Probiotics supplement brand company $BIO issued their HY Report today.

ASX Release

Their Financial Highlights

Biome reports its first net profit in H1 FY25

○ +$96,228 (excluding R&D rebate)

○ +$433,395 (including R&D rebate)

Biome achieved positive EBITDA for H1

○ $351,765 (Excl. R&D Rebate and Share Based Payments)

○ $229,917 in Q2 an increase of 89% vs Q1

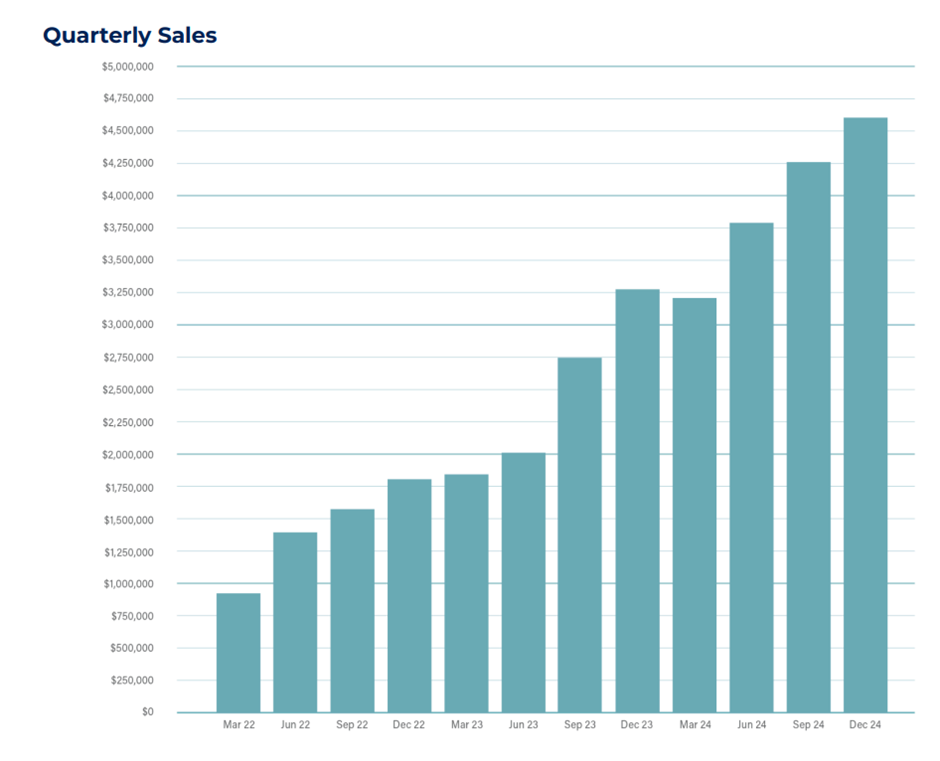

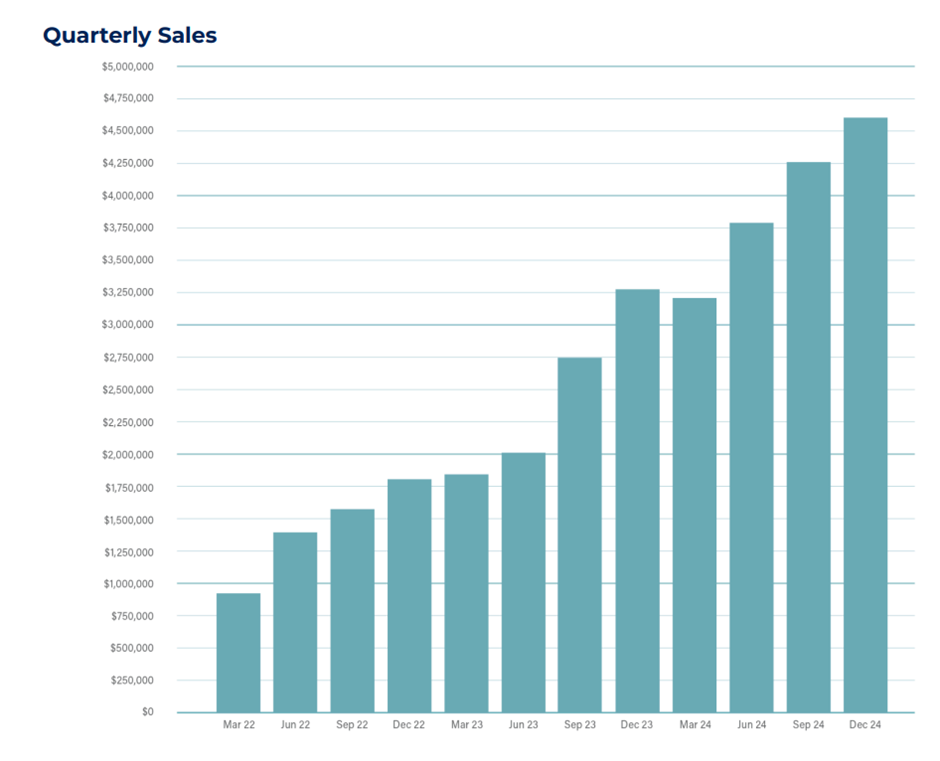

Biome reports record half year and quarterly sales revenue (H1FY25 $8.86m; Q2FY25 $4.6m)

Biome released Vision 27 Strategic plan with three year cumulative revenue guidance of $75-$85m (FY25-27)

Biome reports a gross margin of 61% for the 6 months to 31 December 2024

Their Business Highlights

- Biome increased its Australian distribution footprint in H1 to 6000, an increase of 20% vs H2 FY24

- Biome successfully completed its in-vitro research on its strain BMB18

- Biome entered a partnership with FaBA to gain access to matched research funding to develop BMB18 via a government grant

- Biome launched its new cholesterol-lowering probiotic, Biome Cholesterol™ Probiotic in Q1 FY25

- Biome Successfully launched into Canada with Ecotrend Ecologics in September 2024

Figure: $BIO Quarterly Sales

My Assessment

Pretty much everything in today’s report was either expected or has been reported, such is the fastidiousness with which CEO Blair (BVN) keep us posted on developments. But, it is actually good to see all the achievements of the half pulled together in one place. They’ve been busy and done a lot.

Australia Expanding Outlets

It is good to see a strong focus on expanding Australian distribution. While it is a “soft” metric, getting to the 6000 distribution points target from 5000 6 months early is excellent. After all, it is the Australian sales that will do the heavy lifting of generating cash while the expansions in the UK and Canada find their feet. This kind of trajectory means that the 800o goal in Vision 27 should be easily achieved, well ahead of schedule. Of course, while this is good, BVN has always said that the real potential lies in getting more sales per account.

International - a comprehensive update promised!

BVN has promised a “comprehensive international market update during the year”. This will be welcome. To date we have had some indication of the international sales contribution in FY24, and a little information on the staffing approach. But I’d be keen to see some tangible indications of sales momentum building in the UK, and of course it is very early days in Canada but BVN has spoken positively about product-market fit there, so it would also be good to have some numbers to back that up.

Onshoring Manufacturing - What?

One note in the release caught my attention: “Onshoring finishing manufacturing of Biome’s key product lines.” Without any real explanation. I know BVN has said this is something that might be contemplated in the future, but to see it report as something that is actually done, has caught me by surprise. And I HAVE been paying attention. Just to be clear what this likely means – I would expect that $BIO are finding an Australian onshore contract manufacturer to do the product encapsulation and packaging. I’m not sure what the effect of this will be on %GM, however, with Australia and the major market for the foreseeable future, it will reduce logistics costs, as well as providing some supply chain resilience. So I am all for it, even if I am not sure that $BIO has the scale for this to be a “must do.” I’m keen to learn more about this at future briefings.

Financials

Today’s result is an important milestone. It’s the first half for $BIO achieving positive NPAT, with NPAT up almost $2m compared with the PCP. Just to drive the point home - BVN called out that they achieved this even without the help of the R&D rebate!

This has been driven by strong revenue growth (+47.4%) while Total Operating Expenses actually declined by 3%. The big driver here was a 22% reduction in Corporate Costs to PCP, and sales and marketing growth being kept to only 24.1%.

That financial performance is impressive IMHO. It means the $BIO have been able to moved ahead with Europen commercialisation, run the market test in Canada and then move to commercialisation AND significantly expand the number of Australian outlet by 20% while holding expense essentially flat. Wow! I like it.

Cash - Mind the Inventory

However, digging through the financial accounts there is one thing to keep an eye on, Cash Flow was quite weak, with the business still burning a modest $0.3m of cash during the period. The main driver here is the increase in inventory, which over the 12 months has increased from $2.08m to $3.13m or +50%. Given the expansion of outlets being serviced in Australia, new products, and growth in Europe and North America, this isn’t a concern at this stage. The increase in inventory is broadly in line with revenue growth....just a smidge ahead However, it is a reminder that in FMCG (and I think for these purposes it is instructive to think of $BIO as FMCG rather than healthcare) inventory management is key.

Many a growing FMCG company posts good financials, but can get caught out of cash management given the inventory requirements needed to support market growth (I am triggered by memoroes of $FNP aka $NOU). I think $BIO will be OK, as they have a good %GM and expense control, and they need to invest in inventory to get it to their expanding customer outlets. Of all the places to burn the cash, I am happy that this is the right place for $BIO. BUT, we need to keep an eye on any trends here.

For now, $BIO has bitten off all it can chew, and I expect to now see a period of consolidation around ANZ, UK and Canada. If so, this should enable inventory growth to track more closely in line with revenue growth.

Final Takeaways

This is a good report. No surprises, and overall, it is good to see the financials coming together nicely behind all the recent individual news releases. I’m a happy holder here, and look forward to the update in the international markets.

Although I initially took only a very small (c. 1% position), SP volatility has given opportunities to add more at lower prices. But this is still is a risky and unproven business on the international stage. Can they build a multi-national probiotics brand? Early days. So I am going to maintain my current 3+% RL holding and let the company's progress work its magic over time .... or not.

Disc: Held in RL (3.2%) and SM