@Tom73 that's a good paper - I've been working off older sources, but directionally, the % numbers are consistent with what I assume.

When you work through $CU6's portfolio, apply 1) the CoS's and 2) the timelines to revenue (also in that paper) and you start to model it, you will quickly see that $2.5bn of value is assuming quite a lot of future success.

While it is tempting to model the $CU6 multiple assets/trials as independent events, I don't think we can do that because the common platform means the drivers of success or failure are likely to have some level of correlation.

Modelling each trial as independent, you get quite a low CoF that all 7 assets in clinical development fail. That's probably what you need for $CU6 to go to $0. E.g., assuming 3 x Phase 3, 2 x Phase 2 and 2 x Phase 1, then the probability of all failing is in the ballpark (0.5x0.5x0.9x0.9x0.95x0.95) < 20%.

So, if I believe there is a c. 20% chance that $CU6 goes to zero, then I agree with @topowl, I'd probably only hold a 2% position, giving my risk appetite. This is my intention, once I have completed my review of everything that's readily available in the market, subject to valuation. (I hope your acquaintances understand the risk they are taking in having $CU6 as their only holding!)

But because the assets are not independent, but linked through the common platform, the chances of a total failure are higher, as each trial should not be considered as statistically indepedent. That's tougher to assess, because how do you even frame this? You have to make competely arbitrary assumptions on the conditional probabilities. Well, perhaps not arbitrary. For example, for safety, you can take a look at the information to date across all the clinical studies so far. (We've seen an example of this earlier this week, where the FDA have allowed $NEU's NNZ-2591 to have a less onerous safety protocol in Phase 3 due to the results from the multplie Phase 2 readouts for that drug.)

Equally, should the lead candidate advance positively through Phase 3, then that conditionality works in our favour, as the platform becomes de-risked. Success then becomes how many assets can be developed off the platform, and with what timeline. I think at that time, big pharma are most likely to make a move. The oncology leaders will - once the platform is de-risked - be better able to assess the potential for other indications than the market can. Because the platform is unqiue and radiopharmaceuticals are a relatively new area, then the assessment is hard even for the pharmaceutical companies. Furthermore, each will assess the attractiveness of $CU6 against it's own pipeline. And that's where you will find a lot of divergence in "willingness to pay up". Because the decision to allocate capital to acquire $CU6 is weighed up against the alternatives within their own pipelines.

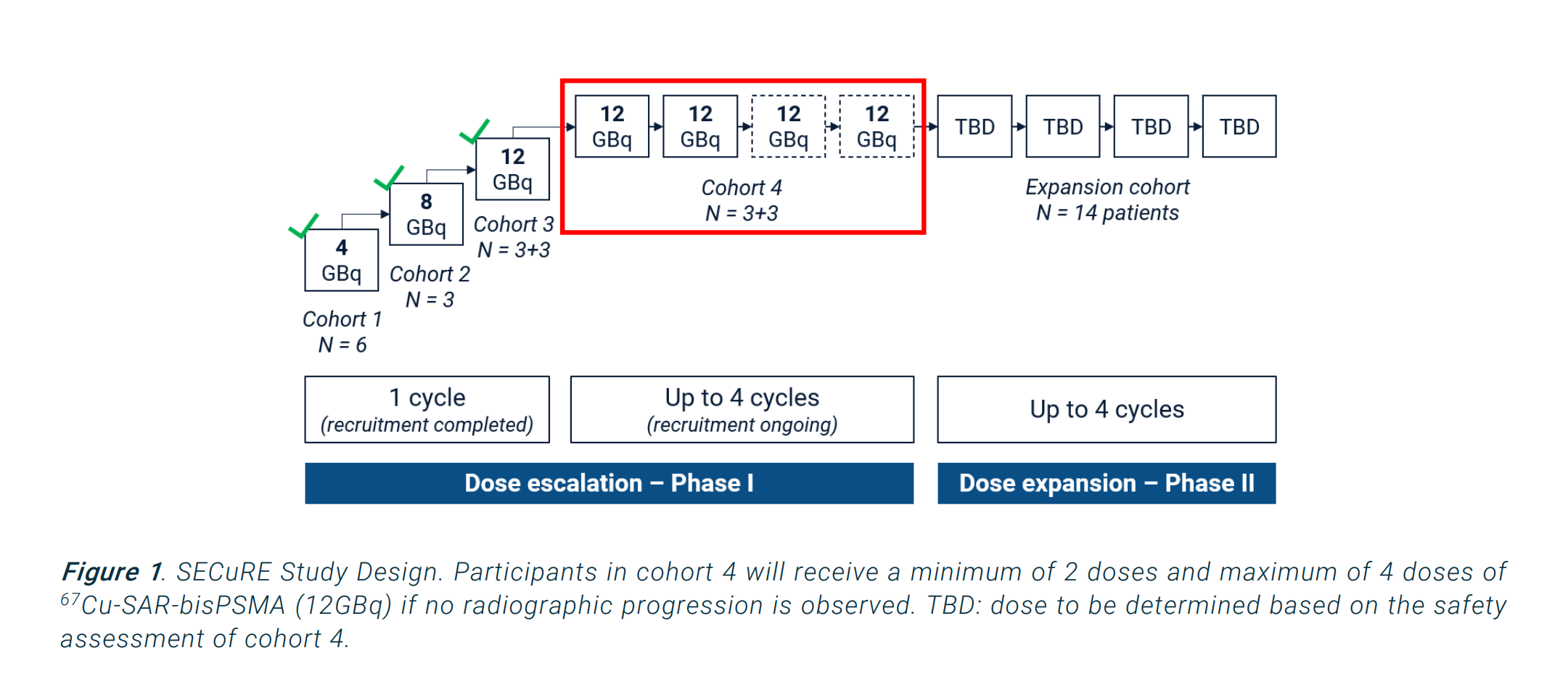

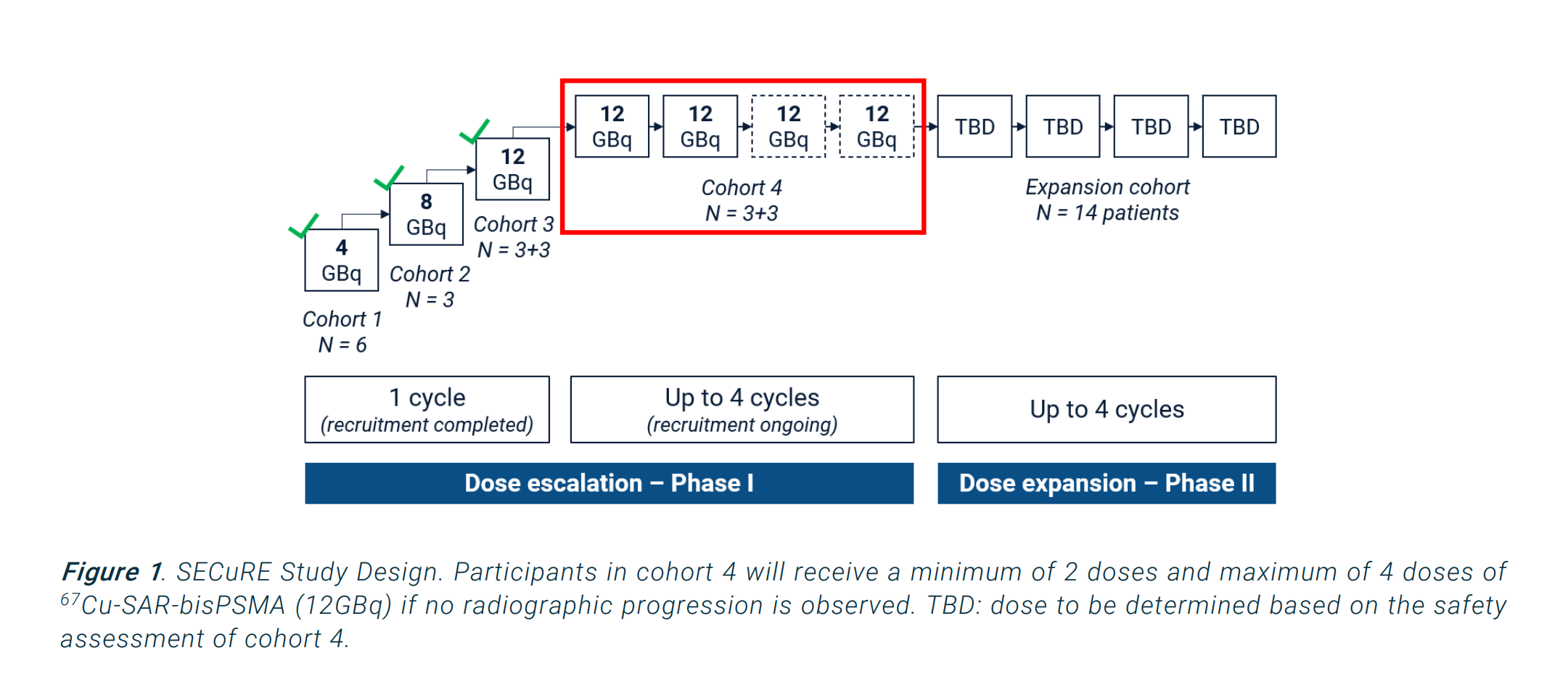

The fly in the ointment is SECURE, where the adaptive Phase 1/2a format (see below), with reporting of individual cohort and patient results, is providing a more dynamic flow of information than is often the case in clinical studies. If we continue to see positive results, with progressively lowering PSA through each of the 4 cycles for cohort 4 and for each patient, then I think you might reasonably model an improved chance of success for this asset. I'm watching this one very closely.

The reason for going into this detail, is to highlight that I wouldn't think of $CU6 as a 50:50 coin toss. It's chances of success are much better than that. (In this, I am talking about the chances of going to near zero, and not about today's valuation.)

Equally, developing a reasonable view of risk-reward is - for me at least - quite hard at this stage. Personally, I haven't yet found an edge or insight that is giving me the confidence that I normally require when investing in this space. By confidence, I don't mean a high CoS, but confidence that my analysis is reasonable,... that I am assessing the risk-reward correctly.