Shares in knowledge management software provider Knosys (ASX:KNO) have enjoyed a strong rally lately; climbing over 50% in the past three months alone. Importantly, this gain has been driven by an ongoing improvement in business fundamentals.

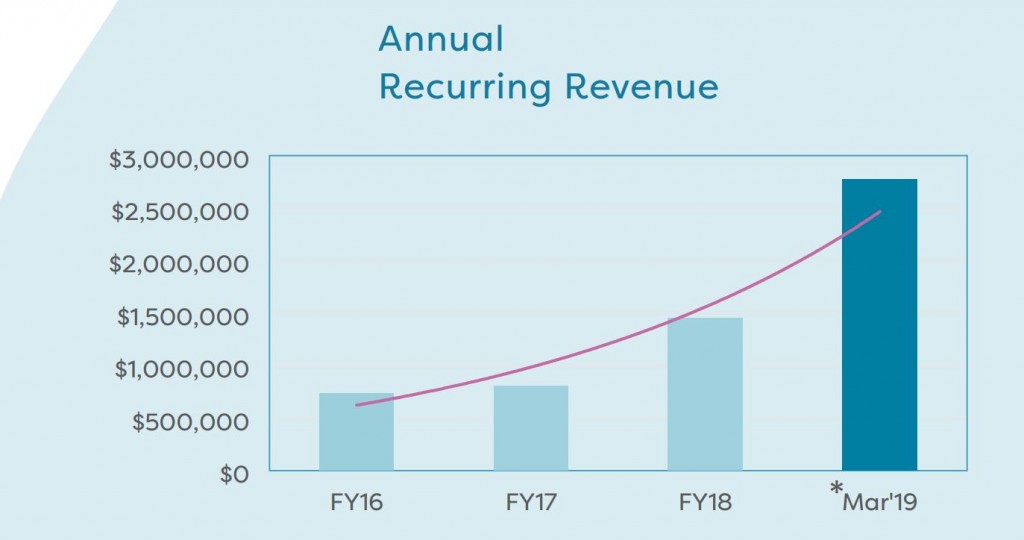

The latest quarterly from Knosys revealed a significant jump in annualised recurring revenue, with total licenses on issue having almost doubled in the past 12 months. The business was also cash flow positive for the latest quarter and retains over $3m of cash in the bank.

What does the company do?

Knosys provides software that collates information from a variety of legacy systems within an organisation, improving productivity and customer experience by providing users a single “source of truth”. Its core product, KnowledgeIQ, and more recently, KIQ Cloud, is applicable to all types of organisations and employs machine learning to help structure and deliver relevant content to users.

Listed in 2015, Knosys has consistently grown revenue over the years and is chasing a $3.8 billion market opportunity. It includes Optus and ANZ bank as its customers.

Is it worth buying?

Trading on just 2.7x sales, Knosys is relatively cheap when compared with many other ASX-listed SaaS companies. Then again, it is still unprofitable and with a market capitalisation of ~$11m it is a relative minnow.

Nevertheless, the business seems to have good traction, important reference clients, and was recently approved to sell cloud services to NSW and Federal Government agencies.

Supporters on Strawman consider shares undervalued…

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223

enabling employees to access