Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Discl: Held IRL 4.56% and in SM

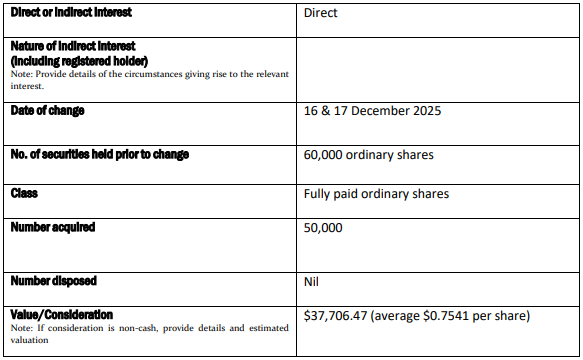

Very nice to see Brad Bender, one of the 2 high-profile-ish US-based directors AIM appointed in Oct 2024, top up his shareholding of AIM by ~83%. He added 50,000 shares to his initial 60,000 holdings from Dec 2024.

The value of $37.8k is small coin in USD, but better to see him buying than not.

Discl: Held IRL 5.16% and in SM

This came from AIM Investor Relations via email as I signed up to the AIM Investor Hub.

The spread of AIM information is a bit inconsistent right now. This email came direct. There is no announcement of this on the ASX nor on the Investor Hub itself. Tony has not posted on Linked In, but I expect him to do so shortly.

Looks like @Strawman and Tony are becoming/are best buddies!

Product & Market Webinar

Join CEO Tony Abrahams and CFO Jason Singh as they provide an overview of the Company’s current product suite alongside consolidated feedback from recent executive visits to Europe and the USA. The Company will outline how this international market feedback aligns with its existing strategy and product roadmap priorities.

The webinar will be moderated by Strawman's Andrew Page and investors are encouraged to ask questions on AIM's growth strategy and geographic expansion.

Webinar Details are as follows:

- Event: AI-Media Product & Market Update Webinar

- Date / Time: Wednesday 3 December 2025, 10AM (AEDT)

- Registration link: https://investorrelations.ai-media.tv/webinars/drLvQy-product-and-market-fit-webinar-dec-2025

The Company notes that this webinar is not a trading update. No financial performance, outlook, or guidance information will be provided, and questions will be strictly limited to product and market topics.

Ongoing demonstration of the growing momentum behind our LEXI AI captioning and translation platform

From planetariums to global media summits, broadcasters to local government, organisations worldwide are choosing AI-Media to deliver real-time accessibility and multilingual engagement, affordably, reliably, and at scale.

Recent wins highlight the versatility of our end-to-end ecosystem and why customers continue to displace legacy human-only solutions with AI-Media.

Scitech (Western Australia) – Making Live Science Truly Inclusive

Scitech, Australia’s leading hands-on science center with 300,000 visitors annually, faced a classic “impossible” captioning challenge: unscripted, fast-paced shows featuring complex astronomical terms inside a dome planetarium.

The Solution:

- LEXI Viewer deployed across the Planetarium, Chevron Science Theatre, and a fully portable mobile trolley for outreach events.

- Real-time AI captions handled terms like “Zubenelgenubi” and “Alpha Centauri” with ease.

Outcome:

What was once considered impossible is now seamless. Deaf and hard-of-hearing staff and visitors have praised the accuracy and responsiveness. Scitech is now more accessible than ever before.

“I’m impressed at how accurate and easy to use the LEXI Viewer is. This is a great step for making our venue more accessible.” – Leon, Planetarium Lead, Scitech

APOS 2025 (Bali) – Asia’s Premier Media & Entertainment Summit Goes Fully Multilingual

For the second consecutive year, Media Partners Asia selected AI-Media as the exclusive live captioning and translation partner for APOS – the region’s most influential media, telecom, and entertainment summit.

Solution:

- Large-screen English captions in the main hall

- Real-time translations into Korean, Vietnamese, Chinese, Thai, and Japanese delivered via the APOS app

- LEXI Voice AI dubbing streamed to foyer spaces and headsets

- Captioned live interviews broadcast from our on-site booth

Outcome:

550 delegates and 80+ global speakers experienced a completely inclusive, tech-forward event.

“AI-Media’s live captioning solution added a vital layer of clarity and inclusion… The live translation… further amplified access and engagement across APOS.” – Lavina Bhojwani, VP & GM, Media Partners Asia

Want to hear more about recent activity?

Discl: Held IRL 4.84% and in SM

The AIM chart is looking very interesting from a top-up perspective.

- Fell right through the 74.5c to 80c level which I thought would be decent support

- 72c is the 50% retracement level - “usually” a decent place to top up

- But better support could come at ~68c which is looking to be at the confluence of (1) support from the 1 year + uptrend line (2) the 200 Simple Moving Average and (3) ~60% retracement

- Failing which, there should be decent support at 61.5c to 65.5c

I suspect I will start nibbling at around 68c at this stage ...

Discl: Held IRL 5.23%, and in SM

Just watched a Tony Abrahams interview on MediaTechTalk released a day ago.

As with all Tony interviews, 95% of the story is familiar, but I still end up walking away engaged throughout the interview, and with some new nuggets of information that I find valuable in further entrenching my already-high conviction:

He ended the session with this quote from the late Leonne Jackson, AIM co-founder:

Accessibility benefits everyone - access to communication should never be a privilege - that conviction is in every product that we ship today.

This point alone resonated with me as this is what David Gardner talks about in the 4th Habit of a Rule Breaker Investor - Follow the Four Tenets of Conscious Capitalism where the 1s tenet is “Invest in companies who put purpose over profit and the Snap Test (would anyone notice or anyone care if the company disappears overnight)”. I think I just found clarity in AIM’s purpose and Snap Test ....

Other Points:

- 86% of 18-24 year olds watch everything with captions - this emphasises the necessity of the AIM product. I absolutely see this in my 17 year old daughter (I can’t stand the captions!)

- Aust had Disability Legislation mandating captioning in 2000, which gave rise to AIM, Europe passed the European Accessibility Act legislation in June 2026, AIM now does not have the same growth constraint that it had with re-speakers, to meet this European legislative-driven demand

- Emphasised the deep integration to each customers media-management systems to provide the customer-centric context for the captioning and translations - this was built during the re-speaker period

- Spent ~$40m to build the technology between 2010 and 2020 - always knew that AI would appear, but did not know WHEN that would happen - the re-speakers were an intermediary solution

- This is another key attribute that I like in my companies - investing to build the capability to scale up ahead of time, so that the technology stack readiness to scale is not a hindrance, there is no catch up, it is execution

- CAT did the same thing when Will Lopes came onboard, as did SDR during Covid

- We are not re-building any core technology that is out there - we are reapplying that technology to B2B workflows in a live environment - this is really worth re-emphasising with respect to competition

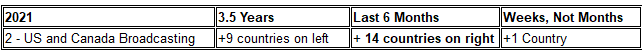

- Growth of EEG encoder country’s - took 18M to get the 1st country outside of the US to work, 6M to the second country working, 4 years later in 39 countries - core broadcasting standard differences that needed to be overcome between the US and the Rest of the World

- US Broadcasters are coming to AIM - spending 4x more than what they were spending 4 years ago, but saving $3-$5m per year from eliminating humans in the loop, every other country, need to knock on doors

Discl: Held IRL and in SM

Looks like Tony's hard sell on the AIM results to the market is paying off ... not sure what drove the 12.4% pop today, but a few things to note from the charts:

- It hit the 52 week high today at 0.95 - it was last here in Dec 2024

- Always nice to see a pop on decent volume - today's volume looks really good

Zooming out, the price is now firmly in the 90.5c to 99.0c zone - lots of history in this zone going back to 2021/2022, which it will have to digest before moving higher.

I do expect it to churn around at these levels for a bit.

But thats one hell of a journey in these 4-5 years-ish - went to hell, literally, it looks like it is moving towards the Heavens now ...

Discl: Held IRL and in SM

Another Tony Linked-In post from 3 weeks ago that popped up in my feed.

My takeaways:

- It reinforces that LEXI Voice is NOT competing with hyperscalers as they improve the accessability to personal language translation technology.

- "Consumer “magic.” Enterprise scale. Same story, different stage." - a nice summary

- Our Tony is watching all things translation like a hawk and comments on these developments to correctly position the development against AIM - I have no quarrels with this.

Disc: Held IRL and in SM

Attended the AIM AGM this morning. Only picked up a few newish data points from the otherwise non-event AGM this morning. Nothing to not like from my perspective.

SUNSETING OF HUMAN SERVICES

- 3 remaining customers to transition from humans to AI - UK Parliament in Oct, then Channel 9 and Channel 7 by Dec 2025, fully completing the sunseting of old legacy translation services

- New professional/consulting services will commence 1 Jan 2026, to comprise 20% of revenue going forward - customers have requested for this to help leverage the benefits from AIM technology stack - this was a nice, simple summary to end confusion around this topic, as it should have been from the start

FUTURE SALES MODEL

- Pivot to indirect sales model to enable global scaling - this is an area I would like to better understand when we get a chance to chat with Tony again as this is going to be the key distribution model going forward

FIRST PAID LEXI VOICE CUSTOMER

Similar to Playbox Neo deal, this deal shows a few of the strategic levers that Tony talks about, in play:

- Channel Partner driven, with the Partner having opportunities in the other municipalities

- 1 of 45,000 municipalities in the US

- A win in the Government/AMER quadrant in the 9 squares model

MONITORING OF AIM SERVICES

AIM has a strong focus on collecting and monitoring of operational data on translation accuracy, latency etc - while needed for auditing etc, from an investors perspective, it gives me confidence that the operational stats that AIM presents will be factual and hence, can be relied upon

COMPETITORS

Translation Technology:

- Hyper scalers who will build and deliver themselves, GoogleMeet, MS Teams, Apple Airpods etc - these are AIM’s product competitors but they are all delivered Direct to Consumer on their devices

- AIM does this translation in an open live environment, doing the translation at source to broadcast with quality control to everyone

Human Translation Competitors:

- Other competitors are the actual human translating competitors

Encoder Competitors

- Largest competitor of encoders - Enco, 20% market vs 80% AIM,

- City of Rialto unplugged Enco to plug in AIM

Not yet seen anyone who has done the orchestration, Live thus far

TONY’S LTIP

Carried with no conversation

THE DEMO

- The Lexi Voice to translate live English to Spanish speech was demonstrated - this was to show the maturity of Lexi Voice in western languages

- Then 2 AIM employees spoke Mandarin and Hindi, respectively - Lexi Text was picking up and displaying the speech into Mandarin and Hindi text almost real time. But speech translation lagged, almost on a paragraph basis. Tony said that while accuracy was to standard, the latency of the voice translation was not - this was what they were focused on addressing in FY26

I thought the Lexi Voice to Spanish was a bit of a non-event as I am a believer that it works, and it worked well.

Having done enough live demo’s myself, the choice of Mandarin and Hindi was rather bold, I thought, as the Voice translation clearly lagged. But I appreciated that boldness and openness to publicly admin it is not yet good enough and in a perverse sense, added to my confidence that they will find a way to get it down to the right level of latency. It does feel like Tony is setting the scene up for something in the Asian-language space for later with the choice of these demo’s .... time will tell what exactly!

Discl: Held IRL and in SM

There is good value monitoring Tony Abrahams' Linked In as his announcements platform.

I can't confess to clearly understand what Playbox Neo is, even after my buddy Chat spat out the info below.

While there is no indication of deal size, I think it is a really good real example of AIM's value proposition, moat, combo of Text + Recorded + Voice product strategy, sticky SAAS revenue, European regulatory tailwind, all playing out in this single deal:

- AIM technical stack inside the PlayboxNeo technical stack - assuming PlayboxNeo feeds content to those ~20,000 channels live/recorded, AIM is plugged into that direct pipe, this could well be a moat inside a moat setup - very nice!

- Combo of Lexi Text, Recorded and Voice - the holy trinity of translation!

- New logo Europe customer with 23 human employees in 2023 who just added a no-human technical service to be European regulatory compliant

- 20,000 channels globally , 120 country reach - presents a really good upselling opportunity when AIM adds more countries to its capability - technically, they should be able to turn on each country as soon as AIM is country-ready

- Which translates into Lexi Network minutes + Lexi Text + Lexi Recorded + Lexi Voice minutes.

PLAYBOX NEO DEAL

A new deal with PlayBox Neo was announced 2 days ago.

Key components included:

- ALTA 2110 IP Encoder – Supports SMPTE ST 2110 workflows, delivering same-language and translated captions with ultra-low latency.

- LEXI Text – Automated captions with broadcast-grade accuracy, powered by AI-Media’s Topic Models for speaker names, technical terminology, and brand-specific language.

- LEXI Recorded – Pre-recorded captions produced in less than half the program runtime.

- LEXI Voice – Real-time multilingual voice translation for live and on-demand content, extending reach globally.

WHO/WHAT IS PLAYBOX NEO

Products & Services

- PlayBox Neo is a company that builds broadcast / media-playout / playout automation / channel branding and streaming solutions. Key offerings include:

- Channel-in-a-Box systems, which integrate several functions needed to run a channel: playout automation (AirBox Neo), live ingest (Capture Suite), scheduling (ListBox), graphics (TitleBox Neo), etc.

- Cloud2TV: a cloud-based virtual playout / cloud playout solution enabling remote operations / flexibility

- Media Gateway: for routing, encoding & decoding, especially in IP / hybrid SDI-IP workflows

- Capture Suite: for live ingest / content acquisition.

- TitleBox Neo / graphics solutions: for interactive graphics, channel branding, overlay, etc.

- Support services: 24/7 customer support, technical maintenance, software upgrades (ASM&TS – Annual Software Maintenance & Technical Support) etc

They provide solutions in hardware, but also software, and as “hardware or as a service” / cloud models.

They serve a broad set of types of TV/branding/plublic/OTT channels: free-to-air, FAST, local channels, corporate channels, satellite, etc.

Customers/channels/reach

They report powering over 20,000 TV and branding channels worldwide.

The geographic reach is “over 120 countries”.

So their “customer base” is fairly large in terms of channel deployments, though the exact number of unique customers (companies) is much lower.

Revenue

This is where public information is more limited. I found some clues, but no reliably confirmed figure for total annual revenue.

- The company has said it had a “record year with increased revenue growth” as of 2024.

- It is described in various sources (e.g. Tracxn) as an unfunded company, meaning it has not raised external investment.

- The number of employees: about 27 employees in 2023 (according to EMIS for the Bulgarian entity).

- Company is based in Sofia, Bulgaria.

Discl: Held IRL and in SM

The AIM price feels like it is really in a good spot today in that it is “somewhat behaving”, chart-wise.

Bit more volume(at least through the ASX, Chi-X is another story altogether - see other thread on this) as the price tries to push through the 61.5c to 65.5c resistance area. The last time it pushed through was in mid-July 2025, but failed to stay above it, then the results kicked in. As “expected”, the price hit resistance at the 200 SMA line - almost smack bang on the line today.

So, the combo of the 200 SMA and the 61.5c resistance area is a short term hurdle to cross - does not feel like it will cross both today, but hell, it looks like it is trying, as it did last Thurs as well.

We also know some Directors are selling, possibly selling hard. The market seems to have absorbed that selling pressure quite nicely since the results. Tony looks to have done a good job with the fundie road show because whatever the Directors give, the pumped up fundies appear to be taking, it would seem. This absorbing of selling pressure is very reassuring for me as the price is holding strong/pushing upwards, which should mean more believers are jumping onboard.

When the selling eventually abates, and assuming no other drama’s, the price looks to be in a good position to cross and stay above 65.5c, which should be a nice forward base thereafter.

If the selling continues, suspect it will keep moving sideways and bounce between 49c and 61.5c.

My 53.5c top up point on results day looks to be a decent entry point. Still waiting patiently to see if a dip to 49c occurs as I want one more top up bite before it gets out of reach ...

Creating this separate post to take it away from the FY25 results focus.

I listened to the Ausbiz interview which is on the AIM Linked-In page and picked up the following Tony comments that got lost in the FY25 results for me:

LEXI Latency Improvements

- LEXI Text LIVE - the improvement in the last 12 months has gone from "5 to 8 seconds response from a human captioner" to "3 secs minus the human"

- LEXI Voice - the improvement in the last 12M has gone from "30 seconds" to "8 seconds minus the human", Tony believes it can go down to 3 seconds in the next 12-18 months

- Takes speech in original language and translates into text in original language

- Translates original language text to new language text

- Renders new language text to speech in new language

- "This reflects the improvement in the underlying AI engines. AIM essentially plugs in and embeds the latest & greatest AI tools into the customers workflow"

While I seem to have heard these comments in the various preso's Tony has done, I did pause for a bit and went "Wow". That quantum of technology improvement is very impressive, particularly when you breakdown the actual steps as to how LEXI Voice actually works.

Which brings to the following points worth repeating that I think the market is not fully clear about, amidst anything and everything mumbled in the name of AI.

- AIM is not competing in the AI space at all.

- It is a "bring-it-on-gimme-more-AI" CUSTOMER and CONSUMER of AI technology.

- The faster and greater the technology advancements are in AI -> the faster AIM can bake these into the AIM tech stack -> the better the latency improvement -> the more efficient LEXI will be -> the more attractive the LEXI economics become

- I should cheer AI translation improvements, not fear them at all

Whatever your thoughts are on Tony, the one thing that impresses me is his ability to stay very consistently on message.

Where he needs to improve is when the story changes/transitions requiring better explanation - I use "explanation" deliberately vs a more negative connotating "transparency".

Where I myself need to improve is to listen more carefully to what he is saying, to catch and interpret that transition, rather than be caught up in the headlines - this is the only thing within my control ...

Discl: Held IRL and in SM

Have finally worked through the AIM 1HFY25 video and releases. My immediate reaction on reading the releases back then was one of uncertainty as the financial numbers did not line up with the positivity from Tony. Unpacking the content took time, but it was well worth the effort as I feel significantly more educated on AIM as a company and I remain 100% onboard.

Discl: Held IRL and in SM

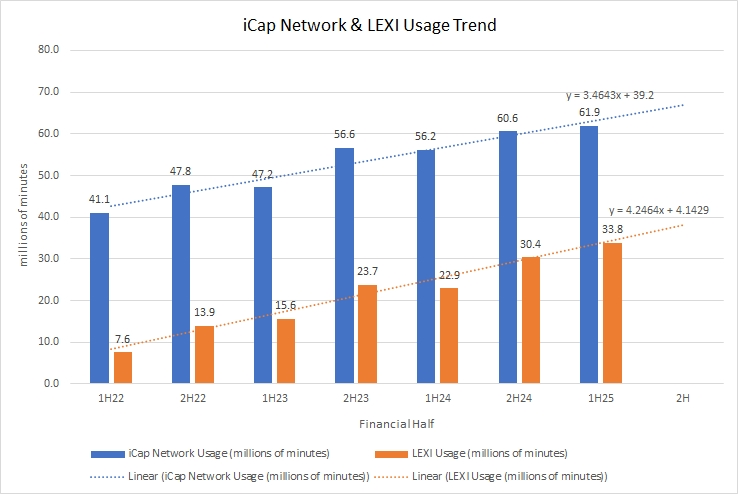

ICAP NETWORK AND LEXI USAGE ARE FIRING

Firstly, I plotted the iCap Network and Lexi Usage Trend slides from both the 1HFY25 and FY24 slide packs into a graph so that I can get a continuous HoH view (both the original slides only show pcp, which only tells half the story)

- I like what I am seeing in terms of the clear and consistent upward trajectory of both (1) the monetisation of the iCap network and (2) Lexi usage

- Revenue must, almost be definition, grow correspondingly over time - which is why upfront, the shortfall in revenue did not quite make sense

- It is clear that Tony considers this trend to be the main leading indicator of how well the business is travelling, the technology uptake etc - similar to C79’s samples processed per quarter chart, this makes sound sense to me

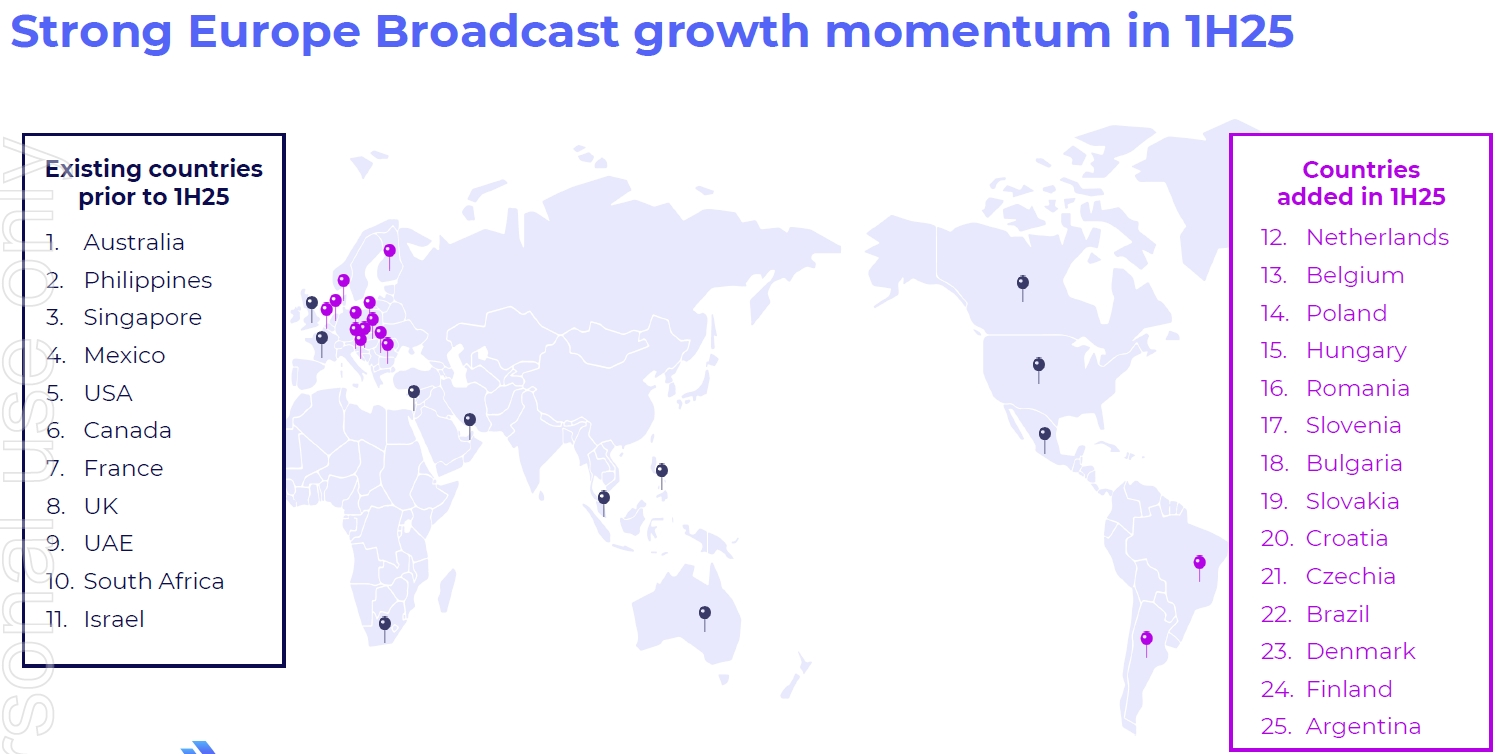

PRODUCT IS READY FOR ASSAULT ON EUROPE BROADCAST

The speed of iCap/Encoder product rollout has significantly accelerated:

This significant solution acceleration is impressive as different orchestration methods between the broadcast playout systems (works completely differently from the US) and different character sets was needed (particularly for the Slavic languages - Poland, Romania, Slovakia, Czechia etc)

- “We are dealing with languages that iCAP and Lexi have never actually had to produce a particular character for before - this work is now done”

European Accessibility Act comes into effect on 28 June 2025 - The Act mandates that a range of products and services such as consumer electronics (TVs, smartphones, computers, gaming consoles, etc.), ticketing and vending machines, websites and mobile acts, among others, comply with accessibility requirements for persons with disabilities

AIM has sold a technology product in each of the 14 countries on the right for the first time in this half

The full focus on opening up Europe has happened/is happening and the ability to extend the iCap and Encoder to new countries in weeks will continue to increase the pace of opening up markets outside of North America

2 NEW PRODUCTS

Lexi Voice is clearly launching 7 April 2025 - big tick

Lexi Brew - I am positively cautious on this - it uses the same iCap/ Encoder architecture/AI, it opens up new revenue streams, and I can see how it will help the Enterprise square, but it felt like it could distract from the immediate focus on the main EMEA game from a technical/product development perspective. Also, this puts AIM down the “AI Play” path, which is not quite how I saw/see AIM. Need to think about this a bit more.

MAKING SENSE OF THE REVENUE SHORTFALL

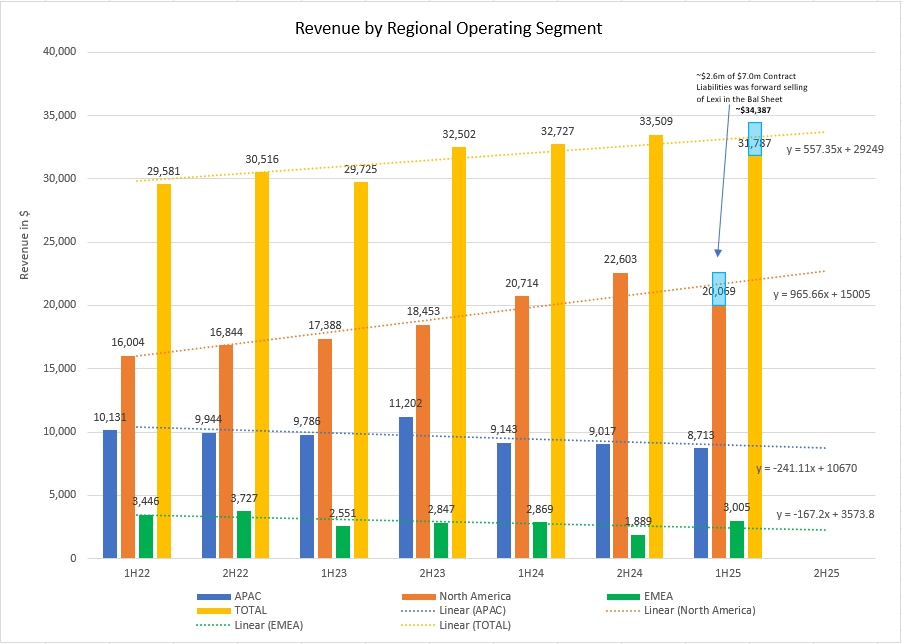

The underwhelming revenue numbers were actually a bit of a worry as this was the first sign of inconsistency in Tony’s narrative. Plotting the revenue by regional operating segments going back to 1HFY2022 post the EEG acquisition, the 1HFY25 revenue shortfall was quite glaring against trend. This really did not make sense if the iCap and Lexi Usage numbers were climbing as they were (per above).

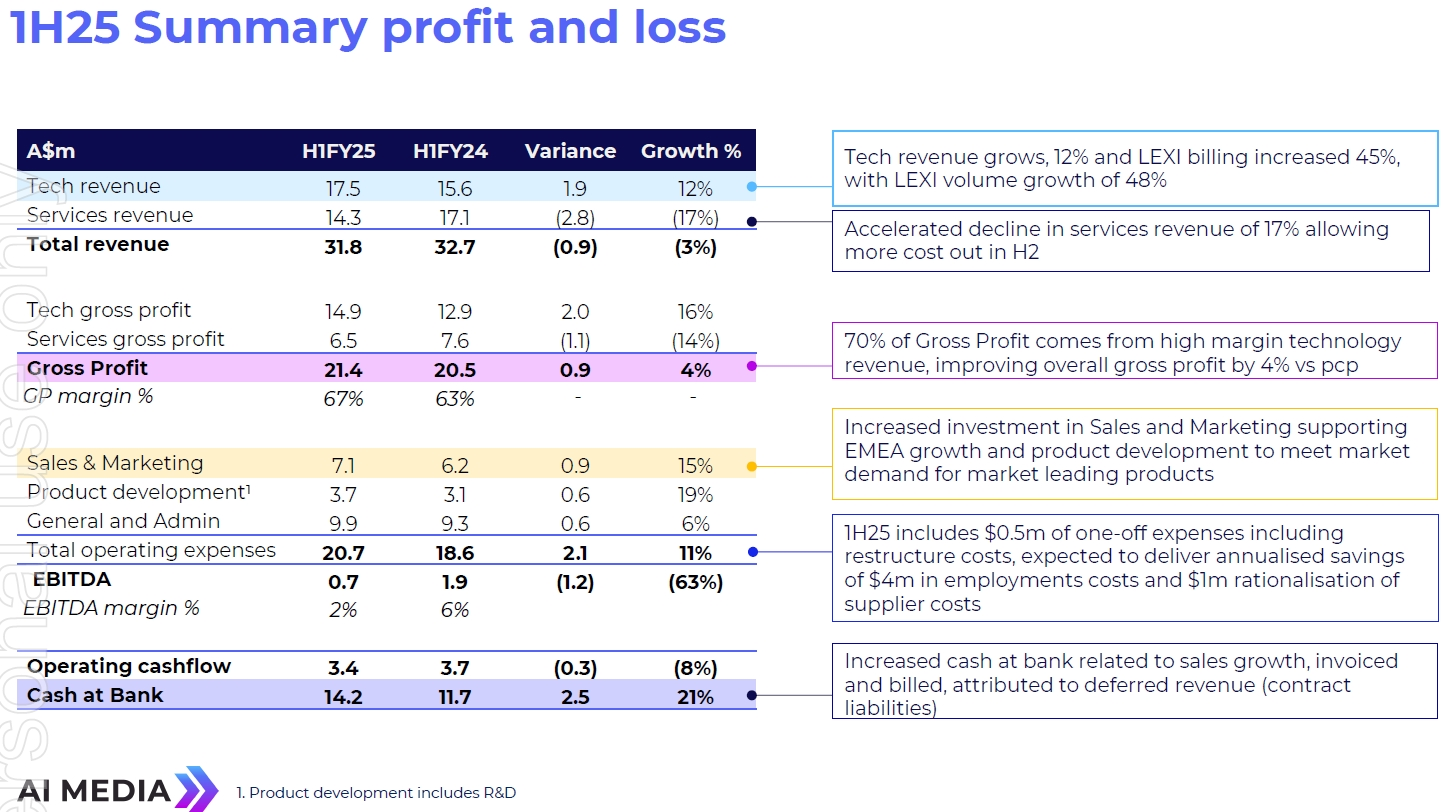

Dinesh made the following comments against the P&L Summary slide:

3% fall in revenue is driven by Services revenue decline, as a business we are trying get out of

Increased billing of Lexi of 45%, sales has increased 45% (this correlated to the growth outlined in the iCap/Lexi usage slide, but can’t see it manifest in the revenue numbers), invoiced the client and collected cash but is sitting as deferred revenue in the balance sheet - reflected in cash flow (this also makes sense)

Transforming into a SAAS business - billing upfront on long-term contracts, and unwinding that over a period of time

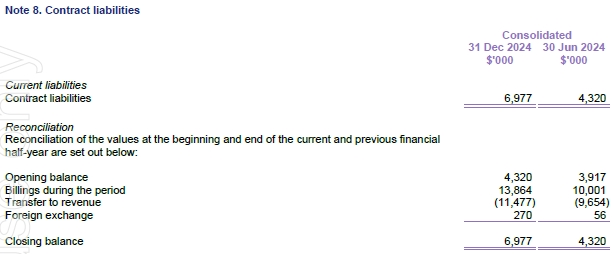

To confirm this, Note 8 in the Appendix D showed a sharp increase in Billings-During-the-Period in 1HFY25 - from $10m to $13.8m, and the closing balance rising sharply from $4.3m to $7.0m - this correlates to what Dinesh said above:

Around 1:39 of the video, Tony made the point that about $2.6 or $2.7m of the $7m Contract Liability balance was Lexi forward sales this period that will be progressively realised in the future and that it was all relating to North America

At 1:41, Tony clarified that the $7.0m of Contract Liabilities in the balance sheet all relate to Lexi forward sales ($4.3m of which were prior period forward sales which presumably still cannot be recognised this period)

I thus added ~$2.6m to the revenue chart against North America and Total Revenue - the blue bar, meaning that if AIM COULD recognise 100% of the Lexi revenue already invoiced and collected for upfront, it would seem that the revenue for 1HFY25 appears to run higher than the run rate of the actual trend line

Tony and Dinesh explained at length that AIM was transitioning from upfront recognition of revenue to periodic recognition of subscription revenue and that during this transition period, the revenue numbers will bounce around. The focus should be on Lexi usage and Lexi revenue growth as that is the true indicator of future revenue and the success of the business - from an accounting perspective, this commentary makes sense.

The challenge that AIM has is that it is not explaining this very well in terms of actual revenue sold, but recognised in this period vs the next etc - Alcidion is a good example of where they are clear with every contract signed, the TCV and the amount of the TCV that is recognised in the current period. HSN also had the same problem in 1HFY25 with lumpy periodic licensing sales in 1HFY24 distorting the 1HFY25 numbers and comparisons.

Tony’s frustration on this front is clearly evident. Telling the market to “ignore the revenue numbers and focus on iCap/Lexi sales/revenue” is not the answer though. Tony and Dinesh need to find a better way to disaggregate the Technology revenue, provide visibility of the forward sales which cannot be recognised and clearly state Lexi-related sales revenue, so that the market can then work backwards and reconcile the “true” revenue position, during this messy transition period.

The combination of (1) 45% growth in Lexi sales that has actually been invoiced and collected (2) the insight on Contract Liabilities (3) the transition from upfront revenue recognition to SAAS revenue recognition gives me confidence that the revenue shortfall is merely an accounting treatment transition issue.

OTHER TAKEAWAYS

Operating cash flow positive of $3.3m again, following slight ($0.1m) negative in 2HFY24 - contributed to a healthy cash balance of $14.1m

Key cyber security accreditations that AIM is focused on is SOC II Implementation and ISO27001, against the new Lexi platform - these are painful implementation and input processes, but once obtained, will address a significant amount of customer concerns around security

QUESTIONS TO ASK TONY

- Would like to unpack “Encoders” in the ecosystem slide - there is mention of Falcon, Alta and Encoder Pro, then “Alta everywhere” - I have thought about the encoders as an EEG box, period ...

- Can he and Dinesh please find a way to clearly disclose Lexi Sales booked and recognised/not recognised as a disclosure item to prevent unnecessary confusion around the revenue numbers.

- Lexi Brew - how and why this can be done in parallel without distracting the big focus on EMEA, what is the competition like

SUMMARY

Having worked through the concern areas, my conviction remains intact. With the current market volatility, will look to top up if the price dips below $0.65, the close to $0.60, the better

Post a valuation or endorse another member's valuation.