31-March-2025: Seems to be the day for announcing acquisitions - both SXE and EGL today.

SCEE (SXE): Acquisition-of-Force-Fire-Holdings.PDF

Also: Investor Presentation - Acquisition of Force Fire Holdings.PDF

Last week in his meeting with us, SCEE's CFO Chris Douglass said they are definitely acquisitive and looking to expand their capabilities through further acquisitions. He wasn't fibbing. Obviously they were all set to announce today's acquisition, but Chris couldn't give us any details of that last week (due to ASX continuous disclosure obligations) but he gave us plenty of strong hints.

Acquisition of Force Fire Holdings: Highlights:

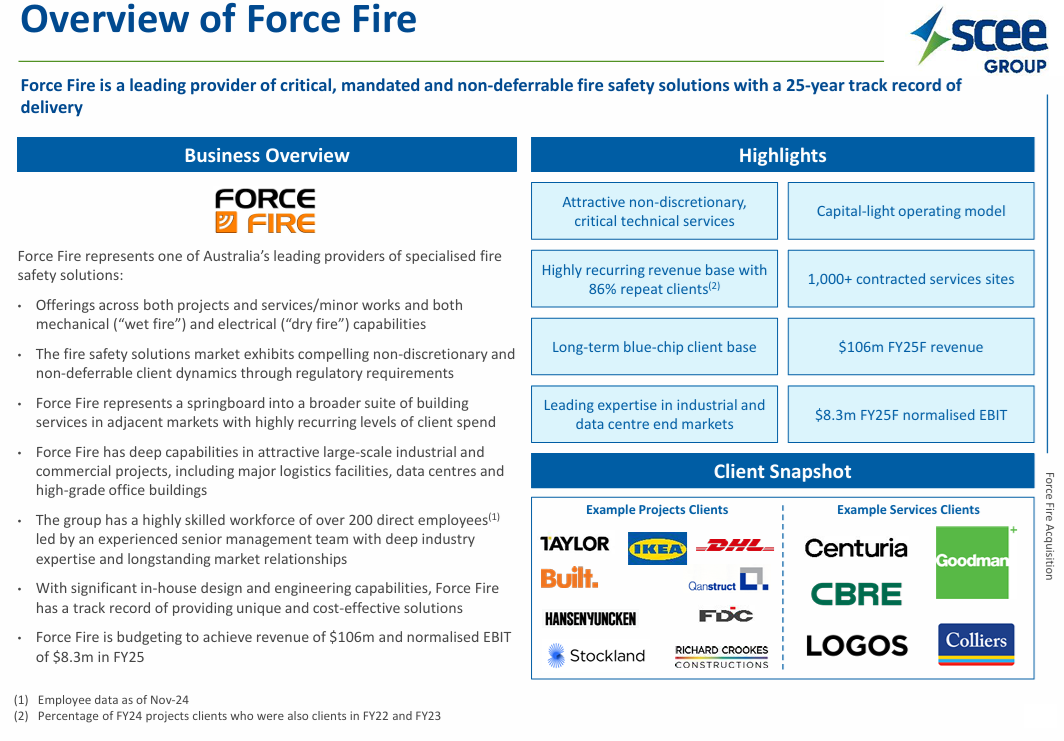

- SCEE to acquire Force Fire Holdings, a leading New South Wales and Queensland based provider of fire safety solutions to the commercial and industrial sectors

- Initial upfront consideration of $36.3m and a total consideration of up to $53.5m for delivering EBIT growth targets in FY26 and FY27

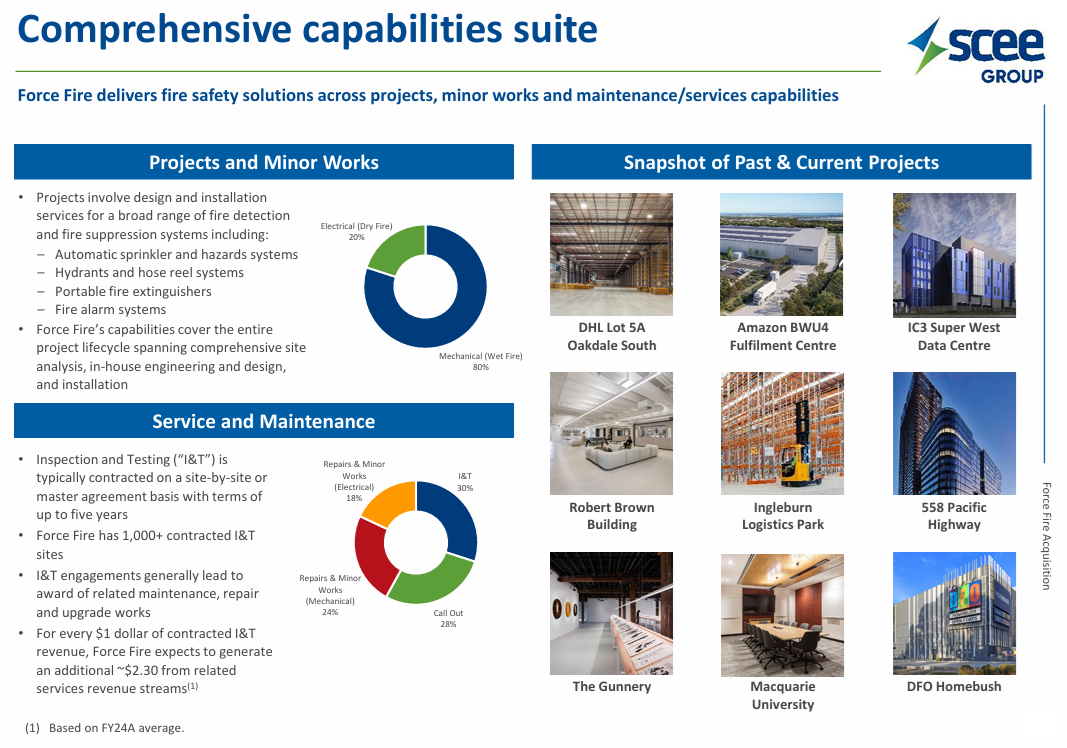

- Fire sector is a natural adjacency to SCEE’s current capabilities

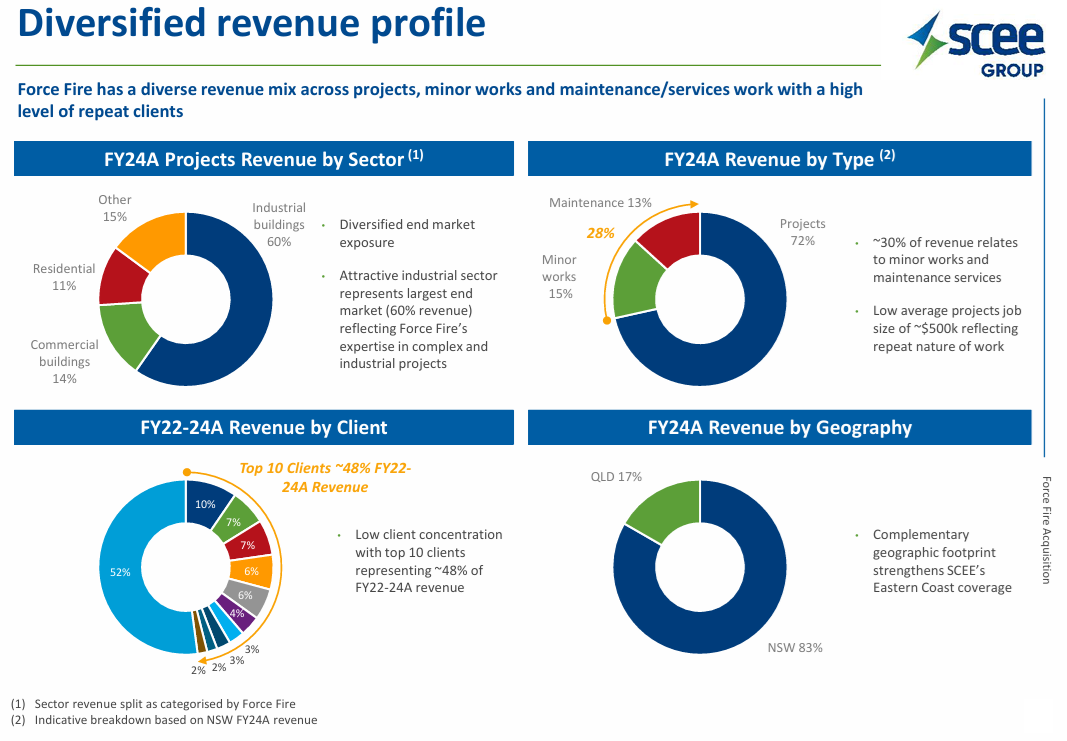

- Further growth in maintenance and recurring style works which account for circa 30% of Force Fire’s revenue

- Transaction to be funded through SCEE’s existing cash reserves

- Forecasting EBIT contribution of at least $10m for FY26 and beyond

Again, like EGL's acquisition of Advanced Boilers and Combustion (also announced today), this acquisition of FFH by SCEE (SXE) is to be paid using their own cash, so no dilution through additional shares being issued or any debt involved. Chris made it clear to us last week that as long as he's their CFO, they would always be in a net cash position. He does not like debt.

In SXE's case they had $100m+ of net cash at December 31, however this acquisition will only use $36.3m of that, with up to $17.2m in deferred consideration to be paid if FFH deliver on EBIT growth targets in the following two financial years.

Chris made it clear last week that SXE run each business unit as a standalone business and they like to keep existing management in place and incentivised to continue to grow that business even after it becomes part of Southern Cross Electrical Engineering (SXE). The terms of this acquisition are certainly consistent with that.

It is also once again a complimentary bolt-on for SXE, expanding further on their capabilities through another adjacent area that also involves electricians, their core business focus.

Remember that Chris said that they look at around 200 opportunities each year and only do a deal on about one every two years, on average, although I did get the idea from Chris that the frequency might increase in the near term.

It certainly shows the power of saying "No" most of the time. When they have actually said Yes and done a deal in prior years, those deals have all been good ones that have enabled SCEE (SXE) to grow at a good clip and provide increasingly good TSRs for their shareholders. This one looks like another one in the same vein.

EPS accretive (of course): The transaction is forecast to result in at least 18% EPS accretion on a FY25 pro forma basis. The impact to SCEE is anticipated to be broadly neutral in FY25 as Force Fire’s contribution in FY25 will be offset by the transaction costs. Their contribution in FY26 is forecast to be at least $10m EBIT.

Disc: Holding both here and IRL.

Looks good. And the market likes it - on a day in which most companies are being sold down, EGL has been up as high as 26.5 cps this morning, and SXE has been up to $1.66/share, both are currently lower than that now, but both are still well up for the day.