Have finally worked through the AIM 1HFY25 video and releases. My immediate reaction on reading the releases back then was one of uncertainty as the financial numbers did not line up with the positivity from Tony. Unpacking the content took time, but it was well worth the effort as I feel significantly more educated on AIM as a company and I remain 100% onboard.

Discl: Held IRL and in SM

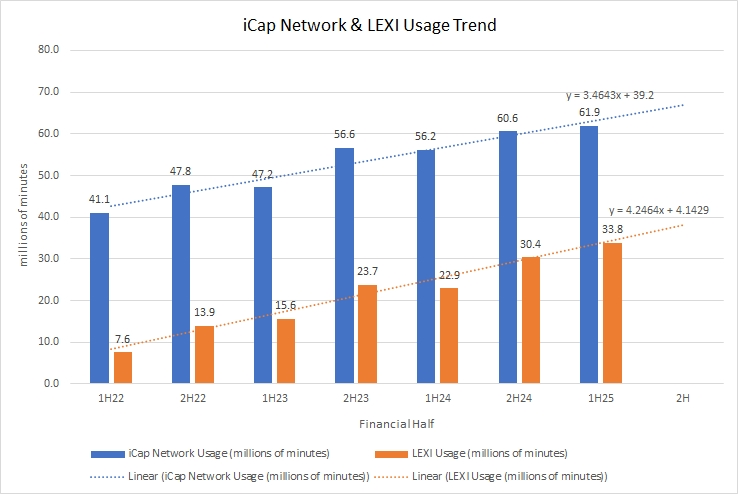

ICAP NETWORK AND LEXI USAGE ARE FIRING

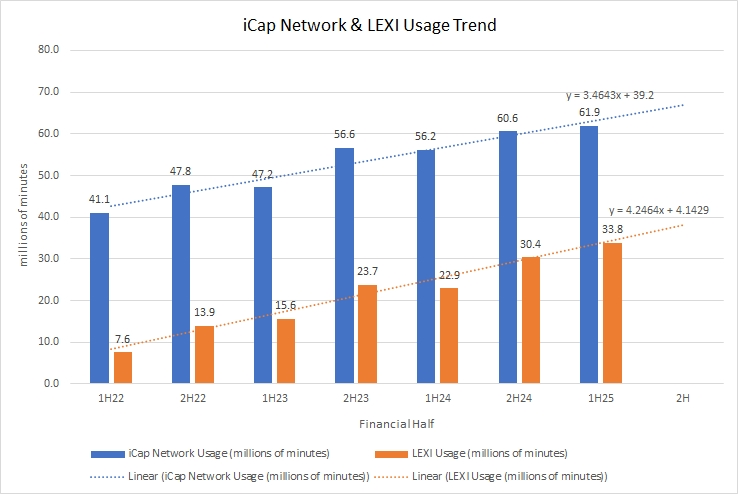

Firstly, I plotted the iCap Network and Lexi Usage Trend slides from both the 1HFY25 and FY24 slide packs into a graph so that I can get a continuous HoH view (both the original slides only show pcp, which only tells half the story)

- I like what I am seeing in terms of the clear and consistent upward trajectory of both (1) the monetisation of the iCap network and (2) Lexi usage

- Revenue must, almost be definition, grow correspondingly over time - which is why upfront, the shortfall in revenue did not quite make sense

- It is clear that Tony considers this trend to be the main leading indicator of how well the business is travelling, the technology uptake etc - similar to C79’s samples processed per quarter chart, this makes sound sense to me

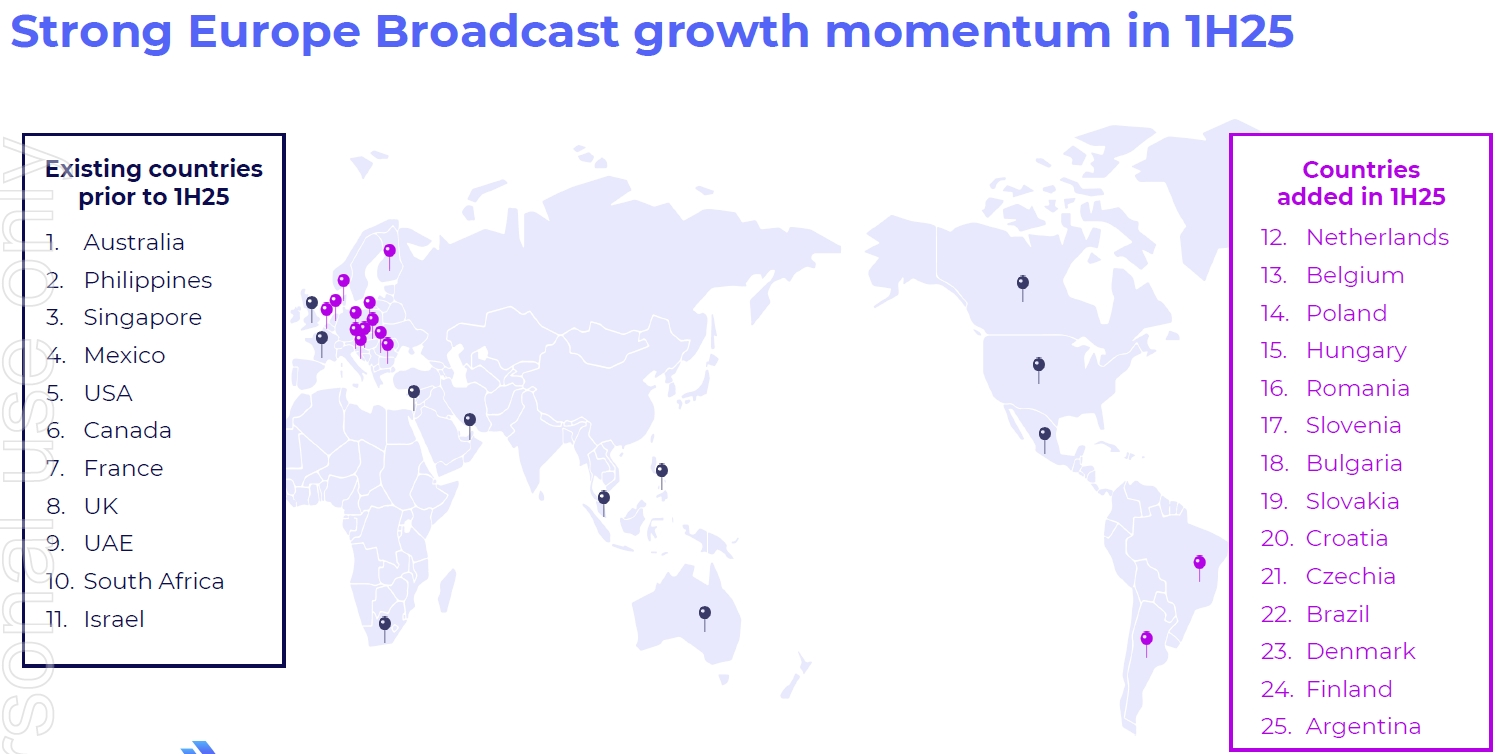

PRODUCT IS READY FOR ASSAULT ON EUROPE BROADCAST

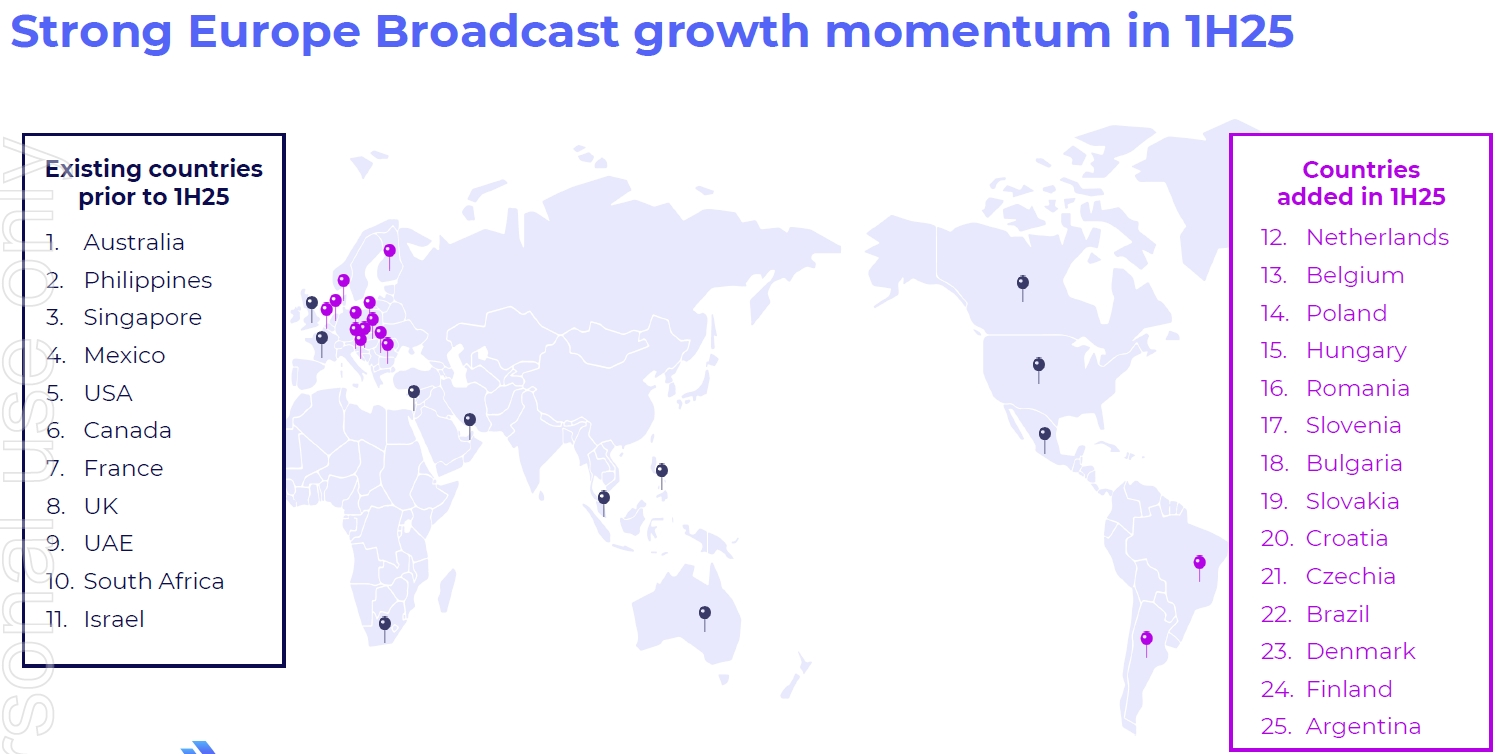

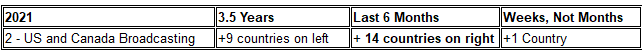

The speed of iCap/Encoder product rollout has significantly accelerated:

This significant solution acceleration is impressive as different orchestration methods between the broadcast playout systems (works completely differently from the US) and different character sets was needed (particularly for the Slavic languages - Poland, Romania, Slovakia, Czechia etc)

- “We are dealing with languages that iCAP and Lexi have never actually had to produce a particular character for before - this work is now done”

European Accessibility Act comes into effect on 28 June 2025 - The Act mandates that a range of products and services such as consumer electronics (TVs, smartphones, computers, gaming consoles, etc.), ticketing and vending machines, websites and mobile acts, among others, comply with accessibility requirements for persons with disabilities

AIM has sold a technology product in each of the 14 countries on the right for the first time in this half

The full focus on opening up Europe has happened/is happening and the ability to extend the iCap and Encoder to new countries in weeks will continue to increase the pace of opening up markets outside of North America

2 NEW PRODUCTS

Lexi Voice is clearly launching 7 April 2025 - big tick

Lexi Brew - I am positively cautious on this - it uses the same iCap/ Encoder architecture/AI, it opens up new revenue streams, and I can see how it will help the Enterprise square, but it felt like it could distract from the immediate focus on the main EMEA game from a technical/product development perspective. Also, this puts AIM down the “AI Play” path, which is not quite how I saw/see AIM. Need to think about this a bit more.

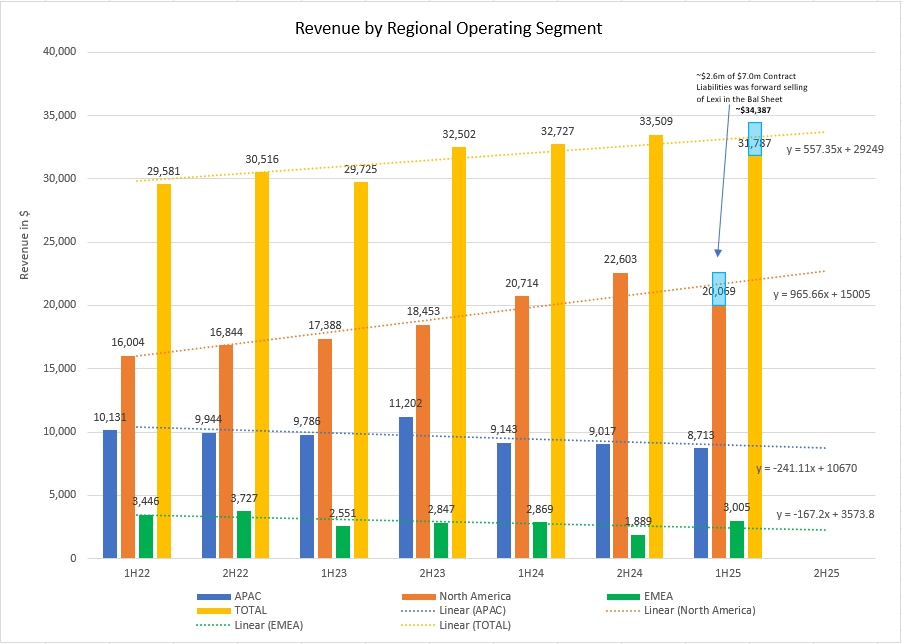

MAKING SENSE OF THE REVENUE SHORTFALL

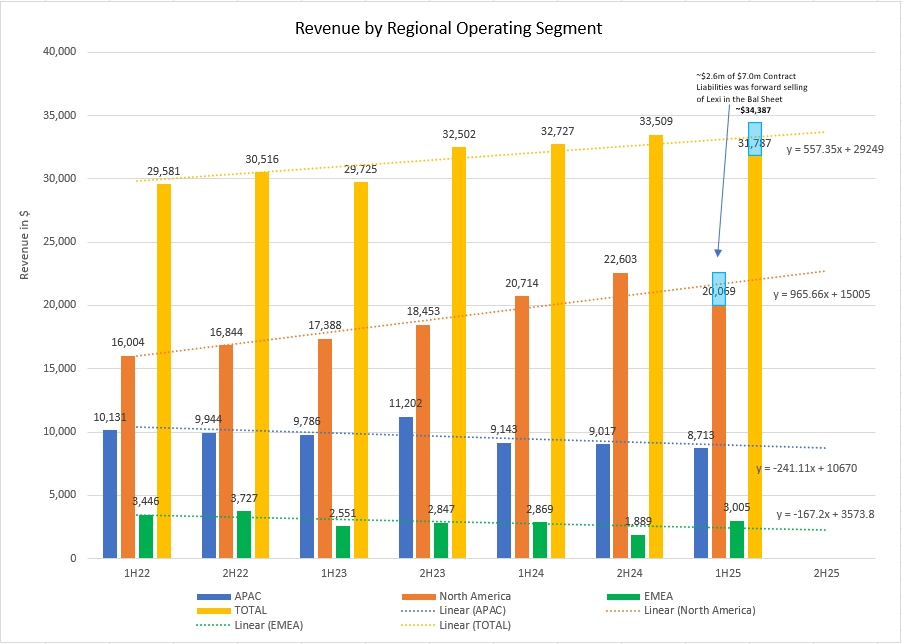

The underwhelming revenue numbers were actually a bit of a worry as this was the first sign of inconsistency in Tony’s narrative. Plotting the revenue by regional operating segments going back to 1HFY2022 post the EEG acquisition, the 1HFY25 revenue shortfall was quite glaring against trend. This really did not make sense if the iCap and Lexi Usage numbers were climbing as they were (per above).

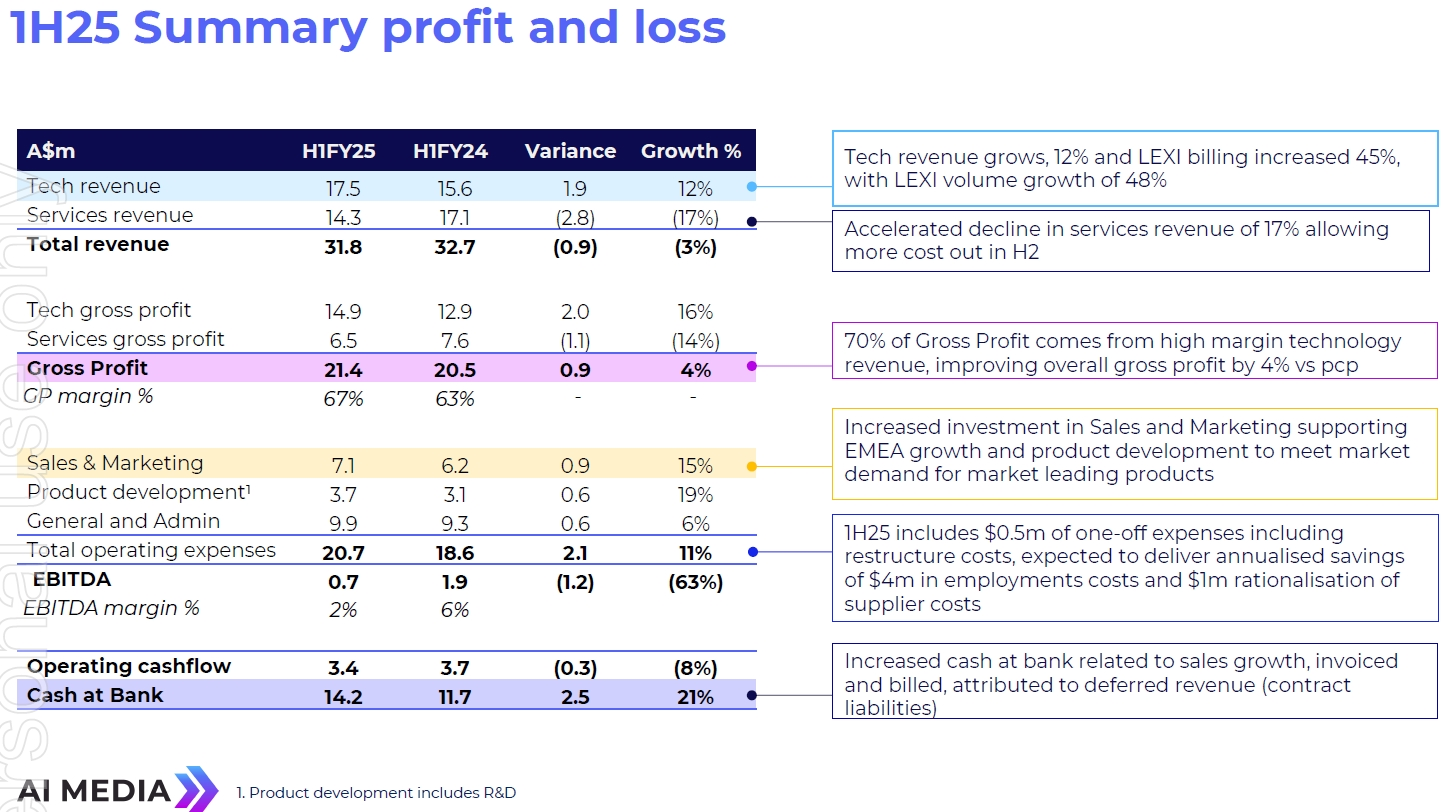

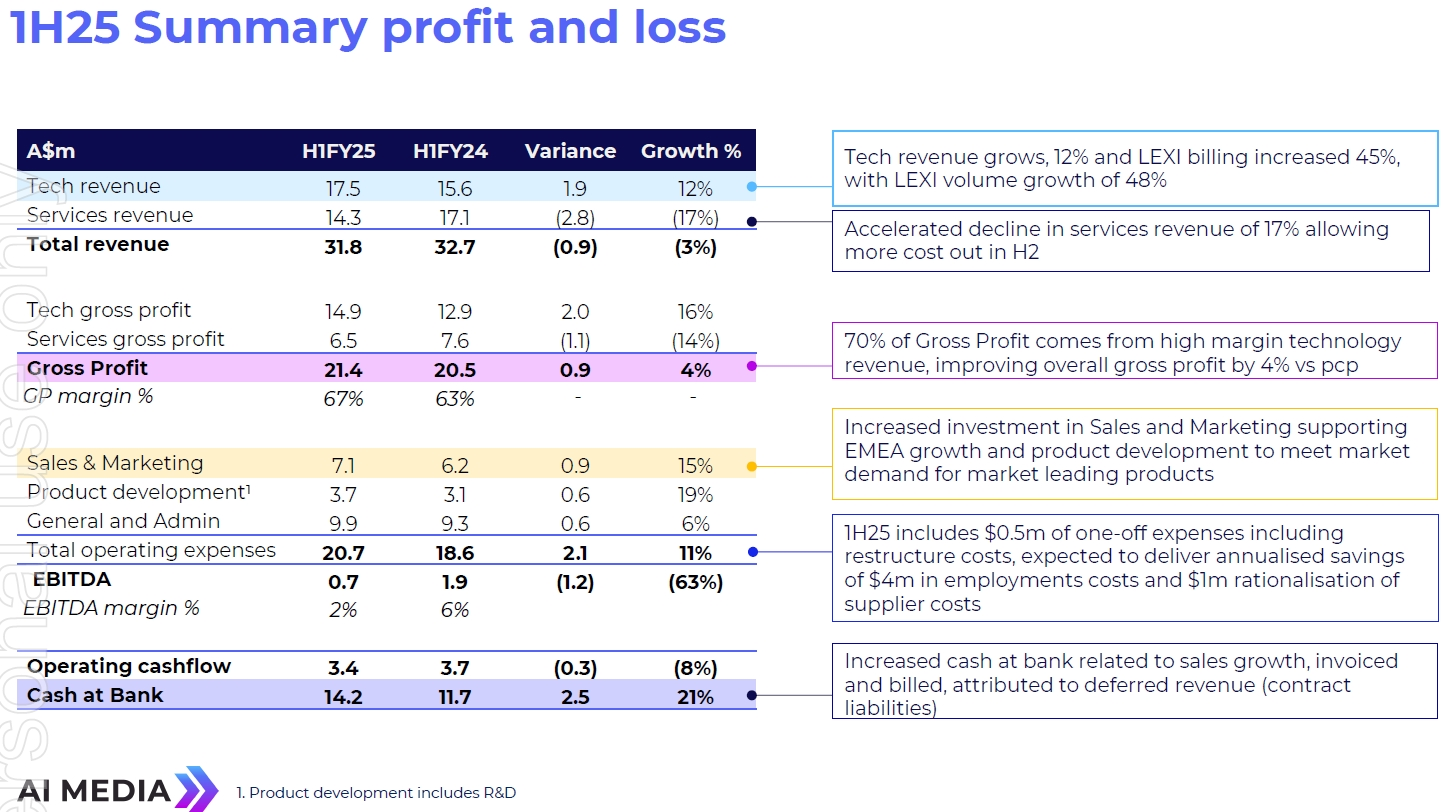

Dinesh made the following comments against the P&L Summary slide:

3% fall in revenue is driven by Services revenue decline, as a business we are trying get out of

Increased billing of Lexi of 45%, sales has increased 45% (this correlated to the growth outlined in the iCap/Lexi usage slide, but can’t see it manifest in the revenue numbers), invoiced the client and collected cash but is sitting as deferred revenue in the balance sheet - reflected in cash flow (this also makes sense)

Transforming into a SAAS business - billing upfront on long-term contracts, and unwinding that over a period of time

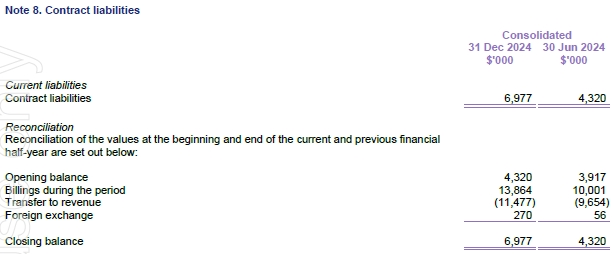

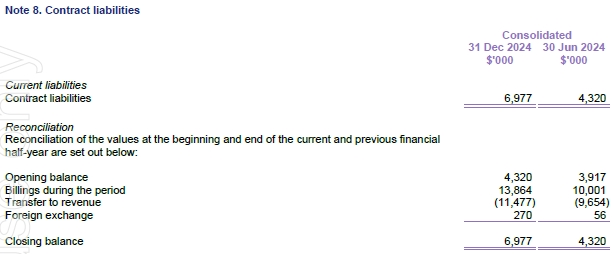

To confirm this, Note 8 in the Appendix D showed a sharp increase in Billings-During-the-Period in 1HFY25 - from $10m to $13.8m, and the closing balance rising sharply from $4.3m to $7.0m - this correlates to what Dinesh said above:

Around 1:39 of the video, Tony made the point that about $2.6 or $2.7m of the $7m Contract Liability balance was Lexi forward sales this period that will be progressively realised in the future and that it was all relating to North America

At 1:41, Tony clarified that the $7.0m of Contract Liabilities in the balance sheet all relate to Lexi forward sales ($4.3m of which were prior period forward sales which presumably still cannot be recognised this period)

I thus added ~$2.6m to the revenue chart against North America and Total Revenue - the blue bar, meaning that if AIM COULD recognise 100% of the Lexi revenue already invoiced and collected for upfront, it would seem that the revenue for 1HFY25 appears to run higher than the run rate of the actual trend line

Tony and Dinesh explained at length that AIM was transitioning from upfront recognition of revenue to periodic recognition of subscription revenue and that during this transition period, the revenue numbers will bounce around. The focus should be on Lexi usage and Lexi revenue growth as that is the true indicator of future revenue and the success of the business - from an accounting perspective, this commentary makes sense.

The challenge that AIM has is that it is not explaining this very well in terms of actual revenue sold, but recognised in this period vs the next etc - Alcidion is a good example of where they are clear with every contract signed, the TCV and the amount of the TCV that is recognised in the current period. HSN also had the same problem in 1HFY25 with lumpy periodic licensing sales in 1HFY24 distorting the 1HFY25 numbers and comparisons.

Tony’s frustration on this front is clearly evident. Telling the market to “ignore the revenue numbers and focus on iCap/Lexi sales/revenue” is not the answer though. Tony and Dinesh need to find a better way to disaggregate the Technology revenue, provide visibility of the forward sales which cannot be recognised and clearly state Lexi-related sales revenue, so that the market can then work backwards and reconcile the “true” revenue position, during this messy transition period.

The combination of (1) 45% growth in Lexi sales that has actually been invoiced and collected (2) the insight on Contract Liabilities (3) the transition from upfront revenue recognition to SAAS revenue recognition gives me confidence that the revenue shortfall is merely an accounting treatment transition issue.

OTHER TAKEAWAYS

Operating cash flow positive of $3.3m again, following slight ($0.1m) negative in 2HFY24 - contributed to a healthy cash balance of $14.1m

Key cyber security accreditations that AIM is focused on is SOC II Implementation and ISO27001, against the new Lexi platform - these are painful implementation and input processes, but once obtained, will address a significant amount of customer concerns around security

QUESTIONS TO ASK TONY

- Would like to unpack “Encoders” in the ecosystem slide - there is mention of Falcon, Alta and Encoder Pro, then “Alta everywhere” - I have thought about the encoders as an EEG box, period ...

- Can he and Dinesh please find a way to clearly disclose Lexi Sales booked and recognised/not recognised as a disclosure item to prevent unnecessary confusion around the revenue numbers.

- Lexi Brew - how and why this can be done in parallel without distracting the big focus on EMEA, what is the competition like

SUMMARY

Having worked through the concern areas, my conviction remains intact. With the current market volatility, will look to top up if the price dips below $0.65, the close to $0.60, the better