Shares in tech-darling Nearmap (ASX:NEA) have dropped by more than 10% in morning trade despite revealing a 45% jump in revenue to $77.6 million.

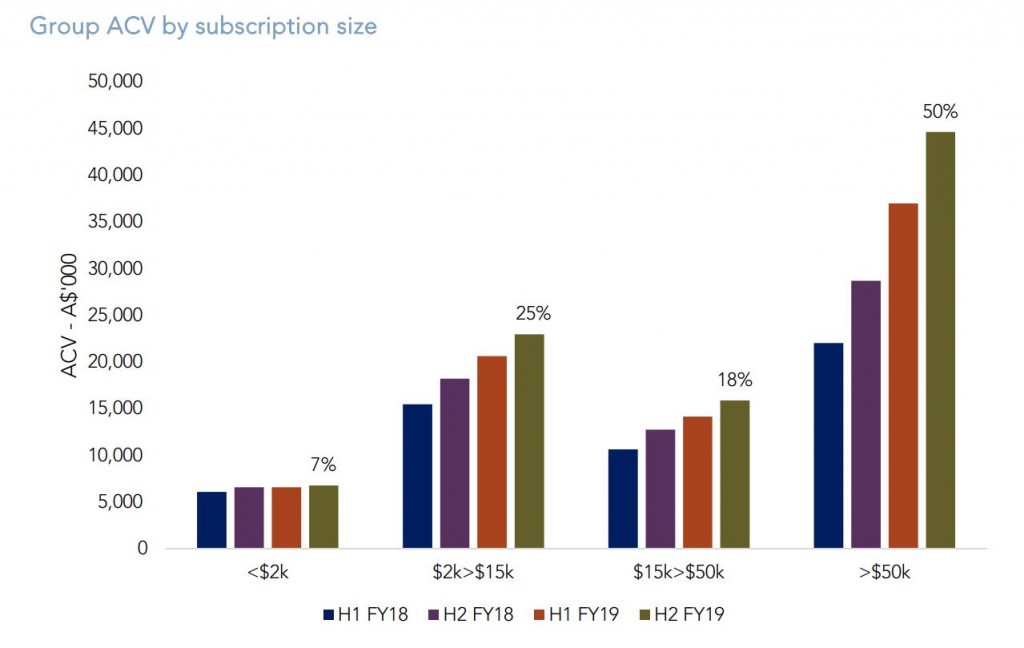

Indeed, the aerial imaging company revealed a slew of positive numbers including a record jump in annualised contract value (ACV), which rose by $24 million, or 36%, to $90.2 million. This all important metric, which indicates the forward value of high margin recurring revenue, was largely driven by a 76% improvement in the North American market. That being said, the more established local segment, which represents close to two-thirds of forward sales, continues to power ahead with ACV growing by 19%.

Meanwhile, the rate of churn among the client base saw solid improvements across the business, with the North American segment revealing a halving in last year’s rate to just 4.4%.

Importantly, Nearmap met guidance for cash-flow breakeven, with the core cash balance (excluding proceeds of the capital raise) growing by $0.3 million to $17.8 million. Combined with the cash from September’s raise, Nearmap now has a total balance of $75.9 million and zero debt.

Of course, Nearmap is still a loss making operation on a statutory basis, largely due to increased depreciation and amortisation costs. Indeed, the statutory net loss increased from -$11 million to over -$14.9 million in FY2019. Although D&A costs are non-cash, they are nevertheless very real and result from the capitalisation of expenses in prior years.

Looking ahead, CEO Robert Newman didn’t provide any specific guidance, other than to say “Nearmap remains well positioned to expand its growth”. With shares now trading on a price to sales ratio of over 15 times, it really needs to be.

Still, Nearmap has a large addressable market in which it appears to be the leader. The business has the potential to scale well with the existing cost base able to sustain a much higher level of sales. Furthermore, it has a large and fast growing level of recurring revenue, loads of cash and a variety of new product offerings in the works.

Ranked #6 on Strawman, it remains below the consensus community valuation. Click below to learn more…

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223