The iSignthis (ASX:ISX) share price reached an all time high of $0.615 during the day, before closing at $0.57. This represents an increase of over 275% in 2019 alone. What is driving iSignthis’ amazing run, and is it too late to get a piece of the action?

What does iSignthis do?

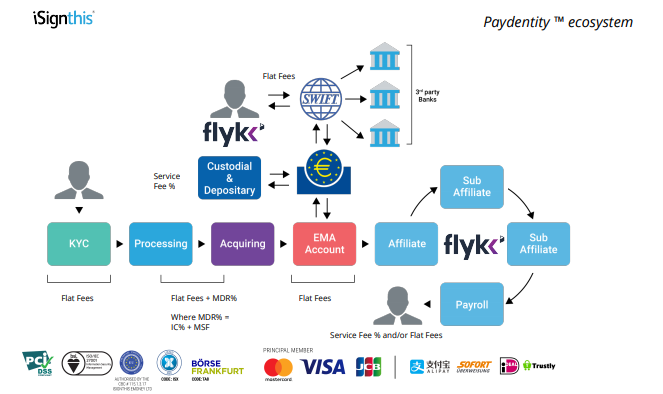

Founded in 2013, iSignthis is a leading software company in online, dynamic verification of identity, authentication of financial transactions and payments. iSignthis provides an end-to-end on-boarding service for merchants, including a unified payment and identity service via their PaydentityTM and ISXPay® solutions.

Strong Progress in FY19

In May 2019, iSignthis announced several significant developments for the organisation, driving the share price higher and higher. This included:

- 1 May – Expansion of executive team. iSignthis indicated it is seeking a new CFO, in line with the company’s plan to commence ‘banking business’ in Australia, subject to their ADI license being finalised by APRA.

- 14 May – Break even run rate achieved. iSignthis announced that it has now achieved a ‘break even’ position on a weekly cash run rate basis, with gross profits (on the basis of cash receipts) now exceeding group operating costs. The company’s Gross profit contribution from its current onboarded merchants(MSF) now exceeds the associated $8.75 million annualised operating cost base.

- 17 May – FY19 guidance reiterated. At its AGM presentation iSignthis highlighted the fact that they are currently the only neobank offering payments, eMoney deposit taking and identity verification across multiple jurisdictions. The company also reiterated its FY19 guidance, targeting an EBIT of $10.7 million. In Q1 2019, revenue totalled $1.85 million (up 78% from Q4 2018), while Cash Receipts totalled $1.4 million (up 55% from Q4 2018). Further iSignthis also confirmed it is already a principal member of Visa, Mastercard, JCB, CUP/UPI, AMEX, Diners Club and Discover, and has a range of bank-to-bank capabilities including SWIFT, SEPA CT/DD/B2B/instant, EFT and BPAY.

Could iSignthis be the next big thing?

Given that iSignthis is performing many banking functions like PayPal, understandably many investors are making comparisons between iSignthis and Paypal. Will iSignthis follow a similar price trajectory as Paypal? Should I invest now before it takes off?

The Strawman consensus valuation currently sees the stock as overvalued. Click the button below to see what the Strawman community is saying about this stock:

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223