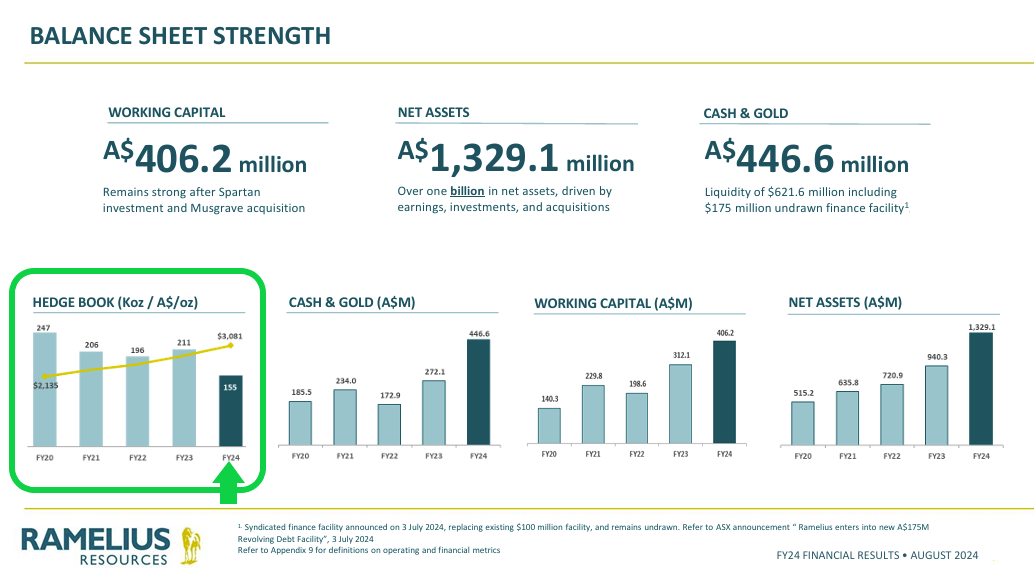

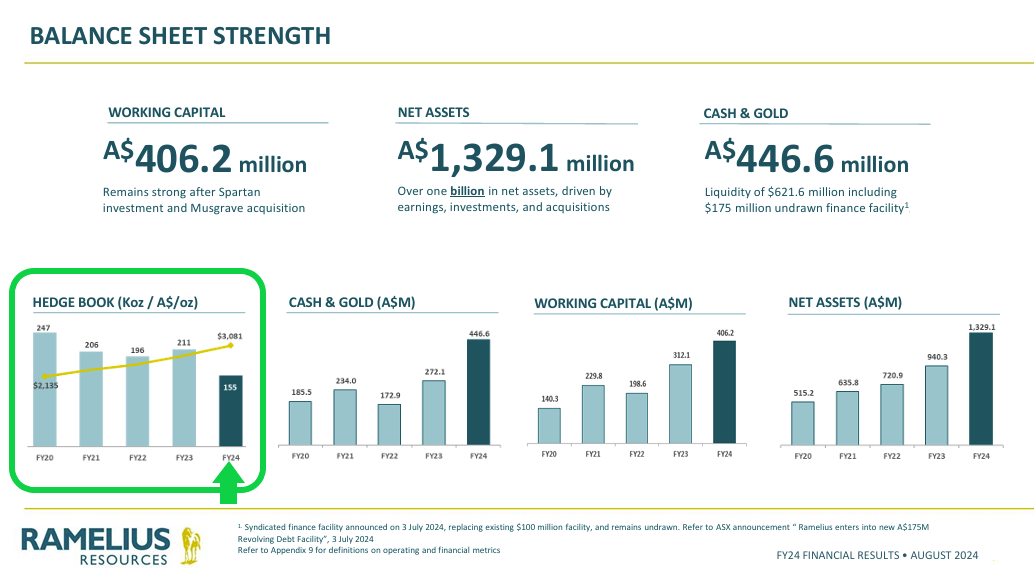

30-Aug-2024: I was going to title this straw "Hedging", but it's really a bull case for Ramelius (RMS), so I've changed the title to "Bull Case". Let's start with their RMS' hedgebook as at June 30th now that they've reported - and their hedge book is now down to 155 Koz, as we can see on slide 10 from their FY24 Financial Year Results Presentation [released on Monday, 26th August]:

It was 211 Koz at June 30, 2023, then 19 Koz less at 192 Koz at Dec 31, 2023, and then 37 Koz lower at 155 Koz at June 30, so those hedges are reducing.

The yellow line is their average contracted gold price for their remaining hedges, which keeps rising, as I note below. It stood at $3,081/oz at 30-June-2024.

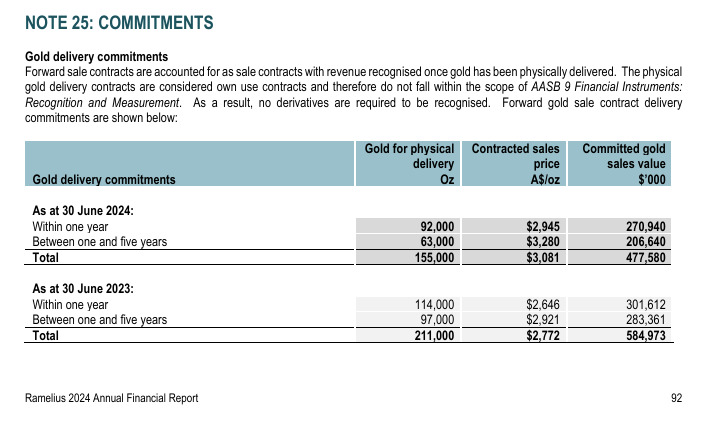

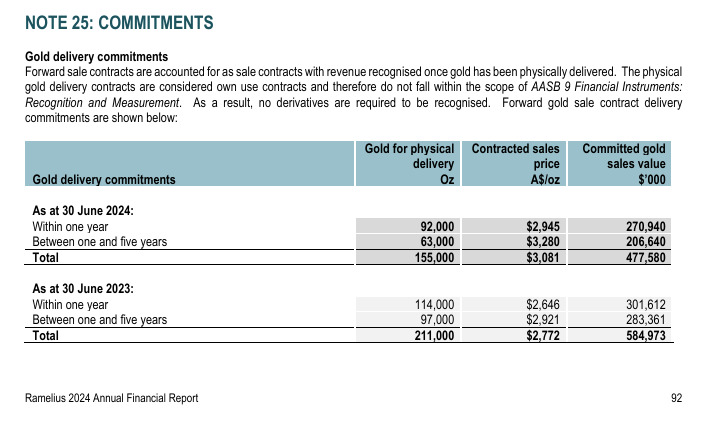

Below is from page 92 of their FY24 Annual Financial Report:

I think they will continue to increase the rate at which they close out those hedges and reduce their hedgebook. They also appear to be selling into their lowest priced hedges, because the remaining average contracted price (A$/oz) is increasing from $2,772 at 30-June-2023 to $2,918 at 31-Dec-2023 to $3,081 at 30-June-2024.

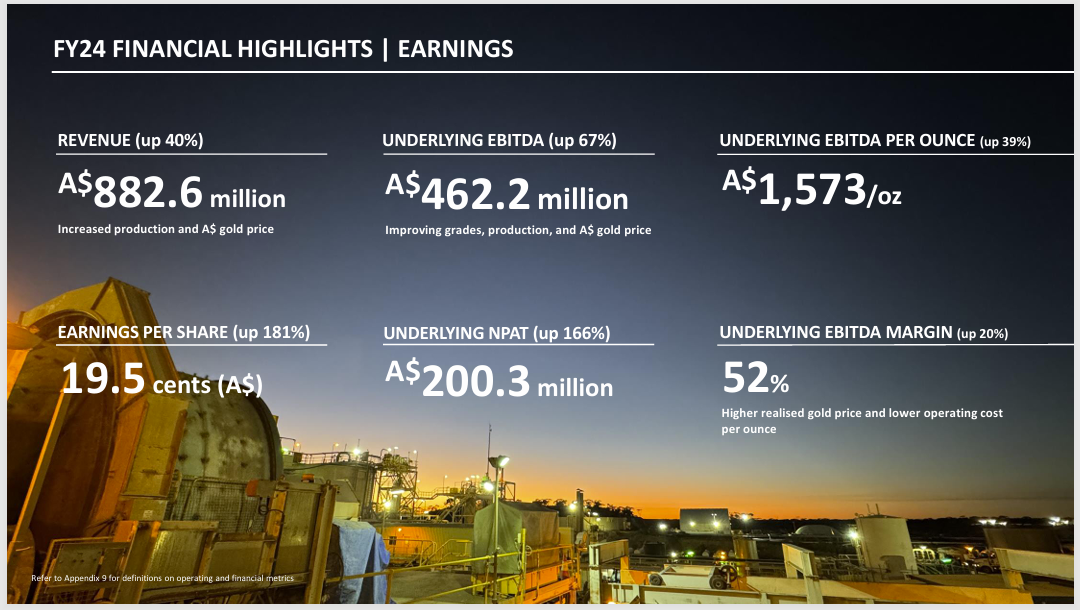

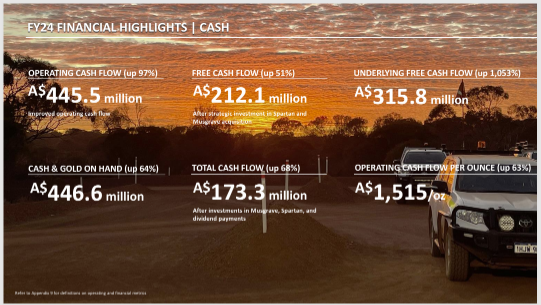

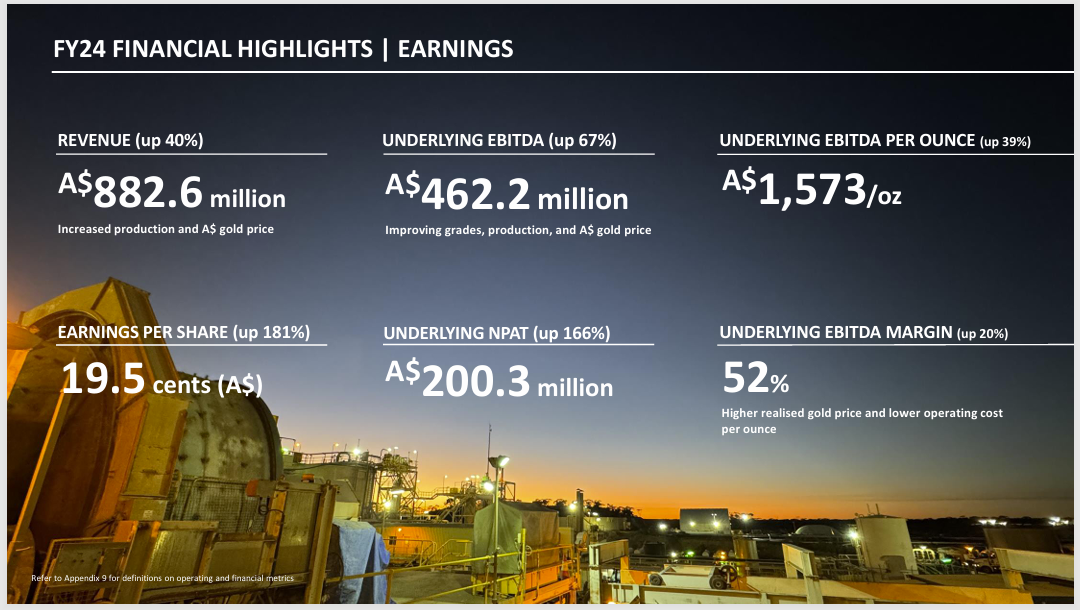

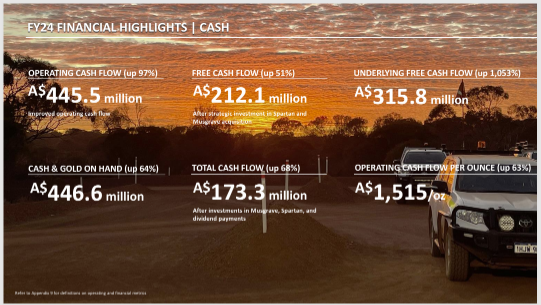

And it doesn't seem to be negatively affecting their numbers. Here are the FY24 highlights:

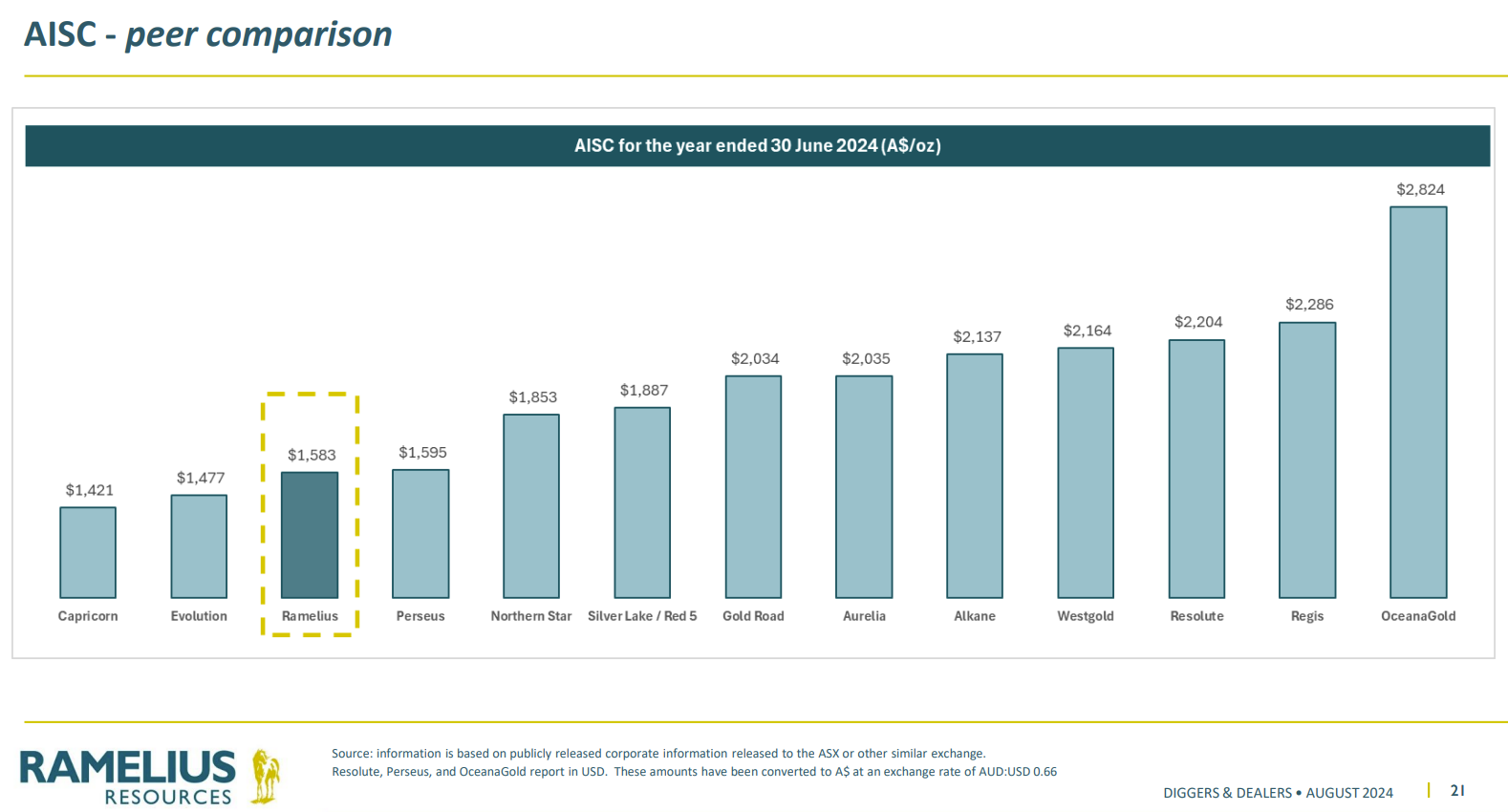

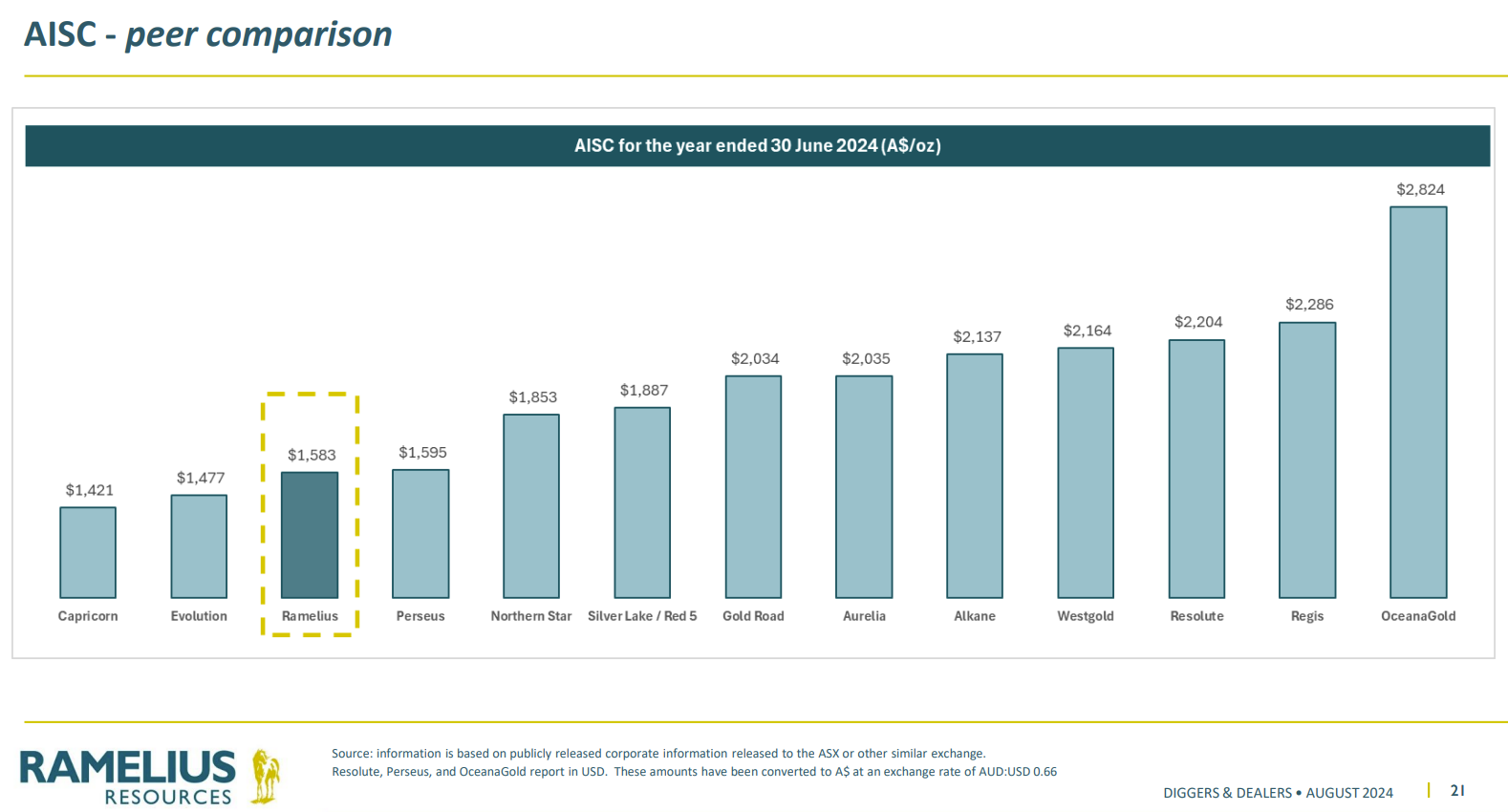

This is possible through a relatively small hedgebook at relatively high prices, meaning they are more exposed to the higher spot price, as well as having some of the lowest costs across the Australian gold industry. Ramelius are certainly in the lowest quartile of the cost curve. There are not too many Aussie gold producers with lower costs unless you start using copper production for byproduct credits (like Evolution Mining does with two of their mines producing far more copper than gold).

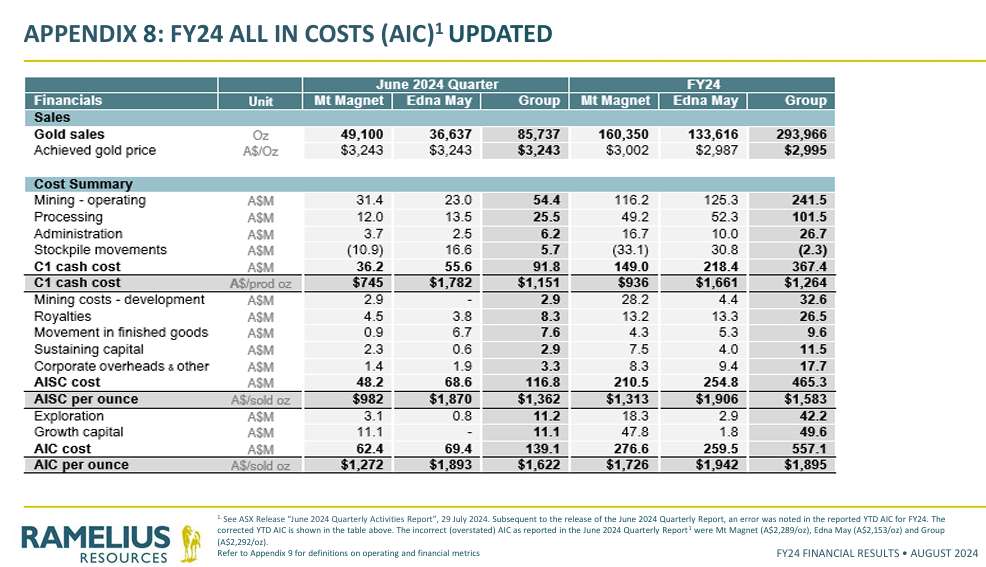

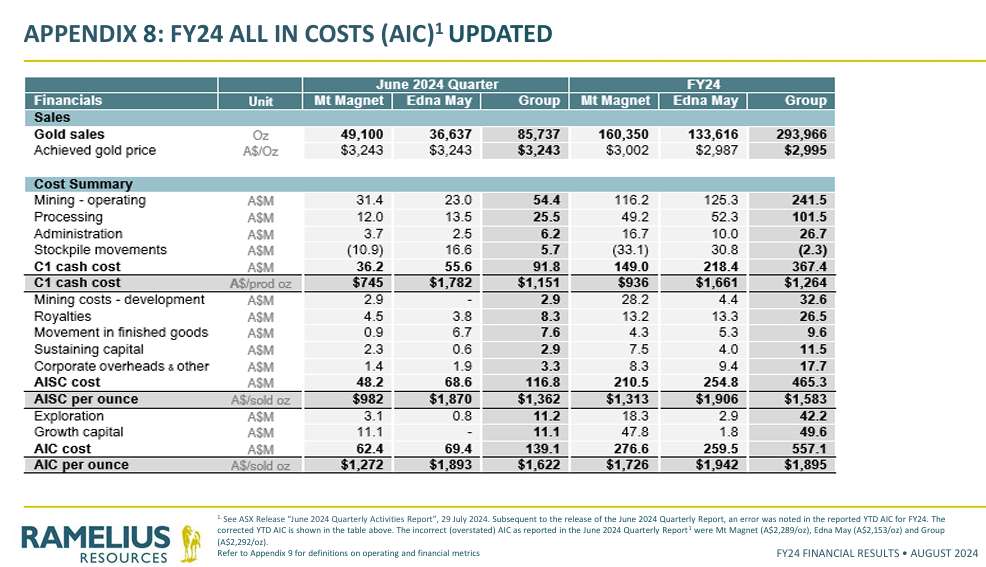

Here's Ramelius' FY24 cost Breakdown:

FY24 Group AISC of A$1,583/oz, and Group AIC of A$1,895/oz, when many of their peers are well over $2,000/oz for their AISC and don't even disclose their AIC like RMS do.

You can also see there (above) that their June 2024 Quarter Results were lower than that, at A$1,362 (AISC) and A$1,622, so they're trending DOWN, not up.

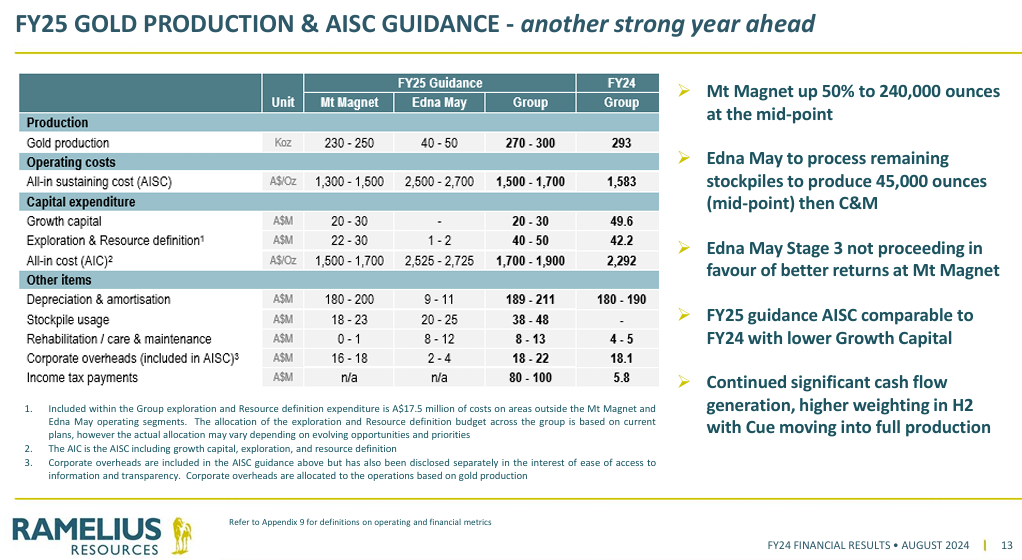

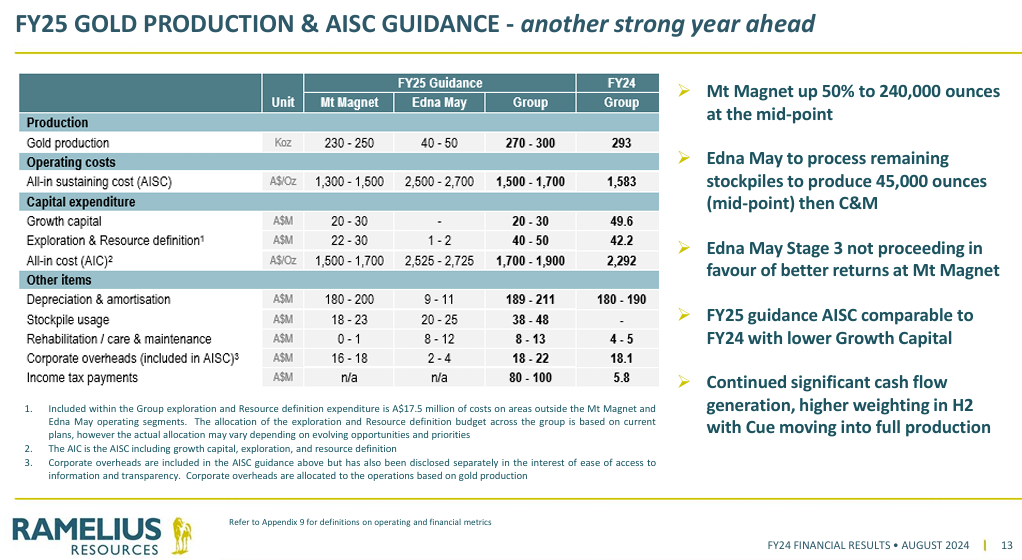

Here's their guidance for the current year (FY25) that will end on June 30 next year:

Conservative FY25 production and cost guidance range of 270 to 300 Koz gold at $1,500 to $1,700 AISC (mid-points of 285 Koz @ $1,600/oz), much the same as FY24 (293 Koz @ $1,583/oz) and given that based on recent history they will probably hit the top end of that production guidance or exceed it, and be within the lower half of their cost guidance, I would say that FY25 is going to be AT LEAST as good as FY24. In fact, it SHOULD be better, because their Capex is going to be lower so their AIC is going to be lower in FY25 than in FY24.

They've got an FY24 AIC of $2,292/oz there in the table above which is $397 higher than the $1,895 FY24 AIC they've got on slide 24 of the same presentation (two tables up here) - and I can explain that difference. First, both of those slides are from the same slide deck, being their 25 page FY24 Financial Results Presentation (pages 13 and 24), however slide 24 - which is Appendix 8 (two tables up from here in this straw) - has an explanation at the bottom saying: See ASX Release “June 2024 Quarterly Activities Report”, 29 July 2024. Subsequent to the release of the June 2024 Quarterly Report, an error was noted in the reported YTD AIC for FY24. The corrected YTD AIC is shown in the table above. The incorrect (overstated) AIC as reported in the June 2024 Quarterly Report were Mt Magnet (A$2,289/oz), Edna May (A$2,153/oz) and Group (A$2,292/oz).

On that slide, the corrected numbers were Mt Magnet (A$1,726/oz), Edna May (A$1,942/oz) and Group (A$1,895/oz). However, back on slide 13 (the first table above) they have used that old (incorrect) $2,292 Group AIC number. That is wrong - it should be $1,895, same as on slide 24 (second table up from here).

If you want to view the incorrect numbers on their June quarterly report, you can view that report here: June 2024 Quarterly and FY25 Guidance presentation - the slide they're talking about is slide 12 of that presentation. They may not have considered it material (in terms of putting out a correction sooner) because they were overstating their costs not understating them, but it is important to get that number correct, otherwise it would have looked like a substantial drop in AIC between FY24 and FY25, when it fact it's going to be fairly similar AIC (All-In Costs), just likely a little lower in FY25 based on their guidance mid-point. So with that in mind, it's not good that they put the wrong number in the table on slide 13 (again) a full month later, having noted the correction further down in the same report (on slide 24).

In summary their correct FY24 AIC is A$1,895, and they're guiding for an AIC of between A$1,700 and $1,900, so the FY25 guidance mid-point is AIC of $1,800/oz, vs $1,895/oz (actual) for FY24, so lower overall costs this year hopefully. And the gold price might just keep rising too!

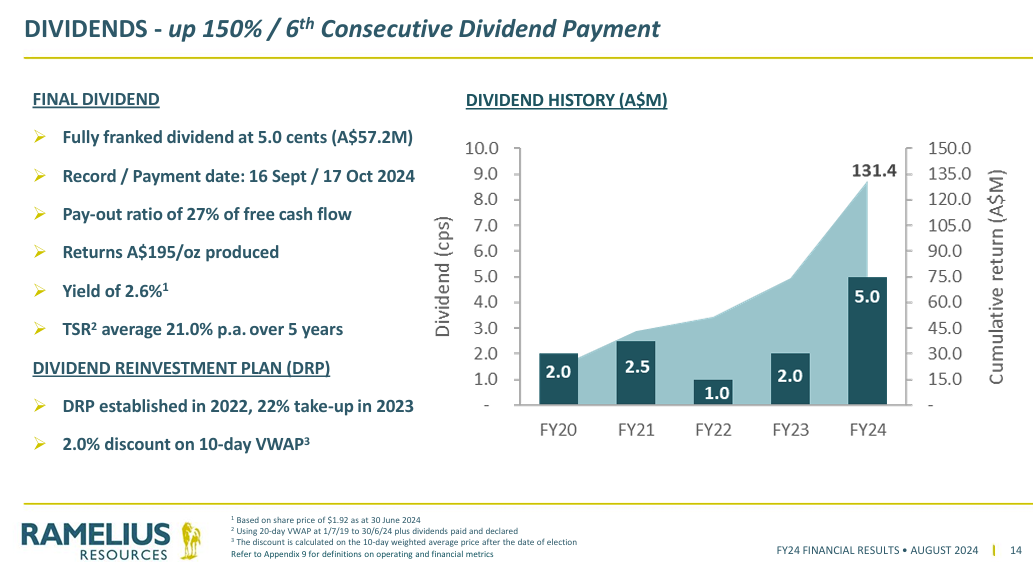

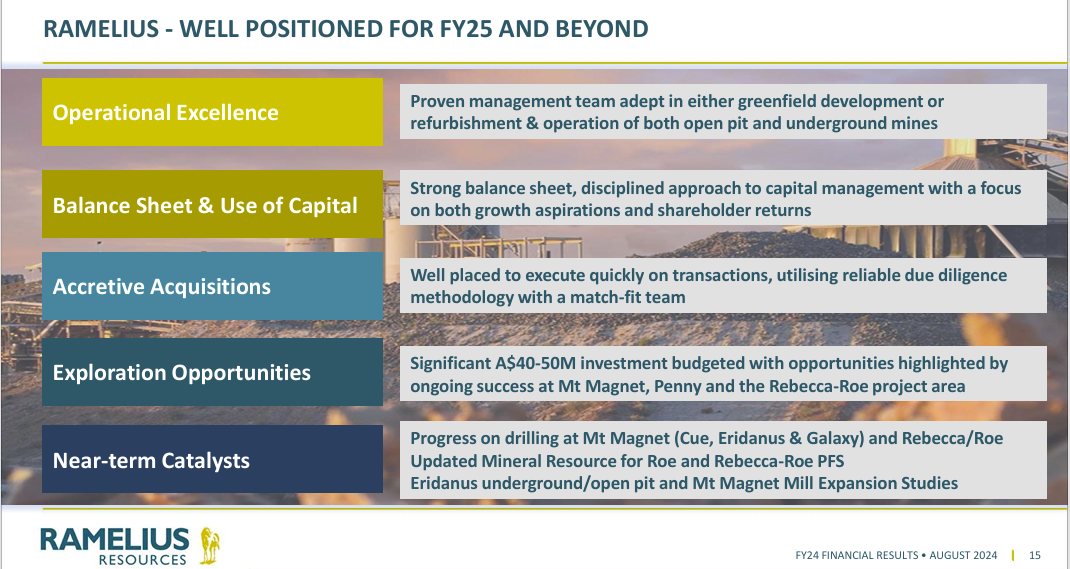

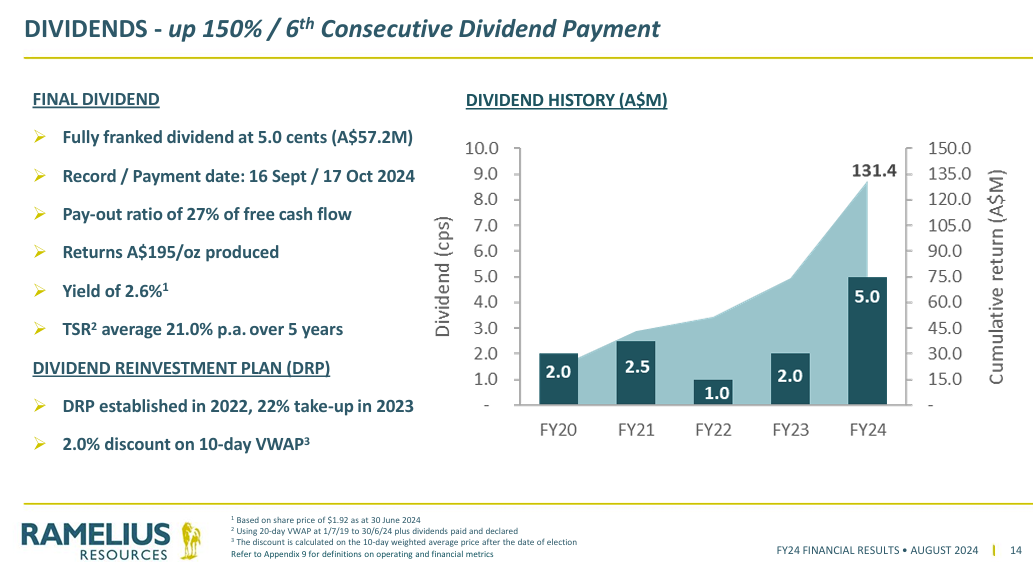

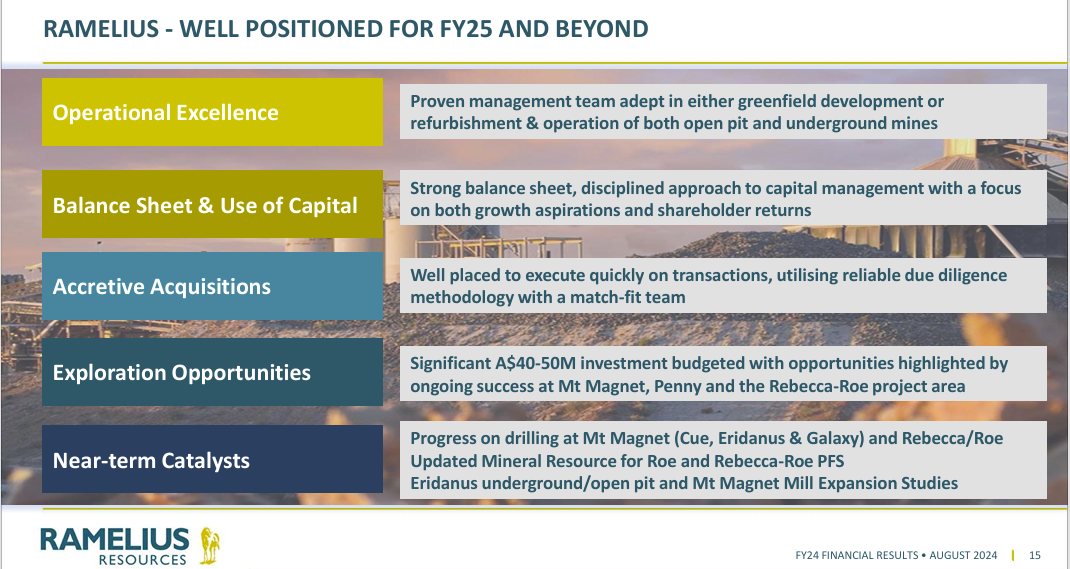

These last two slides (below) sum up where I see the value in RMS right now. Firstly rising dividends to add to the TSRs, which are supported by rising earnings, and then the stuff on the final slide - which is all about management execution in terms of strategic planning and sensible capital allocation decisions, as well as a series of near-term positive catalysts that should keep driving the share price higher if things go to plan.

So, hopefully you can see why I'm happy to be holding RMS at this point. They made a new 12-month high today also, which also happens to be their new all-time high. They closed at $2.22 today and they tagged $2.23 during the day. They've never been this high before. And it's pretty obvious to me that they are in better shape than they've ever been before, so it makes perfect sense for them to be making new all-time highs.