There’s an old (and quite unscientific) investment principle called the ‘rule of five‘ which states that for every five stocks in your portfolio, one will significantly outperform the market, three will more or less match it, and one will…well, it’ll suck. Badly.

Overall, that makes the whole business of portfolio management seem rather futile. If the end result is pretty much a wash, why not just buy an index fund and be done with it? Frankly, that’s not a terrible conclusion for most investors.

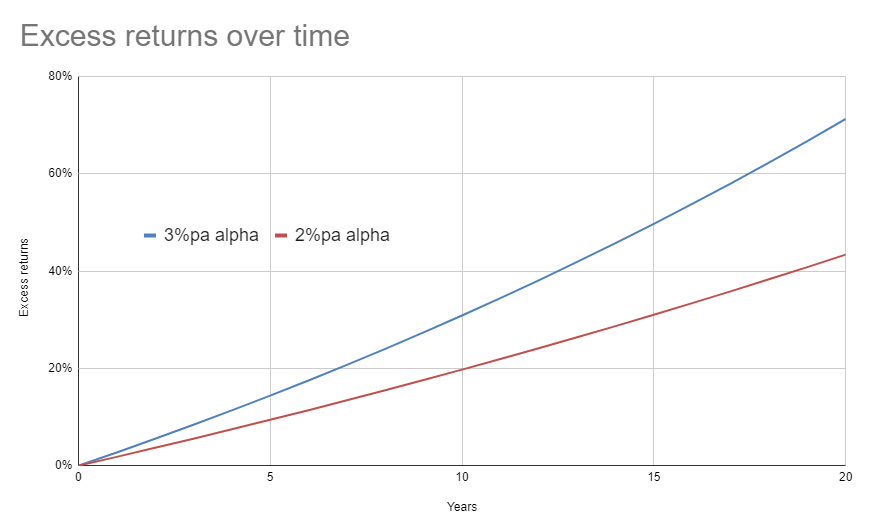

Still, we also know that it only takes a seemingly small average annual outperformance to make a giant difference over time. If you can score a compound annual growth rate of 12%, you’re portfolio will be 20% larger after a decade than someone who manages 10%pa.

If you do 13%pa over ten years, you’re 30% better off.

That’s why we do what we do!

In trying to gain that edge, investors spend most of their time trying to find that king maker that’s going to go to the moon. And why not? The thrill of the hunt is what keeps us stock pickers going.

But the symmetry of the rule of five tells us that we can just as effectively boost our average returns and score that sweet, sweet alpha by finding and pruning those latent capital killers that lurk within our portfolios.

Take your own portfolio, over any period you like, and simply remove the worst performer. Or, sticking to our rule of five, take out the lower quintile of performers. The difference will be massive.

Now, of course, these dogs weren’t obvious in advance — otherwise you wouldn’t have bought them in the first place! But the point is that focusing on what you currently own, and not just on what you could own, can be an incredibly fruitful practice.

That’s why we must continually be looking to break our own ideas: better you find the flaws through objective introspection, than wait for the market to reveal them to you at a later point.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2023 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211