Discl: Held IRL and in SM

SUMMARY

Weak result is not great, BUT signs are that this is temporary and will recover in 2HFY25. No thesis breaking concerns.

NOTES

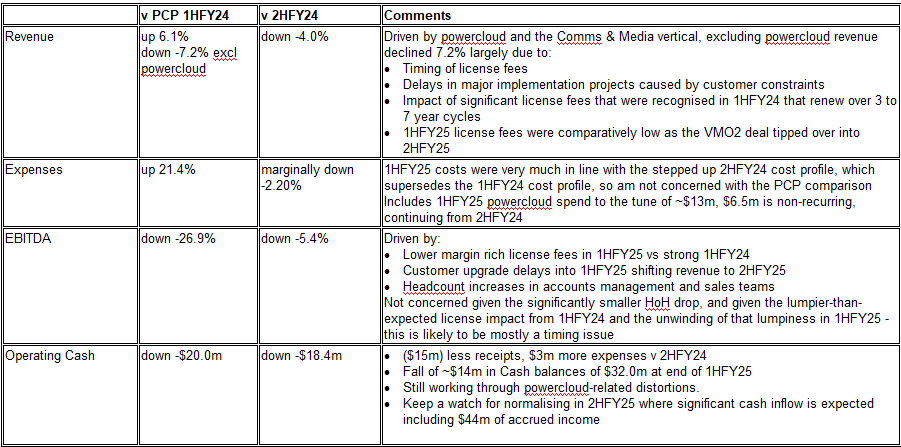

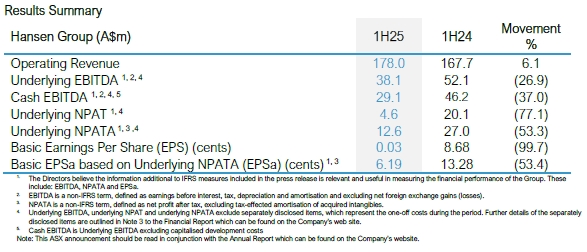

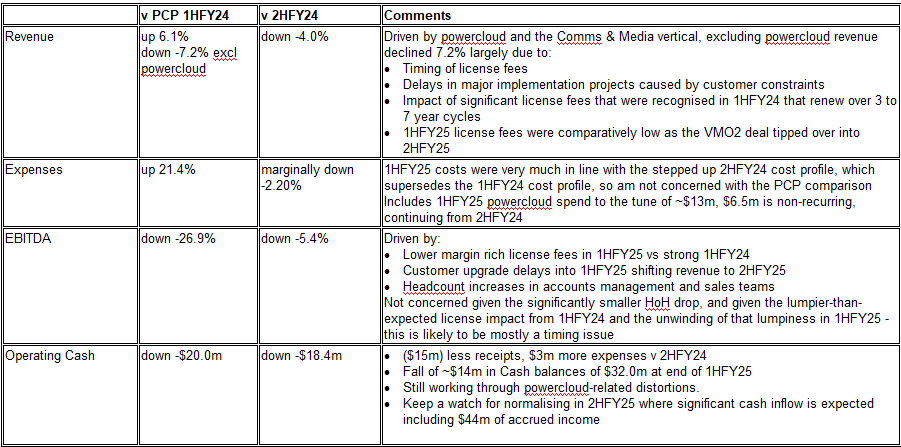

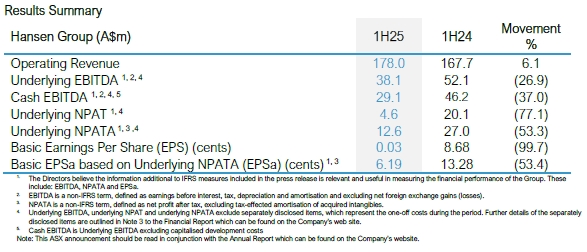

Weak 1H result, driven primarily by (1) lower license fees v strong 1HFY24 license renewals which only renew in 3-7 year cycles (2) upgrade delays which shift revenue into 2HFY25 (3) continued powercloud investment.

New wins in 1HFY25 include City of Kingsport water billing modernisation, A Entelios expansion into Denmark, expansion of relationship with Vattenfall and Stockholm Energi.

2HFY25 revenue and margins looking to be significantly stronger to compensate, due to:

- New logo implementations

- Customer upgrades deferred from 1HFY25

- Deals done in 1HFY25 above

- Impact of VMO2 deal signed in Feb - VMO2 wanted term licenses to capitalise, not SAAS, expect to recognise $10m/yr less 5year license fee

FY25 guidance reaffirmed, Jan 2025 YTD results provide reasonable confidence that this can be met:

- Operating Revenue increased $52.0m in Jan to $230.0m

- Underlying EBITDA increased $29.1m in Jan to $67.2m

- Fx impact YTD immaterial and primarily incurs costs in the same countries where it generates revenue

Customer churn continue to be consistently low

Both Energy & Utilities verticals are well positioned for currently ongoing rapid industry transformation

Powercloud integration and turnaround going well:

- Continued significant investment in core product Retail Core Service system, due to be released in June

- $13m invested to restructure business a ‘wholesale change to business’, reduce its fixed cost base and implement Hansen systems and Processes - powercloud is back to prospecting

- Rationalised workforce from 390 to 140, hired new local management, reduced fixed costs by $31m annually

- Cash generative, expected to deliver positive Underlying EBITDA for FY25, as was guided during acquisition

- Revenue growth anticipated from FY26 from German roll-out of smart meters, only recently commencing

- Updates on powercloud will scale back from hereon, in line with practice from previous acquisitions

Small acquisition of a $2.2m 30% stake in Dial AI, based in Canada - AI-powered tool designed to enhance automated customer interactions (sounds like a Whispir-like solution) - this makes sense to add into the Customer Care suite. Focused on energy & utilities, but can be applied to Telco’s

5c interim dividend, partially franked to 3.3c