24-March-2025: LYL went ex-div today and their share price rose!

The ASX 200 rose 6 points to 7937 (0.1%) in quiet trade ahead of the Budget. The All Ords index fell 0.8% to 8,157.90. Banks were firm. Tariff proof fenced perhaps. CBA up 1.4% and insurers better too, QBE up 0.3%. REITs were a little mixed, GMG down 0.6% and SCG rising 0.6%. RPL was smashed 14.8% on news from OPT that it had missed Phase III end point. RPL owns 32% of OPT. WOW and COL both gave back some of the optimism from Friday’s ACCC report. Tech stocks were under pressure, WTC down 2.9% and 360 falling 4.4%. The All-Tech Index down 0.5%. Retail weaker, with PMV down 2.9%, NCK off 2.0% and MYR down 2.1%. WES rose 1.7%.

Resources were mixed. BHP fell 0.6% with FMG up 3.2% on some broker upgrades. Gold miners were mixed, with VAU down 3.2%, NST off 1.3% and BGL dropping 12.8% on a change in substantial holding from ETF provider Van Eck (9.06% down to 7.59%). There were some positive moves at the small end of the gold sector with NMG, LSA and MDX all rising by between 6% and 7%, and PLC was up +15.38% (shout out to @BkrDzn for his top work on that one shared here recently: Sub 2c Stocks - The Punters Forum - I bought some PLC and NMG recently after doing a bit of digging myself).

MIN bounced 6.9% as the haul road reopened. Oil and gas was flat, coal eased, NHC down 4.4% and WHC off also, and uranium sellers were back with BOE down 3.5% and DYL falling 1.8%. In corporate news, JHX announced a huge US merger and dropped 14.5% on the news. HLI fell 25.6% as CBA said it may not renew its contract. SM1 curdled 12.0% on unimpressive results.

Nothing on the economic front. Asian markets flat. 10-year yields back up to 4.42%.

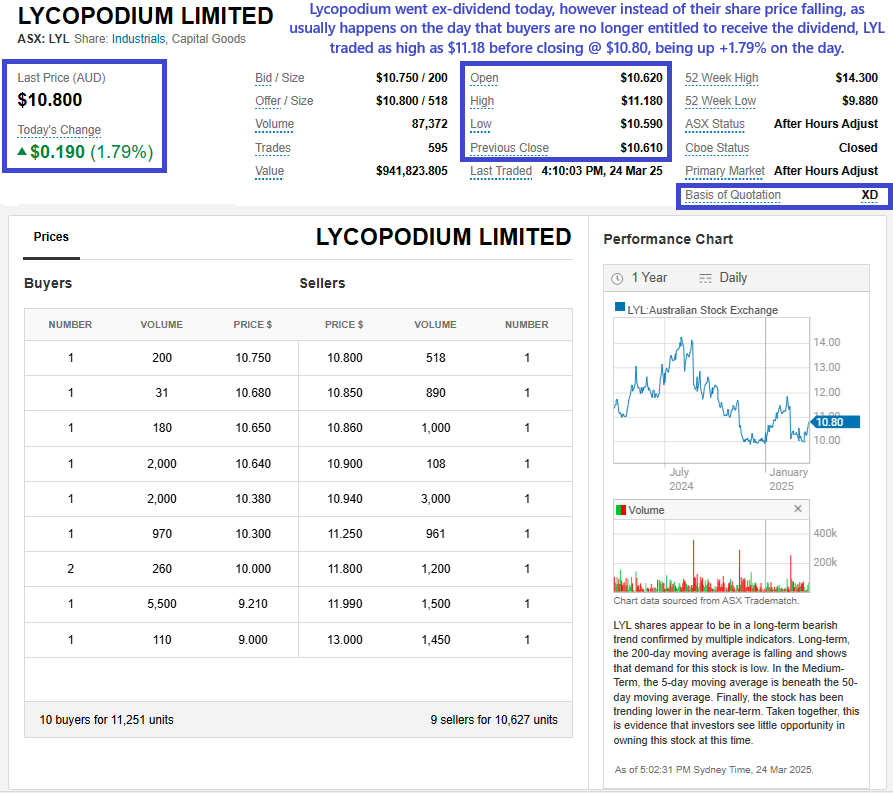

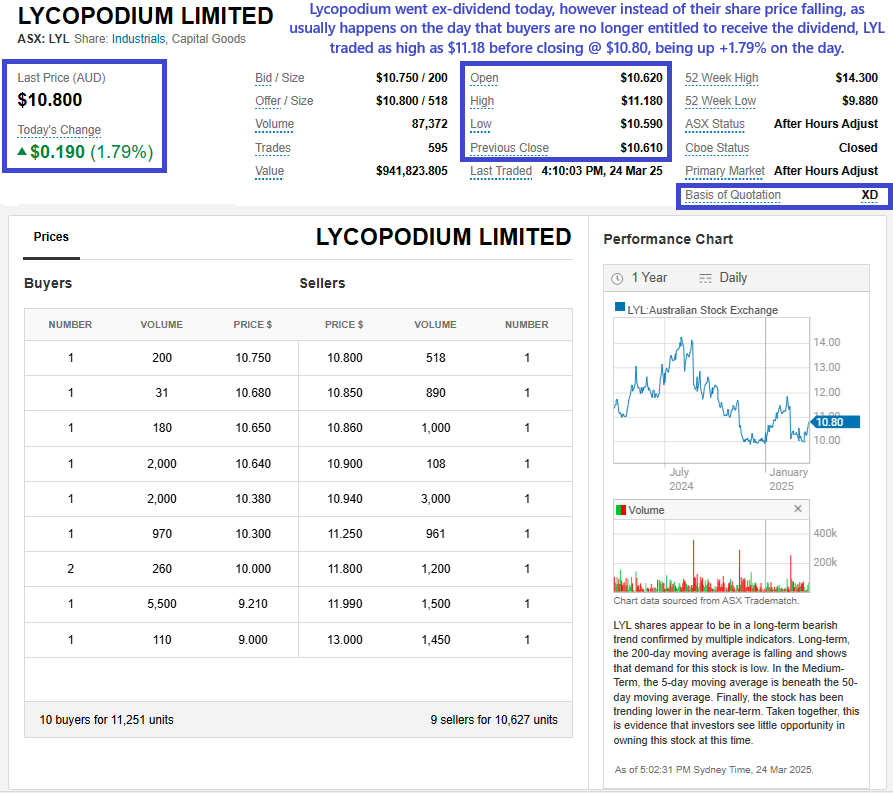

And here's what LYL did:

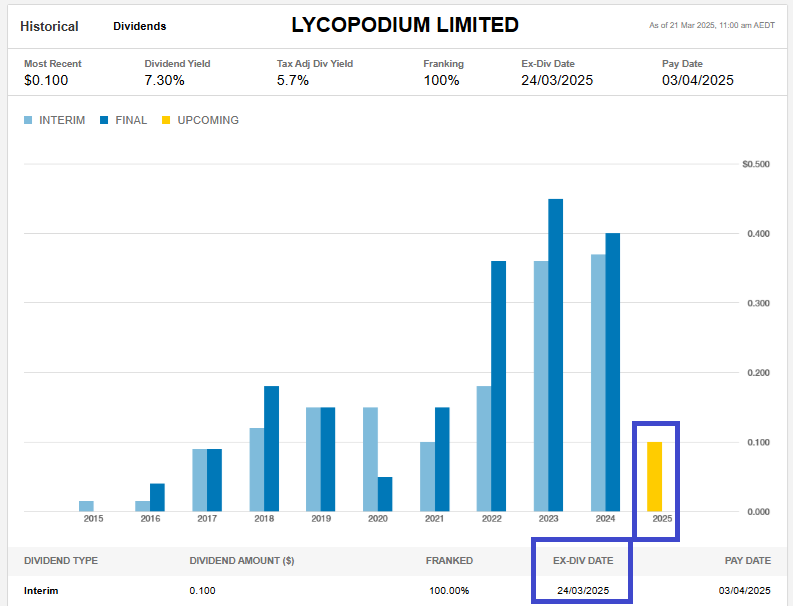

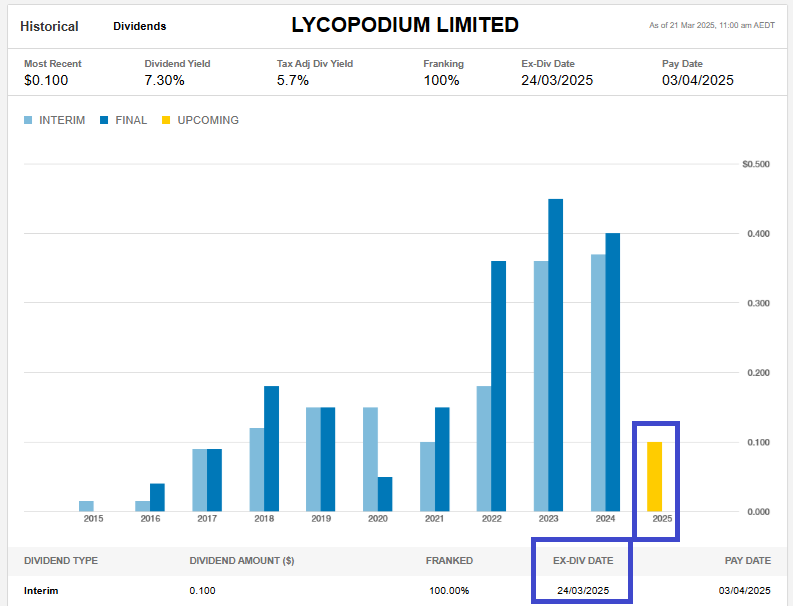

Sure it's a smaller dividend than last year, due to the SAXUM acquisition (60% of), however it's still a little strange that they went up on an ex-div day. As I explained over the weekend, they are a low liquidity microcap, so they can move a fair bit on low volume, but there were 595 trades today, and 87,372 LYL shares changed hands, worth just over $940K, so the volume was decent - for Lycopodium. [Because they're a low liquidity company that trades lightly most of the time]

I have a half-baked theory, which is that some buyers were waiting to see if they did get sold down today as they went ex-div, as is usually the case, coz when a company does drop by more than the grossed up value of the dividend, that can present a good buying area, however that didn't happen, because there were likely no holders left who were in them for the income yield alone (due to that reduced dividend), so the prospective buyers decided to buy anyway.

Maybe...

No matter. Watching. But inactive. I didn't buy or sell anything today, except a tiny SPR top-up here on SM.

Disclosure: Holding LYL. They are my largest position both here and across my real money portfolios.