Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

16th December 2025: Bulletin Resources sells part of their Rebecca Lake Gold Project to Ramelius Resources.PDF

I commented here recently that while I expect RMS (which I hold - 5.1% - currently one of my top three largest gold producer positions) to be producing 500 Koz (thousand ounces) of gold per annum by 2030, I wasn't sure whether Rebecca-Roe would end up being part of that or not because it's so far from their Mt Magnet hub and will require it's own standalone Gold Mill.

My thoughts were that RMS might buy a similar high grade gold deposit or two closer to Mt Magnet and sell off Rebecca-Roe, and that might still occur, however the announcement today that RMS have bought 15 of BNR's Lake Rebecca tenements (a total of 509 square km) for half a mill ($500 K), and that those tenements are all alongside/adjacent to RMS's Rebecca Gold Project, suggests that RMS are instead bulking up their land holding to make the case even stronger for building a new gold mill (gold processing plant) for Rebecca and Roe (together known as RMS' Rebecca-Roe Gold Project), and that would be fine also, especially if they use GNG to design and build the mill (GNG is one of my top two holdings, currently around 12.2%).

RMS also releassed this about a fortnight ago: Rebecca-Roe Gold Project - Agreement Signed with Kakarra Part B Native Title Holders.pdf [04-Dec-2025]

Either way RMS are already in the ASX100 and they'll be a 500 Koz producer within 5 years, and that's going to get a heap more eyes on them and generate a lot more interest in the company.

It's important to remember however that there is going to be a big drop off in production in the current (FY2026) Financial Year compared to their record FY2025 production, and that's all in their guidance for this year, which is significantly lower than last year - which is a direct result of their Edna May Mill being put on C&M earlier this year because the gold that they owned around that mill had all been mined out. So currently all of their production is coming from Mt Magnet and their big growth projects there are their high-grade Dalgaranga assets (Never Never and Pepper) that came with the Spartan acquisition and those will take around 18 months to 2 years to develop and fully come online (and will be processed through their Mt Magnet Mill).

While I still have a high weighting to RMS (5.1% based on last Wednesday's prices when I last updated my spreadhseet), I do expect there's a strong chance that the RMS SP actually goes down when they report in Feb for H1 of FY26 because of the lower production this FY, even though it has been well flagged. Sometimes the market doesn't have a great memory for these things. If they get sold down significantly when they report in Feb, I am very likely to top up my RMS position.

Map Source: https://www.rameliusresources.com.au/wp-content/uploads/bsk-pdf-manager/2025/11/5-Year-Growth-Pathway-to-500koz-Investor-Presentation-November-2025.pdf [03-Nov-2025]

https://www.marketindex.com.au/asx/rms/announcements/ramelius-announces-a-250m-share-buyback-program-6A1302524

Ramelius flags $250m buyback, dividend boost - The Australian

Gold miner Ramelius Resources will buy back up to $250m worth of its shares and increase its minimum dividend to 2c per share per annum as part of its “capital allocation pillars” in FY26 and FY27.

The three pillars outlined are: re-investment into the business, increase in shareholder returns and maintain a strong balance sheet.

The update comes as Ramelius pursues its five-year production target of 500,000 ounces of gold.

The company told shareholders it will continue its development of the Never Never underground mine at Dalgaranga during FY26 and FY27 with steady state production of 1 million tonnes per annum scheduled to be achieved in early FY28.

In the second half of this fiscal and through FY27, Ramelius will be investing in the Mt Magnet hub by upgrading the processing plant with the throughput increasing to 4.3mtpa by the September 2027 quarter – from 1.8mtpa-2mtpa currently.

“This capital management initiative is underpinned by our track record of consistently delivering strong free cash flow and our confidence that it will continue into the future,” managing director Mark Zeptner said.

Held (First gold stock I have bought)

12-Aug-2024: Ramelius Resources Presentation at Diggers and Dealers, August, 2024

Mark Zeptner, RMS' CEO & MD presenting that at D&D last week: https://www.youtube.com/watch?v=XZ-VU8gxc0w

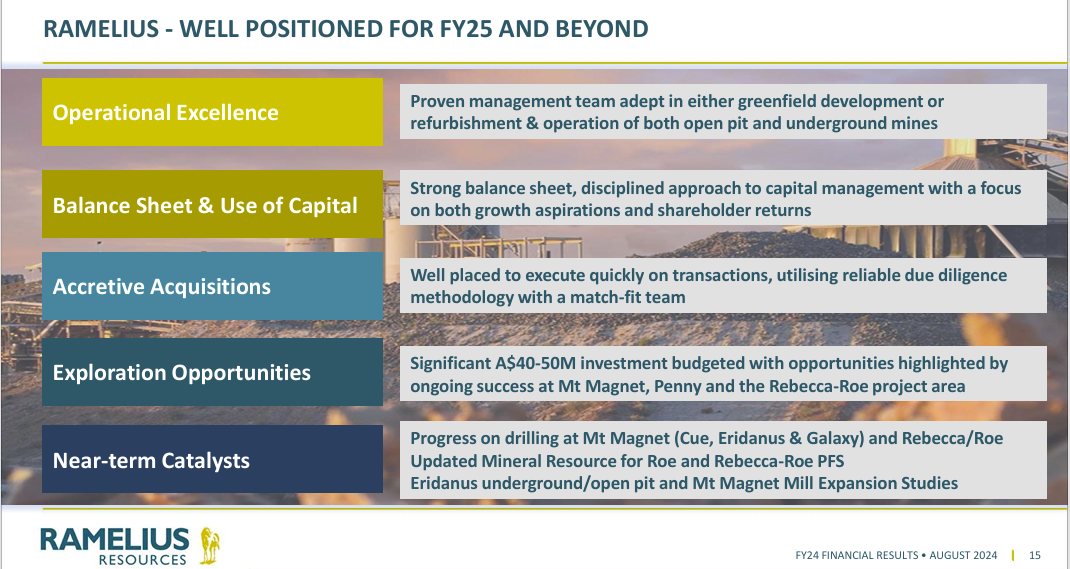

Selection of slides that shows why I hold this company at this point in time:

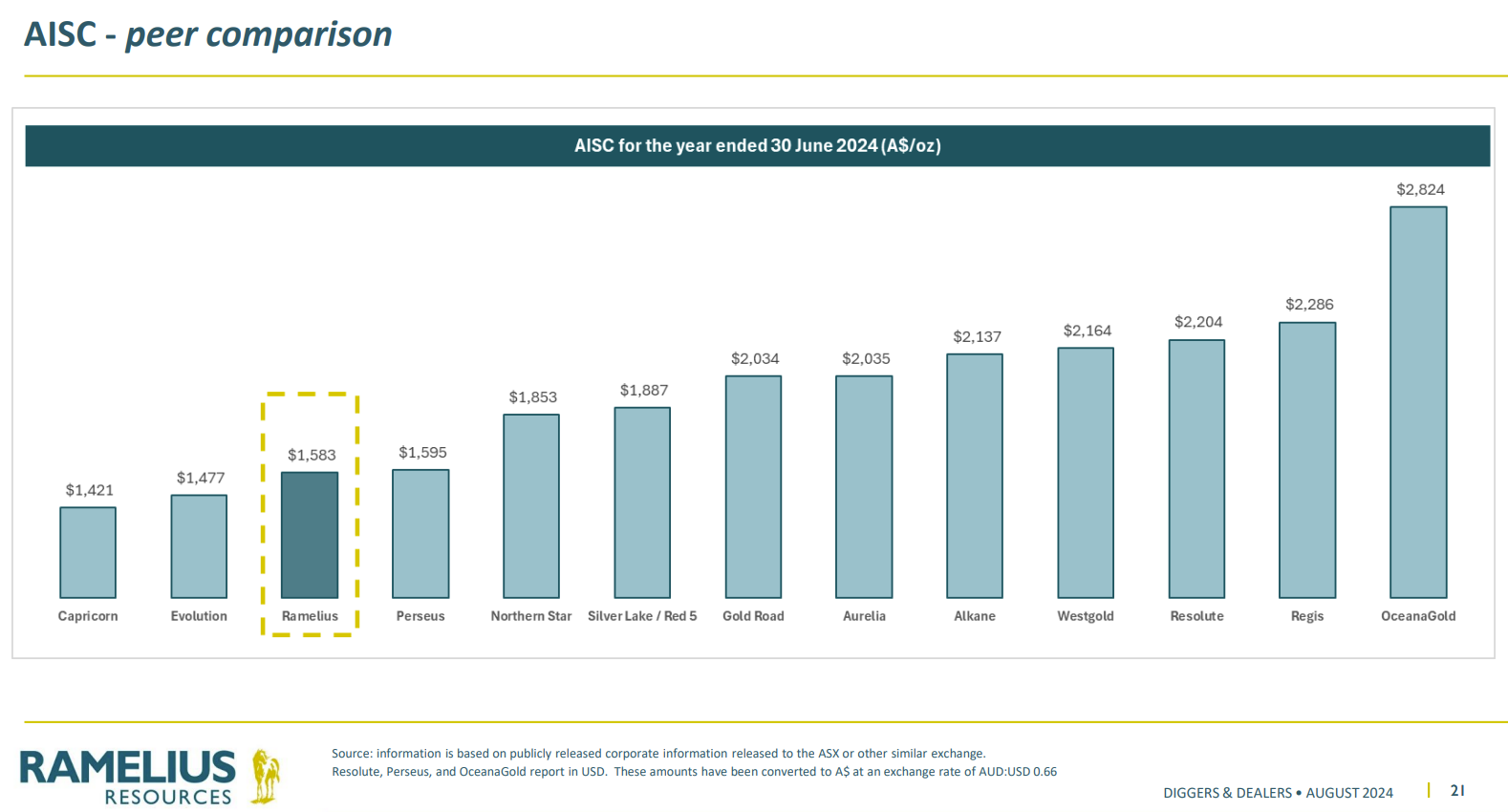

A lot of cash, no debt, a strategic stake in Spartan (SPR, formerly Gascoyne Resources) who own underground gold and a gold mill (processing plant) near RMS's Mt Magnet mine and mill, with good management who have been disciplined and smart (strategic) with their M&A so far. And low costs too:

Further information: https://www.rameliusresources.com.au/

21-Feb-2025: H1 FY2025 results Update:

Source: First page of RMS-Financial-Results-for-the-Six-Months-to-31-December-2024.PDF

Also released today: H1 FY25 Financial Results Presentation.PDF

Market Like!

Raising price target to $2.77 with a 12 month timeframe, so by end of Feb 2026.

https://www.rameliusresources.com.au/

Disclosure: Holding, both here and in my SMSF. I was also holding them in my largest real money portfolio but I took profits recently, content with them being one of the largest positions in my Super.

23rd July 2025: Update:

I'm raising my price target (PT) for RMS from $2.77 to $3.24 since RMS have tagged or got above my previous $2.77 PT a total of seven times since I set it 6 months ago, including today when they closed up +4.51% (or +12 cents) at $2.78.

Their acquisition of Spartan Resources (SPR) - formerly known as Gascoyne Resources - has completed this week and SPR was removed from the ASX list this morning. It's good for RMS that they didn't have any serious competition for Spartan, so there was no other bidder to deal with, which is probably because RMS already owned 19.9% of Spartan before they (RMS) launched their bid for Spartan - it would be difficult for a third party to successfully bid against Ramelius when Ramelius already owned one fifth of Spartan.

So the deal is done; the scheme of arrangement became legally effective yesterday (Tues 22nd July), so RMS today obtained the consent of ASIC pursuant to section 652B of the Corporations Act 2001 (Cth) (Corporations Act) to withdraw its fall back conditional off market takeover bid to acquire all of the shares in Spartan. A formal notice under which Ramelius withdrew its Takeover Bid, is attached to this announcement: RMS-Withdrawal-of-takeover-bid.PDF.

To be clear, that takeover bid was their back-up plan, in case the scheme of arrangement (the friendly takeover) got voted down or blocked for any reason, and because the scheme was voted up, got approved by the courts, and went through without any issues, the back-up plan is no longer required, so has been officially withdrawn.

It is expected that implementation of the Scheme will occur on 31 July 2025, at which time Spartan shareholders will have their Spartan shares acquired under the terms of the Scheme.

For each Spartan share, Ramelius will pay $0.25 cash and issue 0.6957 new Ramelius shares. But first Ramelius have said they will cancel the 254,599,812 Spartan shares that they (Ramelius) held prior to launching their takeover bid - that being 19.9% of SPR's shares on issue (SOI) at that time. This will reduce Spartan's SOI from 1,287,926,503 down to 1,033,326,691 shares.

This means that RMS will be issuing 718,885,379 new RMS shares (1,033,326,691 x 0.6957) and paying $258,331,672.75 in cash to those Spartan shareholders.

While A$258.3 million and change might seem like a fair bit to be paying out, Ramelius ended June with a Cash and Gold Balance of A$809.7M, so they've got the cash! They've been printing money at these recent gold prices.

The 718,885,379 new RMS shares added to RMS current 1,159,131,156 SOI will mean that Ramelius' new SOI total (after they issue those new shares) will be 1,878,016,535 so their share count will increase from 1.16 Billion shares to 1.88 billion shares.

Ramelius' market cap today is A$3.1 Billion. If they are still trading at today's close of $2.78/share or above after they issue those new shares to pay for the Spartan shares they are acquiring, their market cap would be at least $5.2 Billion.

This would put them just ahead of Perseus (PRU, $5 Billion m/cap), with Evolution (EVN, $15.4 B) and NST ($23.6 B) still out in a class of their own - a class of two called "Australian large cap gold miners".

If everything below EVN and NST are classed as mid-tier or smaller, then RMS and PRU are going to be the largest of the mid-tier goldies with companies like Gold Road (GOR, $3.5 B), Regis (RRL, $3.3 B), Capricorn (CapMetals, CMM, $4.1 B), and Genesis (GMD, $4.6 B) being the next group (with market values of between $3B and $5B each).

I would expect GMD to overtake RMS and PRU again at some point, probably in the not-too-distant future, but for now Genesis have slipped below $5 Billion m/cap.

I do hold RMS, GMD, EVN & NST in my SMSF and CMM and GOR at this point also - CMM for a trade on them receiving their final approval for Mt Gibson shortly - and GOR for that large special dividend that they are going to pay to release all of their franking credits prior to being acquired by Gold Fields Ltd, which is HQ'd in South Africa. I also hold another $80K worth of GOR in a different real money portfolio outside of my Super.

I'm not holding RRL or PRU at this point in time.

I am also holding Bellevue Gold (BGL, $1.4 B m/cap) in my SMSF as a turnaround or M&A play (one or the other is going to happen with BGL IMO, not advice, just opinion).

Here on SM I'm holding RMS, GMD, NST and a small CMM position, plus a little EMR and MEK.

I also hold MEK, GG8 and HRZ in a real money portfolio of more speculative earlier stage gold companies.

But back to Ramelius (RMS), they're already in the S&P/ASX 200 Index, however they will soon have a similar market cap to Perseus (PRU) and PRU are already in the ASX 100 index, so there's a decent chance that RMS are going to get added to the ASX 100 at the next rebalance.

In terms of the company itself, Ramelius now have the Spartan growth assets in addition to a nice portfolio of producing and growth assets that they (RMS) already owned, plus they have a good track record of disciplined, strategic M&A.

I rate their management, and as I keep saying, management is VERY important, especially with mining companies where poor capital allocation decisions can destroy millions of dollars of shareholder capital and ruin TSRs.

RMS seem to have management that are good at creating value rather than destroying it, and that's a very good thing.

So plenty to like here, and they're going to get on more radars now that they are likely to shortly be one of Australia's top 5 gold producers - I'm including GMD in that top 5.

Happy to be a holder of RMS shares, both here and IRL.

11th September 2025: Update:

I'm increasing my price target for RMS again today, this time to $4.25 (they closed yesterday @ $3.40) - because they're bigger and better now that they have acquired Spartan and all of that additional high grade ore that comes with Spartan, plus Simon Lawson, who as the ex-MD of Spartan is now Deputy Chair at RMS and heads up Ramelius' new bigger exploration team.

Lawson had great success in recent years at Spartan and I reckon he's going to really turbocharge new gold discoveries at RMS within their large portfolio of Western Australian tenements.

Rather than try to explain my bull thesis here, and why I'm now even more bullish on RMS than I was before - and why RMS is now the largest position in my SMSF, and one of my top 5 positions here also, I highly recommend people watch this August 2025 Diggers and Dealers presentation (link immediately below) by RMS' MD & CEO Mark Zeptner and Simon Lawson (they do half each):

2025 | Ramelius Resources - Mark Zeptner, MD & CEO and Simon Lawson, Deputy Chair [youtube, posted Aug 4, 202]

And here's that presentation slide deck (with no audio) for those who want to spend more time on any of the individual slides: https://www.rameliusresources.com.au/wp-content/uploads/bsk-pdf-manager/2025/08/August-2025-Diggers-and-Dealers-Presentation-1.pdf

More recently (2 days ago, Sept. 9th), RMS' Simon Lawson presented at the Precious Metals Summit in Beaver Creek, Colorado, USA. Here's a link to that presentation slide deck: https://www.rameliusresources.com.au/wp-content/uploads/bsk-pdf-manager/2025/09/September-2025-Gold-Forum-Americas-Presentation.pdf

Here are some of the more important slides from that presentation, which is mostly comparing Ramelius to their North American peers as this presentation was in Colorado:

What hits me most with that slide above is that due to the higher grades of gold in the ore that Ramelius were processing in FY25 - compared to the previous FY - they actually produced MORE GOLD with LESS ORE, and had lower costs.

Every metric above (revenue, EBITDA, EPS, NPAT and EBITDA Margin) was an all-time record for Ramelius in FY25 and WELL UP on FY24. For instance EPS was up +111% and their EBITDA Margin was 68%, up +33% on FY24. NPAT was almost half a billion Australian dollars, up a whopping +119% on FY24. No wonder their dividends are increasing at a good clip, as shown below:

And here's a free cashflow comp chart to RMS' Australian peers:

The deal is they have higher grades of gold than most of their peers, and lower costs, so they produce more free cashflow because their margins are greater.

While they do have some hedging in place, the slide above (2 slides up from here) shows how little of their production is actually hedged (prices are in US$s) and how much of their production is exposed to the high spot gold price.

They are also likely to be admitted to the S&P ASX100 index at the next rebalance, or the one after that, because of their acquisition of Spartan, their larger market cap as a result of that aquisition, and the additional gold they are going to be producing over the next few years which should lead to an even greater positive re-rating in terms of a higher share price (so an even higher m/cap) that further reflects their superior metrics to their peers and their growth profile.

The TL;DR version is: Low cost, high grade, well managed Aussie gold producer with plenty of further upside from here both in terms of exploration and production.

Discl: Holding here and in my SMSF where they are currently my largest position since I sold half of my ARB this week and rolled that cash into MAQ, so still holding ARB but it's a mid-sized position in my SMSF and RMS has become my largest position, which should tell you something because I hold 12 companies in my SMSF at this point, and 9 of them are gold producers, and RMS is the largest position.

https://www.rameliusresources.com.au/

https://www.rameliusresources.com.au/mt-magnet-3d-animation-fly-through/

https://www.rameliusresources.com.au/company-overview/

Saturday 18th October 2025: Update:

Raising my price target to $4.85 due to the US$ gold price now being over $4,000/ounce and the A$ gold price now being over $6,000/ounce and RMS having lower costs than all the major Aussie goldies except EVN - and if RMS had the same copper byproducts that EVN use (from Ernest Henry and Northparkes which both produce more copper than gold) to lower their AISC then RMS would have lower costs than EVN. In other words, with the exception of Evolution Mining who use copper to reduce their gold costs, Ramelius have the lowest costs of any of the larger Aussie gold producers.

And RMS are a large Aussie gold producer now; they were added to the ASX100 index last month (in the September index rebalance) and their market cap is now $7.7 Billion. They have left their former mid-tier peers behind them in the dust and moved on up due to both organic growth and M&A, i.e. their recent acquisition of Spartan.

The reason why RMS' costs are so low is because their gold grades are higher, so they get more gold out of each tonne of ore that they process, and that is likely to get even better when they get into the high grade gold at Never Never and the even higher grade gold at Pepper in the next year or two.

The best way to get your head around what I'm talking about here is to have a gander at this excerpt from page one of Spartan's announcement on 2nd December (2024):

Source: https://www.listcorp.com/asx/spr/spartan-resources-limited/news/pepper-resource-soars-99-percentage-to-873koz-at-10-3g-t-gold-3124618.html [02-Dec-2024]

Those aren't drill hits - that's an MRE - showing the average grades across thousands of ounces in that MRE (Mineral Reserve Estimate) - in fact 2.64 million tonnes of ore @ an average gold grade of 10.31 grams per tonne of gold for 873,400 ounces just at Pepper.

If you combine Never Never and Pepper, you've got 7.76 million tonnes of ore @ 9.32 grams per tonne of gold for 2,324,300 ounces - yep, over 2.3 million ounces of high grade gold, and that was at December last year, they've found more since then.

Source: RMS' D&D Presso, August 2025.

And RMS haven't started mining that yet. That mine is in the development stage, not yet in production. And even WITHOUT that high grade gold, RMS are already the lowest cost major multi-mine pure-gold-play on the ASX because they're already mining high grade gold at their other mines.

Source: RMS' D&D Presso, August 2025.

And now they have Spartan's ex-MD, Simon Lawson as RMS' head of exploration and also on their Board (he's also now the deputy chair of the RMS Board).

If you think I'm being too much of a fanboy over RMS, watch of this presentation then tell me what's NOT to like.

Ramelius Resources Presenation at Diggers and Dealers, August, 2025 [Presenters: Mark Zeptner, and Simon Lawson]

Here's a link to that slide deck: https://www.rameliusresources.com.au/wp-content/uploads/bsk-pdf-manager/2025/08/August-2025-Diggers-and-Dealers-Presentation-1.pdf

So, what's to like?

- Low Costs;

- Major Aussie Gold Producer, now in the ASX100, so will get on more radar screens now (added to the S&P/ASX100 last month);

- Zero Debt;

- Big Pile of Cash - RMS is a cash generating machine at the moment;

- Excellent Management;

- Simon Lawson now heading up their exploration team, so a very motivated and experienced Geo with heaps of runs already on the board;

- There's plenty of scope for further discovery across the tenements they already hold;

- Their hedging is running off, so it won't be long before they are fully unhedged for maximum exposure to the high spot gold price;

- Excellent M&A track record;

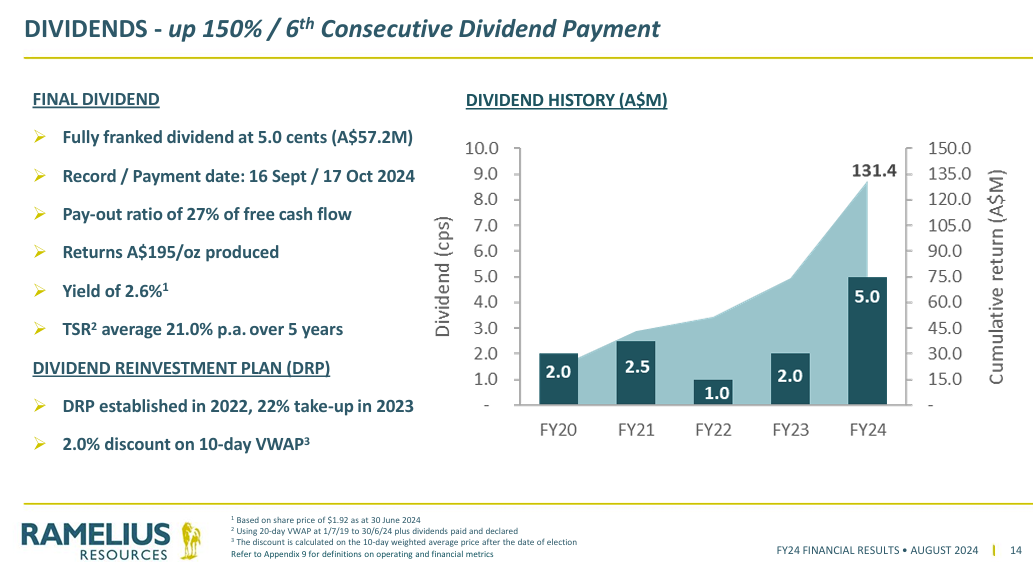

- Growing Fully Franked Dividends;

- They look cheaper than their peers based on: the gold they own underground and on ROM pads, their high grades, their low costs, their cash generation, and their future growth through the Dalgaranga assets that came with the Spartan acquisition, plus whatever else they find going forwards.

- Even if the gold price comes back down a bit, or a lot, RMS' production growth and lower costs will mean they will easily remain highly profitable and won't have any issues, so their SP should hold up a lot better than many of their higher cost peers.

So, yeah, RMS is my largest real life gold company position (held in my SMSF, being the largest position in that portfolio) and they are also my largest position here on SM now that I've sold down my NST position. So yeah, I like the company a lot!

Get some!!

[not advice]

I am doing my simple numbers on gold miners. I have been in NST for the last 5 years as they were (what I thought was) value at time of purchase. Now with a P/E of around 25 I think it is expensive and I think its time to rotate into RMS with a P/E of around 10. Keeping the numbers and strategy basic buy low and sell high. My question is: Is Ramelius the best value miner on the ASX at the moment?

Some loose Ramelius Numbers:

Versus some loose Northern Star numbers cherry picked as its our largest owned miner/producer and I'm a share holder.

Surely its as easy as picking the company/ miner who can produce Gold at the cheapest rate and sell it at the biggest profit, for the longest time at the best P/E ratio...Thoughts?

25th August 2025: FY25 Financial Results and Dividend (4 pages) plus Appendix 4E and FY25 Annual Financial Report (105 pages) plus FY25 Financial Results Presentation (22 pages).

The following (apart from their chart) is sourced from the documents listed above that RMS released today.

What a result !!!!!!!

This is amazing stuff - they mined 63% LESS ore than FY24 and milled 16% LESS ore than FY24 (they had stockpiled ore left from FY24 to mill), yet they produced MORE gold and reduced their costs per ounce produced. How? Because their average mined grade was up a whopping +129% to 5.7 grams/tonne of ore. What a difference grade can make!!

Outstanding!!

And this is BEFORE any contribution from the Spartan assets they've just acquired!

And they are rewarding their shareholders with outstanding TSR's derived from both dividends and share price appreciation:

The market liked it with the RMS share price finishing up +7% today.

Disclosure: Held (both here and in my SMSF).

21-Feb-2025: H1 FY2025 Results:

That's page 1 of today's results announcement: RMS-Financial-Results-for-the-Six-Months-to-31-December-2024.PDF

Also released today: H1 FY25 Financial Results Presentation.PDF

I would normally paste some of the slides from that presentation into this straw, but they're all good, so just click on the link and have a gander.

Disclosure: Holding, both here and in my SMSF.

12-Dec-2024: 8:17 am AEDT: Rebecca Roe Gold Project Prefeasibility Study

12-Dec-2024: 9:03 am AEDT: Rebecca Roe PFS presentation

So this is the PFS (preliminary feasibility study), the DFS (definitive FS) isn't due until mid-2025, and the FID on whether to proceed with the project will depend on the DFS results.

If there's a positive FID based on that DFS next year, then mining at Rebecca is expected to begin in September 2026 and mining at Roe in October 2027, so these are future growth projects for Ramelius, who have plenty of other producing assets as well as development assets for future years.

Map Source: RMS: Penny Gold Mine Update [15-Sep-2023] [When they were buying Musgrave Minerals last year]

Ramelius Resources (RMS) acquired Breaker Resources in March 2023 to consolidate its Rebecca Gold Project with Breaker's Lake Roe Gold Project. Rebecca was acquired by RMS a year earlier, in 2022 when it bought Apollo Consolidated.

Ramelius have a good track record of M&A to build up a portfolio of future growth assets. They have also been finding more gold within their existing tenements, which provides organic growth as well.

In other recent news from RMS:

12/12/2024: 5:21 pm AEDT: Change-in-substantial-holder-notice-from-RMS-for-SPR-(Spartan Resources).PDF

RMS took part in SPR's CR and RMS now own 19.9% of Spartan, up from 17.94% previously.

I have been looking to buy a little Spartan myself, but not up around $1.40 to $1.50 where they've been trading this week - when they have just raised A$220 million at A$1.32/share and prior to that were trading at $1.10/share four weeks ago - and I thought they looked expensive at $1.10 to be honest. I know the CR has derisked them somewhat, but I have noted the SPR share price has fallen for the past 5 trading days in a row, after spiking up over +10% to $1.58 when they came out of that CR trading halt last week - and I think they can fall further. For now I'm happy having exposure to SPR through RMS (who own 19.9% of SPR).

And back on the 4th:

04/12/2024: 8:16 am AEDT: Ramelius-Management-Changes.PDF

Disclosure: I hold RMS. Low cost gold miner and good allocators of capital.

16-Sep-2024: RMS released this today: September 2024 - Gold Forum Americas Presentation

[link didn't work, but hopefully I've fixed it now]

Interestingly, they went ex-div for a 5 cps fully franked dividend on Friday (13th Sept) and their share price didn't fall - it actually rose - they were up +14 cps or +6.54%, which is a fairly decent move on a day when buyers do NOT get their latest dividend. They're down today however. At this point, around 1:30pm Sydney time, RMS is -9 cps (-3.95%), yet still above where they were on Thursday evening (@ $2.14, now $2.19) before going ex-div on Friday.

I hold Ramelius Resources (RMS) - they have everything I'm looking for in an Australian gold producer right now, as I've explained in other straws and/or forum posts here. Good management who are very disciplined around M&A, good growth, zero debt, a pile of cash, increasing dividends, very profitable, and low costs - one of the lowest cost gold producers in Australia currently, and they're finding more gold around their existing tenements, close to their own mills, and good grades too.

The thing is - they've risen from a recent low of $1.82 on August 8th, to $2.28 on Friday (13th Sep) at the close, so they've put on +22% in five weeks, so they're not as cheap as they were. Still a hold here though, if not an outright buy. My best guess is they go higher from here, because they have so many positives, and the only negative would be a falling gold price, and we haven't got that at this point in time, so as long as the gold price holds up (or rises), RMS still look very good to me. I hold them in my SMSF as well as in my other larger portfolio.

Further reading: https://www.rameliusresources.com.au/presentations/

https://www.rameliusresources.com.au/company-overview/

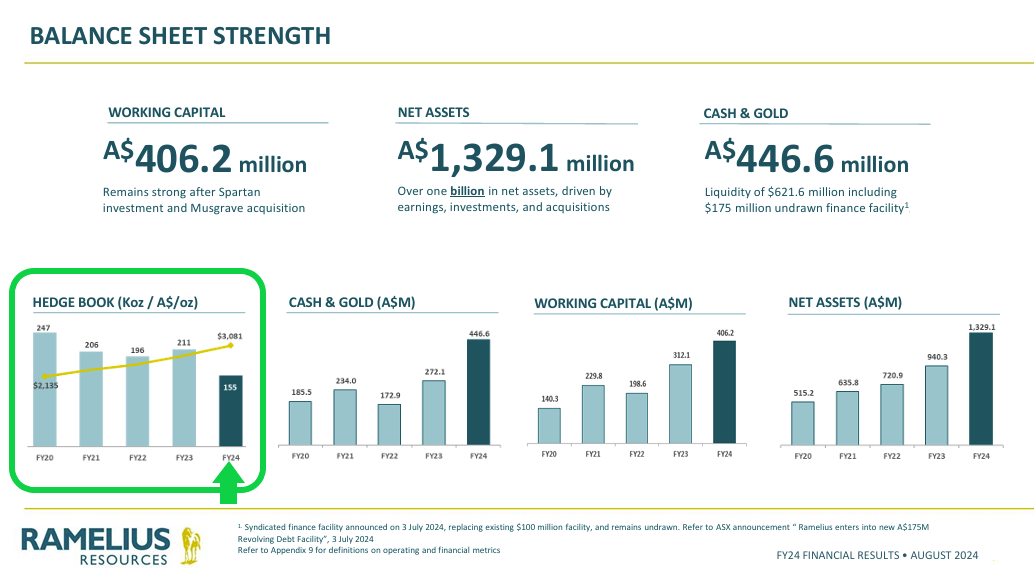

30-Aug-2024: I was going to title this straw "Hedging", but it's really a bull case for Ramelius (RMS), so I've changed the title to "Bull Case". Let's start with their RMS' hedgebook as at June 30th now that they've reported - and their hedge book is now down to 155 Koz, as we can see on slide 10 from their FY24 Financial Year Results Presentation [released on Monday, 26th August]:

It was 211 Koz at June 30, 2023, then 19 Koz less at 192 Koz at Dec 31, 2023, and then 37 Koz lower at 155 Koz at June 30, so those hedges are reducing.

The yellow line is their average contracted gold price for their remaining hedges, which keeps rising, as I note below. It stood at $3,081/oz at 30-June-2024.

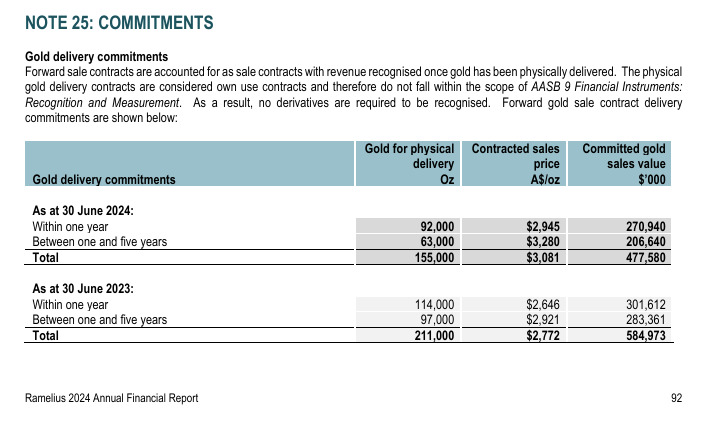

Below is from page 92 of their FY24 Annual Financial Report:

I think they will continue to increase the rate at which they close out those hedges and reduce their hedgebook. They also appear to be selling into their lowest priced hedges, because the remaining average contracted price (A$/oz) is increasing from $2,772 at 30-June-2023 to $2,918 at 31-Dec-2023 to $3,081 at 30-June-2024.

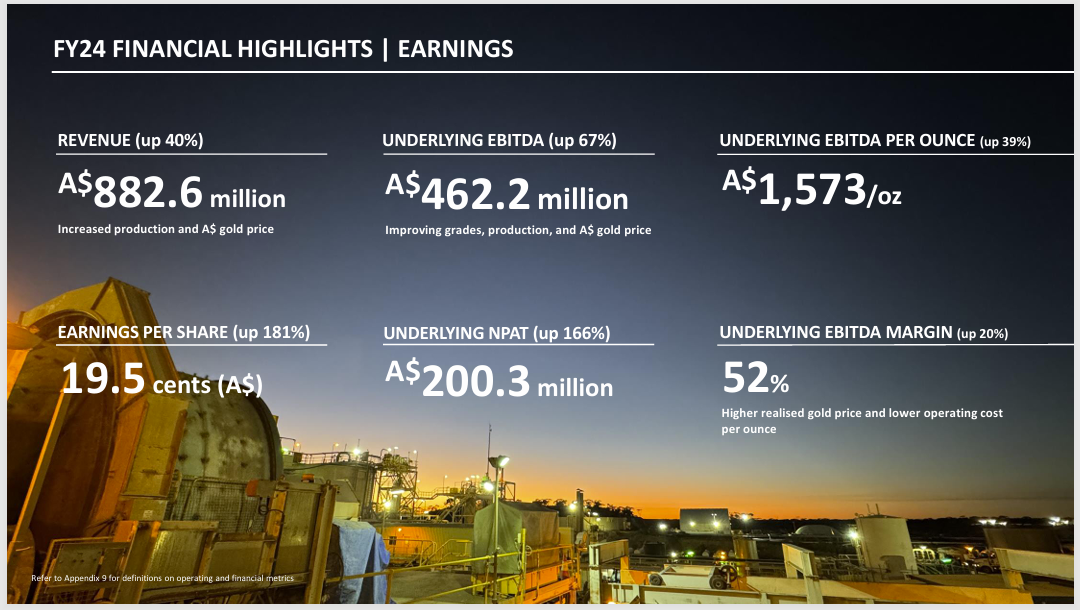

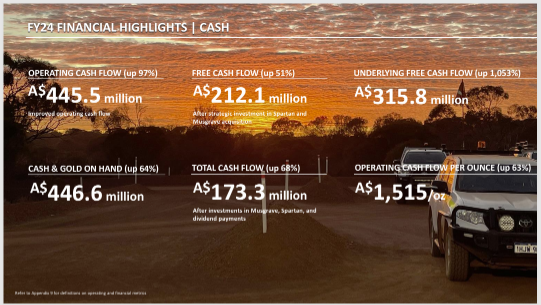

And it doesn't seem to be negatively affecting their numbers. Here are the FY24 highlights:

This is possible through a relatively small hedgebook at relatively high prices, meaning they are more exposed to the higher spot price, as well as having some of the lowest costs across the Australian gold industry. Ramelius are certainly in the lowest quartile of the cost curve. There are not too many Aussie gold producers with lower costs unless you start using copper production for byproduct credits (like Evolution Mining does with two of their mines producing far more copper than gold).

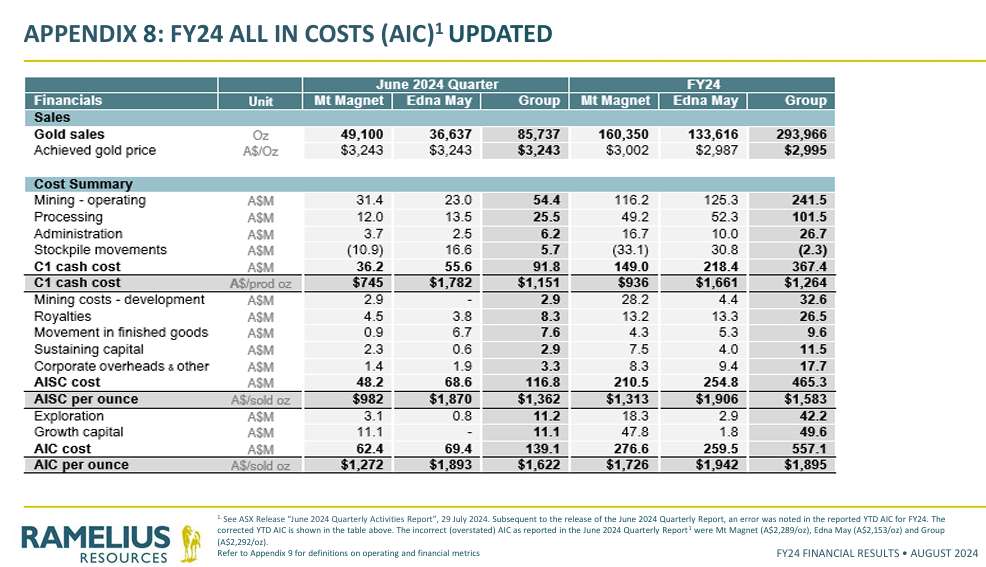

Here's Ramelius' FY24 cost Breakdown:

FY24 Group AISC of A$1,583/oz, and Group AIC of A$1,895/oz, when many of their peers are well over $2,000/oz for their AISC and don't even disclose their AIC like RMS do.

You can also see there (above) that their June 2024 Quarter Results were lower than that, at A$1,362 (AISC) and A$1,622, so they're trending DOWN, not up.

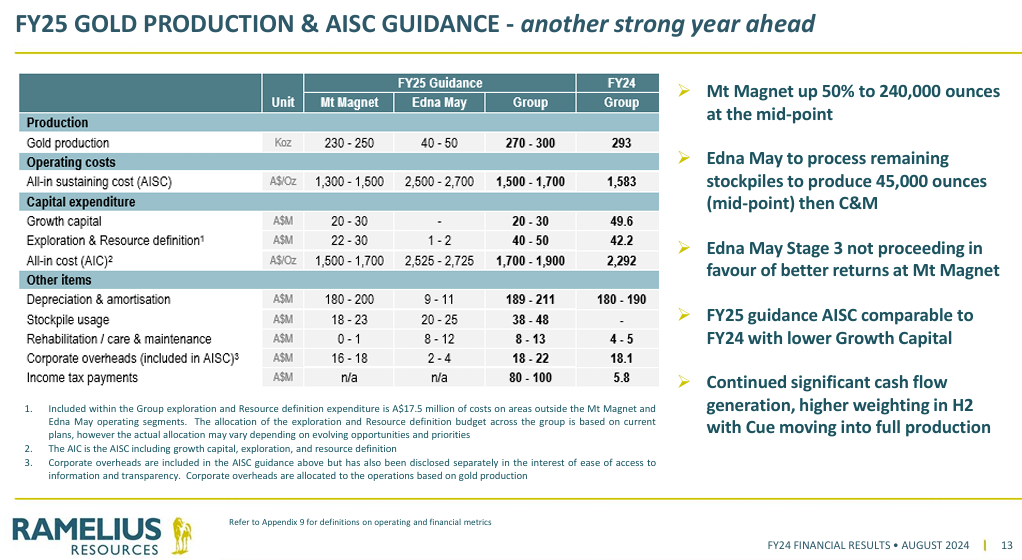

Here's their guidance for the current year (FY25) that will end on June 30 next year:

Conservative FY25 production and cost guidance range of 270 to 300 Koz gold at $1,500 to $1,700 AISC (mid-points of 285 Koz @ $1,600/oz), much the same as FY24 (293 Koz @ $1,583/oz) and given that based on recent history they will probably hit the top end of that production guidance or exceed it, and be within the lower half of their cost guidance, I would say that FY25 is going to be AT LEAST as good as FY24. In fact, it SHOULD be better, because their Capex is going to be lower so their AIC is going to be lower in FY25 than in FY24.

They've got an FY24 AIC of $2,292/oz there in the table above which is $397 higher than the $1,895 FY24 AIC they've got on slide 24 of the same presentation (two tables up here) - and I can explain that difference. First, both of those slides are from the same slide deck, being their 25 page FY24 Financial Results Presentation (pages 13 and 24), however slide 24 - which is Appendix 8 (two tables up from here in this straw) - has an explanation at the bottom saying: See ASX Release “June 2024 Quarterly Activities Report”, 29 July 2024. Subsequent to the release of the June 2024 Quarterly Report, an error was noted in the reported YTD AIC for FY24. The corrected YTD AIC is shown in the table above. The incorrect (overstated) AIC as reported in the June 2024 Quarterly Report were Mt Magnet (A$2,289/oz), Edna May (A$2,153/oz) and Group (A$2,292/oz).

On that slide, the corrected numbers were Mt Magnet (A$1,726/oz), Edna May (A$1,942/oz) and Group (A$1,895/oz). However, back on slide 13 (the first table above) they have used that old (incorrect) $2,292 Group AIC number. That is wrong - it should be $1,895, same as on slide 24 (second table up from here).

If you want to view the incorrect numbers on their June quarterly report, you can view that report here: June 2024 Quarterly and FY25 Guidance presentation - the slide they're talking about is slide 12 of that presentation. They may not have considered it material (in terms of putting out a correction sooner) because they were overstating their costs not understating them, but it is important to get that number correct, otherwise it would have looked like a substantial drop in AIC between FY24 and FY25, when it fact it's going to be fairly similar AIC (All-In Costs), just likely a little lower in FY25 based on their guidance mid-point. So with that in mind, it's not good that they put the wrong number in the table on slide 13 (again) a full month later, having noted the correction further down in the same report (on slide 24).

In summary their correct FY24 AIC is A$1,895, and they're guiding for an AIC of between A$1,700 and $1,900, so the FY25 guidance mid-point is AIC of $1,800/oz, vs $1,895/oz (actual) for FY24, so lower overall costs this year hopefully. And the gold price might just keep rising too!

These last two slides (below) sum up where I see the value in RMS right now. Firstly rising dividends to add to the TSRs, which are supported by rising earnings, and then the stuff on the final slide - which is all about management execution in terms of strategic planning and sensible capital allocation decisions, as well as a series of near-term positive catalysts that should keep driving the share price higher if things go to plan.

So, hopefully you can see why I'm happy to be holding RMS at this point. They made a new 12-month high today also, which also happens to be their new all-time high. They closed at $2.22 today and they tagged $2.23 during the day. They've never been this high before. And it's pretty obvious to me that they are in better shape than they've ever been before, so it makes perfect sense for them to be making new all-time highs.

26-August-2024: RMS-FY24-Financial-Results-and-Dividend.PDF

That's the first page (link above).

Also: 2024-08-26 Financial Report and Appendix A4 for the Year Ended 30 June 2024

And: FY24 Financial Results Presentation

And: August 2024 - Diggers and Dealers presentation

Disclosure: I hold RMS shares.

07-March-2024: Ramelius in 'trading halt' to respond to takeover speculation (miningnews.net)

RMS ASX: Ramelius Resources in exclusive due diligence to acquire Karora Resources (afr.com) [Sarah Thompson, Kanika Sood and Emma Rapaport, Mar 7, 2024 – 12.26pm]

Street Talk

Ramelius in exclusive due diligence to buy Karora

Ramelius Resources is in exclusive due diligence to acquire Toronto-listed WA gold miner Karora Resources, which it hopes will add a new production centre to replace its ageing Edna May asset.

Street Talk can reveal Ramelius boss Mark Zeptner will spend $700 million to $1 billion for the acquisition. Karora will bring new production hubs with mills, and could help the company consolidate its position in the region. A Ramelius spokesperson declined to comment.

Ramelius Resources chief executive Mark Zeptner. Billy-Ray Stokes

Karora’s portfolio, located 60 kilometres from Kalgoorlie, includes 100 per cent ownership of the Beta Hunt mine, Higginsville gold operations and Spargos gold mine. It is expected to produce 170,000 to 195,000 ounces gold in 2024. By contrast, Ramelius has told shareholders it would hit 272,500 ounces production this financial year.

Zeptner and his team are chasing the acquisition after a period of solid performance and perky gold prices. Ramelius shares have risen nearly 48% in the past year, giving it a $1.8 billion market capitalisation and a strong balance sheet.

In particular, it has benefited from high-grade Penny ore being fed into the Mt Magnet Mill. Cash and gold reserves are expected to hit $400 million by year-end, while about $100 million in undrawn debt would further boost its liquidity profile.

Ramelius reported a 14% increase in revenue to $348.5 million at its half-year results on February 20. EBITDA shot up 39% to $140.2 million, thanks to a 12% jump in realised gold price.

New production centre

Ramelius’ biggest asset is the Mt Magnet production centre, which it started building via a $40 million acquisition in 2010. Now, 14 years on, Mt Magnet speaks for 62% of the group’s gold reserves. When combined with Vivien and Penny, it is 53% of the total net present value, according to Macquarie Capital analysts. Production is expected to reduce significantly by the 2029 financial year.

But the more pressing matter for Zeptner has been finding a replacement for Edna May, which it bought from Evolution Mining in 2017. It is now just 2% of the reserves, with a significant production slump ahead in the 2025 financial year. Other bets like the Rebecca project are still a long way from spitting out cash.

Put that all together, and it’s not surprising the management has been on the prowl for acquisitions. Sources told this column logical targets had included Spartan Resources as well as Northern Star’s Carosue Dam. However, the former isn’t operational, while the latter would have been hard to prise from its current owner.

The mooted acquisition at Karora comes after Ramelius acquired ASX-listed gold junior Musgrave Minerals in September.

--- end of excerpt --- [small edits by me]

Disc: I hold RMS and NST shares in real money portfolios, and NST here on SM.

RMS is in a trading halt tonight pending a response to this media speculation in the AFR, which sounds like it's on the money.

I think this announcement was largely expected due to the changing cost structure in the WA industry over the last year. Overall I consider this is a positive reflection on managment quality that they choose to shelve the stage 3 production for a later time. Even though at the current prices it would still make money and add to their production numbers. I am very happy for them to keep it in the ground as a gold reserve that can be tapped when conditions and margins will be better.

It also enables them to save the capex costs which were now up to $220m. They have also maintained there 3 year production guidance and the Edna May mill has ore until 2025. So it would seem likely that the stage 3 project will get revisited pretty quickly if either the industry cost pressures decrease or the gold price goes on a sustained run higher.

This defferal also gives them the space to aquire the 3rd production hub that they have been looking for. They have been talking about this since late 2020 I think, which is fine with me as one of the things I like about RMS is that they are careful at with what they buy. Given that the gold price is now recovering and interest in the sector is increasing again it is probably a much easier time to raise the capital for an aquisition.

Revolving Syndicated Debt Facility established

I sold earlier this week when I noticed RMS share didn't do much during the rally in the gold price which was a good decision given the share price has been trending down ever since. Plus I had to pick something to sell after buying into Nufarm. Not sure what to make of this announcement but I think they have done this in case their future earnings/ production underperform.

Other things to question is the early sale of their LTR lithium royalty and cancellation of their dividend.

So right now, one of the most undervalued producers in the Gold sector, but it is cheap for a reason.

22-June-2020: Ramelius on track for record quarter FY2020 Guidance upgrade

RAMELIUS ON TRACK FOR RECORD QUARTER OF OVER 80,000oz GOLD PRODUCED, FY2020 GUIDANCE UPGRADED

HIGHLIGHTS

- June 2020 Quarter production already a new record of 74,371oz (as at today’s date)

- Full June 2020 Quarter production now expected to exceed 80,000 ounces (Previous Guidance was 65 - 70,000oz)

- Full FY2020 production Guidance upgraded to record 225 – 230,000 ounces (Previous Guidance 210 – 220,000oz)

Ramelius Resources Limited (ASX: RMS) is pleased to advise that it has exceeded the Production Guidance range for the June 2020 Quarter, with 74,371 ounces of gold produced as of 21 June 2020.

This already represents record quarterly and annual production for the Company with two weekly gold pours remaining and has been achieved as a result of excellent performance from both West Australian production centres, particularly Mt Magnet. Based on the production figures received to date, Ramelius has upgraded Guidance for both the June 2020 Quarter and FY2020 as highlighted above.

Ramelius Managing Director, Mark Zeptner today said:

“We are obviously delighted by the operational performance in achieving records in both quarterly and annual gold production, particularly against the backdrop of COVID-19 and the additional administrative requirements the pandemic has necessitated.

We remain confident that Ramelius, with its high-performing team, excellent cash generation and enviable balance sheet, is very well positioned for the next stage of growth.”

Further details will be available in the Production Update and full Quarterly Activities Report, both due in July 2020.

--- ends ---

Gotta love upgrades! The RMS share price was up +16.76% today on the back of this one. They now have a market cap of AU$1.44 billion, and are firmly within our top 10 pure-play gold producers that are based here in Australia with their primary listing on the ASX.

The goldnerds.com.au spreadsheet lists the top 15 like this:

- NCM, Newcrest Mining

- AGG, AngloGold Ashanti *

- KLA, Kirkland Lake Gold *

- NST, Northern Star Resources

- EVN, Evolution Mining

- SAR, Saracen Mineral Holdings

- RRL, Regis Resources

- AQG, Alacer Gold *

- SBM, St Barbara

- OGC, OceanaGold

- SLR, Silver Lake Resources

- RMS, Ramelius Resources

- GOR, Gold Road Resources

- PRU, Perseus Mining

- RSG, Resolute Mining

After RSG, which has a market cap of $1.23 billion, there's a big step down to #16, which is WGX (Westgold Resources) with a market cap of only $853 million.

* However, #2, #3 and #8 (AGG, KLA & AQG) are secondary listings here by companies that are based in South Africa, Canada and the USA respectively. If you filter those three out, you are left with the following top 12:

- NCM, Newcrest Mining

- NST, Northern Star Resources

- EVN, Evolution Mining

- SAR, Saracen Mineral Holdings

- RRL, Regis Resources

- SBM, St Barbara

- OGC, OceanaGold

- SLR, Silver Lake Resources

- RMS, Ramelius Resources

- GOR, Gold Road Resources

- PRU, Perseus Mining

- RSG, Resolute Mining

RMS is now only 3.2% behind SLR's market cap, ($1.706b vs $1.760b), so RMS could easily overtake SLR if they have another day even half as good as today was.

GoldNerds works out the market cap a little differently - as explained below:

Market Capitalization = The value the stock market is currently putting on the entire company.

The market capitalization ("market cap") of a company is all of the following:

- The value of the company as determined by its recent share price and share structure.

- How much it would cost you to buy the entire company, at the recent share price.

- The value of all the company's assets, both financial and physical, including liabilities as negative assets.

To buy a company entirely, you must buy all of the:

- Fully-paid shares (both quoted and unquoted on the stock exchange);

- Shares that could be issued to holders of in-the-money options and warrants; and

- Shares that could be issued to holders of in-the-money partly-paid shares.

Out-of-the-money options and warrants and out-of-the-money partly-paid shares are worthless if someone were to buy all of a company at the current share price, because their holders would pay more than the recent share price to convert them into a fully-paid share.

The market cap is therefore calculated as the sum of:

- The number of fully-paid shares multiplied by the recent share price;

- The number of in-the-money options and warrants multiplied by the differences between their strike price and the recent share price (for each series of options or warrants); and

- The number of in-the-money partly-paid shares multiplied by the amount owing on each partly paid share (for each series of partly-paid shares).

Which is equal to the current share price multiplied by the combined number of shares and in-the-money options, warrants, and partly-paid shares, less the cost of exercising the in-the-money options and partly paid shares (the option cost).

Market cap is of interest in our analysis only because it usually roughly equal to the enterprise value (EV) of the company (because the financial net assets of a company are usually small compared to the physical assets of the company). The EV is the value the stock market is currently putting on the physical (non-financial) assets of the company.

Those same 12 gold producers in order of Enterprise Value (EV) is similar, except RMS moves up one position (leapfrogs SLR) and RSG also moves ahead of PRU:

- NCM, Newcrest Mining

- NST, Northern Star Resources

- EVN, Evolution Mining

- SAR, Saracen Mineral Holdings

- RRL, Regis Resources

- SBM, St Barbara

- OGC, OceanaGold

- RMS, Ramelius Resources

- SLR, Silver Lake Resources

- GOR, Gold Road Resources

- RSG, Resolute Mining

- PRU, Perseus Mining

Of these 12, I currently hold NST, EVN, SAR, RRL and SBM. From outside of those lists, I also hold PNR (Pantoro) which comes in at #19 on the EV list, and at #16 on the Market Cap list. The Producers list - with minimum 70% gold production - vs all other metals, and all companies headquartered here in Australia, so not including AGG, KLA or AQG - runs to 25 companies according to GoldNerds. The lower 13 - in EV order (biggest to smallest, continuing from PRU above) - are WGX, RED, DCN, PNR, TBR, BLK, BCN, MML, TRY, RND, WWI, AUL & KRM.

I also hold a couple of Developers and Explorers, being BGL and YRL - who are both still considered explorers because neither has reached FID - Final Investment Decision - to develop their respective projects into operating mines.

On top of the 25 Gold Producers, there are another 41 Gold Project Developers at various stages of project development, and another 99 Gold Explorers for a total of 165 companies. And that's using those filters - they must be 70% or more in gold, and headquartered in Australia with their primary stock exchange listing here. Remove those filters and the 165 becomes 222 companies.

As of tonight, there are a grand total of 2,127 companies listed on the ASX - you can view the complete list here - and 10.4% of those companies (222) are either gold miners, gold project developers or companies exploring for gold. That's quite a large proportion of the market when you think about it. Of course, many of those companies are very, very small, and most of them will go broke before they find something worth mining - or they'll change into a different type of company with a different focus, like a small biotech or fintech with another wonderful story. Remember the dot com bubble? So many of those new start-ups were ex-precious-or-base-metals-explorers.

Anyway, the point is, you can afford to be choosy. There are many gold companies to choose from, so choose wisely.

RMS looks like one of the better ones. I've held them before and I like their management. I will probably hold them again.