Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Blair Vega Norfolk talks on Ausbiz, via linkedin:

https://investorpa.com/announcement-pdf/20250828/179668.pdf

This appears to be a great development.

And further solidifies Biomes presence as a premium brand in the premium end of the market

BIO CEO, Blair Vega Norfolk talks to East Coast Research.

I felt the interviewer found it hard to stay impartial and balanced, but Blair remained on track and business like.

A step on the road towards "Vision 27" - Full announcement

ASX ANNOUNCEMENT

23 January, 2025

Biome’s Australian Distribution Passes 6000 Health Retail and Practitioner Locations

- ● Biome increases its distribution in Australian practitioner and pharmacy markets to 6,000+ locations

- ● 20% growth in distribution footprint from 5,000 (FY24) to 6,000+ locations over the last six months

- ● Biome signs several new deals including USF Dispensaries in Victoria and Greenleaf Pharmacies in WA

- ● The growth in distribution represents 33% of the new Australian distribution target in the Vision 27 Strategic plan of 8,000 locations before the close of FY27

Data shared from Biome’s, two largest national retail pharmacy partners, Terry White Chemmart and Priceline Pharmacy for 12 months to 31 December, have reported 70% and 95% growth respectively.

Heading in the right direction

FWIW:

From East Coast Research

https://eastcoastresearch.com.au/reports/reports-db/biome-australia-asxbio

And the full report https://www.sharesinvalue.com.au/wp-content/uploads/2025/01/ASX-BIO-ECR-Initiation-Report-22-Jan-2025.pdf

This appears to have come out today and could have something to do with the jump in SP?

Biome Australia – Scaling Up to Dominate the Probiotic Health Market

We initiate coverage on Biome Australia (ASX: BIO) with a 12-month target price of A$0.91, representing a 68% upside from the current share price of A$0.54. Biome is an innovator in the health and wellness sector, focused on developing and distributing evidence-backed probiotics and complementary health products. With distribution points expected to grow from 5,000 to 8,000 under its Vision 27 Strategic Plan, the company is expanding both domestically and internationally. Backed by strong clinical data, Biome’s proprietary formulations address key consumer health needs and position it to capitalise on the growing global demand for evidence-based wellness solutions.

Strong Leadership Driving Strategic Growth and Profitability in a Founder-led Business

Biome Australia’s success is driven by its strong leadership team, which has been instrumental in executing the company’s Vision 27 Strategic Plan and positioning it as a leader in the evidence-based probiotics market. CEO Blair Norfolk has played a key role in scaling Biome’s operations and ensuring a focus on innovation and disciplined growth. The leadership team’s strategic approach, including strengthening mid-level management and prioritising operational efficiency, has supported the company’s transition to profitability and sustained cash flow generation. Their track record of execution and commitment to shareholder value reinforces confidence in Biome’s ability to achieve its growth ambitions and deliver long-term value.

Expanding Market Opportunities Support Strong Growth Thesis and Shareholder Value

The global probiotics market is projected to grow at a CAGR of 14.1%, reaching US$133.9 billion by 2030. Biome’s focus on innovative, clinically validated products positions it to capture a meaningful share of this expanding market. Domestically, Biome is increasing its distribution network across Australia, while internationally, it is targeting high-growth markets in the UK, Ireland, and Canada. These initiatives are key drivers of Biome’s ambitious revenue growth targets, forecast to reach A$56.1 million by FY28E, representing a compound annual growth rate of 37% from FY24A.

Valuation Range of A$0.87–A$0.95 per Share

Using a DCF methodology with a perpetual growth terminal value, we estimate Biome’s intrinsic value to be A$0.87 per share in our base case scenario and A$0.95 per share in a more optimistic bull case. Our mid-point target price of A$0.91 highlights the significant upside potential, driven by the company’s scalable operations, strong leadership, and differentiated product portfolio.

20 January, 2025

Quarterly Activities & Appendix 4C December 2024

Biome records $234k EBITDA for Q2, up 92% vs Q11

Record cash receipts of $4.34m in Q2, up 41% vs PCP

Biome reports record quarterly sales revenue of $4.61m, up 41% vs PCP

Biome maintains gross margin above 60% for Q2

Biome had a cash balance of $2.59m as at 31 December

Biome expects to report its first net profit for H1 FY25

Managing Director Blair Norfolk at Bell Potter Healthcare Conference

viewed this just yet. Hopefully later today

More "soft news". But good news non the less. Onward and upward

ASX ANNOUNCEMENT

27 November 2024

Q2 FY25 Revenue Guidance

● Biome forecast Q2 FY25 sales revenue to surpass $4.5m

Microbiome health company Biome Australia Limited (ASX: BIO) (‘Biome’ or ‘the company’) is pleased to announce strong growth has continued through the December quarter-to-date, with Q2 sales revenue expected to surpass $4.5m. This result will lead to a new quarterly record for sales revenue after last quarter’s record of $4.25m (Q1 FY25).

In the words of @mikebrisy "Soft News"

Still, another feather in Biomes cap.

Another potential product in the bottom draw.

ASX ANNOUNCEMENT

14 November 2024

Biome Strain Development Program Success

- ● Biome has successfully completed the identification, commercial validation and initial characterisation of the probiotic strain Lactobacillus plantarum BMB18

- ● The strain has been lodged with the German culture bank DSMZ

- ● Transfer of the intellectual property, BMB18, to Biome will take place in the coming

- weeks from Biome’s R&D partner

- ● This new IP will strengthen Biome’s advantage in probiotic product development and

- increase protection from competition

Click here for full announcement

On the face of it this seems pretty good. Blair and team continue to deliver

Quarterly Activities & Appendix 4C September 2024

● Biome records $122k of EBITDA for Q1 (Adjusted for share based payments) ○ Third consecutive quarter of positive EBITDA

- ● Record cash receipts of $3.89m in Q1, up 84% vs PCP

- ● Biome reports record quarterly sales revenue $4.25m, up 12% vs Q4 FY24

- ● Biome maintains gross margin above 60% for Q1

- ● Same-store pharmacy sales for Q1 up 68% vs PCP

- ● Clinically proven cholesterol lowering product, Biome Cholesterol launched

- ● Test market in Canada commenced and strategic distribution deal signed

- ● As at September 30th, the company has a cash balance of $2.67m

Fill Announcement click here

Biome Australia (ASX:BIO) | Webinar with Blair Norfolk | 16/10/24 - Sharewise

BIO has just released their anticipated plan for the next 3 years "Vision 27" click here

Video presentation click here Once again Blair presents very well. Seems to know his stuff, seems to be across various pharmacy markets worldwide.

At first glance the outlook seems positive, potentially very positive

A few key take aways:

- Increase pharmacy/distribution points in Australia from 5,000 - 8,000 (67% TAM)

- Increase companies global footprint, pushing into Canada and Europe. Funded via existing cash flow.

- New product range to launch in H2 FY25.

- Intellectual Property agreement was completed in FY24 and accompanying project to develop novel biological IP is well underway

The push into the North American region begins:

ASX ANNOUNCEMENT

19 September 2024

- ● Biome executes agreement to distribute Activated Proibotics in Canada with new partner Ecotrend Ecologics

- ● Biome’s Activated Probiotics team presents and exhibits at CHFA Now in Toronto

Full Ann - click here

For what it's worth, Canary Capital brought out the following "Equity research report" last week. Click here

While this may be their effort to pump up the share price, its worth a read.

The report gives some background to the company and the industry. It outlines some key risks the company faces.

Also BIO is compared to Blackmore's, Life-space and Swisse. All of which have been bought out.

I attended the BIO company presentation webinar this morning.

For the recording Click here

Blair Norfolk spoke to this document released late last month: Click here

There were no revelations that I picked up on as he stuck to the script and really worked his way through the previously released document, which is worth a read.

He pushed his consistent lines:

- The company produces 18 quality products.

- Biome works closely with Pharmacists and chemists, the aim is to have these professionals promote and sell.

- Biome aims to maximise margins for pharmacists to incentivise recommending the products. The cut for a pharmacy could be from $13-$28 for a Biome product v a few dollars from most products a pharmacist might sell (that was my understanding).

- BIO have avoided working with "discount" chemists etc and do not intent getting into discounting products in a short term sugar rush, race to the bottom.

- When asked about possible cap raise Blair said this was not on the radar.

When asked if there were any funds investing in the company, Blair said that there were some. However none had exceeded the 5% threshold and therefore did not need to disclose these holdings.

Just before the webinar, the company released an announcement to say that will set a new sales record for Q1 2025.

Blair also added that the company will update the market on their Vision 2027 strategic plan sometime in the next three weeks.

ASX ANNOUNCEMENT

2 September 2024

Q1 FY25 Revenue Guidance

● Biome forecast Q1 FY25 sales revenue to surpass $4.0m

Microbiome health company Biome Australia Limited (ASX: BIO) (‘Biome’ or ‘the company’) is pleased to announce, after a strong start to the September quarter, Q1 sales revenue is expected to surpass $4.0m. This result will lead to a new record quarter for sales revenue after last quarter’s record of $3.8m (Q4 FY24).

ASX ANNOUNCEMENT

29 July 2024

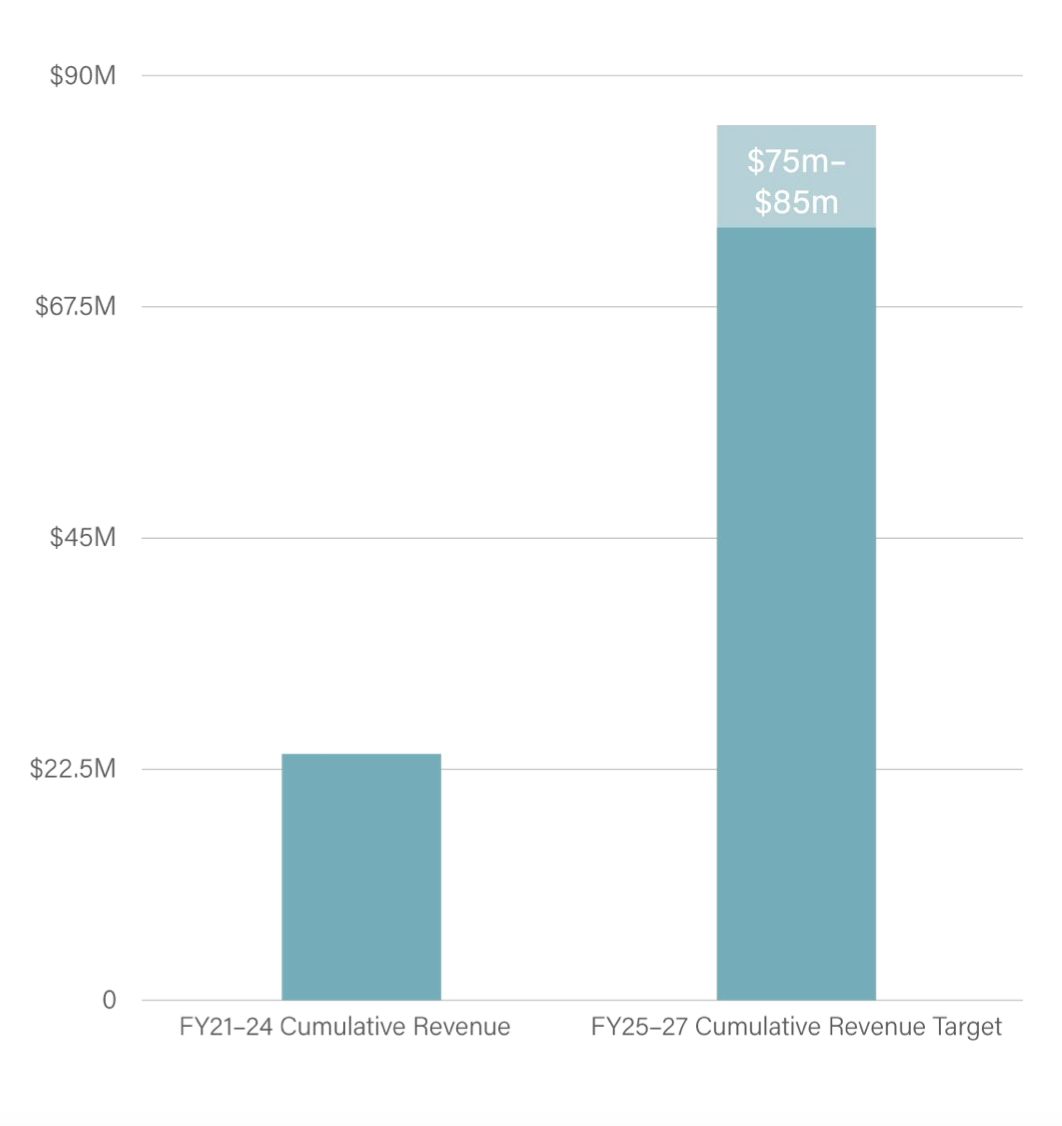

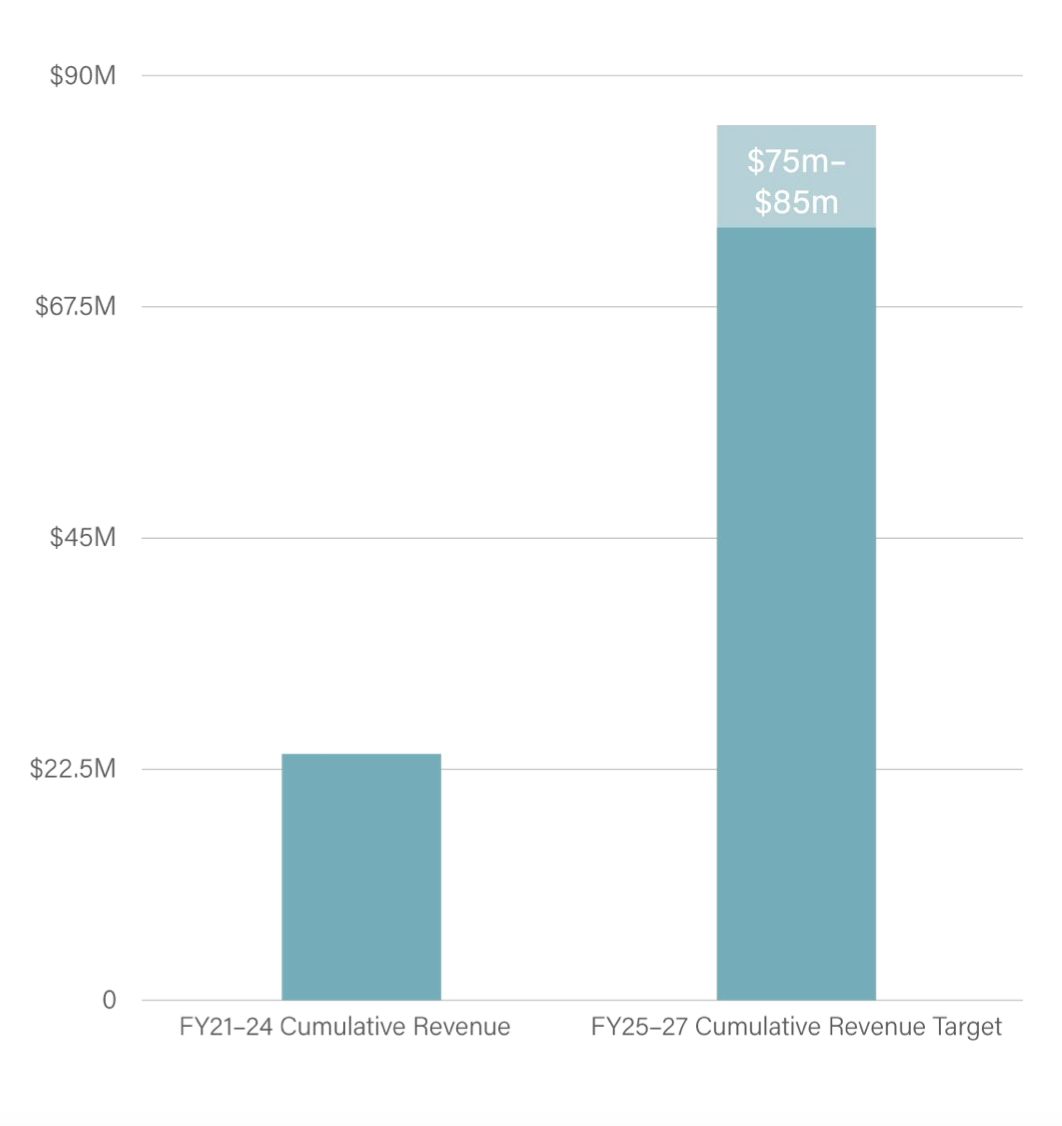

Biome shares revenue target as part of Vision 27 Strategic Plan

● Biome sets revenue target of up to $85m cumulative through the next three years (FY25-FY27)

● Biome exceeded the last three-year cumulative target (FY21-24) by 14% overall ($24m vs $21m)

○ The final year of this plan was exceeded by 30% ($13m vs $10m)

● Biome’s Vision 27 target of up to $85m represents an over 400% increase on previous three-year target.

https://investorpa.com/announcement-pdf/20240819/24906.pdf

There was talk of this 3 year target being an odd move by Blair. Lets see how it plays out

ASX ANNOUNCEMENT

19 August 2024

Biome’s Clinically Proven Cholesterol Reducing Probiotic Launched:

- ● Biome has launched its new cholesterol lowering probiotic, Biome Cholesterol Probiotic, in both pharmacy and practitioner channels.

- ● A double blind, placebo controlled 12 week trial reduced total cholesterol by 14% and LDL (bad cholesterol) by 15% whilst increasing HDL (good cholesterol) by 7% compared to baseline

- ● Potential for Biome Cholesterol Probiotic to be used as an adjunct alongside statins to support increased efficacy of treatment or to reduce the dosage and side effects of this type of treatment

- ● For people who don’t tolerate statins therapy, Biome Cholesterol Probiotic will provide physicians with an additional therapeutic option to help manage the cholesterol levels of these patients

- ● Cardiovascular diseases are the leading cause of death globally with high total cholesterol, high LDL cholesterol and low HDL cholesterol being major risk factors

- ● More than 4 million Australians are reported to be living with cardiovascular diseases

Blair Norfolk on Ausbiz today:

"we love to under promise and over deliver"

https://ausbiz.com.au/media/biomes-expanding-ecosystem-?videoId=37065

ASX ANNOUNCEMENT

29 July 2024

Biome shares revenue target as part of Vision 27 Strategic Plan

- ● Biome sets revenue target of up to $85m cumulative through the next three years (FY25-FY27)

- ● Biome exceeded the last three-year cumulative target (FY21-24) by 14% overall ($24m vs $21m)

○ The final year of this plan was exceeded by 30% ($13m vs $10m) ● Biome’s Vision 27 target of up to $85m represents an over 400%

increase on previous three-year target

Microbiome health company Biome Australia Limited (ASX: BIO) (‘Biome’ or ‘the company’) is pleased to announce a revenue target that will be driven by Biome’s Vision 27, three-year strategic plan, due to be released to the market later this quarter.

The cumulative revenue target has been set at a range of $75m to $85m over three years (1 July, 2024 - 30 June, 2027). This represents more than 400% growth over the preceding period’s target of $21m and 350% compared to the actual result of $24m in cumulative sales revenue (FY21-24).

The key focus is to continue to invest for growth while continuing to grow profit.

Biome will share the complete Vision 27 with the market later this quarter, supported by an investor webinar.

BIO appears on The Call on Ausbiz today.

Michael Wayne and Henry Jennings both gave it what I gather was a quick look over.

Both suggesting that investors take profits at this point, given the run up in SP.

Post a valuation or endorse another member's valuation.