As investors cotton on to the generally positive movements in the uranium price, the outlook for uranium explorers and producers is also improving.

GTi Resources (ASX: GTR) first came to investors’ attention in April this year, following the announcement that it was in possession of a number of past producing uranium and vanadium properties located in Utah, USA and would start its maiden drill program at the highly prospective Jeffrey Project.

In March/April, this company was an unknown microcap stock priced below 1c, but with momentum in the story over May, the company’s share price ran to over 5 cents.

It has since retreated to 2.7 cents. However the company’s project is more advanced than back in May and could now be on the cusp of a potential re-rate on the back of drill results which are just days away.

A significant drill hit could send GTi Resources on a swift upward trajectory again, proving that it pays to be an early mover in a burgeoning sector.

GTi Resources was the first of the ASX explorers to make this kind of move in this sector in the US. As such, the company is in the enviable position of already having conducted a drill campaign, with investors now waiting on drill results.

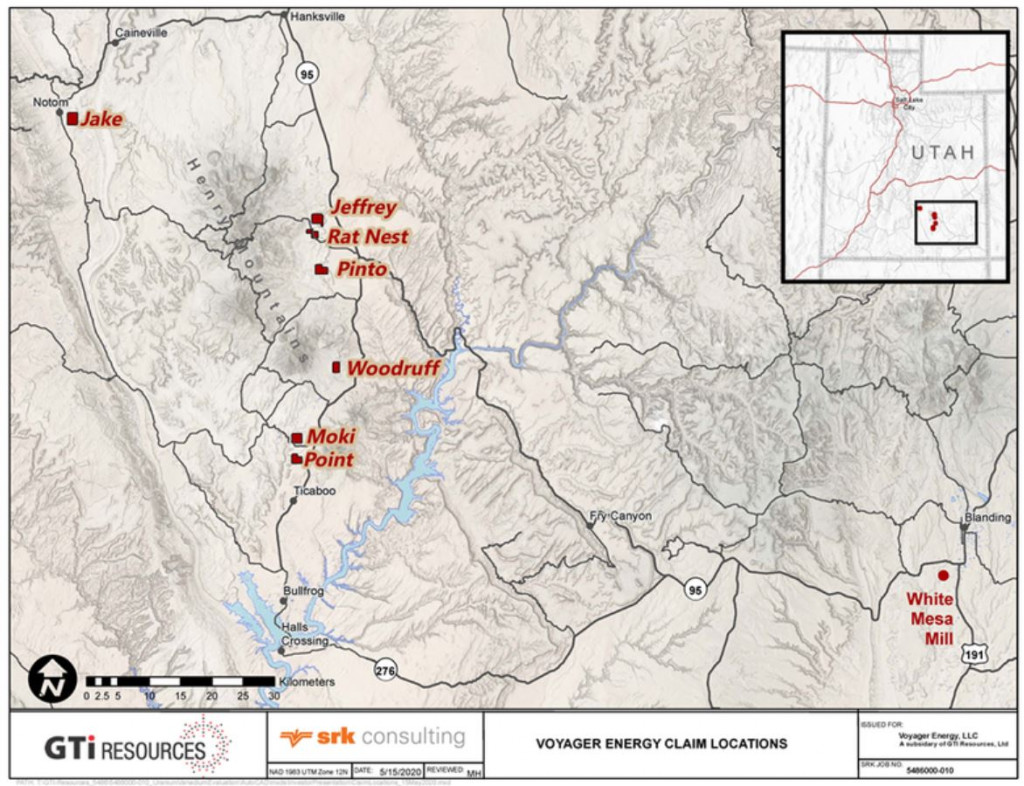

GTi Resources’ properties are located close to a major highway, grid power and local skilled workforce. Most importantly, it is also within trucking distance to a fully permitted and operational uranium/vanadium processing mill owned and operated by the ~ CA$250m market capped Energy Fuels (TSE: EFR). Known as the White Mesa mill, this is the only operating conventional uranium and vanadium mill in the US.

The Properties cover ~1,500 hectares of the Henry Mountains region, a historically highly prolific region, which has, in the past, provided the most important uranium resources in the USA. It forms part of the prolific Colorado Plateau uranium province.

Milestones on track

True to its nature of staying ahead of the uranium exploration pack, this week GTi Resources announced it had completed its maiden drill program on schedule at the Jeffrey Project, with the company successfully achieving the drilling and down-hole gamma logging of the targeted 12 diamond core drill holes to test the extent of shallow uranium and vanadium mineralisation across the southern portion of the Jeffrey Project.

The first set of eU3O8 downhole gamma assay results from the maiden drilling program are expected within 10 days, with drill core analysis results to follow by mid-August.

This has been a much-anticipated exploration program, highlighted by the seven-fold increase in the company’s share price over the last three months. Given the shallow nature of the mineralised horizon, a total of 182 metres of core drilling was sufficient to gather a meaningful data set.

In addition to the 12 new drill holes, a further 6 historical drill holes were located near the newly drilled holes and subsequently logged with a downhole gamma probe. The recent exploration work including the new drilling has quickly yielded data from 44 drill holes, including data from previous drilling, and this will be utilised to inform GTi Resources’ understanding of the mineralisation and to guide the next phase of exploration.

The next exploration phase may entail a much larger drill program, targeting potential development of a JORC code compliant Mineral Resource, ultimately guiding future production studies.

The shallow nature of the mineralisation allows for relatively low-cost rapid exploration.

GTi Resources is moving to rapidly advance its projects in Utah given the potential to supply high-grade uranium ore to help fill existing local mill processing capacity.

Management is also actively looking for value accretive opportunities to expand its US project portfolio in this space.

The macro thematic

The uranium investment thematic centres around the extent of the collapse in uranium production and exploration in the US, contrasted with the very strong signals the US Government is putting out around the importance of the uranium mining industry.

The US is the world’s largest consumer of uranium, requiring over 48 mlbs per annum.

Nuclear power is intrinsically tied to US national security, and the Federal Government has stated that it will take bold action to revive and strengthen the uranium mining industry.

GTi Resources picked its uranium/vanadium ground next to a producing mill fully aware that the US market has strong demand and no supply.

It was inevitable the country would have to act on this imbalance and recently the US sounded its intention to once again become a world power in nuclear energy.

This comes at a time when, up until recently, the uranium spot price has been on the rise; note activity in the sector is still ramping up.

Twenty new nuclear reactors are scheduled to come online and over ten reactors are expected to be constructed per year between 2020 and 2030.

Looking globally, substantial ongoing supply disruptions from large global producers including Cameco (Canada) and Kazatomprom (Kazakhstan) in 2020 are expected to accelerate demand.

As an early mover small cap stock in this sector, GTi Resources could be well placed in this supply/demand equation.

Disclaimer– This content was produced and paid for by StocksDigital. The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

© 2020 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211