Pushpay (ASX:PPH), a developer of a payments platform for the faith sector, has delivered an impressive result for half year ending September 2019. Let us count the ways.

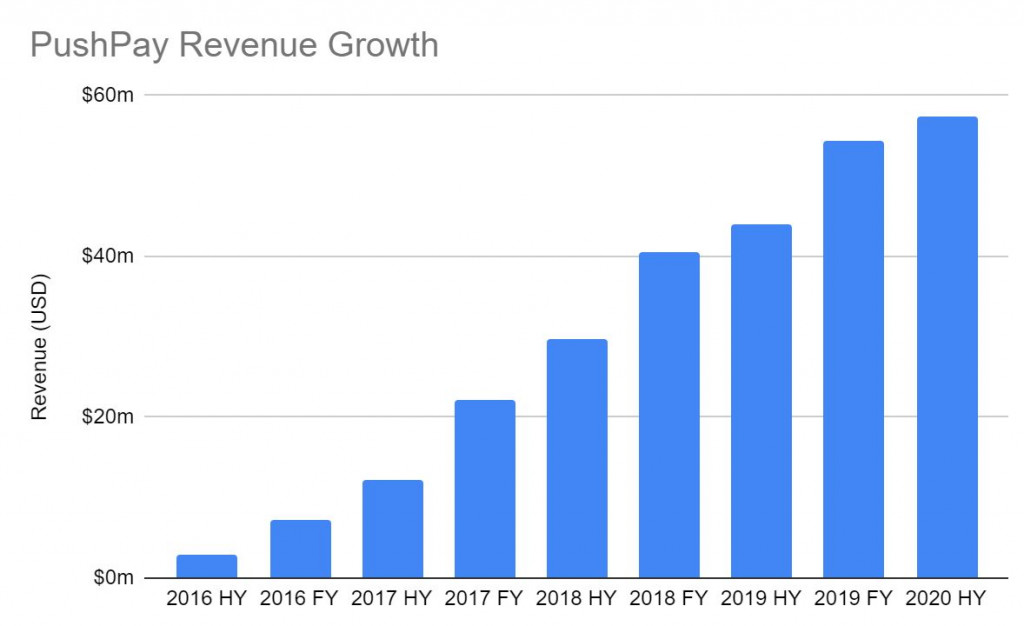

Revenue increased 30% to US$57.4 million, underpinned by 6.5% rise in customer numbers, a 45% lift in processing volume and a 20% increase in average spend per customer. Although the pace of revenue growth is slowing as the business increases in size (it’s far easier to grow off a small base!), Pushpay has carved out an enviable track record of top-line growth.

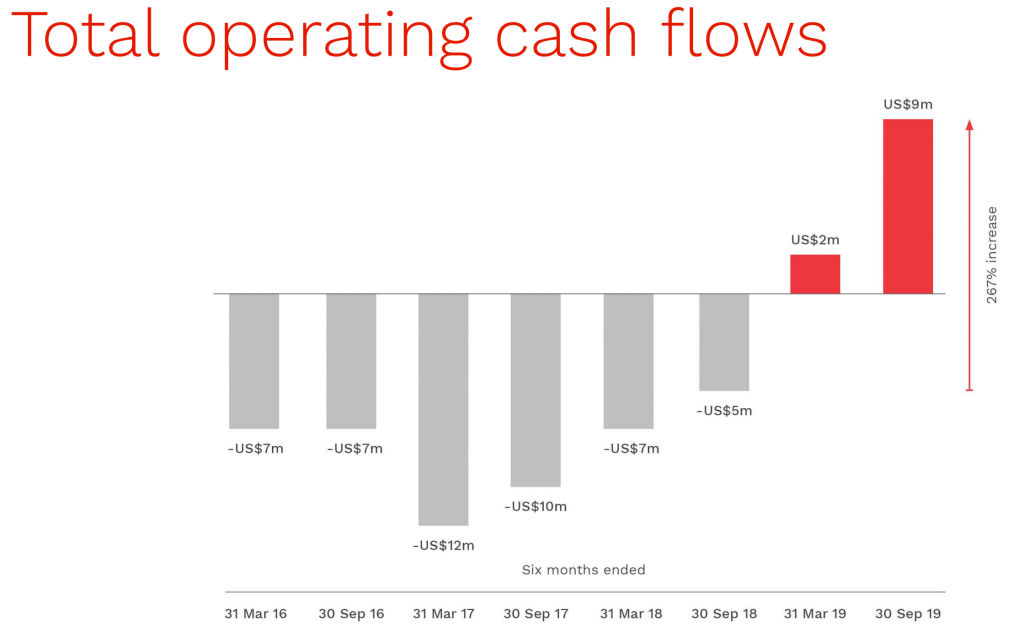

With the business having now pivoted passed break-even, the improvement to the bottom line is especially noteworthy.

Net profit after tax came in US$10.9 million higher at US$6.5 million for the half year. Importantly, that was aided by an increase in the group’s gross margin (from 57% to 65%) and a 2% decrease in operating expense.

This is how you scale.

For the six months through to the end of September, Pushpay reported US$8.9 million dollars in operating cash flows. With US$22.9 million of cash and term deposits and zero debt, the balance sheet is in rude good health — especially given revenue retention remains above 100%. This also gives Pushpay a good degree of optionality in terms of investment and acquisition potential.

For the full year, Pushpay has reiterated guidance for a ~25% lift in operating revenue to between US$121 – US$124 million. After already raising its forecast for operating profit (EBITDAF) twice in the past six months, the company has reiterated guidance for between US$23 – US$25 million in EBITDAF. That compares to just US$1.6 million in FY19, and gives another reminder of the operating leverage potential.

Based on this guidance, shares in Pushpay are presently trading on a forward price to sales ratio of ~4.7. The forward PE is likely ~38 times. For a business that is exhibiting such strong growth, and has a long term revenue target of US$1 billion, that current price seems undemanding — especially when viewed in the context of other ASX-listed tech companies.

It is perhaps a slowdown in customer acquisition that has dampened market enthusiasm in recent times. Nevertheless, according to the Strawman community, the value proposition remains compelling and shares remain below the consensus valuation.

Click below to see why Pushpay is the #1 ranked stock on Strawman.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223