Some strong numbers from AVA, some of which were already revealed in the January trading update.

Still, 20% revenue growth to $17m at an EBITDA margin of 10% ($1.7m compared to a $0.9m loss in the previous first half) was nice to see. Gross margins improved 3% to 64% thanks to a favourable segment mix (Detect has the best margins by far). Contracted annual recurring revenue was up 20%, and represents around a third of all sales orders for the half.

AVA saw a sales intake (signed but not yet delivered) of $16.3m, which is below the $19.7m pace received in H1 FY24 (but part of that was a big order from the Access segment as distributors built inventory). The sales backlog more than doubled to $7.6m and they reckon there is a $100m sales opportunity with close dates in this calendar year. $8.5m of this is seen as high probability and there is $26.6m of sales opportunities in progress.

A big part of the thesis has always been the ability for the business to realise some good operating leverage, and after a lot of restructure after Mal arrived, it was good to see operating expenses dip $0.3m and still see strong revenue growth.

Detect was the star of the show -- and this has always been the most interesting segment -- where revenue rose by 57%, and represented 71% of all first half revenue.

Access segment actually saw a dip, but the comparable period including initial stocking by resellers. So that's not too concerning. Still, will need to see some growth from here. Illuminate was also slightly down, but good to see that there is increasing cross-sell/bundling with Detect sales.

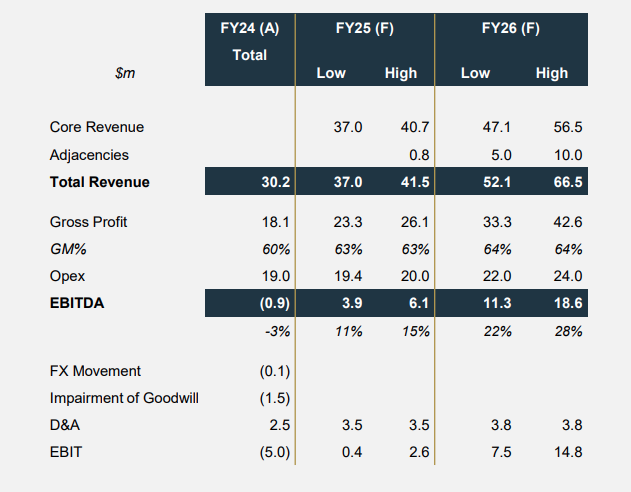

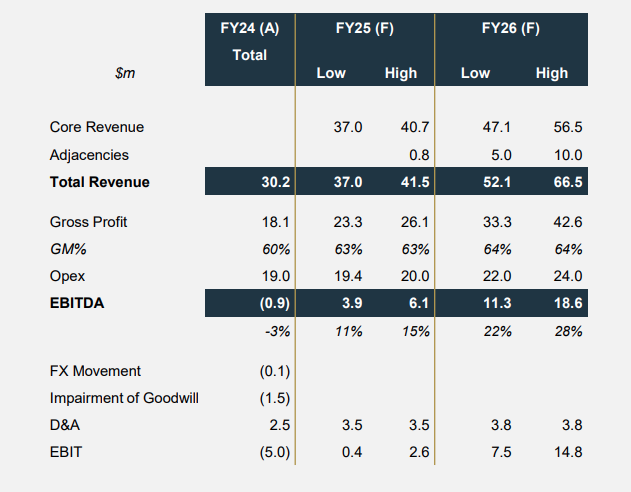

FY guidance is for revenue between $37-41.7m -- which would be ~30% up on last year at the midpoint, and suggests H2 revenue growth of almost 40%. According to their outlook, they expect an 11-15% EBITDA margin on this revenue, which is expected to further improve in FY26

All in all, great to see good sales momentum and expectations for further growth, with a stable cost base and rising gross margins, not to mention being EBITDA positive with $4.7m in cash in the bank. They also broke even on a statutory basis, so hopefully they really are at an inflection point.

The market just cant get excited about AVA, but another half or two of continued progress like this and it will be very hard to ignore, and I suspect a decent re-rate would be likely. I mean, they are on an EV/EBITDA ratio of 5.3x, which strikes me as dirt cheap for a business that is growing the top line at 20-30%, and is breakeven with rapidly expanding operating margins.

Of course, we need a strong second half for this to be true, and maybe that falls short. But if not, you'd have to think AVA could command a share price somewhere in the 20-30c range.

It's certainly been one to test the patience, but I think Mal has done well to reposition the business and it remains somewhat of an asymmetric bet -- much more upside than downside.

[Held]

a

a

a

a