Nice update today.

Glad I topped up IRL yesterday at ~$4.58 as the price fell back into and successfully tested the now-strongish support zone of around $4.38-$4.75, which is also C79's 52-week lows. With no news driving the price falls to 52-week lows, it seemed like a good risk to take.

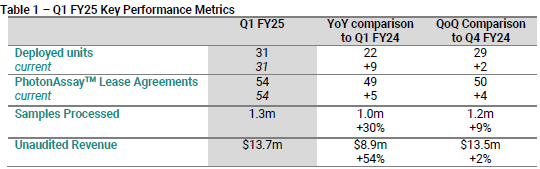

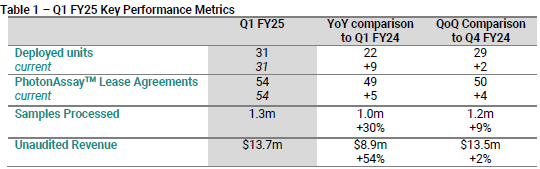

Big ticks this Quarter - (1) 4 new lease agreements signed (2) 2 units deployed (3) 9% uptick in sample volumes (4) 1st US-based installation, one more WIP in Alaska - all are signs of increasing technology penetration and global reach

Highlights

- Two units deployed during the Quarter, including the first unit at the Barrick-Newmont NGM complex, marking Chrysos’ first USA-based installation. A total of 31 units now deployed.

- Four new lease agreements signed during the Quarter comprising two new agreements with SGS in Africa and Australia, and two new agreements for deployment into African-based laboratories, bringing the total number of contracted units to 54.

- Unaudited Revenue of $13.7m, reflecting 2% growth Quarter-on-Quarter (QoQ) and 54% growth Year-on-Year (YoY).

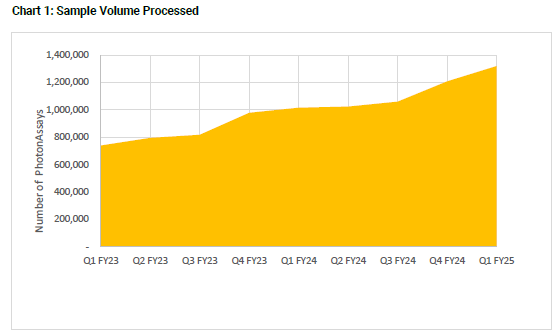

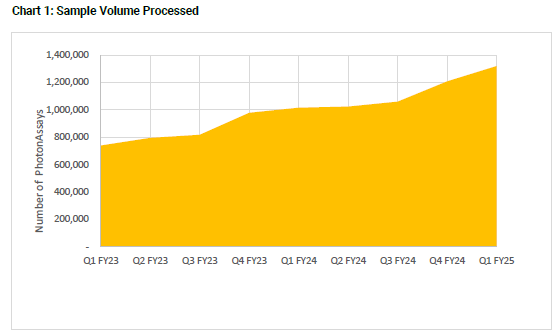

- Sample volumes totalled 1.3m, reflecting 9% growth QoQ and 30% growth YoY, with latent capacity available to capture industry cycle upturn.

- Well-funded to support continued PhotonAssayTM unit growth, with cash position of $47.5m as of 30 September 2024 and $95m in undrawn debt available.

- Continuing revenue growth, along with ongoing market penetration across key mining hubs, sees the business on track to achieve its FY25 guidance of $60-$70m of revenue and $9-$19m EBITDA

- 13 units ready to be shipped and installed in support of Chrysos’ FY25 deployment schedule, including two new units that passed factory acceptance testing during the Quarter.

Price Action

Price yesterday testing again the floor around ~$4.38, on no news, which is the 52-week low - now unjustifiably so given today’s update.