Valuation is — or at least should be — at the core of any investment decision. Without a general idea of what a stock is ‘really’ worth, how can you know if the market is offering you good value?

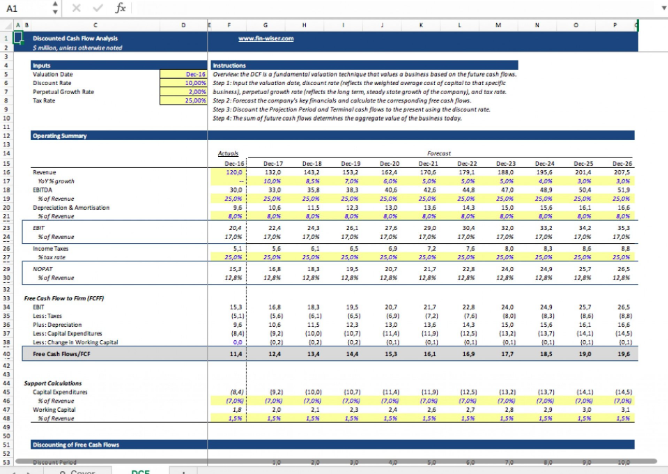

Defining the true, or intrinsic, value of a business is easy; it’s the discounted value of the cash that can be taken out of a business during its remaining life.

Makes sense, right? What I pay out today has to be less than what I’ll eventually back (or could get back), otherwise it’s a losing proposition. Of course, because there’s a risk I wont get the cash flows I expect, and because of things like inflation and opportunity cost, I probably want to ensure I get a lot more back than I put in.

So all you need to do is map out all of the free cash flows of a business from here until the end of days, discount it all back and then add it together — Viola! Just like that, you now know exactly what a company is really worth.

Well, at least in theory…

It’s an elegant and rational model, but it’s only as good as the assumptions you use. You may have a beautiful and detailed spreadsheet, but if you put garbage in, you’ll get garbage out.

Once you start playing around with these models you’ll also notice just how sensitive they are to seemingly small changes in your assumptions. If you have a bias — and we all do — it’s easy to push the valuation to where you want it to be.

Nevertheless, it’s a worthwhile process. Thinking through things like revenue growth, gross margins and fixed costs will help you get a good handle on the economic characteristics of the business.

It is, however, a daunting task. Especially if you’re just starting out. Fortunately there are a few shortcuts.

One classic approach is with the humble PE ratio. It’s crude, but when applied in the right context, it can be a powerful heuristic.

Another related technique, and one I’m quite fond of, is using an estimate of the earnings and PE of a business to calculate a target price, and then discounting that back to a present value.

It’s simply rearranging the equation PE = Price / Earnings.

For example, let’s say I assume a company will be generating 20c in per share profit in 5 years time. If the PE then is 20, the market price will be $4.00 (20 x $0.20). If I want a 10% average annual return, I just divide $4.00 by 1.1 five times.

By that rationale, I should be a happy buyer at any price at or below $2.48.

Needless to say, this is also only as good as the estimates you use — and here you’re also trying to guess the mood of the market years from now. But what I like about it, other than being super easy to apply, is that here you only need to guess two things. And if you assume modest market multiples, you don’t need to rely on a sunny market sentiment to drive returns.

Remember too that you don’t need to settle on a single valuation. You can test a a variety of different assumptions and then weight the outputs against your level of conviction. There’s a super simple Google sheet here that will do this for you. (Just go to ‘File’ > ‘Make a copy’ if you want to have a play with it.)

If income investing is more your thing, there’s a neat derivation of the discounted cash flow approach called the Gordon Growth model. Here, you add the current dividend yield to the average expected rate of dividend growth to work out your total return. EG. If a company is presently yielding 4%, and you expect dividends to grow at about 3% per year, your total return will be roughly 7% over the long term.

There are loads of other valuation approaches, of course. If you have a preferred approach, or know of some useful resources, be sure to share it on our forums. There’s already a good thread here, or you can just start a new one.

The key thing to remember is that the market is there to serve you, not to inform you. Armed with an independent, rational and conservative notion of value, you’ll make far better investment decisions.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2023 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211