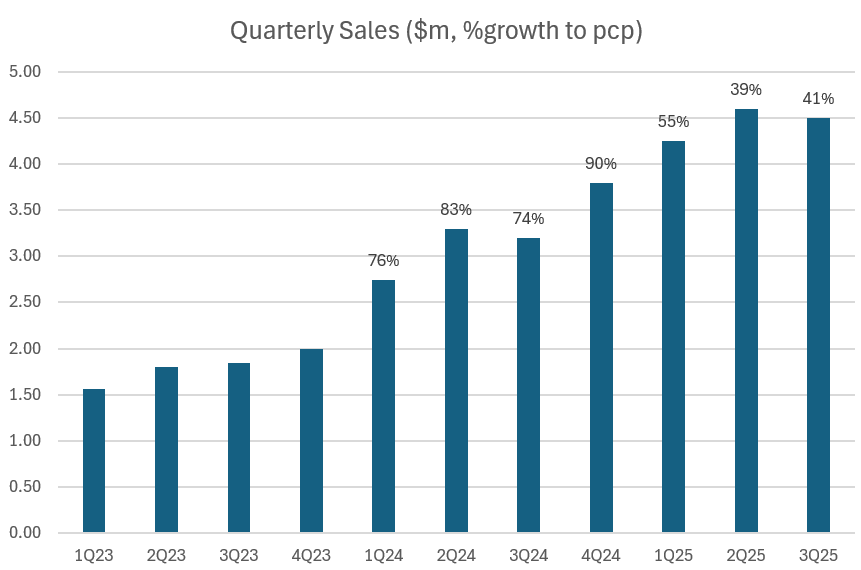

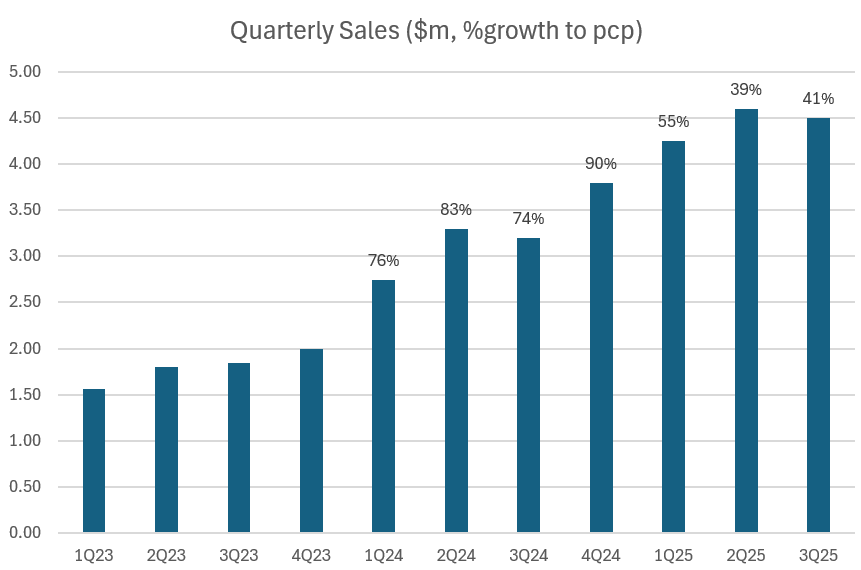

Probiotic brand $BIO reported their 3Q Sales figures. Quarterly Sales Report

Sales are down -2.2% on the previous Q, as 3Q appears to be a cyclically soft quarter, and we saw the same last year (-3.0%).

Sales are up 41% on PCP.

Overall, the sales growth is maturing. If we look at the Trailing 12 Month sales growth over the last 4 quarterly reports the trend is clear: 81%, 74%, 60% and 53%, although the rate of decline is falling. At some point this will stabilise, for example, as the contribution from international sales (still a very small base) starts to contribute. Anyway that what I am looking for as part of my thesis!

They've called out same store sales growth of 45% for the 3 months to Feb-25 (presumably because they don't yet have store level data, rather than due to cherry-picking?) showing the priority being given to growing existing accounts is yielding results.

Terry White ChemMart also awarded them Retailer of the Year - a nice little accolade when you think about the competition.

SP has languished as a result of lack of positive recent surprises and general market funk. But as far as I am concerned, $BIO remains solidly on track.

Looking forward to seeing the 4C in a couple of weeks, to see how the financials are evolving ... top line vs expense and inventory.

Disc: Held in RL and SM