Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

“Shoot First, Ask Questions Later”

Today, probiotic brand $BIO announced its 4C. I took one look at it, and seeing a favourable “buy/sell” queue at the market open, sold my entire RL position, and I’ve just put in the order to sell on SM too.

Why would I do such a thing? I didn’t even have time this morning to attend the Webinar (although I would ideally have preferred to have done so, and I will watch the recording when its available)?

To answer that question, I’m not going to do a complete analysis of the quarter. Most things appear to be going well, with a logical progression of things I’ve written about at great length before. So, to save everyone’s time, I'll get to the point.

Reason 1: Inventory.

Reason 2: Inventory – how it was accounted for in the 4C.

Basically, a “Red Flag” (two actually) for me was raised today, in an area I have covered amply in previous straws. So, I was looking out for it.

Basically, Q4 saw a large build in inventory. Of this, $1.643m was accounted for as Operating Cashflow, and $1.295m as Investing Cashflow.

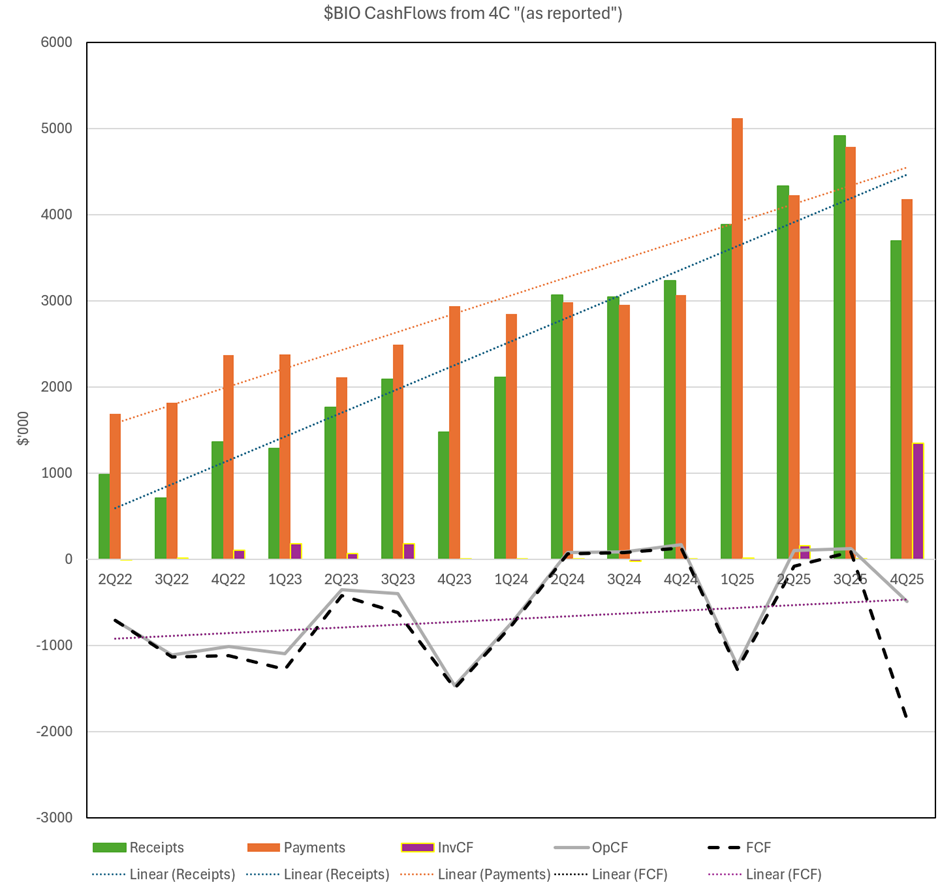

So, let me plot the 4C in two ways. Figure 1, “as reported”, and Figure 2, “as I read it”.

Figure 1: $BIO Cashflows from 4C (“as reported”)

Source: 4C report

Looking at the fifteen 4C report since IPO, prior to today, all inventory building has been classified as an “Operating Cashflow”, which is pretty normal – particularly in what I consider as a fast moving consumer goods operation.

So, one might think (and I certainly do) that putting a material chunk of inventory into “Investing Cashflow” for the first time ever would warrant an explanation. Well, here’s what was said.

- In the headlines … crickets. Oh, but “Net Operating Cash Outflow of $485 in Q4” OK, that’s not a problem because Q4 tends to be the weaker quarter for receipt.

- In the body of the report: “Within the quarter Biome made key strategic investments to support medium to long-term growth in both Australian and international markets. The highlights were the launch of Biome’s new range of products, Activated Therapeutics, an inventory-build to support FY26 growth, an investment in key international markets and the Activated Probiotics Symposium, a once-in-three-year customer education event.” [my emphasis added]

- … and a little later …… “The Company also drew down $1.3m from the NAB trade finance facility for investment in additional inventory to fund future sales growth and to maintain gross margin.” [my emphasis added]

- … and later still … “Payments for inventory and fulfillment was $1.643m, plus an additional $1.3m investment in safety stock. The company will maintain its working stock circa $3m while actively managing its level of safety stock, taking into consideration expected future sales growth, and seasonal, logistic and production factors.”

I don’t like the reporting of inventory build in this way. Building inventory, including safety stock, is completely normal and continuing part of any operation. And generally, as sales grow, the inventory and working capital to support it also grows. Safety stock (certainly as I have taught to over 600 MBA students over a decade) is an important working capital component of an operation. It has to be managed carefully, and it a critical and unavailable part of any operation.

Importantly, inventory also grows as a company expands to more regions (as $BIO has), as you need to hold more pools of inventory close to the market to support sales and customer service.

And inventory also grows the more product lines you have. (Again, as $BIO has, particulary with the whole new Activated Theraputics range.)

Therefore one of the key measures you have to monitor in the growth of any fast moving consumer goods company, is the growth of inventory. Because it consumes more and more cash as sales grow, geographies are expanded, and product variants proliferate. This has been a failure moce for many high growth FMCG businesses in the past, and no doubt it will continue to be in the future.

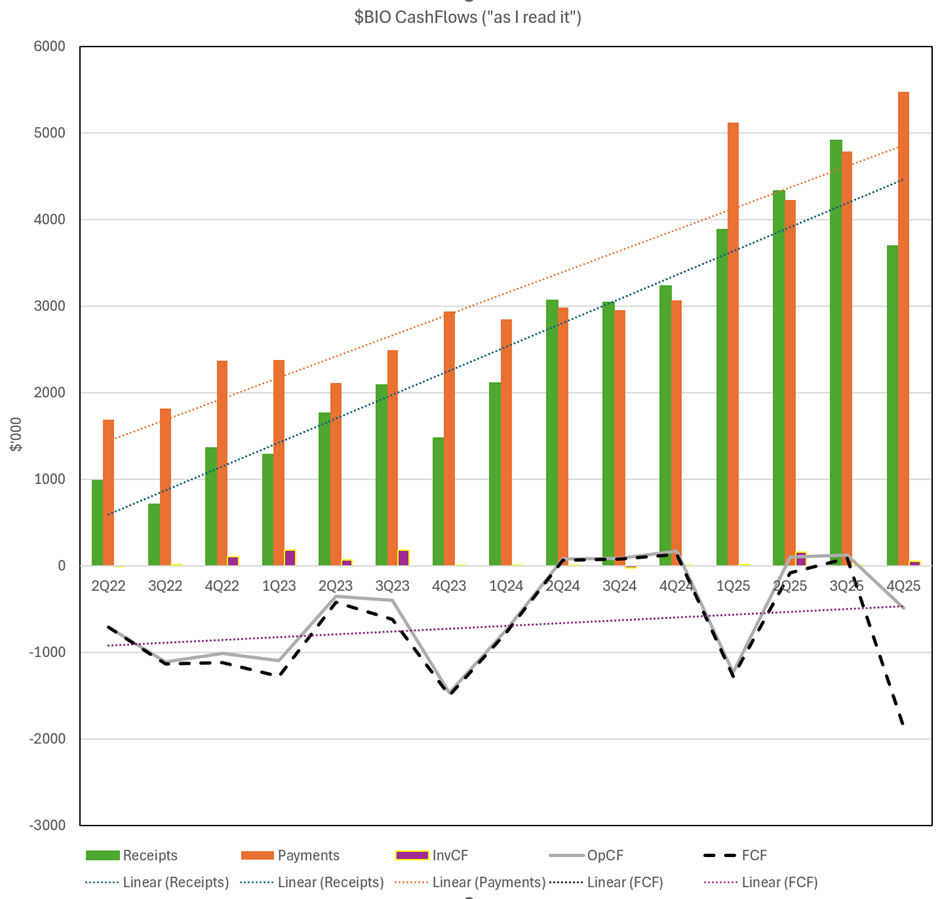

So, I don’t consider the inventory build as an Investing Cashflow. I see it as an inevitable part of the operation. And so, I have restated the 4C chart “as I read it” below in Figure 2.

Figure 2: $BIO Cashflows (“as I read it”)

This now gives a very different view as to the respective slopes of the “receipts” and “payments” dotted trend lines driving “Operating Cashflow” as I have redefined it. It is a very different picture between Figure 1 and Figure 2.

And for me that’s what today’s report is obfuscating. The operating leverage is not as strong as it has hitherto appeared. But this wasn’t a shock for me, I have been monitoring this factor over several 4Cs, and if you go back and read some of my earlier Straws, you will see I called it out. But I did not expect to see the magnitude of today’s number.

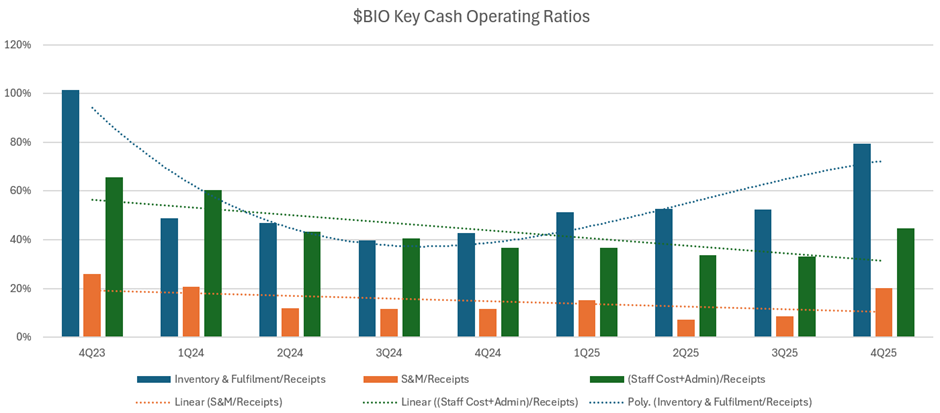

To provide another lens on this, in Figure 3 below I have plotted some other operating ratios.

Figure 3: Key Operating Ratios

Source: 4C reports. Note - all inventory build has been classified as “Operating Cashflow” for the purposes of this report (This differs from the reported basis).

What this picture tells me, is that up until mid-FY24, $BIO’s operations appeared to be scaling quite nicely. However, more recently, the trends have flattened out and – certainly on some metrics – seem to be going backwards.

This is critically important. Because it means that the bigger $BIO is getting, the weaker the cash operating margins are becoming. That’s why it is a thesis breaker for me.

I first invested in $BIO in July 2024, just before the 4Q25 report. My thesis was based on a view that the business would develop more favourable economics as it scaled. Five quarterly reports later, and on each of the three operational ratios plotted above, the opposite has happened.

When I invest, I am investing in an “economic engine” and I want to see – over a series of reports – evidence that the economic engine is building and becoming stronger. I can’t see that here, and therefore I am out.

“Shoot First – Ask Questions Later”

But I didn’t do all this analysis before selling this morning. All I saw was that inventory was up significantly, and that a large chunk of it has been classified as an “Investing Cashflow” with a rationale I found unconvincing and unprecedented.

(As this point, I will recall $FNP or $NOU as it is now called - those who have followed my work over the years might recall it. I have written about this before, because it was an example of a low margin foods business that got into all sorts of trouble with inventory management as it tried to scale. It was my worst $ASX investment ever, and I have written at length about it before. The big lesson I took from that event was how important it is to track inventory metrics in high growth, consumer good manufacturers. I didn’t then, and I paid dearly for it. Now I am not saying $BIO is another $FNP/$NOU. Definitely not. But when I see adverse inventory trends, as well as “reporting oddities”, that’s a double red flag for me.)

So for me it was a case of “shoot first, and ask questions later.” I have exited my full position for more or less what I paid for it. Whew.

Have I over-reacted? Quite possibly. But today’s report adds to a trend that goes against everything I know (and teach) and have experienced to my personal financial detriment.

I hope I am wrong and that over coming reports the business continues to go from strength to strength. If the facts prove me wrong, then I’ll be happy to get back onboard. But I think that, even in the success case, this is going to be a slower burn than I had initially hoped. That, combined with its microcap "fragility", fundamentally changes the risk-reward equation for me.

Finally, I didn't need to do all the analysis that I've presented in this post, because I was looking for the effect. Why? I had three questions on my risk register:

Q1: Is the quality of growth in Australia holding up, as the business matures in this market?

Q2. How dilutive to the operating leverage is getting going in NZ, UKI and Canada all at the same time?

Q3: Is the Activated Therapeutics line (a profileration of SKUs which I view as departing from the core science thesis), actually a good idea? More SKUs, more operational complexity, more inventory etc.

I don't know the answer to these questions. But the summative effect doesn't look good to me....at least in the short term.

Disc: Not held in RL and SM

Probiotics company $BIO have announced their international sales as promised.

Their Headlines

● Biome reports $1.5m in International Sales Revenue for FY25, up 69% vs PCP.

● Secured prominent strategic distribution partnerships across three key international markets in Q4 FY25:

○ Ireland - Uniphar, pharmacy wholesale and retail with 1,400+ pharmacy customers

○ New Zealand - Propharma (EBOS), the country's largest pharmacy wholesale network

○ Canada - Multiple high-value agreements with prominent pharmacy and health food retail groups:

■ Pure Pharmacy Group (British Columbia)

■ Healthy Planet Group (National)

■ Nature's Emporium (Ontario)

■ Nature's Signature (Ontario)

● Biome is now strategically positioned for significant international growth and expansion in FY26, leveraging new distribution channels to access thousands of additional pharmacy and health food locations commencing Q1 FY26.

My Analysis

$1.5m in international sales revenue represents 8.1% of total sales revenue, so NZ, UKI and Canada are starting to make a modest but meaningful contribution to the Group. Importantly, they are growing strongly at 69% vs pcp, vs. the overall group growth of 41%. (stripping out Australia from RoW, in FY25 Australia grew from $12.1m to $16.9m a rate of 39.6%.)

A fair amount of focus appears to be going in to Canada. CEO Blair has spoken recently how he thinks there will be a strong product fit in Canada, so the addition of two "sales and education" team members as well as the distributorship sets things up for a strong contribution in FY26.

The early retail chain signings are promising - but many more are needed. The Canadian outlets listed in the release reflect (by my research) only some 70-80 outlets. So it is still early days as Canada has some 10,000-12,000 phamacy outlets and another 2,000 specialist nutritional supplement outlets.

Although there is no breakdown to the RoW numbers, I believe most of the performance will have come from NZ and UKI, because Canada was only launched commercially in September 2024.

The distribution partnerships will be important, allowing $BIO to scale without having to growth a large international "sales and education" workforce. Important will be to leverage the small number of staff in each location to train staff at the distributors because it is critical that the end retailer understands the importance of the "behind-the-counter-positioning" needed to access the favourable margin contribution the products have reportedly proven in Australia. Without that, they are just another supplement on the shelves. Of course, with the distribution deals, some 20% to 30% of final price goes to the distributor, so there is a clear calculation to make between lower sales force costs with the lower revenue released per unit.

Conclusion

Overall, it looks like good progress.

It will be interesting to see the FY financials for evidence that $BIO can achieve disciplined profitable growth and, as part of that, to see how working capital is scaling as sales grow.

Progress in UKI and Canada is important to $BIO achieving its goals as Australian growth inevitably starts to mature.

In FY26, I'll be looking for the % revenue growth rate from RoW to accelerate beyond 69%. The distributorships signed across the year, as well as the retail chains added, together with the increased staffing and a full year contribution from Canada means that if the product has a good fit in these international markets, we should see accelerating growth.

For now, I'll hold my current position of 5% (RL). Delivery seems to be tracking in line with the strategy.

Disc: Held in RL and SM

Probiotics company $BIO published their 4C today.

While the shares have been in doldrums for the last few months, with a fairly ugly short term chart, I'll summarise my analysis which explains why - based on performance - I am not unduly concerned at this stage, and what I am looking forward in the come reports.

Their Highlights

● Biome records $195k EBITDA for Q3

● Biome recorded a net operating cash inflow of $123k

● Biome achieves another high growth quarter in sales revenue, reaching ~$4.51m for Q3, an increase of 41% vs PCP

● Biome achieved a gross margin of 61% for Q3

● Biome had a cash balance of $2.7m as at 31 March 2025

● Biome expects to report its first full year net profit for FY25

● Record cash receipts of $4.91m in Q3, up 61% vs PCP and up 13.% vs Q2

Revenue Growth Chart

(Note: the Q3 dip appears to be seasonal, so expecting a strong final Q)

Analysis of Cashflow Trends

Basically, for the last 6 consecutive quarters, $BIO have been cashflow positive - save for the MD 3yr LTIP payment in 1Q FY25, which more than wipes out the gains!

So, someone looking at the trend of the last 6-8Q, rather than the longer trend, could reasonable ask whether the underlying operating economics of this business are strong enough to justify its valuation.

To answer this question, you have to dig a little deeper. And therefore below I have plotted they cash operating ratios, which I think tells the story.

I've been selective here, leaving off R&D and Capex - as they are not material items, exhibiting no major trend.

Overhead (green)

I've combined [Staff Cost + Admin & Corporate Costs] and these are declining nicely as a % receipt from 66% in $Q23 to 33% in 3Q25m down a little from 34% in 2Q25.

So, Blair is maintaining overhead discipline, despite over this time adding a small number of heads for the expansion in UKI and Canada.So far, so good.

Sales & Marketing (Orange)

As a function of receipts, sales, marketing and advertising has fallen from 26% of receipts in 4Q23 to around 9%, up slightly from 7% in the previous Q. That's also pretty good, although I expect the staff costs of the sales and marketng "educators" are accounted for in the "Staff Costs" line.

One thing to watch will be that this might increase in the next few quarters, as $BIO introduces the "Activated Therapeutics" range.

However, overall both as a trend and as an absolutely percentage, there is nothing to be concerned about here.

Inventory and Fulfilment (Blue)

As I indicated in my last major analysis of $BIO, inventory and fulfilment is where we are seeing the drag on overall operating leverage coming through. It reached a lowpoint on a strong downward trend of 40% in 3QFY24, but has been steadily trending up ever since, now standing in the latest period at 53%. It needs to come down again to not be an overall drag on the business economics.

So why is this happening?

As new products are added to the range, expansion occurs internationally, and $BIO steps up the rate of adding new outlets at an accelerated rate, this is clearly adding weight in the supply chain. From my perspective this is the key metric to monitor in the periods ahead.

Inventory and channel management is a big issue in FMCG. It is clear that this is the motivation for BVN to onshore final packaging to Australia, but that in itself can only make a very small difference, as I've shown previously.

My sense is that this is a deliberate strategy from Blair. Having got comfortable that he is there or therabouts on cash flow break-even, he is investing in inventory to supply new outlets and new terriritories, so that product is available in more locations to build the brand and drive sales velocity.

But of course, it is by no means a given that in new outlets sales velocity will continue to grow and so this is the key metric to continue to monitor. It we don't see that turn back down over time, then it becomes a thesis breaker.

My Conclusions

Unlike with many other brands, Blair isn't use big sales, marketing and advertising budgets to drive revenue and brand awareness. He's doing it through the marketing educators with the pratitioner customers, and backing that up with inventory as new outlets come online. Through this strategy, he has got pretty much to a breakeven business, as outlets continue to expand both in Australia and overseas.

So now its game on. There is no possible justification for further territorial expansion until he can show favourable economics across Australia, NZ, UKI and Canada. That is now the point to be proven.

I will now keep alert to two potential future red flags: 1) further territory expansions and 2) inability to get the inventory/fulfillment ratio down - or at least to stablise it. (Of course, adding Activated Therapuetics to the mix might keep some pressure on this metric in the next report or two.)

I'm happy to hold at my current position size and see how this story unfolds over the next year. And with quarterly reporting likely to be retained for a while, I can closely monitor the key operating ratios.

This is by no means a done deal, but the game is now on.

Disc: Held in RL and SM

Probiotic brand $BIO reported their 3Q Sales figures. Quarterly Sales Report

Sales are down -2.2% on the previous Q, as 3Q appears to be a cyclically soft quarter, and we saw the same last year (-3.0%).

Sales are up 41% on PCP.

Overall, the sales growth is maturing. If we look at the Trailing 12 Month sales growth over the last 4 quarterly reports the trend is clear: 81%, 74%, 60% and 53%, although the rate of decline is falling. At some point this will stabilise, for example, as the contribution from international sales (still a very small base) starts to contribute. Anyway that what I am looking for as part of my thesis!

They've called out same store sales growth of 45% for the 3 months to Feb-25 (presumably because they don't yet have store level data, rather than due to cherry-picking?) showing the priority being given to growing existing accounts is yielding results.

Terry White ChemMart also awarded them Retailer of the Year - a nice little accolade when you think about the competition.

SP has languished as a result of lack of positive recent surprises and general market funk. But as far as I am concerned, $BIO remains solidly on track.

Looking forward to seeing the 4C in a couple of weeks, to see how the financials are evolving ... top line vs expense and inventory.

Disc: Held in RL and SM

Probiotics supplement brand company $BIO issued their HY Report today.

Their Financial Highlights

Biome reports its first net profit in H1 FY25

○ +$96,228 (excluding R&D rebate)

○ +$433,395 (including R&D rebate)

Biome achieved positive EBITDA for H1

○ $351,765 (Excl. R&D Rebate and Share Based Payments)

○ $229,917 in Q2 an increase of 89% vs Q1

Biome reports record half year and quarterly sales revenue (H1FY25 $8.86m; Q2FY25 $4.6m)

Biome released Vision 27 Strategic plan with three year cumulative revenue guidance of $75-$85m (FY25-27)

Biome reports a gross margin of 61% for the 6 months to 31 December 2024

Their Business Highlights

- Biome increased its Australian distribution footprint in H1 to 6000, an increase of 20% vs H2 FY24

- Biome successfully completed its in-vitro research on its strain BMB18

- Biome entered a partnership with FaBA to gain access to matched research funding to develop BMB18 via a government grant

- Biome launched its new cholesterol-lowering probiotic, Biome Cholesterol™ Probiotic in Q1 FY25

- Biome Successfully launched into Canada with Ecotrend Ecologics in September 2024

Figure: $BIO Quarterly Sales

My Assessment

Pretty much everything in today’s report was either expected or has been reported, such is the fastidiousness with which CEO Blair (BVN) keep us posted on developments. But, it is actually good to see all the achievements of the half pulled together in one place. They’ve been busy and done a lot.

Australia Expanding Outlets

It is good to see a strong focus on expanding Australian distribution. While it is a “soft” metric, getting to the 6000 distribution points target from 5000 6 months early is excellent. After all, it is the Australian sales that will do the heavy lifting of generating cash while the expansions in the UK and Canada find their feet. This kind of trajectory means that the 800o goal in Vision 27 should be easily achieved, well ahead of schedule. Of course, while this is good, BVN has always said that the real potential lies in getting more sales per account.

International - a comprehensive update promised!

BVN has promised a “comprehensive international market update during the year”. This will be welcome. To date we have had some indication of the international sales contribution in FY24, and a little information on the staffing approach. But I’d be keen to see some tangible indications of sales momentum building in the UK, and of course it is very early days in Canada but BVN has spoken positively about product-market fit there, so it would also be good to have some numbers to back that up.

Onshoring Manufacturing - What?

One note in the release caught my attention: “Onshoring finishing manufacturing of Biome’s key product lines.” Without any real explanation. I know BVN has said this is something that might be contemplated in the future, but to see it report as something that is actually done, has caught me by surprise. And I HAVE been paying attention. Just to be clear what this likely means – I would expect that $BIO are finding an Australian onshore contract manufacturer to do the product encapsulation and packaging. I’m not sure what the effect of this will be on %GM, however, with Australia and the major market for the foreseeable future, it will reduce logistics costs, as well as providing some supply chain resilience. So I am all for it, even if I am not sure that $BIO has the scale for this to be a “must do.” I’m keen to learn more about this at future briefings.

Financials

Today’s result is an important milestone. It’s the first half for $BIO achieving positive NPAT, with NPAT up almost $2m compared with the PCP. Just to drive the point home - BVN called out that they achieved this even without the help of the R&D rebate!

This has been driven by strong revenue growth (+47.4%) while Total Operating Expenses actually declined by 3%. The big driver here was a 22% reduction in Corporate Costs to PCP, and sales and marketing growth being kept to only 24.1%.

That financial performance is impressive IMHO. It means the $BIO have been able to moved ahead with Europen commercialisation, run the market test in Canada and then move to commercialisation AND significantly expand the number of Australian outlet by 20% while holding expense essentially flat. Wow! I like it.

Cash - Mind the Inventory

However, digging through the financial accounts there is one thing to keep an eye on, Cash Flow was quite weak, with the business still burning a modest $0.3m of cash during the period. The main driver here is the increase in inventory, which over the 12 months has increased from $2.08m to $3.13m or +50%. Given the expansion of outlets being serviced in Australia, new products, and growth in Europe and North America, this isn’t a concern at this stage. The increase in inventory is broadly in line with revenue growth....just a smidge ahead However, it is a reminder that in FMCG (and I think for these purposes it is instructive to think of $BIO as FMCG rather than healthcare) inventory management is key.

Many a growing FMCG company posts good financials, but can get caught out of cash management given the inventory requirements needed to support market growth (I am triggered by memoroes of $FNP aka $NOU). I think $BIO will be OK, as they have a good %GM and expense control, and they need to invest in inventory to get it to their expanding customer outlets. Of all the places to burn the cash, I am happy that this is the right place for $BIO. BUT, we need to keep an eye on any trends here.

For now, $BIO has bitten off all it can chew, and I expect to now see a period of consolidation around ANZ, UK and Canada. If so, this should enable inventory growth to track more closely in line with revenue growth.

Final Takeaways

This is a good report. No surprises, and overall, it is good to see the financials coming together nicely behind all the recent individual news releases. I’m a happy holder here, and look forward to the update in the international markets.

Although I initially took only a very small (c. 1% position), SP volatility has given opportunities to add more at lower prices. But this is still is a risky and unproven business on the international stage. Can they build a multi-national probiotics brand? Early days. So I am going to maintain my current 3+% RL holding and let the company's progress work its magic over time .... or not.

Disc: Held in RL (3.2%) and SM

The post below popped up in my LinkedIn feed this morning, giving an insight into how $BIO is going about establishing the product presence in the UK nutrition and wellness practitioner market. I've added below a brief description of the association, (provided by my BA ChatGPT.)

Industry bodies like this are always on the lookout to drive member engagement and value. So a good reception at, for example, the Berkshire branch, would doubtless lead to invitations over coming weeks and months at other association branches - over time getting the message to a decent share of active portion of the associations 3,500 members, and leading to coverage in association newsletters and social media posts.

These industry bodies appear to be as important in the UK as they are in Australia, and tapping into them in this way, as indicated by the post, is likely a very cost effective way of executing $BIO education-based sales and marketing program.

About The BANT (by ChatGPT)

The British Association for Nutrition and Lifestyle Medicine (BANT) is a non-profit professional body representing approximately 3,500 nutrition practitioners in the UK. Established over 20 years ago, BANT sets standards of excellence in science-based nutrition and lifestyle medicine.

BANT members are trained in nutritional sciences at a minimum of degree level and are equipped to work clinically with individuals. They provide personalized nutrition and lifestyle recommendations, translating complex science into practical advice tailored to individual health goals and dietary preferences.

A key resource offered by BANT is the Nutrition Evidence Database (NED), the UK's first scientific database specializing in nutrition and lifestyle medicine. NED provides evidence-based information to support clinical interventions and inform practitioners' recommendations.

BANT also engages in public education, offering resources to help individuals make informed dietary and lifestyle choices. Their mission is to promote health and well-being through personalized nutrition and lifestyle medicine, contributing to the integration of these practices into mainstream healthcare.

Disc: Held in RL and SM

And yet again ... price-sensitive-not-price-sensitive

$BIO looking to tap the QLD-based, government funded Australia's Food and Beverage Accelerator to support the development of its recently acquired proprietary probiotic strain.

$BIO already use Australian universities to lead other clinical research programs, so this is simply a smart way of tapping a pot of innovation funds, and tapping Australia's extensive research infrastructure.

Product development on the smell of an oily rag. I like it. But again, it shouldn't be a price sensitive announcement. It is simply BAU. IMHO. We'll see if the market agrees or not.

Disc: Held in RL and SM

Yet another "price sensitive" announcement from $BIO, this time on progress in developing one of their proprietary strains.

I'll keep this brief. I don't think it should be price sensitive and I don't believe it warranted an ASX announcement at all.

It is a positive report of essentially a lab characterisation of the albility of a probiotic strain to have certain biological effects which, if translated into humans, might yield certain health benefits. It is not the result of a clinical trial, and in fact it is simply a precursor to the clinical work that needs to follow.

I believe $BIO is more about brand and marketing than it is about strong clinical evidence. And in line with that, I believe today's announcement is more about branding and marketing, than scientific or clinical information of any weight.

I wish $BIO would stop making "price sensitive" announcements like this. This kind of update would better be one bullet point in a regular investor presentation.

At some stage, I wonder if my irritation will start to undermine my thesis and conviction in this business?

Disc: Held in RL and SM

$BIO reported their 4C this morning.

Their Highlights

● Biome records $234k EBITDA for Q2, up 92% vs Q1

● Record cash receipts of $4.34m in Q2, up 41% vs PCP

● Biome reports record quarterly sales revenue of $4.61m, up 41% vs PCP

● Biome maintains gross margin above 60% for Q2

● Biome had a cash balance of $2.59m as at 31 December

● Biome expects to report its first net profit for H1 FY25

My Analysis

I've plotted the cash flow trend chart below.

We're back to operating cashflow positive - just , and a slight overall negative FCF (see coment below on investment).

The main difference in operating costs is that BVN's incentive payment which spiked the Q1 number is absent this quarter, so receipts and revenues are more in line. However, increased inventory contributes to operating costs clearly being a step up from the pretty flat base maintained during FY24. Other cost line items continue to be well-controlled.

There is also a tick up in investing cashflows again, with the acquisition of German probiotic strain for the company's sole use and future development.

Now with sales and marketing operations in Australia, NZ, UK, and Canada - potentially stepping out further into the EU - can $BIO replicate the early success in Australia in its international markets? A red flag would be moderating sales growth even as sales and marketing costs increase. That likely needs one to two more years to get a good handle on.

I'm not so sure how good an idea it is to focus on becoming NPAT positive in 1H25 - although I am not complaining. The maiden profit will be thin whatever it is, and what I am more focused on is the relative slopes of the receipts and payments curves. That's the indicator to me of whether this brand can become a cash generative machine.

Overall

OK result.

Disc: Held in RL and SM

And first out of the blocks in trading updates for 2025 from my portfolio is,...surprise, surprise,... $BIO.

- Unaudited revenue of c. $4.6m vs. the forecast given in November of $4.5m

- 1H FY25 is c. $8.9m, up 48.3% on pcp

- Quarterly sales on an annual run rate of $18.4m

My Analysis

This kind of growth keeps them in line with the VIsion 2027 targets. While percentage growth is declining as it cycles a more material base (39.4% to pcp), quarterly sales adds have averaged $0.33m over the last 4 reports. Were this to continue through Q3 and Q4, that would put $BIO on a FY revenue of $19.1m, which is close to where I think they need to be to hit the mid-point of the Vision 2027 Targets.

So, an "on track" result.

The beat to recently issued guidance continues the pattern of what appears to be BVN putting out a guidance number that he is reasonably confident can be beaten. Doesn't mean that they won't get it wrong in future, and of course such misses are a good thing for anyone looking to accumulate.

If history is to be repeated, we should soon get an update with FY revenue guidance, which has been known to follow a few days after the Trading update rather than be incorporated into the 4C report which will come in a couple of weeks. Afterall, BVN does love his frequent updates!

(OK, back to the beach, as I'm not officially back on the case yet, but thought I'd post this straw over my morning coffee!)

Disc: Held in RL and SM

Scene: Somewhere on Teams, Zoom, or in a Boardroom in VIC, Australia.

BVN: "OK, the way I see it, we have 2 choices to get the SP moving."

Ilario and Dominique (in unison): "Oh yay. What's that?"

BVN: "Option 1, I put out a price sensitive announcement saying that we're going to change the corporate logo."

Ilario and Dominique (in unison): "OK,... and ....Option 2?"

BVN: "You guys follow my lead and buy a few shares each."

Ilario and Dominique (in unison): "Oh,....OK. Sounds like we'll go with 2."

BVN: "Cool, I'll get right on with writing the ASX release."

{Legal Notice: The above script is purely fictional. Any resemblance to real people or events is purely coincidental}

Disc: Held in RL and SM

More positive newsflow for probiotics brand $BIO in both Canada and Australia.

Hightlights

● Following a successful test market launch in Canada, Biome moves to an official market launch in both health retail and practitioner markets

● First Canadian staff member to start on the road (in Ontario) this November

● Three additional products approved by Health Canada in October

● Biome reaches a new three month record with 188,000 consumer units purchased of Activated Probiotics in Australian market, up ~60% vs PCP (Aug-Oct 2023)

● Terry White Chemmart retail scan sales reach $3.5m for 12 months to October up ~75%

● Biome Cholesterol Probiotic successfully launched internationally

My Assessment

Good news all round.

Sales appear to be running ahead of the 50% my model requires for $BIO to hit the 2027 Strategic goals.

The test maketing period in Canada was shorter than I had in mind (no good reason), so the full commercial rollout with 12/17 products approved will start to get acoounts going this year. While the FY25 contribution to sales will be small, it sets things up nicely for FY26 and beyond. BVN has spoken very positively about the Canadian market in his last presentation, which as I recall was delivered while he was in Canada. A leading indicator of market traction will be indicated by the rate at which BVN adds further "educational" staff.

Overall, good news.

I'm happy to keep at my current RL position which is 2%, as I still see this as a higher risk proposition and will build my position over time.

Disc: Held in RL and SM

He's a little market anecdote.

Today, I was in my local pharmacy - part of theChempro chain. I've been in and out of it several time in the last 6 months, and noticed the Activated Probiotics range, and that the range is stocked right next to the payment terminal has been growing to now encompass the full range. However, the metres of shelf space is still about 8-10% of that given to the more extensive Bioceuticals range.

I got to speak to the head pharmacist in the shop, as it was a quiet time, and I asked him if he could recommend something for a minor condition I have, and for which I usually take a prescription medication.

Quick as a flash, he was on to the relevant Activated Probiotic range. He rolled out all the key messages (per CEO Blair) and spoke about how I'd probably need to take the recommendation for 2-3 months to see the benefit. He spoke about the clinical evidence, and pointed out that the condition-specific label made it unique among probiotics.

He also mentioned that he had personally tried the general Biome Advanced Probiotic and had observed benefits (digestion, gut health in the pharmacist's case.)

As I got deeper into the specifics of my condition, he finally recommended another treatment, with a good rationale as to why that was preferred over the probiotic.

My Key Takeaways From this Isolated Datapoint

- The market training investment is clearly putting the $BIO brand in the front of mind of the pharmacist

- The range is prominently displayed right next to the payment terminal and, although, only having a very small fraction of space of the established brand, was closer in reach to someone standing at the payment terminal

- Pharmacists in Australia are well trained professionals, and given a deeper discussion, this pharmacist ultimately made another recommendation, having weighed the $BIO product with alternatives.(The alternative was NOT a probiotic)

While no payday for $BIO here, it is one datapoint that backs up what BVN has been telling investors. So, I took heart.

Disc: Held in RL and SM

$BIO follow-up hard on the heels of yesterday's Vision 27 strategy launch with their quarterly sales result.

Their Highlights

● Biome achieves record quarterly sales revenue of ~$4.25m (unaudited)

● Sales revenue increased ~$1.51m or 55% vs PCP Q1 FY24

● Sales revenue increased ~$450k or 12% vs Q4 FY24

● Q1 Sales revenue represents a ~$17m annualised run rate (ARR)

My Analysis

A good result, ahead of their announced quarterly target by 6.3%.

With a Q1 annualised sales run-rate of $17m on a growth trajectory of +55% to pcp, depending on quarterly variability an annual result of $20m is potentially within reach. (My valuation central case has $19.5m for FY25) That would potentially lead to a maiden positive NPAT result ... but I am getting ahead of myself here. In any event, this should be increasing the quarterly net cash surpluses nicely.

Overall: On track.

Note: My criterion to increase my holding further is some visibility of product-market fit in UKI, as this is central to my long-term thesis. I'll measure this by the international sales trajectory incremental to FY24 $0.895m, as the contribution from other markets is likely small.

Disc: Held in RL (2%) and SM

Probiotics firm $BIO have announced their Vision 27 strategic plan, as CEO Blair had promised for September. (No announcement of a webinar to go with it as yet, but the presentation is reasonable self-contained).

Much is the market sensitive information has been released before: (cumulative revenue target FY25-27 of $75-85m; test market entry to Canada)

There are some more detailed specifics about individual markets, albeit entirely consistent with what's been said before, and also on supply chain.

There is reference to a new proprietary strain of L. plantarum XXXX (name to be finalised) without saying what it's for.

There is also reference to an upcoming new brand and product range aimed at filling an existing market gap. Not a lot of detail here and we'll find out more in H2FY25, (I am idly speculating that this is a more generic range to create more SKUs in the behind the counter display, probably not back up by the clinical trials on condition-specific labels, Differentiated brand is so as not to confuse the with the clincal-supported label claims of the Activated Probiotics range)

Those are just some initial observations from a very quick scan.

Dis: Held in RL and SM

I know I haven't posted on $BIO for a few days. Partly because my investing effort is geting absorbed by results season, and partly because I have started some work getting stuck into reviewing the clinical research behind their products.

For anyone who is interested, they list relevant research papers in the "Science" tab for each product on the Activated Probiotics website. So, you can get a flavour of what has been done quite readily.

However, in one of the early products I investigated, at first I couldn't find evidence of a placebo-controlled, randomised, double-blind clinical trial (PCRDB) in the reseach papers cited by $BIO. Initially, I was concerned. But on doing a deeper search, eventually I DID find a relevant clinical study to this standard by one of their research partners, which was more recent that the study on the product website. (Why is it not the one quoted on the website?)

Long story short, the task of investigating the clinical work for 16 products (well, actually fewer, because there are some overlaps) is going to be a bigger undertaking than I initially thought. I am progressing it, and will report my finding here. But it might take a while.

So far, there are no major flags giving me concern that BVN's characterisation of their work is anything but accurate.

What I am finding is that there is a huge amount of clinical research on health benefits of probiotics - after all, there are many bacteria and almost countless strains, many competitors and a huge range of products out there.

On the "Science" element of the Deep Dive, I am forming some loosely supported hypotheses, bsaed on my work to date:

- The vast majority of the clinical research on probiotics is of a lower standard than PCRDB.

- Therefore, while perhaps not unique, $BIO is indeed an early mover in bringing strain-specific products to market with this level of clinical backing. So far, the reported clinical benefits are signficant. (especially, when you consider than many approved, "conventional" pharmaceuticals only have modest benefits in a proportion of patients treated.)

- While they have some IP protection in wrapping the strain, the formulation, and the label claim backed by a cliniclal trial, it is conceivable that related strains might also deliver a similar clinical effect. So a determined or lucky competitor could launch a "me-too" product if they are prepared to invest (I am not a microbiologist, so I need to test this).

- One issue I am uncovering is that in some of the cited clinical trial evidence I have read to date, it is unclear to me whether the trial was conducted with the same formulation as the commercial product. There are two sub-questions 1) Does this matter and 2) Is it that I just haven't uncovered the relevant clinical trial report. On 1) I think it does matter, because the formulation influences where in the gut and at what rate the product is delivered. So this is one flag to follow-up on.

Anyway, this is turning out to be a big piece of work that is causing some indigestion and heart burn ... pass the probiotics!

The good news - I can see why BVN says $BIO is a first mover and differentiated. There does appear to be good empirical science behind their claims, even if the mechanisms of action are less clear and - in some case - appear contestable. As far as I can see, much of the science of how the microbiome achieves outcomes is not fully understood. In many cases I've read there are plausible theories for the mechanisms, but that is not the same as proof. Again, the same is true in pharmaceuticals to some degree. But I am getting to the limit of my scientific competence here.

The less good news - if they develop a valuable business, I think any moat is less secure than one might think for a competitor prepared to go after it. But I have to get more input on this. Of course, this is where being an early-mover with a strong brand will help. And it is clear that they are making good progress in building a brand known to practitioners in Australia.

Lots of questions, but so far no red flags.

Held: RL (0.65%) and SM

As I speculated yesterday, Bell Potter have updated their valuation slightly off the back of yesterday's 4C. I haven't seen the updated report yet, but picked the following FN Arena summary off the news-wires. Likely explains this morning's SP response, recoverings yesterday's "profit-taking".

TP change appears related only due to tweaking the discount rate - which I don't understand. But in any event, they are still probably below where I sit on valuation, particularly after yesterday's SM meeting.

From FN Arena

Displaying the fastest sales growth of the past five quarters, notes Bell Potter, Biome Australia's June quarter increased by 88% on the previous corresponding period.

Also, operating cash flow (OCF) nearly doubled the March quarter, and was the third successive positive quarter, highlights the broker.

Bell Potter attributes sales growth to the release of new products over FY24 and a 25% increase in distribution footprint across pharmacy and health practitioners. Pharmacy sales account for around 66% of total sales, note the analysts.

The target rises to 80c from 73c as the broker lowers the assumed discount rate to 11.8% from 12.5%.

Sector: Household & Personal Products.

Target price is $0.80.Current Price is $0.73. Difference: $0.08 - (brackets indicate current price is over target). If BIO meets the Bell Potter target it will return approximately 9% (excluding dividends, fees and charges - negative figures indicate an expected loss).

Disc: Held in RL and SM

What an interview - well done @Strawman. Your discussion approach was able to get a lot more insights out of Blair than other interviews out there, and I've gained a step-change in my own understanding. (I think this gives StrawPeople an edge over the market!)

Rather than summarise my key takeaways, because it will rehash much of what I've already written, I want to focus on Blair. But I recommend anyone who's interest has been piqued to watch the FULL interview.

Rarely (if ever in the microcap space) have I come across a CEO with such clarity and range, and internal cohesion in their strategic thinking. I truely rate Blair very highly, and as an example, draw attention to his ability to talk with clarity about 2024, 2025, next five years and next ten years. That's one sign of a great strategic leader. He also now has a cashflow positive business, so its not just a "story". He is the captain of his ship.

I upped my stake this morning in RL to 0.75% (as the market superficially appears to have taken some trading profits on a lower q-on-q receipts). I plan to go higher, but will wait now until I see the FY results and, more importantly, the three-year strategy which he will announce (and which I expect will role out some conservative 3-year targets)

I will place some trades to align Strawman (so please don't all just out and pop the SP before the close!! ;-) )

Very, very impressed.

Disc: Held in RL (0.75%) and SM

Very helpfully, $BIO have issued their 4C ahead of today's Strawman meeting, and reporting pretty early in the 4C cycle.

Their Highlight

- Record cash receipts of $3.23m in Q4 FY24, up 118% vs PCP

- Biome reports record quarterly sales revenue $3.8m, up 88% vs PCP

- Accounts receivable increase from $2.44m to $2.99m over the quarter

- Biome maintains gross margin above 60% for Q4 FY24

- As at June 30th, the company has a cash balance of $2.86m

- Biome records a third consecutive quarter of positive cash flow for Q4 FY24

- Biome records a second consecutive quarter of positive EBITDA for Q4 FY24

- Same-store pharmacy sales for Q4 up 78% vs PCP

My Takeaways

Pretty decent results. I was half expecting to see slightly higher payments - based on last two years. But, no, the expense control continues to be excellent.

I have updated my standard CF trend analysis below. The above comment means the trend is ticking up nicely.

Good that %GM maintained at 60%.

For such a small cap, $BIO has quite a stable CF performance.

SP has got a bit spicey lately, and today's result looks like it will do nothing to take the heat out of it.

I'd like to increase my teany, tiny position, but I'm going to be careful not to do anything to add to the heat on this one. We've seem 2 weeks of fairly decent volumes, driving the SP up, with average daily volumes around a million shares or so. So, it looks like there is a bit of accummulation going on, probably on the back of the BP Buy recommendation. BP's sales forecast probably needs upping, so I expect to see them increase their price target at the next revision (will they do of the 4C or wait for the FY Result?).

My $1.10 "scenario" is looking less aggressive by the day.

Research Update

I've done a bunch of further research on the Probiotic Sector which I've not yet published. I think $BIO are building a good brand, but both in Australia and internationally, there are a LOT of brands in the market. There are also a lot of smaller players who, like $BIO, are getting science behind their products, as well as working on targeting the healtcare professional communities as well as building presence in B2C Channels. There are also an increasing number of products that have sustained released encapsulation technologies to get the active agent to the right part of the gut. (As I said in my first post, these technologies are decades old, but of course there is continuous innovation here.)

\While there is no doubt they are doing a great job in Australia, I need to see evidence of what the international business looks like before building too significant a position.

Disc: Held in RL(0.25%) and SM

I conclude my week of immersion in probiotics (not literally) with a summary profile and some commentary on BioGaia - a $1.8bn market cap Swedish company and pioneer in probiotics development for some 30 years.

I chose this company because in many ways, it looks like $BIO might be if it is super-successful over the next 10 years. Understanding it also helps inform what $BIO is up against.

Metrics

I pulled out the following, making the rough conversion that BiaGaia reports in SEK, with 7 SEK about equal to 1 AUD. (Reference points are to the FY24 consensus.)

- P/E 30.4

- Market Cap / Revenue = 8.71 (so maybe the minnow $BIO is not so priecy after all)

- EV/EBITDA = 21.5

- 3 yr Revenue CAGR = 22%

- 3 yr NPAT CAGR = 28%

- Gross Margin = 73%

- Operating Margin = 35%

- Net Margin = 28%

Revenues are globally diversified: Americas (39%), EMEA (38%) APAC (23%)

Interestingly, it has also recently entered Canada. While there are some overlaps between BioGaia and $BIO products, there are also areas where they won't compete.

Thinking about the UK, while their products appear to be available and well-establised in several online channels, only one baby product is available via the Boots Chain. This indicates to me that they might also be following a similar discerning GTM strategy to $BIO.

Their product range is also widely available in Australia. So that's good news. $BIO has been able to achieve its success to date in Australia even with the strong presence of its more established European competitor. (I think this is rather important)

There are some big differences in strategy between the companies. For example, BioGaia does a lot of inhouse R&D, and it manufacturers (at least many) of its active agents with state of the art biofermentation facilities.

Also, the CVs of the Board and Management Team strike me as being a significant step up in strength and depth. (Sorry to bang on about it)

At about this stage, I have run out of steam for the week. So, I collared my BA Perplexity.AI and set them one final task for the week, providing them with the 2023 Annual Report to summarise along three key headings.

Here is the link to the report.

Here is my BA's summary (unedited) - but from a glance appears reasonable.

Here is a summary of BioGaia, focusing on their financial performance, product portfolio, and strategy/competitive advantages:

Financial Performance (2021-2023)

BioGaia has demonstrated strong financial performance over the past three years:

2023:

- Net sales: SEK 1,297 million (17% increase from 2022)

- Operating profit: SEK 443 million

- Operating margin: 34%

2022:

- Net sales: SEK 1,085 million (44% increase from 2021)

- Operating profit: SEK 387 million

- Operating margin: 36%

2021:

- Net sales: SEK 753 million (4% increase from 2020)

- Operating profit: SEK 254 million

- Operating margin: 34%

The company has shown consistent growth in net sales, with a significant jump in 2022 and continued strong performance in 2023. Operating margins have remained stable in the 34-36% range, indicating efficient operations and cost management.

Product Portfolio

BioGaia develops, manufactures, and markets probiotic products for gut, oral, and immune health. Their product portfolio includes:

Pediatrics (78% of sales in 2023):

- Protectis drops for infants

- Prodentis KIDS for oral health

Adult Health (21% of sales in 2023):

- Probiotic supplements for various health conditions

- Other (1% of sales in 2023):

Aldermis: Cosmetic probiotic skin ointment for infants and children

Key features of BioGaia's product portfolio:

- Based on L. reuteri bacterial strains

- Clinically proven effects

- Over 90% of products sold under the BioGaia brand or co-branding

- Available in over 100 countries

Strategy and Competitive Advantages

BioGaia's strategy and competitive advantages can be summarized in the following key areas:

1. Research and Innovation:

- Invest approximately 10% of net sales in R&D

- 30+ years of research and innovation in probiotics and microbiome

- 250+ published studies with BioGaia's bacteria strains

- 600 granted patents

- Collaboration with leading researchers worldwide

2. Brand Strategy:

- Transition from B2B to B2C model

- Increase product sales under the BioGaia brand

- Focus on building consumer trust and awareness

3. Omnichannel Distribution:

Two main distribution channels:

a) Distribution partners (nutrition and pharmaceutical companies)

b) Direct distribution through subsidiaries

Expanding e-commerce presence, particularly on platforms like Amazon

Six direct markets: USA, UK, Japan, Canada, Finland, and Sweden

4. Product Development:

- Continuous research to identify new applications for bacterial strains

- Development of consumer-friendly and high-quality probiotic products

- Focus on improving existing products (e.g., environmental sustainability, user-friendliness)

5. Global Expansion:

- Entering new direct markets (e.g., Canada in 2023)

- Strengthening partnerships in existing markets

- Adapting marketing strategies to local consumer needs (e.g., digital marketing on TikTok in China)

6. Financial Strength:

- Strong net cash balance

- Steady profitability and cash flow

- Ability to maintain dividend policy and invest in growth initiatives

7. Sustainability Focus:

- Commitment to sustainable product origins

- Investment in climate innovations

- Recognition with a gold medal by EcoVadis for sustainability efforts

8. Expertise and Leadership:

- Experienced management team with industry knowledge

- New CEO (Theresa Agnew) bringing extensive experience from consumer healthcare and OTC pharmaceuticals

9. Production Capabilities:

- Modern production facility in Eslöv, Sweden

- Semi-automated production lines

- Pilot facility for fermentation of next-generation probiotics

10. Market Position:

- World-leading probiotics company

- Pioneer in microbiome research

- High level of confidence among healthcare professionals

BioGaia's strategy focuses on leveraging its scientific expertise, strong brand, and global distribution network to maintain its position as a leader in the probiotics market. The company's commitment to research, product innovation, and sustainability, combined with its financial strength and flexible business model, positions it well for continued growth in the evolving health and wellness sector.

----

Happy weekend!

In my ongoing research, this morning I came across a Bell Potter note - well the front page at least! (Updated June-24, TP=0.73)

Just to compare, their FY25 and FY26 NPAT is $0.3m and $3.2m, respectively. My "scenario" that I showed in yesterday's straw (which I argued supports a TP of $1.10), has values of $1.9m and $7.4m.

So my "scenario" is quite a bit more bullish than BP, but in the grand scheme of things, it is in the ballpark.

If I am critical of this note, it appears that they talk about a "gap in the market". This may be true about the Australian market (which is also supported by @Rick's anecdote, yesterday). However, I am less clear the extent to which the same can be said in other markets.

Without making a negative remark about Bell Potter, I do make the general comment that some analysts tend just to repackage what management has told them, without doing independent, fact-based research. So, in sharing this research, I am not endorsing the statements, but just sharing the views of others.

I remain in an information gathering and analysis mode, and I am not yet taking a view on the stock (for avoidance of doubt). But it is interesting.

Disc: Held in RL (0.25%) and SM

In this straw I set out an interesting journey I have been on this week, following an exchange with @Tezzdog last weekend, that put $BIO on my radar screen. I posted an initial - and somewhat bearish - response to @Tezzdog's question.

@Strawman promptly came to the party and, by midday Monday, had lined up a SM Meeting with MD and Founder Blair Vega Norfolk (BVN) for Monday coming. (Well done, sir! Where else can you get that kind of access to a CEO – I ask you.)

For those who are interested, this straw contains some further resources that can help prepare for Monday. (If you are anything like me, I like to go into Strawman meetings with a lot of research under my belt, as I find I "hear" so much more. I agree with @Wini from the recent SM Meeting that its important to have an informed point of view, before you listen to management.)

Alternatively, you can skip all this and I’ll see you on Monday, leaving you with the thought that, yesterday, I picked up a tiny starter stake in $BIO - even though there's every chance I have royally overpaid. However, if it meets my expectations, I have a lot in the tank I'd be prepared to allocate over the next year or two. So, I'm not too fussed.

Summarising my Bearish Views

My governing thoughts (based on an hour's research on Sunday) was that I considered 1) the global competitive landscape and 2) the strength of board and management as significant barriers to achieving the global success to which $BIO aspires. I also highlighted why, at 11x revenue - whatever the outlook - it ain't cheap. That was then.

Meetings with BVN which Helped Me Form a More Bullish View

The following two videos are worth viewing:

There's quite a bit of overlap between the two videos, with more insights in the second. So, I got my assistant Claude.AI to summarise the transcripts under key headings. I've reviewed it, it seems pretty accurate, and I’ve dumped it at the end of this Straw for those who are interested, but haven't got 30 minutes to watch the video. (Scroll down to the dotted line, if you want to skip straight to that bit.)

My Take-Aways - what I've learned over the last 5 days

I structured my takeaways from this material and other research under some key headings, including what I learned in doing the next level of research, and how it challenged some of my initial bearish views. I was not starting from scratch, as I did some work on the probiotics market several years ago when I was looking at Blackmores, but never progressed further. It is a market that has long been of interest to me, partly because it combines healthcare and retail – two areas in which I am very happy investing and have enjoyed some success over the years.

1. Research-supported Condition-specific Activated Probiotics

In my bearish response at the weekend, I focused on just how large and well-established the global probiotics market is, and how established the international competition $BIO will faceas it ventures beyond Australia.

BVN made a remark in both videos (which no doubt we'll hear on Monday) that $BIO are first movers in "clinically supported, condition-specific, probiotics". Having cursorily examined some of the global competitors, I am not sure I agree with this statement, and I believe I can show that it is incorrect. However, it is true that the vast majority of the current global probiotics market has quite general label claims (e.g., “promoting gut health”), without specific clinical trials support or defined, specific indications.

Another advantage is that the formulation/encapsulation technology $BIO uses allows more of the live probiotics to survive passing through the stomach to reach the gut (small and large intestines). Again, while I am sure this isn't unique, it is a differentiator from the vast majority of probiotic pills, powders, yoghurts, and drinks out there, which churn around in the stomach acid for 30 minutes or so. (I happen to have 5 years’ experience working in pharmaceutical formulation technology and manufacturing, so am not an entirely novice in this area. In fact, part of my post-doctoral research involved a collaboration looking at sustained-release formulations, albeit I was not a principal investigator for this work!)

The standard behind $BIOs claims is that each formulation is supported by double-blind, randomised, controlled, clinical trials measured against specific end points. Again, I want to emphasise that I don't believe they are unique in this respect. However, it does differentiate them from most of the current market. Learning this, made me sit up and take more notice.

2. A Differentiated Go To Market (GTM) Approach

This is where BVN's marketing background shines through - and I think it really does differentiate them. Listening to him speak convinces me that this guy really does have deep marketing expertise.

Most probiotics are essentially a fast-moving consumer good (FMCG). Develop the brand, do the distribution deals, and get as much shelf acreage for each SKU. Support sales through brand-building, advertising and marketing spend. This is what Blackmores does with Bioceuticals. If necessary, discount the hell out of it to land the mega distribution deals, e.g., Chemist Warehouse.

$BIO is different. They sell "behind the counter". They aim to provide products to the community pharmacist, the nutritionist, the dentist, etc. where they can add value to their customers. They are giving these customers something you can't get at the "pile 'em high and sell 'em cheap" outlets.

This means the professional is incentivised to recommend $BIO's product. Because they generate more margin per sq metre of shop space than the competing mass market offerings, where margins are thin. While $BIO does distribution deals, they won't compromise on price. BVN quantifies these metrics in the videos, and I’m sure we’ll hear more about that next week.

To test this, I've done some online trawling, and indeed, each product appears to have a consistent price floor. Maintaining pricing discipline appears to be a core value – it maintains margins and supports the delivery of value to the healthcare-professional-retailers.

3. A Global Rollout that Follows the Australian GTM Approach

$BIO are not in a hurry in their global rollout. While they have plans for UK, EU, Canada and soon we'll hear about the USA, they are following a strategically slow approach.

The UK and Ireland is an example. They've been working there already with key professionals and opinion leaders to market test the product fit and build the support of the healthcare professional community.

This approach is consistent with what they've delivered in Australia since 2018. It not a boots-on-the-ground and roll it out classic FMCG sales and marketing strategy. They want to work with the targeted healthcare professionals to build product support and market fit.

(I think BVN started out in luxury goods marketing, so he understands brand value and pricing!)

This is very important to me, because it means that with the next 1-2 years of getting going in the UK, we'll have an opportunity to see to what extent they can scale in another market. And from UKI, then the EU is next.

4. Capital Raise - What Capital Raise?

In my bearish response over the weekend to @Tezzdog, I "confidently" predicted that with the recent, massive uptick in SP, and the impending global rollout, that $BIO will be raising capital, and soon.

But will they? Watch the video and see what you think. BVN clearly takes some pride in that they haven’t done a major raising since IPO and that they are now cashflow positive. Their GTM approach is entirely consistent with boot-strapped growth (think $PME).

Furthermore, with 60% gross margins (which I think must include elements of embedded "R&D" and "manufacuting capex" in the cost of goods given their business model), excellent expense control, and a capital-light model, maybe they can do it.

That said, the SP has gone crazy over the last year, so perhaps there is something to be said for building a strong balance sheet. Defintitely one for @Strawman to question on Monday.

5. Market Position

This is really all about Australia. $BIO has established 5,000 “distribution points” across Australia, roughly split 50:50 between community pharmacies and practitioners. They have deals with Terry White Chemmart (600 pharmacies) and Priceline, and supply 1500+ independent pharmacies, giving them a product line that the big discounters can’t access -well they can if they are prepared to pay the full price.

So, what does $13m of sales look like in an Australian market context?

Well, according to Research and Market (2023), the overall market size is around $350m. But of course much that includes the animal segment and probiotic foods. Based on an older source (2016), only about 8-10% of the headline market relates to “Dietary Supplements”. If that’s true, then $BIO have achieved a significant Australian market share in 5-6 years. (I need to do more work on this.)

BVN believes the runway ahead in Australia is 8x current sales, driven by doubling the number of outlets and then growing the sales per outlet. I’m less sure about this, and hopefully we can discuss further on Monday. (To what extent does the “creaming curve” and “diminishing return” come in to play?)

In any event, it looks like there is a good runway ahead in Australia, where they appear to have established a financially sustainable model at $13m revenue, growing at c. 70-80% p.a..

6. Economics and Scaling - Looks Good So Far

6.1 Quarterly Cash Flow Trends

(edited straw now includes legend in graph below)

The chart above shows my usual trend analysis from the 4C Cashflow statements. While there is some seasonality through the year (which BVN comments on), the trend is clear.

This business appears to have clearly headed to the inflection point, while yet to achieve $15m in annual revenue. This has been possible because of disciplined expense control and the capital light model (R&D partnerships, and outsourced manufacturing – active agents and formulation.)

6.2 Balance Sheet

With only $2m in cash at the last 4C, $BIO is running close to having to raise capital.

However, rather than do this (beyond exercise of options), BVN has been drawing down some debt. At the last 4C they had drawn $1m of a $1.2m facility.

Although $BIO now appears to be cashflow positive, a question for the SM meeting is whether it would be prudent to leverage the current high SP and raise some capital to buttress the balance sheet for the next phase of growth. (To my mind, $20 million wouldn't be too dilutive, and would give some head room on staffing, and licencing in new molecules.)

6.3 Financials and a What-If Scenario

I’ve done a little “spreadsheet jockeying” this week (of course, as I’ve had two weeks of cold turkey!), and from the 2021-2024F actuals, and a modelled scenario for FY25 and FY26 I have developed the picture below.

The above picture is a scenario – its not a forecast!

What it shows is the impact of strong revenue growth, 78%, 76% and 80% (FC) for the last 3 years, including the current.

Expense control has been exemplary, with +3.4% (FY22) and +6.7% (FY23), and I’ve thrown in a +20% assumption for each of FY24, FY25 and FY26.

With minimal D&A (capital light), if revenue growth in FY25 and FY26 are 75% and 70%, this baby is soon generating a meaningful NPAT!

Why did I choose these revenue growth numbers for this scenario – see my comments in 5. Market Position, above. And BVN says in the video that current rates of growth can be sustained in the short to medium term.

7. Ownership

According to Simply Wall Street, individual insiders own 34.5% of $BIO, with BVN’s shareholding at 8.5%, and BVN’s long-term partner in science Dr JB (who I referred to last weekend as the part-time chief scientific officer) has 1.72%,

So, there is reasonable alignment and, in one year, BVN has become a wealthy man!

8. Valuation

In my experience, it is notoriously difficult to value a company that’s coming up to the inflection point.

In terms of valuation multiples, you might take one look at 11x Revenue and move on.

But if $BIO can deliver the financial performance in the scenario I’ve shown above, then at a SP of $0.63, its P/E in 2026 falls to 19.

If its P/E in 2026 is 40 (which would be very modest given my forecast revenue and earning growth), then the valuation discounted back to today would be $1.10.

So that’s not a valuation, but as a result I felt quite comfortable taking a RL position of 0.25% because I want to follow this business very carefully as I do further research.

4Q is typically a high payments period, so if there is a bit of a "SP panic" at the next 4C, I’ll up my position. Whatever happens, our shared experiences here in microcap land is that you can take your time building a position. FOMO is for Dumbos!

9. BVN – A Founder with a Vision

BVN tells his personal story in the longer video – and it is quite interesting. I’m quite impressed by him. We’ll all get a chance to form our own views next week, so I’ll keep this brief.

One point from his CV is that he is a Non-Exec Board Member of the International Probiotics Association. I think this is interesting because it means he is linked into the global industry players, and this role will help him incubate the partnerships that are key to $BIO’s business model. And it also gives him an international industry perspective, which is so important to $BIO’s long-term success. (You can see some of his posts showing his attendance at industry events on LinkedIn.)

CONCLUSIONS

I find $BIO and BVN interesting. It was easy to be dismissive with 1 hour’s research on Sunday. But with now 30 hours of more in-depth work under my belt, including updating my view on the sector globally, I find $BIO to be very interesting and am really looking forward to next week’s meeting.

I still have concerns about the Board and Management bench strength, given the company’s ambition. But I find BVN to be impressive. He is the founder and has a vision for this firm. He appears to be strongly values-driven, and clearly articulates his strategic thinking. (And remember, Sam Huppert and Richard White grew with their businesses over the years!)

While I don’t completely buy everything he has said (when viewed from the perspective of some of the larger probiotic-specialist competitors overseas), $BIO is definitely a unique play in this part of the world. The big question is – how do they scale and compete internationally? UKI will give us the first insights, and we will see this over the next 1-2 years. Yay!

My final word – thank you @Tezzdog for asking the question! If nothing else, you have helped me have a very interesting first week back from holiday.

--------------------------------------------------------------------------------------------------------------------------

Claude.AIs Summary of the "Shares In Value" Interview with BVN (5th July 2024)

--------------------------------------------------------------------------------------------------------------------------

Company Background and History

Biome Australia (ASX: BIO) is a company focused on developing and commercializing live biotherapeutics and complementary medicines. Founded by Blair Vega Norfolk in 2018, the company's journey began much earlier:

- In 2012, Norfolk completed his MBA and was working in California advising nutraceutical companies on customer understanding.

- After developing his second autoimmune disease, Norfolk partnered with Dr. JB, an Australian PhD in medicine with 20-30 years in drug research, to formulate nutraceutical products in 2013.

- They initially planned to test market in Australia before launching in North America, but realized Australia was a significant market for complementary medicines and probiotics.

- From 2013-2018, they used their initial company as a vehicle for R&D, market understanding, and building relationships with distributors, pharmacy groups, and suppliers.

- In 2016, they moved into R&D and research in the microbiome space.

- Biome Australia was founded in 2018 to focus on condition-specific probiotic products.

Product Range and Unique Selling Proposition

Biome Australia launched its Activated Probiotics brand in November 2019 with nine products. Key aspects include:

- First-mover in condition-specific probiotic products globally

- Unique IP and products put through randomized, placebo-controlled, double-blind clinical trials

Product highlights:

- Biome Lift: Clinically validated probiotic for mental health

- Biome Fem: Probiotic for female vaginal health conditions

The company's point of difference in the market includes:

- First-mover advantage in condition-specific probiotics

- World-first clinical trials

- No direct competition on their products

- Premium, affordable pricing strategy without discounts

- Strong margin (60%+) compared to industry standards

Growth and Distribution

Biome Australia has experienced rapid growth since its launch:

- FY20: 100 stores, $800,000 revenue

- FY21: 1000+ stores, $2.1 million revenue

- FY22: $4.1 million revenue

- FY23: $7.2 million revenue

- FY24: $13 million revenue (beating upgraded forecast of $12.5 million)

Current distribution:

- Approximately 5,000 distribution points in Australia

- Roughly 50/50 split between community pharmacies and practitioner market

- Major customers include Terry White Chemmart (600 pharmacies) and Priceline Pharmacy

- 1500+ independent pharmacies

Future growth strategy:

- Currently at 40% of addressable market in terms of distribution points

- Only 25% developed within existing distribution footprint

- Potential to quadruple current revenue with existing distribution

- Opportunity to double distribution

- Conservative approach to expansion, focusing on optimizing existing accounts before adding new ones

Financial Performance and Outlook

Key financial highlights:

- Achieved first quarter of positive cash flow in December quarter (FY24 Q2)

- Positive cash flow in March and June quarters (FY24 Q3 and Q4)

- Positive EBITDA for the first two quarters in a row

- Cash flow positive and expected to remain so

- No capital raising since IPO ($8 million raised)

- Grew from $2 million to $13 million in sales and became profitable with initial capital

Future financial outlook:

- Continuing to reinvest for growth

- Aiming to become a significant dividend-paying business in the long term

- Planning to release "Vision 27" - a three-year strategic plan

- Likely to provide revenue forecasts for upcoming quarters and financial years

Clinical Research Pipeline

Biome Australia differentiates itself through clinical trials on finished products:

- Leveraged 30 years of partner IP and research to develop their product range

- Own 40-50% of their product formulations and research

- For licensed products, conduct clinical trials to own hybrid IP

Current clinical trials:

1. Biome Lift (mental health probiotic):

o Study with La Trobe University on sub-threshold depression

o Product on long-term exclusive license, but clinical trial gives Biome IP ownership

2. Biome Daily Kids:

o Study at Federation University on children in daycare settings

o Focus on upper respiratory tract infections, colds, flu, and stomach bugs

o Biome owns the IP, formulation, and concept

3. Additional studies in late-stage development (yet to be announced)

Research strategy:

- Lean R&D budget

- Develop relationships with universities and IP companies

- Negotiate partnerships where Biome provides advice and product, while partners fund the studies

Product Efficacy and Impact

Biome Australia focuses on demonstrating product efficacy through:

- Clinical trials

- Real patient feedback and testimonials

- Visual evidence for dermatological products (e.g., eczema and acne treatments)

The company emphasizes its social and ethical impact:

- Registered as a B Corp company

- Reports on social, environmental, and sustainability standards

- Focuses on patient impact and improving quality of life

International Expansion

Biome Australia has a conservative but strategic approach to international expansion:

- Entered UK and Irish markets 2.5 years ago

- Initial soft launch focused on educating health professionals