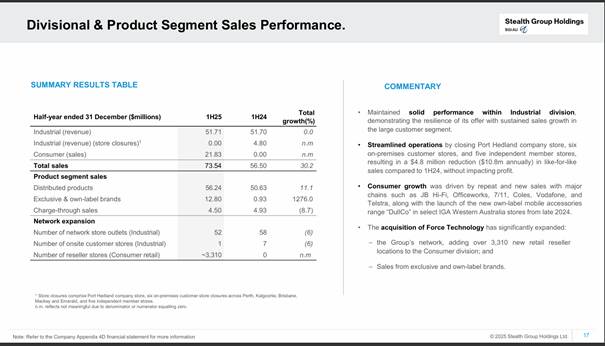

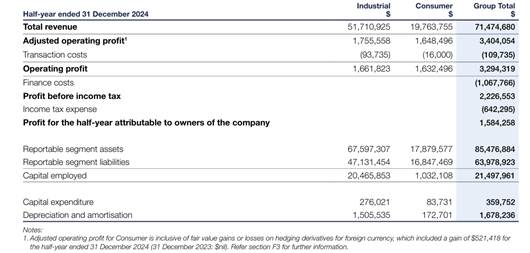

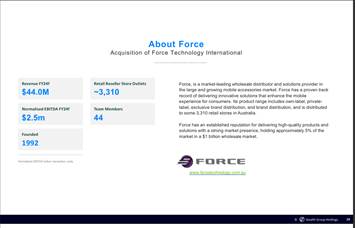

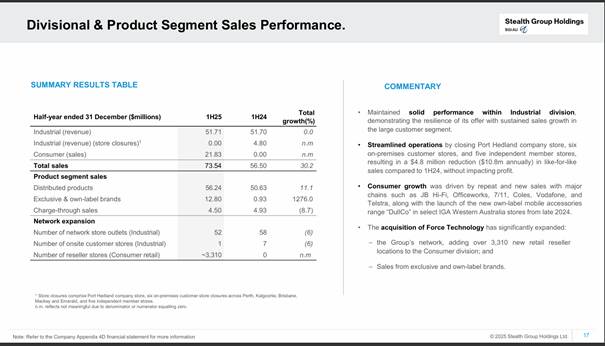

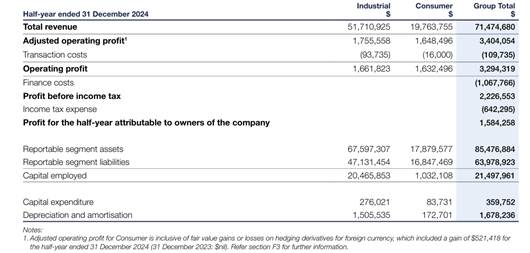

A good issue to tease apart @rh8178 , there was negative organic growth in H1FY25 and on seeing the results I was initially alarmed. However, on closer review the drop in Industrial division revenue of $4.7m was presented as due to store closures as shown in the slide 17 below. Consumer sales (ie Force) were $22m so around half the FY24 forecast revenue projection for Force provided at the time of acquisition (slide further down).

So, on the face of it, no organic growth, but a solid improvement in the bottom line from cost controls and closing low profit or unprofitable stores. Profit was up and investors (including me) happy and growth from acquisitions works provided they are good additions and leverage the existing operations to create further operating leverage and expand NPAT% margins.

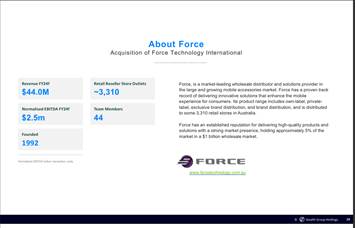

However, it looks like Force revenue may have dropped, the sales figure of $21.83m in the presentation slide 17 is revenue of $19.76m as per note B1 @rh8178 refers to. The difference will be rebates or other net sales adjustments. Based on the presentation at the time of the Force acquisition (below), annual sales for FY24 were expected to be $44m (same as FY23), so $22m for the half as pointed out.

The unanswered question is what is the seasonality of these sales? We know that the Industrial business has higher H2 sales, but I am not sure if this has also been confirmed for the Consumer business. If so, then we are back to sales probably being relatively flat for Force for the full year.

Now back to your point @rh8178 and @Strawman concern, no organic growth is flat out bad if it continues, growth just by acquisition is high risk and unsustainable long term – not a business I want to own. However, we have had 2 organic growth drivers in play which is the only growth I have included in my sales bridge to get to $250m. The long-awaited Loyalty Rewards ($60m) and the recently announced exclusive brands deal which included CAT power tools (30m). In addition we have the Hire Tools business being launched in 20 store in stores that should improve margins and probably increase revenue but by how much we don’t know.

We may attribute the recent period of flat sales as a reflection of management distraction integrating a new division (Force) and closing 12 stores. A focused management and store expansion along with additional brands, hire revenue and loyalty program revenue gives a lot of opportunity for organic growth.

We need more good questions like these to keep us on our toes. We also probably need better answer than I have provided, so I look forward to others thoughts on this issue and whatever comes of this capital raise.

Slide 17 H1FY25 Presentation (25/2/25):

All of the fall in Industrial sales is identified as due to store closures – looks a bit neat and conflicts with a statement early in the presentation (912) that Industrial sales increased 8.8% like for like pcp… hmmm

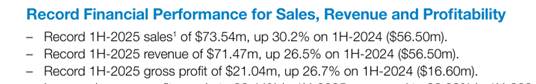

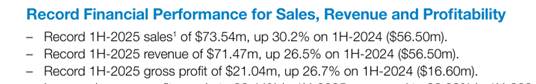

Page 6 H1FY25 Financials:

The above reconciles the reported revenue with the sales in the presentation. Note also that Sales and Revenue are the same for 1H-2024, so it’s only with the introduction of Force that we have the difference, so the gross to net sales variance is in the Consumer division and is new.

Note B1 H1FY25 Financials:

Slide 14 Acquisition Presentation Briefing (6/6/24):

Note: FY23 revenue similar for Force (ie no growth anticipated in FY24)

Disc: I own RL & SM