Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Blair Vega Norfolk talks on Ausbiz, via linkedin:

https://investorpa.com/announcement-pdf/20250828/179668.pdf

This appears to be a great development.

And further solidifies Biomes presence as a premium brand in the premium end of the market

“Shoot First, Ask Questions Later”

Today, probiotic brand $BIO announced its 4C. I took one look at it, and seeing a favourable “buy/sell” queue at the market open, sold my entire RL position, and I’ve just put in the order to sell on SM too.

Why would I do such a thing? I didn’t even have time this morning to attend the Webinar (although I would ideally have preferred to have done so, and I will watch the recording when its available)?

To answer that question, I’m not going to do a complete analysis of the quarter. Most things appear to be going well, with a logical progression of things I’ve written about at great length before. So, to save everyone’s time, I'll get to the point.

Reason 1: Inventory.

Reason 2: Inventory – how it was accounted for in the 4C.

Basically, a “Red Flag” (two actually) for me was raised today, in an area I have covered amply in previous straws. So, I was looking out for it.

Basically, Q4 saw a large build in inventory. Of this, $1.643m was accounted for as Operating Cashflow, and $1.295m as Investing Cashflow.

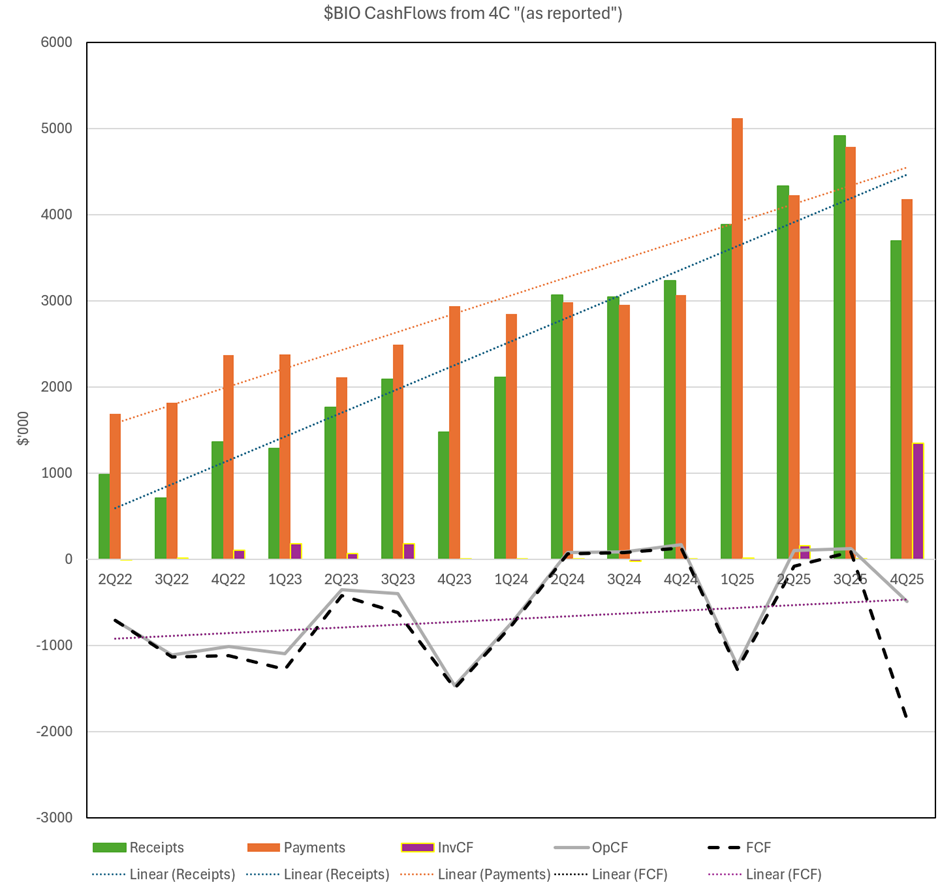

So, let me plot the 4C in two ways. Figure 1, “as reported”, and Figure 2, “as I read it”.

Figure 1: $BIO Cashflows from 4C (“as reported”)

Source: 4C report

Looking at the fifteen 4C report since IPO, prior to today, all inventory building has been classified as an “Operating Cashflow”, which is pretty normal – particularly in what I consider as a fast moving consumer goods operation.

So, one might think (and I certainly do) that putting a material chunk of inventory into “Investing Cashflow” for the first time ever would warrant an explanation. Well, here’s what was said.

- In the headlines … crickets. Oh, but “Net Operating Cash Outflow of $485 in Q4” OK, that’s not a problem because Q4 tends to be the weaker quarter for receipt.

- In the body of the report: “Within the quarter Biome made key strategic investments to support medium to long-term growth in both Australian and international markets. The highlights were the launch of Biome’s new range of products, Activated Therapeutics, an inventory-build to support FY26 growth, an investment in key international markets and the Activated Probiotics Symposium, a once-in-three-year customer education event.” [my emphasis added]

- … and a little later …… “The Company also drew down $1.3m from the NAB trade finance facility for investment in additional inventory to fund future sales growth and to maintain gross margin.” [my emphasis added]

- … and later still … “Payments for inventory and fulfillment was $1.643m, plus an additional $1.3m investment in safety stock. The company will maintain its working stock circa $3m while actively managing its level of safety stock, taking into consideration expected future sales growth, and seasonal, logistic and production factors.”

I don’t like the reporting of inventory build in this way. Building inventory, including safety stock, is completely normal and continuing part of any operation. And generally, as sales grow, the inventory and working capital to support it also grows. Safety stock (certainly as I have taught to over 600 MBA students over a decade) is an important working capital component of an operation. It has to be managed carefully, and it a critical and unavailable part of any operation.

Importantly, inventory also grows as a company expands to more regions (as $BIO has), as you need to hold more pools of inventory close to the market to support sales and customer service.

And inventory also grows the more product lines you have. (Again, as $BIO has, particulary with the whole new Activated Theraputics range.)

Therefore one of the key measures you have to monitor in the growth of any fast moving consumer goods company, is the growth of inventory. Because it consumes more and more cash as sales grow, geographies are expanded, and product variants proliferate. This has been a failure moce for many high growth FMCG businesses in the past, and no doubt it will continue to be in the future.

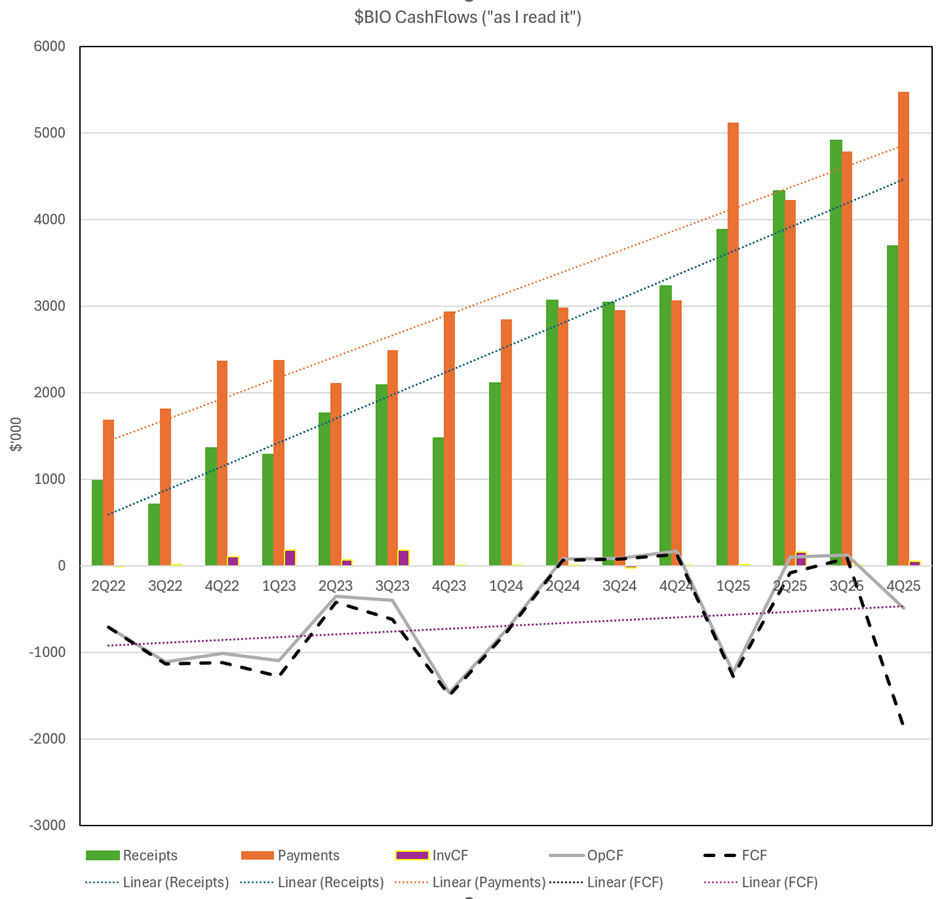

So, I don’t consider the inventory build as an Investing Cashflow. I see it as an inevitable part of the operation. And so, I have restated the 4C chart “as I read it” below in Figure 2.

Figure 2: $BIO Cashflows (“as I read it”)

This now gives a very different view as to the respective slopes of the “receipts” and “payments” dotted trend lines driving “Operating Cashflow” as I have redefined it. It is a very different picture between Figure 1 and Figure 2.

And for me that’s what today’s report is obfuscating. The operating leverage is not as strong as it has hitherto appeared. But this wasn’t a shock for me, I have been monitoring this factor over several 4Cs, and if you go back and read some of my earlier Straws, you will see I called it out. But I did not expect to see the magnitude of today’s number.

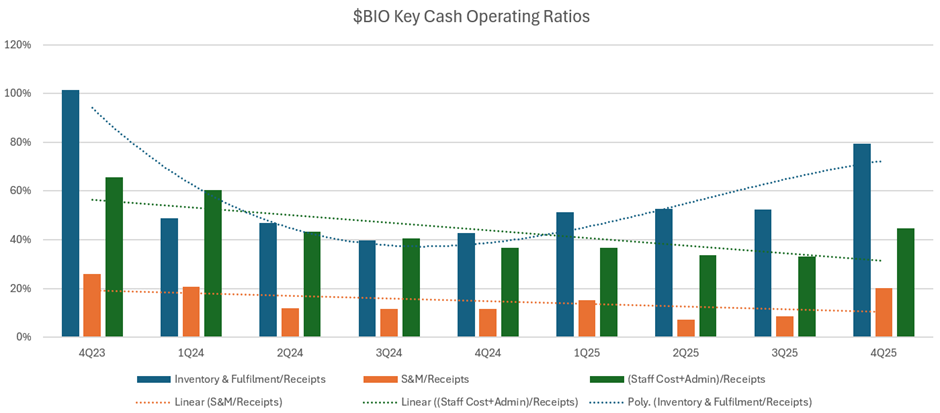

To provide another lens on this, in Figure 3 below I have plotted some other operating ratios.

Figure 3: Key Operating Ratios

Source: 4C reports. Note - all inventory build has been classified as “Operating Cashflow” for the purposes of this report (This differs from the reported basis).

What this picture tells me, is that up until mid-FY24, $BIO’s operations appeared to be scaling quite nicely. However, more recently, the trends have flattened out and – certainly on some metrics – seem to be going backwards.

This is critically important. Because it means that the bigger $BIO is getting, the weaker the cash operating margins are becoming. That’s why it is a thesis breaker for me.

I first invested in $BIO in July 2024, just before the 4Q25 report. My thesis was based on a view that the business would develop more favourable economics as it scaled. Five quarterly reports later, and on each of the three operational ratios plotted above, the opposite has happened.

When I invest, I am investing in an “economic engine” and I want to see – over a series of reports – evidence that the economic engine is building and becoming stronger. I can’t see that here, and therefore I am out.

“Shoot First – Ask Questions Later”

But I didn’t do all this analysis before selling this morning. All I saw was that inventory was up significantly, and that a large chunk of it has been classified as an “Investing Cashflow” with a rationale I found unconvincing and unprecedented.

(As this point, I will recall $FNP or $NOU as it is now called - those who have followed my work over the years might recall it. I have written about this before, because it was an example of a low margin foods business that got into all sorts of trouble with inventory management as it tried to scale. It was my worst $ASX investment ever, and I have written at length about it before. The big lesson I took from that event was how important it is to track inventory metrics in high growth, consumer good manufacturers. I didn’t then, and I paid dearly for it. Now I am not saying $BIO is another $FNP/$NOU. Definitely not. But when I see adverse inventory trends, as well as “reporting oddities”, that’s a double red flag for me.)

So for me it was a case of “shoot first, and ask questions later.” I have exited my full position for more or less what I paid for it. Whew.

Have I over-reacted? Quite possibly. But today’s report adds to a trend that goes against everything I know (and teach) and have experienced to my personal financial detriment.

I hope I am wrong and that over coming reports the business continues to go from strength to strength. If the facts prove me wrong, then I’ll be happy to get back onboard. But I think that, even in the success case, this is going to be a slower burn than I had initially hoped. That, combined with its microcap "fragility", fundamentally changes the risk-reward equation for me.

Finally, I didn't need to do all the analysis that I've presented in this post, because I was looking for the effect. Why? I had three questions on my risk register:

Q1: Is the quality of growth in Australia holding up, as the business matures in this market?

Q2. How dilutive to the operating leverage is getting going in NZ, UKI and Canada all at the same time?

Q3: Is the Activated Therapeutics line (a profileration of SKUs which I view as departing from the core science thesis), actually a good idea? More SKUs, more operational complexity, more inventory etc.

I don't know the answer to these questions. But the summative effect doesn't look good to me....at least in the short term.

Disc: Not held in RL and SM

29-July-25

Update to valuation. This is a simple 'Placeholder" to bring it in line with my straw today following the 4C report.

(I have not done a complete re-valuation, and am therefore simply replacing my prior valuation with today placeholder from Morningstar's Quantiative service.)

Disc: Not Held

Probiotics company $BIO have announced their international sales as promised.

Their Headlines

● Biome reports $1.5m in International Sales Revenue for FY25, up 69% vs PCP.

● Secured prominent strategic distribution partnerships across three key international markets in Q4 FY25:

○ Ireland - Uniphar, pharmacy wholesale and retail with 1,400+ pharmacy customers

○ New Zealand - Propharma (EBOS), the country's largest pharmacy wholesale network

○ Canada - Multiple high-value agreements with prominent pharmacy and health food retail groups:

■ Pure Pharmacy Group (British Columbia)

■ Healthy Planet Group (National)

■ Nature's Emporium (Ontario)

■ Nature's Signature (Ontario)

● Biome is now strategically positioned for significant international growth and expansion in FY26, leveraging new distribution channels to access thousands of additional pharmacy and health food locations commencing Q1 FY26.

My Analysis

$1.5m in international sales revenue represents 8.1% of total sales revenue, so NZ, UKI and Canada are starting to make a modest but meaningful contribution to the Group. Importantly, they are growing strongly at 69% vs pcp, vs. the overall group growth of 41%. (stripping out Australia from RoW, in FY25 Australia grew from $12.1m to $16.9m a rate of 39.6%.)

A fair amount of focus appears to be going in to Canada. CEO Blair has spoken recently how he thinks there will be a strong product fit in Canada, so the addition of two "sales and education" team members as well as the distributorship sets things up for a strong contribution in FY26.

The early retail chain signings are promising - but many more are needed. The Canadian outlets listed in the release reflect (by my research) only some 70-80 outlets. So it is still early days as Canada has some 10,000-12,000 phamacy outlets and another 2,000 specialist nutritional supplement outlets.

Although there is no breakdown to the RoW numbers, I believe most of the performance will have come from NZ and UKI, because Canada was only launched commercially in September 2024.

The distribution partnerships will be important, allowing $BIO to scale without having to growth a large international "sales and education" workforce. Important will be to leverage the small number of staff in each location to train staff at the distributors because it is critical that the end retailer understands the importance of the "behind-the-counter-positioning" needed to access the favourable margin contribution the products have reportedly proven in Australia. Without that, they are just another supplement on the shelves. Of course, with the distribution deals, some 20% to 30% of final price goes to the distributor, so there is a clear calculation to make between lower sales force costs with the lower revenue released per unit.

Conclusion

Overall, it looks like good progress.

It will be interesting to see the FY financials for evidence that $BIO can achieve disciplined profitable growth and, as part of that, to see how working capital is scaling as sales grow.

Progress in UKI and Canada is important to $BIO achieving its goals as Australian growth inevitably starts to mature.

In FY26, I'll be looking for the % revenue growth rate from RoW to accelerate beyond 69%. The distributorships signed across the year, as well as the retail chains added, together with the increased staffing and a full year contribution from Canada means that if the product has a good fit in these international markets, we should see accelerating growth.

For now, I'll hold my current position of 5% (RL). Delivery seems to be tracking in line with the strategy.

Disc: Held in RL and SM

Short update before numbers are released at the end of the quarter. No specific numbers but, plenty to suggest they are on track and growing.

Below I have listed in point form some of the key points Blair was able to share.

-well on target for vision 27

-material update coming from Europe

-record quarter

-Canada going very well

-BIO growing at 10x the category average v others in the same market

-more shelf space rolling out in Australia

-looking to close deals in Europe over next few weeks

-looking to get into pharmacy wholesale in europe

-two new products in activated biotic range to be released taking product offer to 20 with long term goal of 25-30 maintaining a focus on quality products that help people.

-first 4 activated therapeutic products to be released - gastric?, gut, menopause and supportive weight loss product (mention that pharmacy had been asking for this to help people using weight loss drugs)

-pre approval in NZ for activated therapeutics

-working on this in Canada, UK and ireland

-late state planning for final study for B&B18 strain which, will then see it rolled out across their product range.

-expect to have first year of profit

-expect to continue profitable growth for year to come.

-strategies in place to maintain high growing.

-new funds continue to come on board and although they ask to enter via a CR they have been politely told no.

These were the key points I was able to take down. I might be slightly off on the exact words but, there was enough hints from Blair that share price aside they are on track if not ahead of their vision 27 target.

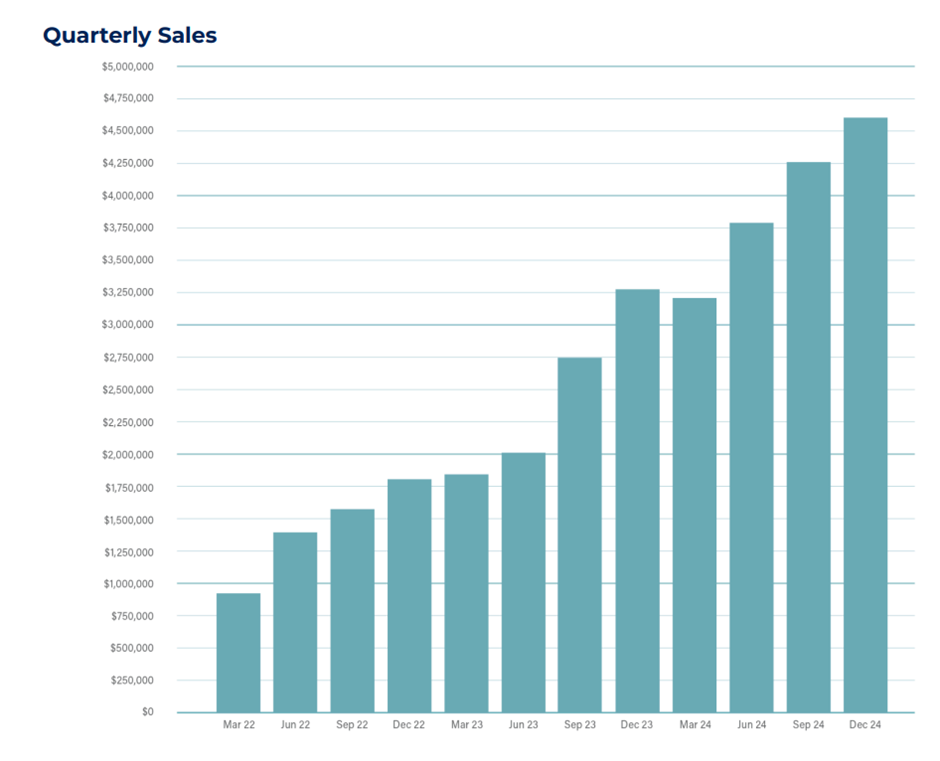

Probiotics company $BIO published their 4C today.

While the shares have been in doldrums for the last few months, with a fairly ugly short term chart, I'll summarise my analysis which explains why - based on performance - I am not unduly concerned at this stage, and what I am looking forward in the come reports.

Their Highlights

● Biome records $195k EBITDA for Q3

● Biome recorded a net operating cash inflow of $123k

● Biome achieves another high growth quarter in sales revenue, reaching ~$4.51m for Q3, an increase of 41% vs PCP

● Biome achieved a gross margin of 61% for Q3

● Biome had a cash balance of $2.7m as at 31 March 2025

● Biome expects to report its first full year net profit for FY25

● Record cash receipts of $4.91m in Q3, up 61% vs PCP and up 13.% vs Q2

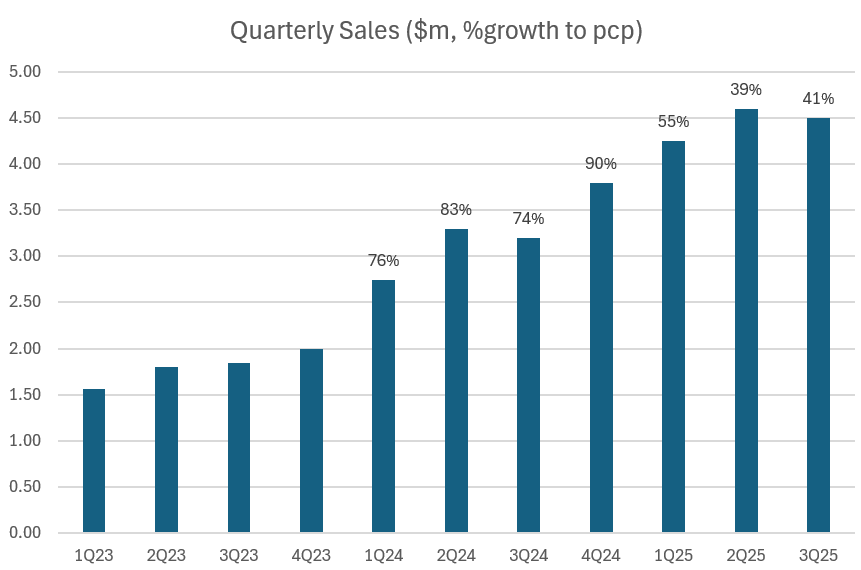

Revenue Growth Chart

(Note: the Q3 dip appears to be seasonal, so expecting a strong final Q)

Analysis of Cashflow Trends

Basically, for the last 6 consecutive quarters, $BIO have been cashflow positive - save for the MD 3yr LTIP payment in 1Q FY25, which more than wipes out the gains!

So, someone looking at the trend of the last 6-8Q, rather than the longer trend, could reasonable ask whether the underlying operating economics of this business are strong enough to justify its valuation.

To answer this question, you have to dig a little deeper. And therefore below I have plotted they cash operating ratios, which I think tells the story.

I've been selective here, leaving off R&D and Capex - as they are not material items, exhibiting no major trend.

Overhead (green)

I've combined [Staff Cost + Admin & Corporate Costs] and these are declining nicely as a % receipt from 66% in $Q23 to 33% in 3Q25m down a little from 34% in 2Q25.

So, Blair is maintaining overhead discipline, despite over this time adding a small number of heads for the expansion in UKI and Canada.So far, so good.

Sales & Marketing (Orange)

As a function of receipts, sales, marketing and advertising has fallen from 26% of receipts in 4Q23 to around 9%, up slightly from 7% in the previous Q. That's also pretty good, although I expect the staff costs of the sales and marketng "educators" are accounted for in the "Staff Costs" line.

One thing to watch will be that this might increase in the next few quarters, as $BIO introduces the "Activated Therapeutics" range.

However, overall both as a trend and as an absolutely percentage, there is nothing to be concerned about here.

Inventory and Fulfilment (Blue)

As I indicated in my last major analysis of $BIO, inventory and fulfilment is where we are seeing the drag on overall operating leverage coming through. It reached a lowpoint on a strong downward trend of 40% in 3QFY24, but has been steadily trending up ever since, now standing in the latest period at 53%. It needs to come down again to not be an overall drag on the business economics.

So why is this happening?

As new products are added to the range, expansion occurs internationally, and $BIO steps up the rate of adding new outlets at an accelerated rate, this is clearly adding weight in the supply chain. From my perspective this is the key metric to monitor in the periods ahead.

Inventory and channel management is a big issue in FMCG. It is clear that this is the motivation for BVN to onshore final packaging to Australia, but that in itself can only make a very small difference, as I've shown previously.

My sense is that this is a deliberate strategy from Blair. Having got comfortable that he is there or therabouts on cash flow break-even, he is investing in inventory to supply new outlets and new terriritories, so that product is available in more locations to build the brand and drive sales velocity.

But of course, it is by no means a given that in new outlets sales velocity will continue to grow and so this is the key metric to continue to monitor. It we don't see that turn back down over time, then it becomes a thesis breaker.

My Conclusions

Unlike with many other brands, Blair isn't use big sales, marketing and advertising budgets to drive revenue and brand awareness. He's doing it through the marketing educators with the pratitioner customers, and backing that up with inventory as new outlets come online. Through this strategy, he has got pretty much to a breakeven business, as outlets continue to expand both in Australia and overseas.

So now its game on. There is no possible justification for further territorial expansion until he can show favourable economics across Australia, NZ, UKI and Canada. That is now the point to be proven.

I will now keep alert to two potential future red flags: 1) further territory expansions and 2) inability to get the inventory/fulfillment ratio down - or at least to stablise it. (Of course, adding Activated Therapuetics to the mix might keep some pressure on this metric in the next report or two.)

I'm happy to hold at my current position size and see how this story unfolds over the next year. And with quarterly reporting likely to be retained for a while, I can closely monitor the key operating ratios.

This is by no means a done deal, but the game is now on.

Disc: Held in RL and SM

Probiotic brand $BIO reported their 3Q Sales figures. Quarterly Sales Report

Sales are down -2.2% on the previous Q, as 3Q appears to be a cyclically soft quarter, and we saw the same last year (-3.0%).

Sales are up 41% on PCP.

Overall, the sales growth is maturing. If we look at the Trailing 12 Month sales growth over the last 4 quarterly reports the trend is clear: 81%, 74%, 60% and 53%, although the rate of decline is falling. At some point this will stabilise, for example, as the contribution from international sales (still a very small base) starts to contribute. Anyway that what I am looking for as part of my thesis!

They've called out same store sales growth of 45% for the 3 months to Feb-25 (presumably because they don't yet have store level data, rather than due to cherry-picking?) showing the priority being given to growing existing accounts is yielding results.

Terry White ChemMart also awarded them Retailer of the Year - a nice little accolade when you think about the competition.

SP has languished as a result of lack of positive recent surprises and general market funk. But as far as I am concerned, $BIO remains solidly on track.

Looking forward to seeing the 4C in a couple of weeks, to see how the financials are evolving ... top line vs expense and inventory.

Disc: Held in RL and SM

BIO CEO, Blair Vega Norfolk talks to East Coast Research.

I felt the interviewer found it hard to stay impartial and balanced, but Blair remained on track and business like.

Below is Biomes Company Presentation.

Anyone invested or considering investing will get a lot of value from the interview with company’s CEO. It also adds additional colour to the presentation. Including the exciting market of Canada.

Probiotics supplement brand company $BIO issued their HY Report today.

Their Financial Highlights

Biome reports its first net profit in H1 FY25

○ +$96,228 (excluding R&D rebate)

○ +$433,395 (including R&D rebate)

Biome achieved positive EBITDA for H1

○ $351,765 (Excl. R&D Rebate and Share Based Payments)

○ $229,917 in Q2 an increase of 89% vs Q1

Biome reports record half year and quarterly sales revenue (H1FY25 $8.86m; Q2FY25 $4.6m)

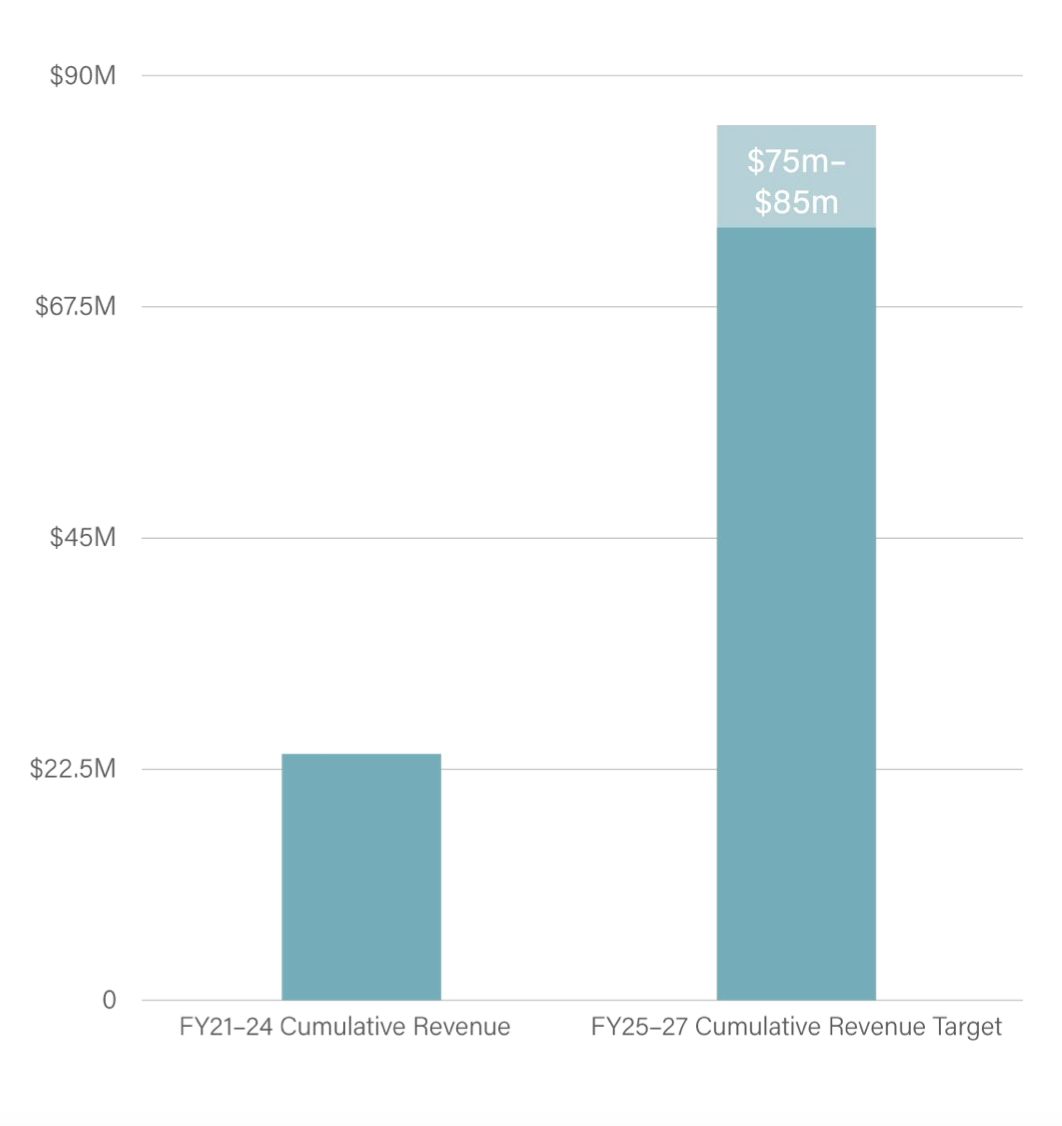

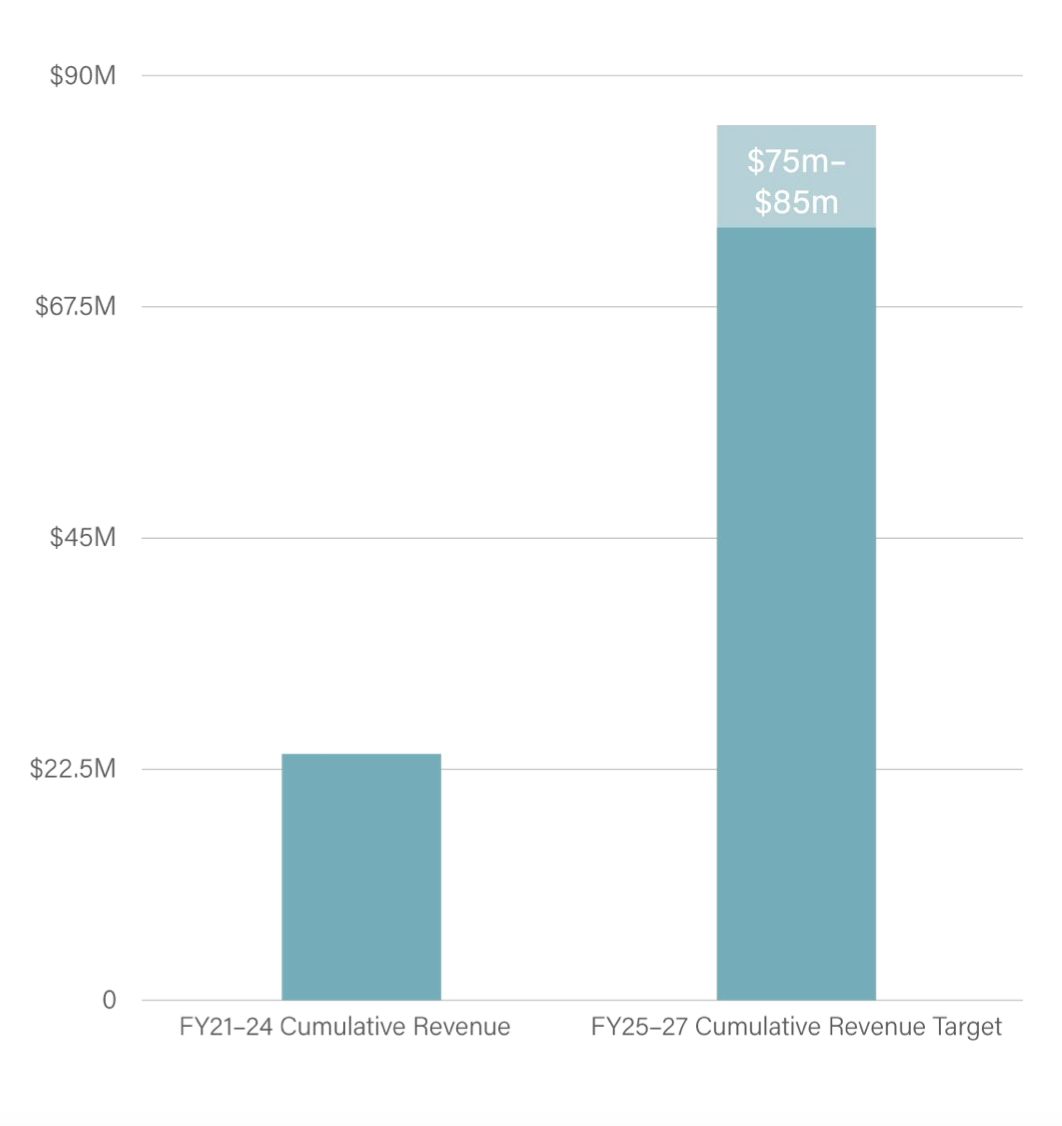

Biome released Vision 27 Strategic plan with three year cumulative revenue guidance of $75-$85m (FY25-27)

Biome reports a gross margin of 61% for the 6 months to 31 December 2024

Their Business Highlights

- Biome increased its Australian distribution footprint in H1 to 6000, an increase of 20% vs H2 FY24

- Biome successfully completed its in-vitro research on its strain BMB18

- Biome entered a partnership with FaBA to gain access to matched research funding to develop BMB18 via a government grant

- Biome launched its new cholesterol-lowering probiotic, Biome Cholesterol™ Probiotic in Q1 FY25

- Biome Successfully launched into Canada with Ecotrend Ecologics in September 2024

Figure: $BIO Quarterly Sales

My Assessment

Pretty much everything in today’s report was either expected or has been reported, such is the fastidiousness with which CEO Blair (BVN) keep us posted on developments. But, it is actually good to see all the achievements of the half pulled together in one place. They’ve been busy and done a lot.

Australia Expanding Outlets

It is good to see a strong focus on expanding Australian distribution. While it is a “soft” metric, getting to the 6000 distribution points target from 5000 6 months early is excellent. After all, it is the Australian sales that will do the heavy lifting of generating cash while the expansions in the UK and Canada find their feet. This kind of trajectory means that the 800o goal in Vision 27 should be easily achieved, well ahead of schedule. Of course, while this is good, BVN has always said that the real potential lies in getting more sales per account.

International - a comprehensive update promised!

BVN has promised a “comprehensive international market update during the year”. This will be welcome. To date we have had some indication of the international sales contribution in FY24, and a little information on the staffing approach. But I’d be keen to see some tangible indications of sales momentum building in the UK, and of course it is very early days in Canada but BVN has spoken positively about product-market fit there, so it would also be good to have some numbers to back that up.

Onshoring Manufacturing - What?

One note in the release caught my attention: “Onshoring finishing manufacturing of Biome’s key product lines.” Without any real explanation. I know BVN has said this is something that might be contemplated in the future, but to see it report as something that is actually done, has caught me by surprise. And I HAVE been paying attention. Just to be clear what this likely means – I would expect that $BIO are finding an Australian onshore contract manufacturer to do the product encapsulation and packaging. I’m not sure what the effect of this will be on %GM, however, with Australia and the major market for the foreseeable future, it will reduce logistics costs, as well as providing some supply chain resilience. So I am all for it, even if I am not sure that $BIO has the scale for this to be a “must do.” I’m keen to learn more about this at future briefings.

Financials

Today’s result is an important milestone. It’s the first half for $BIO achieving positive NPAT, with NPAT up almost $2m compared with the PCP. Just to drive the point home - BVN called out that they achieved this even without the help of the R&D rebate!

This has been driven by strong revenue growth (+47.4%) while Total Operating Expenses actually declined by 3%. The big driver here was a 22% reduction in Corporate Costs to PCP, and sales and marketing growth being kept to only 24.1%.

That financial performance is impressive IMHO. It means the $BIO have been able to moved ahead with Europen commercialisation, run the market test in Canada and then move to commercialisation AND significantly expand the number of Australian outlet by 20% while holding expense essentially flat. Wow! I like it.

Cash - Mind the Inventory

However, digging through the financial accounts there is one thing to keep an eye on, Cash Flow was quite weak, with the business still burning a modest $0.3m of cash during the period. The main driver here is the increase in inventory, which over the 12 months has increased from $2.08m to $3.13m or +50%. Given the expansion of outlets being serviced in Australia, new products, and growth in Europe and North America, this isn’t a concern at this stage. The increase in inventory is broadly in line with revenue growth....just a smidge ahead However, it is a reminder that in FMCG (and I think for these purposes it is instructive to think of $BIO as FMCG rather than healthcare) inventory management is key.

Many a growing FMCG company posts good financials, but can get caught out of cash management given the inventory requirements needed to support market growth (I am triggered by memoroes of $FNP aka $NOU). I think $BIO will be OK, as they have a good %GM and expense control, and they need to invest in inventory to get it to their expanding customer outlets. Of all the places to burn the cash, I am happy that this is the right place for $BIO. BUT, we need to keep an eye on any trends here.

For now, $BIO has bitten off all it can chew, and I expect to now see a period of consolidation around ANZ, UK and Canada. If so, this should enable inventory growth to track more closely in line with revenue growth.

Final Takeaways

This is a good report. No surprises, and overall, it is good to see the financials coming together nicely behind all the recent individual news releases. I’m a happy holder here, and look forward to the update in the international markets.

Although I initially took only a very small (c. 1% position), SP volatility has given opportunities to add more at lower prices. But this is still is a risky and unproven business on the international stage. Can they build a multi-national probiotics brand? Early days. So I am going to maintain my current 3+% RL holding and let the company's progress work its magic over time .... or not.

Disc: Held in RL (3.2%) and SM

The post below popped up in my LinkedIn feed this morning, giving an insight into how $BIO is going about establishing the product presence in the UK nutrition and wellness practitioner market. I've added below a brief description of the association, (provided by my BA ChatGPT.)

Industry bodies like this are always on the lookout to drive member engagement and value. So a good reception at, for example, the Berkshire branch, would doubtless lead to invitations over coming weeks and months at other association branches - over time getting the message to a decent share of active portion of the associations 3,500 members, and leading to coverage in association newsletters and social media posts.

These industry bodies appear to be as important in the UK as they are in Australia, and tapping into them in this way, as indicated by the post, is likely a very cost effective way of executing $BIO education-based sales and marketing program.

About The BANT (by ChatGPT)

The British Association for Nutrition and Lifestyle Medicine (BANT) is a non-profit professional body representing approximately 3,500 nutrition practitioners in the UK. Established over 20 years ago, BANT sets standards of excellence in science-based nutrition and lifestyle medicine.

BANT members are trained in nutritional sciences at a minimum of degree level and are equipped to work clinically with individuals. They provide personalized nutrition and lifestyle recommendations, translating complex science into practical advice tailored to individual health goals and dietary preferences.

A key resource offered by BANT is the Nutrition Evidence Database (NED), the UK's first scientific database specializing in nutrition and lifestyle medicine. NED provides evidence-based information to support clinical interventions and inform practitioners' recommendations.

BANT also engages in public education, offering resources to help individuals make informed dietary and lifestyle choices. Their mission is to promote health and well-being through personalized nutrition and lifestyle medicine, contributing to the integration of these practices into mainstream healthcare.

Disc: Held in RL and SM

And yet again ... price-sensitive-not-price-sensitive

$BIO looking to tap the QLD-based, government funded Australia's Food and Beverage Accelerator to support the development of its recently acquired proprietary probiotic strain.

$BIO already use Australian universities to lead other clinical research programs, so this is simply a smart way of tapping a pot of innovation funds, and tapping Australia's extensive research infrastructure.

Product development on the smell of an oily rag. I like it. But again, it shouldn't be a price sensitive announcement. It is simply BAU. IMHO. We'll see if the market agrees or not.

Disc: Held in RL and SM

A step on the road towards "Vision 27" - Full announcement

ASX ANNOUNCEMENT

23 January, 2025

Biome’s Australian Distribution Passes 6000 Health Retail and Practitioner Locations

- ● Biome increases its distribution in Australian practitioner and pharmacy markets to 6,000+ locations

- ● 20% growth in distribution footprint from 5,000 (FY24) to 6,000+ locations over the last six months

- ● Biome signs several new deals including USF Dispensaries in Victoria and Greenleaf Pharmacies in WA

- ● The growth in distribution represents 33% of the new Australian distribution target in the Vision 27 Strategic plan of 8,000 locations before the close of FY27

Data shared from Biome’s, two largest national retail pharmacy partners, Terry White Chemmart and Priceline Pharmacy for 12 months to 31 December, have reported 70% and 95% growth respectively.

Heading in the right direction

FWIW:

From East Coast Research

https://eastcoastresearch.com.au/reports/reports-db/biome-australia-asxbio

And the full report https://www.sharesinvalue.com.au/wp-content/uploads/2025/01/ASX-BIO-ECR-Initiation-Report-22-Jan-2025.pdf

This appears to have come out today and could have something to do with the jump in SP?

Biome Australia – Scaling Up to Dominate the Probiotic Health Market

We initiate coverage on Biome Australia (ASX: BIO) with a 12-month target price of A$0.91, representing a 68% upside from the current share price of A$0.54. Biome is an innovator in the health and wellness sector, focused on developing and distributing evidence-backed probiotics and complementary health products. With distribution points expected to grow from 5,000 to 8,000 under its Vision 27 Strategic Plan, the company is expanding both domestically and internationally. Backed by strong clinical data, Biome’s proprietary formulations address key consumer health needs and position it to capitalise on the growing global demand for evidence-based wellness solutions.

Strong Leadership Driving Strategic Growth and Profitability in a Founder-led Business

Biome Australia’s success is driven by its strong leadership team, which has been instrumental in executing the company’s Vision 27 Strategic Plan and positioning it as a leader in the evidence-based probiotics market. CEO Blair Norfolk has played a key role in scaling Biome’s operations and ensuring a focus on innovation and disciplined growth. The leadership team’s strategic approach, including strengthening mid-level management and prioritising operational efficiency, has supported the company’s transition to profitability and sustained cash flow generation. Their track record of execution and commitment to shareholder value reinforces confidence in Biome’s ability to achieve its growth ambitions and deliver long-term value.

Expanding Market Opportunities Support Strong Growth Thesis and Shareholder Value

The global probiotics market is projected to grow at a CAGR of 14.1%, reaching US$133.9 billion by 2030. Biome’s focus on innovative, clinically validated products positions it to capture a meaningful share of this expanding market. Domestically, Biome is increasing its distribution network across Australia, while internationally, it is targeting high-growth markets in the UK, Ireland, and Canada. These initiatives are key drivers of Biome’s ambitious revenue growth targets, forecast to reach A$56.1 million by FY28E, representing a compound annual growth rate of 37% from FY24A.

Valuation Range of A$0.87–A$0.95 per Share

Using a DCF methodology with a perpetual growth terminal value, we estimate Biome’s intrinsic value to be A$0.87 per share in our base case scenario and A$0.95 per share in a more optimistic bull case. Our mid-point target price of A$0.91 highlights the significant upside potential, driven by the company’s scalable operations, strong leadership, and differentiated product portfolio.

20 January, 2025

Quarterly Activities & Appendix 4C December 2024

Biome records $234k EBITDA for Q2, up 92% vs Q11

Record cash receipts of $4.34m in Q2, up 41% vs PCP

Biome reports record quarterly sales revenue of $4.61m, up 41% vs PCP

Biome maintains gross margin above 60% for Q2

Biome had a cash balance of $2.59m as at 31 December

Biome expects to report its first net profit for H1 FY25

And first out of the blocks in trading updates for 2025 from my portfolio is,...surprise, surprise,... $BIO.

- Unaudited revenue of c. $4.6m vs. the forecast given in November of $4.5m

- 1H FY25 is c. $8.9m, up 48.3% on pcp

- Quarterly sales on an annual run rate of $18.4m

My Analysis

This kind of growth keeps them in line with the VIsion 2027 targets. While percentage growth is declining as it cycles a more material base (39.4% to pcp), quarterly sales adds have averaged $0.33m over the last 4 reports. Were this to continue through Q3 and Q4, that would put $BIO on a FY revenue of $19.1m, which is close to where I think they need to be to hit the mid-point of the Vision 2027 Targets.

So, an "on track" result.

The beat to recently issued guidance continues the pattern of what appears to be BVN putting out a guidance number that he is reasonably confident can be beaten. Doesn't mean that they won't get it wrong in future, and of course such misses are a good thing for anyone looking to accumulate.

If history is to be repeated, we should soon get an update with FY revenue guidance, which has been known to follow a few days after the Trading update rather than be incorporated into the 4C report which will come in a couple of weeks. Afterall, BVN does love his frequent updates!

(OK, back to the beach, as I'm not officially back on the case yet, but thought I'd post this straw over my morning coffee!)

Disc: Held in RL and SM

Scene: Somewhere on Teams, Zoom, or in a Boardroom in VIC, Australia.

BVN: "OK, the way I see it, we have 2 choices to get the SP moving."

Ilario and Dominique (in unison): "Oh yay. What's that?"

BVN: "Option 1, I put out a price sensitive announcement saying that we're going to change the corporate logo."

Ilario and Dominique (in unison): "OK,... and ....Option 2?"

BVN: "You guys follow my lead and buy a few shares each."

Ilario and Dominique (in unison): "Oh,....OK. Sounds like we'll go with 2."

BVN: "Cool, I'll get right on with writing the ASX release."

{Legal Notice: The above script is purely fictional. Any resemblance to real people or events is purely coincidental}

Disc: Held in RL and SM

A bit over a week ago Intelligent Investor posted a research writeup on Biome - titled "Biome's balancing act - This probiotic startup is enjoying strong demand, but it's an uphill battle from here"

It's behind their paywall but ended not with a "Buy", "Sell" or "Hold" rating but rather with a "We'll be watching Biome from the sidelines"

Some of what they covered in the writeup was discussed in their latest Intelligent Investor : Stock Take Podcast which is also available on Youtube

https://youtu.be/S_5DyF1aWdk?si=r37MB3m8Phu8zfMZ&t=1900

The Biome discussion starts at around 31:40

Managing Director Blair Norfolk at Bell Potter Healthcare Conference

viewed this just yet. Hopefully later today

More "soft news". But good news non the less. Onward and upward

ASX ANNOUNCEMENT

27 November 2024

Q2 FY25 Revenue Guidance

● Biome forecast Q2 FY25 sales revenue to surpass $4.5m

Microbiome health company Biome Australia Limited (ASX: BIO) (‘Biome’ or ‘the company’) is pleased to announce strong growth has continued through the December quarter-to-date, with Q2 sales revenue expected to surpass $4.5m. This result will lead to a new quarterly record for sales revenue after last quarter’s record of $4.25m (Q1 FY25).

More positive newsflow for probiotics brand $BIO in both Canada and Australia.

Hightlights

● Following a successful test market launch in Canada, Biome moves to an official market launch in both health retail and practitioner markets

● First Canadian staff member to start on the road (in Ontario) this November

● Three additional products approved by Health Canada in October

● Biome reaches a new three month record with 188,000 consumer units purchased of Activated Probiotics in Australian market, up ~60% vs PCP (Aug-Oct 2023)

● Terry White Chemmart retail scan sales reach $3.5m for 12 months to October up ~75%

● Biome Cholesterol Probiotic successfully launched internationally

My Assessment

Good news all round.

Sales appear to be running ahead of the 50% my model requires for $BIO to hit the 2027 Strategic goals.

The test maketing period in Canada was shorter than I had in mind (no good reason), so the full commercial rollout with 12/17 products approved will start to get acoounts going this year. While the FY25 contribution to sales will be small, it sets things up nicely for FY26 and beyond. BVN has spoken very positively about the Canadian market in his last presentation, which as I recall was delivered while he was in Canada. A leading indicator of market traction will be indicated by the rate at which BVN adds further "educational" staff.

Overall, good news.

I'm happy to keep at my current RL position which is 2%, as I still see this as a higher risk proposition and will build my position over time.

Disc: Held in RL and SM

He's a little market anecdote.

Today, I was in my local pharmacy - part of theChempro chain. I've been in and out of it several time in the last 6 months, and noticed the Activated Probiotics range, and that the range is stocked right next to the payment terminal has been growing to now encompass the full range. However, the metres of shelf space is still about 8-10% of that given to the more extensive Bioceuticals range.

I got to speak to the head pharmacist in the shop, as it was a quiet time, and I asked him if he could recommend something for a minor condition I have, and for which I usually take a prescription medication.

Quick as a flash, he was on to the relevant Activated Probiotic range. He rolled out all the key messages (per CEO Blair) and spoke about how I'd probably need to take the recommendation for 2-3 months to see the benefit. He spoke about the clinical evidence, and pointed out that the condition-specific label made it unique among probiotics.

He also mentioned that he had personally tried the general Biome Advanced Probiotic and had observed benefits (digestion, gut health in the pharmacist's case.)

As I got deeper into the specifics of my condition, he finally recommended another treatment, with a good rationale as to why that was preferred over the probiotic.

My Key Takeaways From this Isolated Datapoint

- The market training investment is clearly putting the $BIO brand in the front of mind of the pharmacist

- The range is prominently displayed right next to the payment terminal and, although, only having a very small fraction of space of the established brand, was closer in reach to someone standing at the payment terminal

- Pharmacists in Australia are well trained professionals, and given a deeper discussion, this pharmacist ultimately made another recommendation, having weighed the $BIO product with alternatives.(The alternative was NOT a probiotic)

While no payday for $BIO here, it is one datapoint that backs up what BVN has been telling investors. So, I took heart.

Disc: Held in RL and SM

On the face of it this seems pretty good. Blair and team continue to deliver

Quarterly Activities & Appendix 4C September 2024

● Biome records $122k of EBITDA for Q1 (Adjusted for share based payments) ○ Third consecutive quarter of positive EBITDA

- ● Record cash receipts of $3.89m in Q1, up 84% vs PCP

- ● Biome reports record quarterly sales revenue $4.25m, up 12% vs Q4 FY24

- ● Biome maintains gross margin above 60% for Q1

- ● Same-store pharmacy sales for Q1 up 68% vs PCP

- ● Clinically proven cholesterol lowering product, Biome Cholesterol launched

- ● Test market in Canada commenced and strategic distribution deal signed

- ● As at September 30th, the company has a cash balance of $2.67m

Fill Announcement click here

Biome Australia (ASX:BIO) | Webinar with Blair Norfolk | 16/10/24 - Sharewise

Q1 Sales revenue represents a ~$17m annualised run rate (ARR)

Get Share price going - Activated Probiotics, Activated Nutrients, and AXP.

ASX ANNOUNCEMENT 1 October 2024 Biome reports record quarterly sales revenue for Q1 FY25

● Biome achieves record quarterly sales revenue of ~$4.25m (unaudited)

● Sales revenue increased ~$1.51m or 55% vs PCP Q1 FY24

● Sales revenue increased ~$450k or 12% vs Q4 FY24

● Q1 Sales revenue represents a ~$17m annualised run rate (ARR) Microbiome health company Biome Australia Limited (ASX: BIO) (‘Biome’ or ‘the company’) is pleased to provide a trading update for Q1 FY25. Biome’s quarterly sales revenue totalled ~$4.25m (unaudited), representing a 55% increase vs the previous corresponding period (Q1 FY24, $2.74m) and 12% above the previous record quarter (Q4 FY24, $3.8m).

This result exceeded the $4m target for the quarter (Ref: ASX announcement dated 3 September 2024) by $250k or 6.3%. Biome’s Q1 sales revenue represents an annualised run rate of $17m, with growth expected to continue through the remainder of FY25.

Biome Australia’s Managing Director and Founder, Blair Vega Norfolk, commented: “I am excited to share this result for Q1 FY25, another record quarter in sales revenue following our recent release of Biome’s Vision 27, which outlined our growth plan and prospects over the next three years.

I look forward to sharing further updates on our growth and performance in the coming periods.” -ENDS

$BIO follow-up hard on the heels of yesterday's Vision 27 strategy launch with their quarterly sales result.

Their Highlights

● Biome achieves record quarterly sales revenue of ~$4.25m (unaudited)

● Sales revenue increased ~$1.51m or 55% vs PCP Q1 FY24

● Sales revenue increased ~$450k or 12% vs Q4 FY24

● Q1 Sales revenue represents a ~$17m annualised run rate (ARR)

My Analysis

A good result, ahead of their announced quarterly target by 6.3%.

With a Q1 annualised sales run-rate of $17m on a growth trajectory of +55% to pcp, depending on quarterly variability an annual result of $20m is potentially within reach. (My valuation central case has $19.5m for FY25) That would potentially lead to a maiden positive NPAT result ... but I am getting ahead of myself here. In any event, this should be increasing the quarterly net cash surpluses nicely.

Overall: On track.

Note: My criterion to increase my holding further is some visibility of product-market fit in UKI, as this is central to my long-term thesis. I'll measure this by the international sales trajectory incremental to FY24 $0.895m, as the contribution from other markets is likely small.

Disc: Held in RL (2%) and SM

BIO has just released their anticipated plan for the next 3 years "Vision 27" click here

Video presentation click here Once again Blair presents very well. Seems to know his stuff, seems to be across various pharmacy markets worldwide.

At first glance the outlook seems positive, potentially very positive

A few key take aways:

- Increase pharmacy/distribution points in Australia from 5,000 - 8,000 (67% TAM)

- Increase companies global footprint, pushing into Canada and Europe. Funded via existing cash flow.

- New product range to launch in H2 FY25.

- Intellectual Property agreement was completed in FY24 and accompanying project to develop novel biological IP is well underway

Probiotics firm $BIO have announced their Vision 27 strategic plan, as CEO Blair had promised for September. (No announcement of a webinar to go with it as yet, but the presentation is reasonable self-contained).

Much is the market sensitive information has been released before: (cumulative revenue target FY25-27 of $75-85m; test market entry to Canada)

There are some more detailed specifics about individual markets, albeit entirely consistent with what's been said before, and also on supply chain.

There is reference to a new proprietary strain of L. plantarum XXXX (name to be finalised) without saying what it's for.

There is also reference to an upcoming new brand and product range aimed at filling an existing market gap. Not a lot of detail here and we'll find out more in H2FY25, (I am idly speculating that this is a more generic range to create more SKUs in the behind the counter display, probably not back up by the clinical trials on condition-specific labels, Differentiated brand is so as not to confuse the with the clincal-supported label claims of the Activated Probiotics range)

Those are just some initial observations from a very quick scan.

Dis: Held in RL and SM

Return (inc div) 1yr: 465.38% 3yr: N/A 5yr: N/A

Distributer footprint:

Ecotrend Ecologics | Natural Health Product Distributor

Today we manage over 2500 retail and over 2500 professional accounts, as well as work with over 120 fantastic and unique brands. Ecotrend believes in the human touch. Family and friends play an important role in the almost familial relationships we are proud to maintain with our brands. Treating both people and our planet with dignity, Ecotrend has nurtured a foundation of loyalty and trust. Health is not just supplements and vitamins; it’s a lifestyle. Ecotrend Ecologics is your go-to distributor for high-quality lifestyle products, including top brands of vitamins and supplements.

The push into the North American region begins:

ASX ANNOUNCEMENT

19 September 2024

- ● Biome executes agreement to distribute Activated Proibotics in Canada with new partner Ecotrend Ecologics

- ● Biome’s Activated Probiotics team presents and exhibits at CHFA Now in Toronto

Full Ann - click here

For what it's worth, Canary Capital brought out the following "Equity research report" last week. Click here

While this may be their effort to pump up the share price, its worth a read.

The report gives some background to the company and the industry. It outlines some key risks the company faces.

Also BIO is compared to Blackmore's, Life-space and Swisse. All of which have been bought out.

I attended the BIO company presentation webinar this morning.

For the recording Click here

Blair Norfolk spoke to this document released late last month: Click here

There were no revelations that I picked up on as he stuck to the script and really worked his way through the previously released document, which is worth a read.

He pushed his consistent lines:

- The company produces 18 quality products.

- Biome works closely with Pharmacists and chemists, the aim is to have these professionals promote and sell.

- Biome aims to maximise margins for pharmacists to incentivise recommending the products. The cut for a pharmacy could be from $13-$28 for a Biome product v a few dollars from most products a pharmacist might sell (that was my understanding).

- BIO have avoided working with "discount" chemists etc and do not intent getting into discounting products in a short term sugar rush, race to the bottom.

- When asked about possible cap raise Blair said this was not on the radar.

When asked if there were any funds investing in the company, Blair said that there were some. However none had exceeded the 5% threshold and therefore did not need to disclose these holdings.

Just before the webinar, the company released an announcement to say that will set a new sales record for Q1 2025.

Blair also added that the company will update the market on their Vision 2027 strategic plan sometime in the next three weeks.

ASX ANNOUNCEMENT

2 September 2024

Q1 FY25 Revenue Guidance

● Biome forecast Q1 FY25 sales revenue to surpass $4.0m

Microbiome health company Biome Australia Limited (ASX: BIO) (‘Biome’ or ‘the company’) is pleased to announce, after a strong start to the September quarter, Q1 sales revenue is expected to surpass $4.0m. This result will lead to a new record quarter for sales revenue after last quarter’s record of $3.8m (Q4 FY24).

ASX ANNOUNCEMENT

29 July 2024

Biome shares revenue target as part of Vision 27 Strategic Plan

● Biome sets revenue target of up to $85m cumulative through the next three years (FY25-FY27)

● Biome exceeded the last three-year cumulative target (FY21-24) by 14% overall ($24m vs $21m)

○ The final year of this plan was exceeded by 30% ($13m vs $10m)

● Biome’s Vision 27 target of up to $85m represents an over 400% increase on previous three-year target.

https://investorpa.com/announcement-pdf/20240819/24906.pdf

There was talk of this 3 year target being an odd move by Blair. Lets see how it plays out

ASX ANNOUNCEMENT

19 August 2024

Biome’s Clinically Proven Cholesterol Reducing Probiotic Launched:

- ● Biome has launched its new cholesterol lowering probiotic, Biome Cholesterol Probiotic, in both pharmacy and practitioner channels.

- ● A double blind, placebo controlled 12 week trial reduced total cholesterol by 14% and LDL (bad cholesterol) by 15% whilst increasing HDL (good cholesterol) by 7% compared to baseline

- ● Potential for Biome Cholesterol Probiotic to be used as an adjunct alongside statins to support increased efficacy of treatment or to reduce the dosage and side effects of this type of treatment

- ● For people who don’t tolerate statins therapy, Biome Cholesterol Probiotic will provide physicians with an additional therapeutic option to help manage the cholesterol levels of these patients

- ● Cardiovascular diseases are the leading cause of death globally with high total cholesterol, high LDL cholesterol and low HDL cholesterol being major risk factors

- ● More than 4 million Australians are reported to be living with cardiovascular diseases

Did anyone else notice the coincidental timing of the directors being issued 6.7m shares on December 1, 2023, funded by a loan from the company with a price of 12c/share and then what happened to the share price from the day they were issued ? From what I can see there is no escrow period on those shares.

I checked Biome website:

Activated Probiotics® is a world-first range of live biotherapeutic products clinically proven to help prevent and support the management of various health concerns, including low mood and sleep, bone health, iron malabsorption, mild eczema and IBS, through randomised double-blind placebo-controlled trials. Through practitioner-only distribution, Biome is committed to educating health professionals on the newfound systemic health effects of the gut microbiota and helps them to provide innovative and evidence-based complementary medicines for the management of some of humanity’s most prevalent and chronic health concerns.

Biome also developed and distributes scientifically formulated, organic nutraceutical range Activated Nutrients®.

I see that Biome has released an ambitious 3 year revenue target of $75 - 85m total for the next 3 years (FY25 to FY27). We'll get the full 3 year strategic plan later this quarter.

As Blair notes in the announcement, the previous 3 year target through to FY24 was exceeded, by achieving $24m vs a targeted $21m.

A cumulative target is a little odd, and as with the previous 3 years certainly wont be linear. But, for the sake of argument, let's try and map the last 3 years onto the next.

FY22 -- $4.1m (16.8% of 3 year total)

FY23 -- $7.2m (29.6% of 3 year total)

FY24 -- $13m (53.5% of 3 year total)

If we assume the cumulative total through to FY27 will be $80m, and the same proportions hold (they won't, but let's just see anyway), then the next three years revenue will look like this:

FY25 -- $13.4m

FY26 -- $23.7m

FY27 -- $42.8m

Given we finished FY24 on a ARR of ~$15m, this already looks wrong. So let's try a consistent growth rate.

To get to a total of $80m, we'd need a rate of ~30%, so..

FY25 -- $20m

FY26 -- $25m

FY27 -- $35m

Anyway -- all just guess work to try and map out how the company arrived at a $75-85m target. The point is that they seem to think that they can sustain very high growth in the coming years.

To come at it from a valuation standpoint, let's thumb suck a FY27 NPAT of $4m and an ending PE of 35 to get a market cap of $140m, which would be a share price of ~65c with no dilution. Discounted back by 10%pa gives a fair value of 48c.

Anyway, all very basic back of the napkin stuff. But helps frame up expectations for me.

ASX ANNOUNCEMENT

29 July 2024

Biome shares revenue target as part of Vision 27 Strategic Plan

- ● Biome sets revenue target of up to $85m cumulative through the next three years (FY25-FY27)

- ● Biome exceeded the last three-year cumulative target (FY21-24) by 14% overall ($24m vs $21m)

○ The final year of this plan was exceeded by 30% ($13m vs $10m) ● Biome’s Vision 27 target of up to $85m represents an over 400%

increase on previous three-year target

Microbiome health company Biome Australia Limited (ASX: BIO) (‘Biome’ or ‘the company’) is pleased to announce a revenue target that will be driven by Biome’s Vision 27, three-year strategic plan, due to be released to the market later this quarter.

The cumulative revenue target has been set at a range of $75m to $85m over three years (1 July, 2024 - 30 June, 2027). This represents more than 400% growth over the preceding period’s target of $21m and 350% compared to the actual result of $24m in cumulative sales revenue (FY21-24).

The key focus is to continue to invest for growth while continuing to grow profit.

Biome will share the complete Vision 27 with the market later this quarter, supported by an investor webinar.

I know I haven't posted on $BIO for a few days. Partly because my investing effort is geting absorbed by results season, and partly because I have started some work getting stuck into reviewing the clinical research behind their products.

For anyone who is interested, they list relevant research papers in the "Science" tab for each product on the Activated Probiotics website. So, you can get a flavour of what has been done quite readily.

However, in one of the early products I investigated, at first I couldn't find evidence of a placebo-controlled, randomised, double-blind clinical trial (PCRDB) in the reseach papers cited by $BIO. Initially, I was concerned. But on doing a deeper search, eventually I DID find a relevant clinical study to this standard by one of their research partners, which was more recent that the study on the product website. (Why is it not the one quoted on the website?)

Long story short, the task of investigating the clinical work for 16 products (well, actually fewer, because there are some overlaps) is going to be a bigger undertaking than I initially thought. I am progressing it, and will report my finding here. But it might take a while.

So far, there are no major flags giving me concern that BVN's characterisation of their work is anything but accurate.

What I am finding is that there is a huge amount of clinical research on health benefits of probiotics - after all, there are many bacteria and almost countless strains, many competitors and a huge range of products out there.

On the "Science" element of the Deep Dive, I am forming some loosely supported hypotheses, bsaed on my work to date:

- The vast majority of the clinical research on probiotics is of a lower standard than PCRDB.

- Therefore, while perhaps not unique, $BIO is indeed an early mover in bringing strain-specific products to market with this level of clinical backing. So far, the reported clinical benefits are signficant. (especially, when you consider than many approved, "conventional" pharmaceuticals only have modest benefits in a proportion of patients treated.)

- While they have some IP protection in wrapping the strain, the formulation, and the label claim backed by a cliniclal trial, it is conceivable that related strains might also deliver a similar clinical effect. So a determined or lucky competitor could launch a "me-too" product if they are prepared to invest (I am not a microbiologist, so I need to test this).

- One issue I am uncovering is that in some of the cited clinical trial evidence I have read to date, it is unclear to me whether the trial was conducted with the same formulation as the commercial product. There are two sub-questions 1) Does this matter and 2) Is it that I just haven't uncovered the relevant clinical trial report. On 1) I think it does matter, because the formulation influences where in the gut and at what rate the product is delivered. So this is one flag to follow-up on.

Anyway, this is turning out to be a big piece of work that is causing some indigestion and heart burn ... pass the probiotics!

The good news - I can see why BVN says $BIO is a first mover and differentiated. There does appear to be good empirical science behind their claims, even if the mechanisms of action are less clear and - in some case - appear contestable. As far as I can see, much of the science of how the microbiome achieves outcomes is not fully understood. In many cases I've read there are plausible theories for the mechanisms, but that is not the same as proof. Again, the same is true in pharmaceuticals to some degree. But I am getting to the limit of my scientific competence here.

The less good news - if they develop a valuable business, I think any moat is less secure than one might think for a competitor prepared to go after it. But I have to get more input on this. Of course, this is where being an early-mover with a strong brand will help. And it is clear that they are making good progress in building a brand known to practitioners in Australia.

Lots of questions, but so far no red flags.

Held: RL (0.65%) and SM

Today, I decided to visit my local pharmacy to inquire if they stocked Activated Probiotic. To my surprise, I received an overwhelmingly positive response from the pharmacist. I've interacted with this chap a few times before, but I've never seen his face light up like it did when I mentioned Activated Probiotic.

He enthusiastically told me, "We love this product!" and then eagerly asked me how I had heard about it. It was clear that this product is highly regarded and appreciated by the pharmacy staff. - So I'll add this data point of one into the investment matrix.

As I speculated yesterday, Bell Potter have updated their valuation slightly off the back of yesterday's 4C. I haven't seen the updated report yet, but picked the following FN Arena summary off the news-wires. Likely explains this morning's SP response, recoverings yesterday's "profit-taking".

TP change appears related only due to tweaking the discount rate - which I don't understand. But in any event, they are still probably below where I sit on valuation, particularly after yesterday's SM meeting.

From FN Arena

Displaying the fastest sales growth of the past five quarters, notes Bell Potter, Biome Australia's June quarter increased by 88% on the previous corresponding period.

Also, operating cash flow (OCF) nearly doubled the March quarter, and was the third successive positive quarter, highlights the broker.

Bell Potter attributes sales growth to the release of new products over FY24 and a 25% increase in distribution footprint across pharmacy and health practitioners. Pharmacy sales account for around 66% of total sales, note the analysts.

The target rises to 80c from 73c as the broker lowers the assumed discount rate to 11.8% from 12.5%.

Sector: Household & Personal Products.

Target price is $0.80.Current Price is $0.73. Difference: $0.08 - (brackets indicate current price is over target). If BIO meets the Bell Potter target it will return approximately 9% (excluding dividends, fees and charges - negative figures indicate an expected loss).

Disc: Held in RL and SM

Interview with Biome CEO Blair Vaga Norfolk on Strawman

Biome produces probiotics products based on clinically tested strains that target specific health issues. Traditionally the probiotic market has been focused primarily on gut health, but Biome has found evidence that probiotics can target a range of conditions including acne, depression, IBS, thrush and more.

Biome has two primary channels to market their products: practitioners (such as pharmacists and naturopaths), and health foods store and direct selling. Naturopaths are a key vehicle to educate the end user as they tend to move faster on new research and studies, while GPs are the slowest. Many GPs are still wary of new treatments. Blair doesn’t see this as an issue. The Biome approach is to educate the pharmacist and complementary medicine market, who in turn educate their patients. In this sense their marketing is more B2B than it may first appear. It also appears to be stickier revenue: the pharmacies are the one ordering the product, and will reorder if their customers are happy with the product.

Production and packaging of the product is handled by third parties, warehousing is in house. Blair would consider bringing some parts of this supply chain in house in the future, but primarily as a way to improve control and profit margin. Doesn’t sound like a priority in the short term.

Annual sales growth ~70-80% at 60% gross profit (impressive!).

Overall I was really impressed with what I learned about Biome. Blair came across as a very patient, confident manager who is prepared to move carefully. He seems to have a strong understanding of where his product is placed in the market and how to market it. He mentioned their existing UK operations are small but break even, and it sounds like this could be an excellent launch pad for the EU market when they are ready. This seems like a big opportunity. He notes that probiotics are far more accepted already in some parts of Europe (eg. Germany) than in others. Does that make it a more saturated market, though?

He’s planning to announce an updated sales strategy later this year. This will be very interesting to see. Based on what I have read so far, and saw today, he seems like a thoughtful manager who can execute.

Planning to buy a small initial holding and possibly more after further research. Blair was adamant there are no plans to raise capital at this stage which is impressive, given the recent run-up in price.

The market cap is now $143 million which I believe means it’s going to be on the radar of more funds. If growth and profitability continue it will can’t help but attract more attention.

What an interview - well done @Strawman. Your discussion approach was able to get a lot more insights out of Blair than other interviews out there, and I've gained a step-change in my own understanding. (I think this gives StrawPeople an edge over the market!)

Rather than summarise my key takeaways, because it will rehash much of what I've already written, I want to focus on Blair. But I recommend anyone who's interest has been piqued to watch the FULL interview.

Rarely (if ever in the microcap space) have I come across a CEO with such clarity and range, and internal cohesion in their strategic thinking. I truely rate Blair very highly, and as an example, draw attention to his ability to talk with clarity about 2024, 2025, next five years and next ten years. That's one sign of a great strategic leader. He also now has a cashflow positive business, so its not just a "story". He is the captain of his ship.

I upped my stake this morning in RL to 0.75% (as the market superficially appears to have taken some trading profits on a lower q-on-q receipts). I plan to go higher, but will wait now until I see the FY results and, more importantly, the three-year strategy which he will announce (and which I expect will role out some conservative 3-year targets)

I will place some trades to align Strawman (so please don't all just out and pop the SP before the close!! ;-) )

Very, very impressed.

Disc: Held in RL (0.75%) and SM

I conclude my week of immersion in probiotics (not literally) with a summary profile and some commentary on BioGaia - a $1.8bn market cap Swedish company and pioneer in probiotics development for some 30 years.

I chose this company because in many ways, it looks like $BIO might be if it is super-successful over the next 10 years. Understanding it also helps inform what $BIO is up against.

Metrics

I pulled out the following, making the rough conversion that BiaGaia reports in SEK, with 7 SEK about equal to 1 AUD. (Reference points are to the FY24 consensus.)

- P/E 30.4

- Market Cap / Revenue = 8.71 (so maybe the minnow $BIO is not so priecy after all)

- EV/EBITDA = 21.5

- 3 yr Revenue CAGR = 22%

- 3 yr NPAT CAGR = 28%

- Gross Margin = 73%

- Operating Margin = 35%

- Net Margin = 28%

Revenues are globally diversified: Americas (39%), EMEA (38%) APAC (23%)

Interestingly, it has also recently entered Canada. While there are some overlaps between BioGaia and $BIO products, there are also areas where they won't compete.

Thinking about the UK, while their products appear to be available and well-establised in several online channels, only one baby product is available via the Boots Chain. This indicates to me that they might also be following a similar discerning GTM strategy to $BIO.

Their product range is also widely available in Australia. So that's good news. $BIO has been able to achieve its success to date in Australia even with the strong presence of its more established European competitor. (I think this is rather important)

There are some big differences in strategy between the companies. For example, BioGaia does a lot of inhouse R&D, and it manufacturers (at least many) of its active agents with state of the art biofermentation facilities.

Also, the CVs of the Board and Management Team strike me as being a significant step up in strength and depth. (Sorry to bang on about it)

At about this stage, I have run out of steam for the week. So, I collared my BA Perplexity.AI and set them one final task for the week, providing them with the 2023 Annual Report to summarise along three key headings.

Here is the link to the report.

Here is my BA's summary (unedited) - but from a glance appears reasonable.

Here is a summary of BioGaia, focusing on their financial performance, product portfolio, and strategy/competitive advantages:

Financial Performance (2021-2023)

BioGaia has demonstrated strong financial performance over the past three years:

2023:

- Net sales: SEK 1,297 million (17% increase from 2022)

- Operating profit: SEK 443 million

- Operating margin: 34%

2022:

- Net sales: SEK 1,085 million (44% increase from 2021)

- Operating profit: SEK 387 million

- Operating margin: 36%

2021:

- Net sales: SEK 753 million (4% increase from 2020)

- Operating profit: SEK 254 million

- Operating margin: 34%

The company has shown consistent growth in net sales, with a significant jump in 2022 and continued strong performance in 2023. Operating margins have remained stable in the 34-36% range, indicating efficient operations and cost management.

Product Portfolio

BioGaia develops, manufactures, and markets probiotic products for gut, oral, and immune health. Their product portfolio includes:

Pediatrics (78% of sales in 2023):

- Protectis drops for infants

- Prodentis KIDS for oral health

Adult Health (21% of sales in 2023):

- Probiotic supplements for various health conditions

- Other (1% of sales in 2023):

Aldermis: Cosmetic probiotic skin ointment for infants and children

Key features of BioGaia's product portfolio:

- Based on L. reuteri bacterial strains

- Clinically proven effects

- Over 90% of products sold under the BioGaia brand or co-branding

- Available in over 100 countries

Strategy and Competitive Advantages

BioGaia's strategy and competitive advantages can be summarized in the following key areas:

1. Research and Innovation:

- Invest approximately 10% of net sales in R&D

- 30+ years of research and innovation in probiotics and microbiome

- 250+ published studies with BioGaia's bacteria strains

- 600 granted patents

- Collaboration with leading researchers worldwide

2. Brand Strategy:

- Transition from B2B to B2C model

- Increase product sales under the BioGaia brand

- Focus on building consumer trust and awareness

3. Omnichannel Distribution:

Two main distribution channels:

a) Distribution partners (nutrition and pharmaceutical companies)

b) Direct distribution through subsidiaries

Expanding e-commerce presence, particularly on platforms like Amazon

Six direct markets: USA, UK, Japan, Canada, Finland, and Sweden

4. Product Development:

- Continuous research to identify new applications for bacterial strains

- Development of consumer-friendly and high-quality probiotic products

- Focus on improving existing products (e.g., environmental sustainability, user-friendliness)

5. Global Expansion:

- Entering new direct markets (e.g., Canada in 2023)

- Strengthening partnerships in existing markets

- Adapting marketing strategies to local consumer needs (e.g., digital marketing on TikTok in China)

6. Financial Strength:

- Strong net cash balance

- Steady profitability and cash flow

- Ability to maintain dividend policy and invest in growth initiatives

7. Sustainability Focus:

- Commitment to sustainable product origins

- Investment in climate innovations

- Recognition with a gold medal by EcoVadis for sustainability efforts

8. Expertise and Leadership:

- Experienced management team with industry knowledge

- New CEO (Theresa Agnew) bringing extensive experience from consumer healthcare and OTC pharmaceuticals

9. Production Capabilities:

- Modern production facility in Eslöv, Sweden

- Semi-automated production lines

- Pilot facility for fermentation of next-generation probiotics

10. Market Position:

- World-leading probiotics company

- Pioneer in microbiome research

- High level of confidence among healthcare professionals

BioGaia's strategy focuses on leveraging its scientific expertise, strong brand, and global distribution network to maintain its position as a leader in the probiotics market. The company's commitment to research, product innovation, and sustainability, combined with its financial strength and flexible business model, positions it well for continued growth in the evolving health and wellness sector.

----

Happy weekend!

In my ongoing research, this morning I came across a Bell Potter note - well the front page at least! (Updated June-24, TP=0.73)

Just to compare, their FY25 and FY26 NPAT is $0.3m and $3.2m, respectively. My "scenario" that I showed in yesterday's straw (which I argued supports a TP of $1.10), has values of $1.9m and $7.4m.

So my "scenario" is quite a bit more bullish than BP, but in the grand scheme of things, it is in the ballpark.

If I am critical of this note, it appears that they talk about a "gap in the market". This may be true about the Australian market (which is also supported by @Rick's anecdote, yesterday). However, I am less clear the extent to which the same can be said in other markets.

Without making a negative remark about Bell Potter, I do make the general comment that some analysts tend just to repackage what management has told them, without doing independent, fact-based research. So, in sharing this research, I am not endorsing the statements, but just sharing the views of others.

I remain in an information gathering and analysis mode, and I am not yet taking a view on the stock (for avoidance of doubt). But it is interesting.

Disc: Held in RL (0.25%) and SM

In this straw I set out an interesting journey I have been on this week, following an exchange with @Tezzdog last weekend, that put $BIO on my radar screen. I posted an initial - and somewhat bearish - response to @Tezzdog's question.

@Strawman promptly came to the party and, by midday Monday, had lined up a SM Meeting with MD and Founder Blair Vega Norfolk (BVN) for Monday coming. (Well done, sir! Where else can you get that kind of access to a CEO – I ask you.)

For those who are interested, this straw contains some further resources that can help prepare for Monday. (If you are anything like me, I like to go into Strawman meetings with a lot of research under my belt, as I find I "hear" so much more. I agree with @Wini from the recent SM Meeting that its important to have an informed point of view, before you listen to management.)

Alternatively, you can skip all this and I’ll see you on Monday, leaving you with the thought that, yesterday, I picked up a tiny starter stake in $BIO - even though there's every chance I have royally overpaid. However, if it meets my expectations, I have a lot in the tank I'd be prepared to allocate over the next year or two. So, I'm not too fussed.

Summarising my Bearish Views

My governing thoughts (based on an hour's research on Sunday) was that I considered 1) the global competitive landscape and 2) the strength of board and management as significant barriers to achieving the global success to which $BIO aspires. I also highlighted why, at 11x revenue - whatever the outlook - it ain't cheap. That was then.

Meetings with BVN which Helped Me Form a More Bullish View

The following two videos are worth viewing:

There's quite a bit of overlap between the two videos, with more insights in the second. So, I got my assistant Claude.AI to summarise the transcripts under key headings. I've reviewed it, it seems pretty accurate, and I’ve dumped it at the end of this Straw for those who are interested, but haven't got 30 minutes to watch the video. (Scroll down to the dotted line, if you want to skip straight to that bit.)

My Take-Aways - what I've learned over the last 5 days

I structured my takeaways from this material and other research under some key headings, including what I learned in doing the next level of research, and how it challenged some of my initial bearish views. I was not starting from scratch, as I did some work on the probiotics market several years ago when I was looking at Blackmores, but never progressed further. It is a market that has long been of interest to me, partly because it combines healthcare and retail – two areas in which I am very happy investing and have enjoyed some success over the years.

1. Research-supported Condition-specific Activated Probiotics