Pinned straw:

@Rick and @Jimmy there's no doubt the results are soft, but I also see this as a buying opportunity - and I'll explain why.

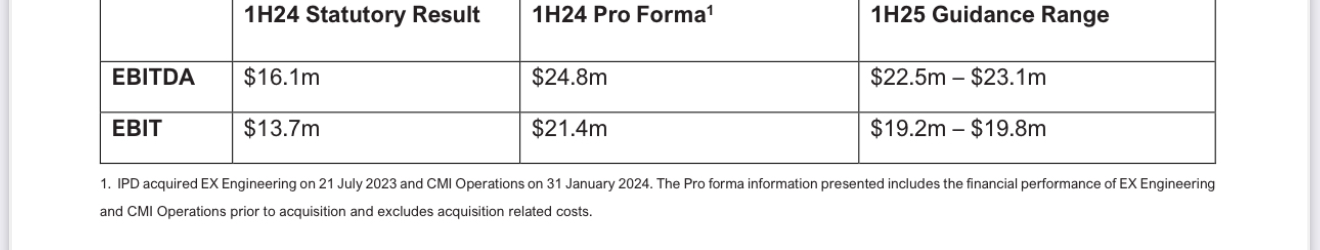

First, the numbers - against my model and guidance

We start with an ambiguous statement about revenue growth - is the growth referred to on a pro forma basis or against FY24?

Assumptions

- For now, I am going to complete my analysis on the basis that revenue in FY25 is flat to pro forma revenue in FY24, or $350.4m

- I'll also assume H2 and H1 are flat (generally, underlying growth and acquisitions, has meant that's not been true with H2>H1)

- I'll also take midpoint of guidance.

- Interest cost $2.5m

- Tax rate 30%

FY25 numbers based on these assumptions (margins in brackets)

- EBITDA: $45.6 (13.0% vs. 13.7% FY24 reported)

- EBIT: $39.0 (11.1% vs. 11.7% FY24 reported)

- NPAT: $25.6 (7.7% vs. 7.3% FY24 reported)

- EPS $0.25 vs. $0.22 FY24 reported

The FY24 Proforma Margins are: EBITDA (14.2%), EBIT (12.2%) and NPAT (8.4%) - so you can see the "margin compression" Michael is talking about.

Valuation

If I run a series of EPS growth scenarios for the next 3 years, discounted back to end of FY25, I get the following table for EOFY25 valuations:

Note: this is in the context of 3-yr EPS of 44% and 2-year of 30%.

In July, I put a tentative valuation on $IPG of $5.40. That was predicated on a better start for the IPG+CMI combination than we are seeing from today's guidance, but with a less rosey view on the P/E than based on history. (16 - 26; average about 20)

Some of my above assumptions are a bit conservative. So, for example, if Michael Sainsbury is to be taken at his word, then the larger-job-longer-duration order book should see a reversal of margin compression as well as revenue growth in H2.

What helps me square the circle is that with all his talk about margin compression, given the EBIT and EBITDA provided for H1, that means Revenue can't be that bad, otherwise its hard to get low revenue and compressed margins, and still hit the guidance values offered for EBIT and EBITDA.

On the range of values above, eps growth of 10% and a P/E of 16, would be a thesis breaker, and I believe $IPG will do a lot better than that. This is because we are currently in a cyclical low (see next section).

In fact, even with today's soggy guidance, I still see a valuation range that is comfortably $4.00 - $6.00. I can't tie it down more than that because not only do we have the muddy waters of the CMI acquisition, but now there's the added narrative of the changing structure of work from "daily trade to larger more complex orders". I'll really need to see the detail of the 1H results, and hopefully some guidance for the FY25, in February. For now, I'll update my SM valuation from $5.40 to $5.00 ($4.00-$6.00). Hence, I'm buying at $3.68,

I'll listen to the AGM tomorrow, to hear if there is some elaboration.

Why 1H FY25 should be expected to be soft

We know the commercial sector is soft, confirmed by the recent Bell Potter note "channel check".

I've also included some macro chart on Building Capex and Plant and Machinery Capex at the bottom of this strawm and for which we get the next numbers for Q3 on Thursday. You'd assume these won't be great the deeper we go into the restrictive period for interest rates. $IPG's spend is driven by commercial and industrial capex, after all.

So, What's Going on with the SP Reaction?

I think the SP response is an over-reaction. And my story goes like this.

First, I think some of the analysts have gotten a bit too excited about $IPG. Just look at the upgrades below. The most recent upgrades were not justified on a value basis (in my view), because a lot of the growth has been inorganic. I've also noticed several brokers pumping $IPG to investors over the last 6-12 months, and they've been using these inflationed valuations to do this [Average $5.89 ($5.76, $6.20; n=4].

Despite being pumped by these brokers, we've seen the SP trading sideways, and I hypothsise that there has been a rotation on the share register, with holders from IPO who have done 4-5x being replaced by new investors who (like me) buy the "electrification of everything" narrative.

I believe the fundamentals of the soft FY25 have already been captured in the 20% SP decline since the FY24 results and, that today's open, was probably a fair reflection of value, taking a bearish near term outlook.

So, why the 12% step-down (at time of writing) - I think we're maybe shaking out more IPO holders now rueing that they didn't get out at $5, added to low conviction newbies, and now add to that the momentum investors as $IPG is flashing "SELL" on pretty much all the technical indicators.

So, for me, that's a BUY, which is what I've been doing.

Disc: Held in RL (even more) and SM

--------------------------------------------------

Some Macro Charts - Data Update for Q3 on Thursday!