The market has reacted very negatively to IPD Group’s Earnings guidance today, down over 11%. Is this an overreaction, or is it warranted?

1H25 EBIT guidance is $19.2 million to $19.8 million, mid-point $19.5 million. Assuming a 30% tax rate, that’s $13.6 million net profit before interest. Assuming 2H is similar that’s about $25 million before interest for FY25 which is a miss on analyst expectations of c. $30 million.

CEO, Michael Sainsbury, said margins will be impacted in 1HFY25.

What do others think?

Not held.

ASX Announcement

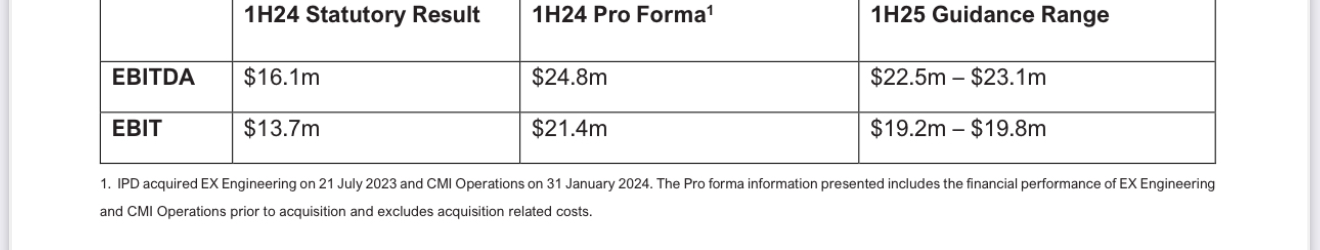

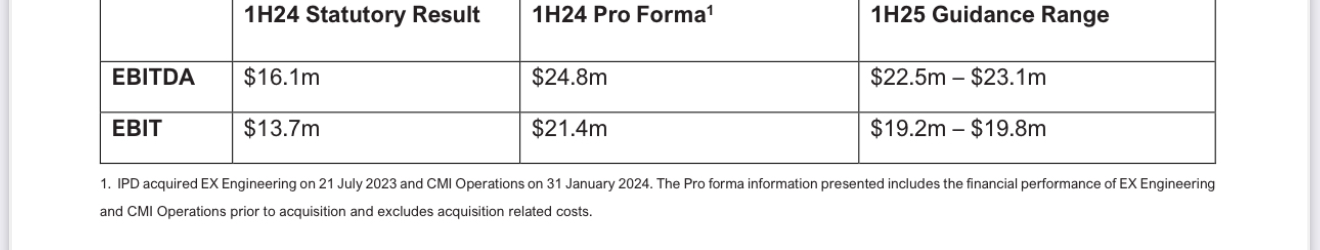

Based on unaudited results for the 4 months ending October 2024, and management forecasts for November and December, the Company provides the following earnings guidance range for 1H25:

The Company also notes that:

• Revenue for 1H25 is forecast to exceed the pcp (Pro Forma);

• Average monthly orders received has grown 39% in Jul-Oct 2024 Vs 1H24 (Pro Forma); and

• Order Backlog (as at end October 2024) has grown to $93.1m, a 50% increase on the pcp (Pro Forma).

Michael Sainsbury, IPD Group Limited CEO, said: “We are pleased to remain on track to deliver another half of revenue growth in a challenging environment. Amidst the wider macroeconomic challenges in the commercial construction sector, we have seen our order book transition from daily trade to larger and more complex orders, which typically have longer lead times and less certainty around delivery timing. This has resulted in a proportion of orders that would previously have already become invoiced Revenue now sitting in our Order Backlog. We have made additional investments into our operating cost base to generate and deliver these additional orders, which will impact margins for 1HFY25. Our operating cost base however is well placed to service future growth. We remain excited by IPD’s ongoing evolution and the continued improvements to our overall value proposition and look forward to providing more details around today’s update at the Company’s AGM on Tuesday, 26 November 2024.”