — if you couldn’t easily explain the core idea to a 12 year old — it may be wise to pass.

Or, as Luke might say, a business unclear is one to steer clear.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2024 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211