It’s remarkable how many sacred cows there are in economics. Concepts that are, for some reason, beyond scrutiny.

But dig beneath the surface, and you start to see how absurd many ‘fundamental’ concepts are. Which is a worry when you consider many form the basis of a lot of important policy decisions.

Take GDP for example, which measures the total monetary value of goods and services produced within a country’s borders over a set period of time. The bigger the number, the richer the country, right?

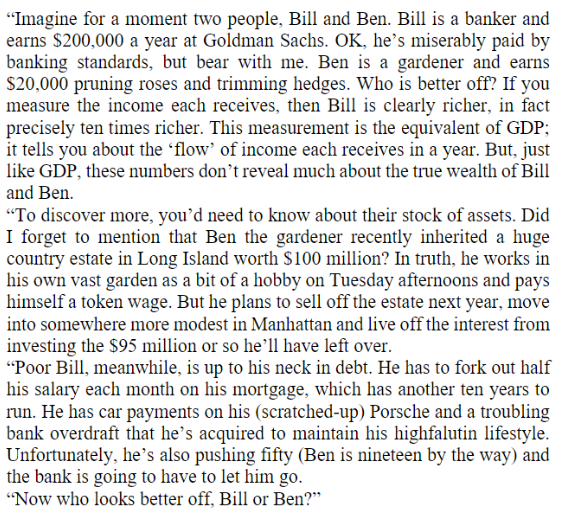

In The Growth Illusion, author David Pilling provides this metaphor:

GDP measures ‘flow’ and ignores ‘stock’.

Indeed, it ignores the depletion of various forms of capital, including social, cultural, and environmental capital. The blind pursuit of GDP growth has led to the strip-mining of these precious resources, eroding the foundation upon which true economic prosperity is built.

It also fails to distinguish between productive and unproductive economic activities. For instance, the cost of cleaning up environmental damage or rebuilding after a natural disaster is included in GDP calculations, as it involves economic transactions. However, these activities do not represent genuine economic progress or an improvement in people’s lives.

If you think otherwise, why not go through town and break every window you see? You’ll be helping the economy!

Another limitation of GDP is that it does not consider the distribution of wealth and income within a society. A country with a high GDP may appear prosperous, but if the wealth is concentrated in the hands of a few, while the majority struggle to make ends meet, it hardly represents a successful economy. I’d point to the USA as a prime example, where ‘middle’ America continues to go backwards while the rich continue to get richer. Frankly, we seem to be going in the same direction here.

None of this is to say that GDP is a useless metric. But there’s no way it deserves the myopic focus it receives. And it shouldn’t automatically be equated with economic well being — especially when viewed over long periods of time.

Consider this: (inflation adjusted) GDP per capita in Indonesia today is the same as it was for Americans in the early part of last century. Would you rather live in Jakarta today, or in the US before there were antibiotics and electricity?

Measuring the health of the economy using GDP is like evaluating a company purely on the basis of its revenue. Anyone who did that would conclude that AMP was a far superior company than ProMedicus — the revenues are 10x bigger after all! The only problem is that AMP has destroyed 80% of shareholder wealth over the last decade, while ProMedicus has delivered a >100x return.

You may contend that it’s more about the growth than the absolute number that matters, but if that were the case Dubber (whose revenues grew 20x between 2018-2023) would have been far superior to poor old ProMedicus, whose top-line expanded by only 3.5 times over the same period.

The point is that whether you’re looking at an individual company or an entire economy, you need to take a holistic approach. And never be afraid to question established ‘facts’ — especially when it comes to finance and economics.

“By doubting we are led to question, by questioning we arrive at the truth.” – Peter Abelard

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2024 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211