No thesis breakers in that quarterly report @Rapstar - and while the March quarter report from NST was indeed underwhelming in terms of gold produced, my thoughts are that it was the full year guidance downgrade they included in that report that did most of the damage in terms of turning market sentiment negative against NST for a few days. In that few days they dropped -17% from over $23/share to close at a bee's whisker above $19 share yesterday, however they rose +0.68% (or +13 cents) today to close at $19.17, so perhaps the selling might be over, at least for now.

A couple of points:

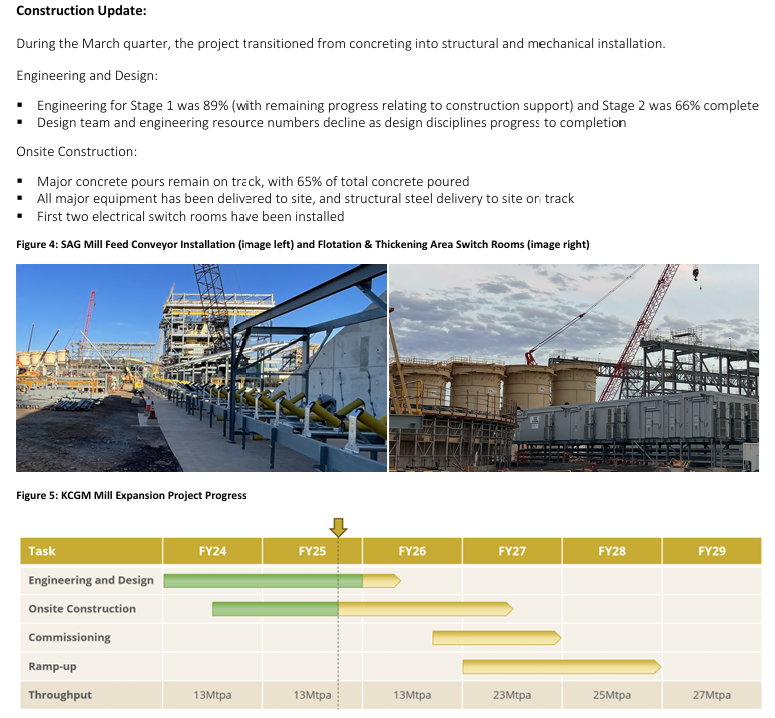

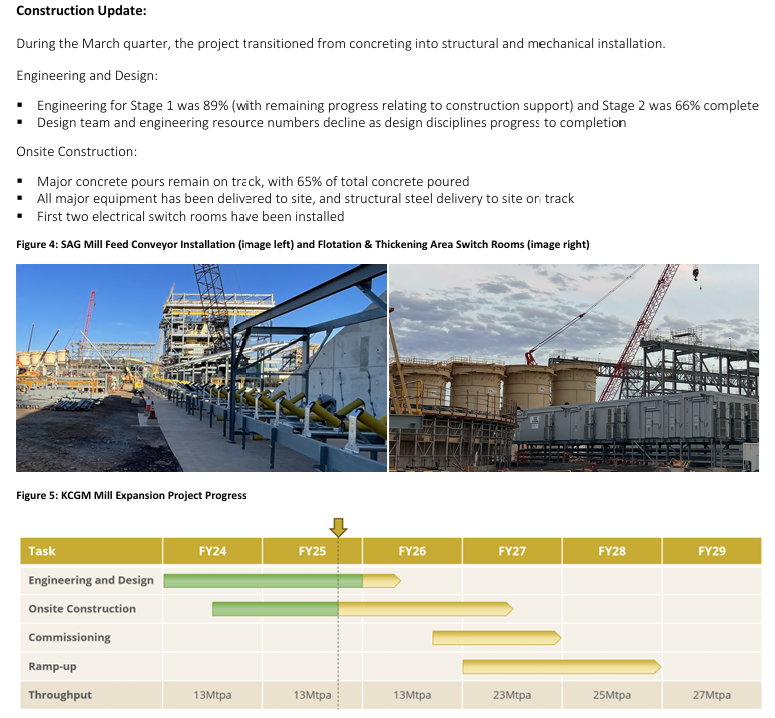

- Issues at the Super Pit and Fimiston mill - together known as KCGM or Kalgoorlie Consolidated Gold Mines - being the company that was formed many moons ago to own the assets in a JV structure with the various partners changing a number of times (for a long time the partners were Newmont and Barrick) until finally it was Saracen and Northern Star, and then just Northern Star after they acquired Saracen, so KCGM is now a 100% owned subsidiary of NST, but back to my point - issues at KCGM have to be expected when they're right in the middle of a multi-year expansion expected to cost at least A$1.5 billion that will increase the KCGM mill (Fimiston Mill) processing capacity from 13 million tonnes per annum (mtpa) to 27 mtpa by FY2029. Things aren't always going to go smoothly when you're more than doubling the capacity of a mill while still trying to run that mill at it's old capacity throughout.

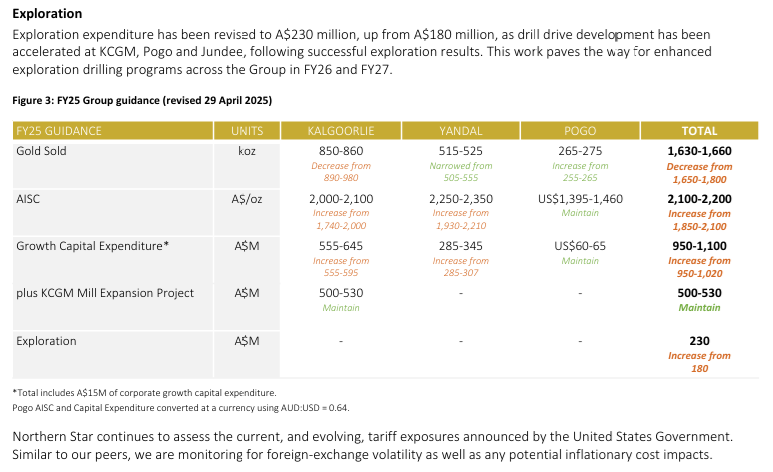

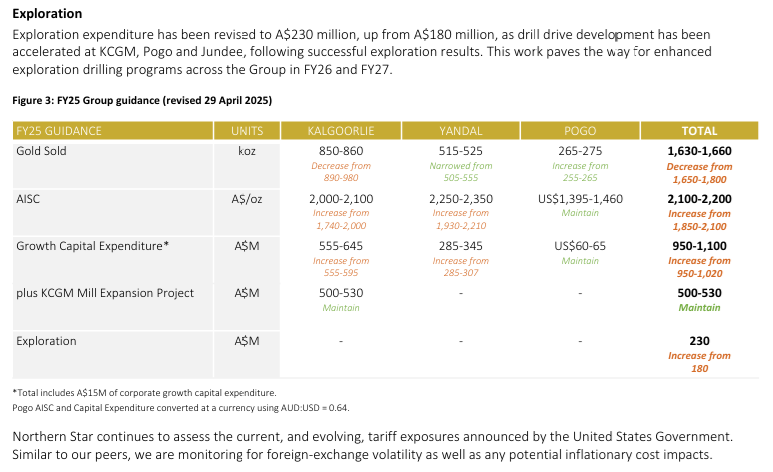

- This isn't about losing gold, i.e. not about gold they expected to be in the ore not being in the ore, which is what happened in the same quarter over at Bellevue (BGL), which is why BGL were in a trading suspension for a fortnight and came out of it with a fresh CR and a large future production downgrade, and a lower share price. In this case, it's just minor issues and mostly at a single gold centre, likely due to that mill being in the middle of a major expansion, with good numbers from all of NST's other gold production centres; even Pogo in Alaska has finally come good now. There were higher maintenance costs at Yandal but otherwise this was about KCGM mostly. NST's FY25 production and cost guidance has now been revised down to 1,630-1,660koz at A$2,100-2,200/oz - previously 1,650-1,800koz at A$1,850-2,100/oz - so the midpoint of the new production guidance (1,645koz) is just below the lower end of their previous guidance (1,650koz) and their new cost guidance midpoint ($2,150/oz) is just above the top end of their previous guidance ($2,100/oz). It's not a thesis breaker. And the gold is all still there, it hasn't gone away.

The positives include:

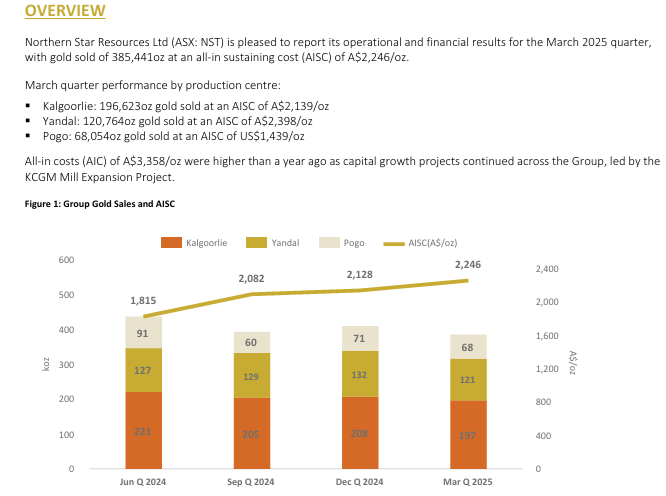

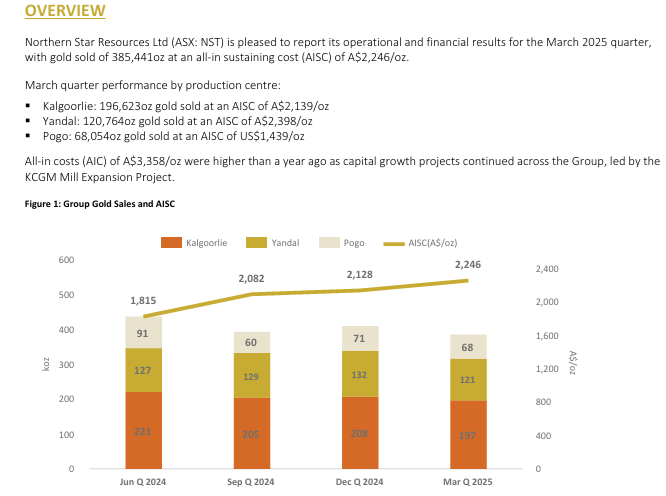

- Gold sold in the March quarter totalled 385koz at an AISC of A$2,246/oz (US$1,409/oz) which is fine when the spot price is over A$5,000/oz (over US$3,200). NST's costs could actually double from here and they'd STILL be profitable at current gold prices, i.e. the current gold price is more than double NST's All-In Sustaining Cost (AISC) per ounce.

- KCGM underground and open pit ore movement was higher; however an expected grade uplift expected in the March quarter was delayed until the June quarter so we can expect higher grades in the June quarter (that we're in now) and that usually means lower costs. While that negatively affected the March quarter production numbers, it should be a positive for the current quarter.

- Jundee mined volumes were significantly higher with Thunderbox milling costs reducing.

- Pogo gold sales totalled 68koz for the quarter with the mill continuing to deliver consistently strong performance.

- Underlying free cash flow of A$201 million with strong net mine cash flow of A$295 million.

- KCGM Mill Expansion tracking to plan; has now transitioned into structural and mechanical installation.

- Strong investment-grade balance sheet with a fully funded organic growth strategy and net cash of A$181 million after A$279 million paid out in dividends - so cash & bullion of A$1,121M less corporate bank debt of A$0M (no bank debt) less bond issue (A$940M = US$600M at AUD:USD rate of 0.63) less capitalised transactions costs.

- Hedge book continuing to wind down with no hedges added over the last two quarters.

- On-market share buy-back (SBB) program now 89% complete and the average price paid during the SBB has been A$10.51/share, remembering that NST is now trading at over $19/share and was trading at over $23/share just prior to this latest quarterly report release. The on-market SBB remains open until September this year. I'm glad they bought most of those shares when NST's share price was substantially lower than it is today.

- The De Grey takeover has been greenlighted by the court and the shareholders of both companies, and the De Grey Scheme of Arrangement was effective from 23rd April with an implementation date of 5th May (Monday). DEG was removed from the ASX list on April 23rd. The deal is done.

- NST are increasing expenditure on exploration, so targeting further organic growth through finding more gold in land they already own.

It's important to remember that NST is Australia's largest gold producer, a top 10 global gold producer, and while their costs have increased over recent years, they remain at less than half the current gold price, and they have three gold processing centres, are doubling their largest one (KCMG), and are adding Hemi through the acquisition of De Grey, with Hemi being the largest undeveloped gold deposit in Australia.

De Grey's Mallina project contains an estimated 13.6 million ounces of gold at a grade of 1.4 grams per tonne with most of that being at Hemi (which is part of Mallina) and once NST get it into production Hemi is expected to produce 540,000 ounces of gold per year over the first 10 years, with peak production of 637,000 ounces in year 5. And that's based on the drilling done so far, and there always ends up being more gold there with these big deposits than you know there is when you start mining them.

There was less gold produced at all three mining centres in the March quarter than in the previous quarter, as shown above, but not much less at Pogo, and at Yandal it was due to some unplanned maintenance issues and we've discussed KCGM (shown there as "Kalgooorlie") where they also had access to some higher grade ore delayed until the current (June) quarter.

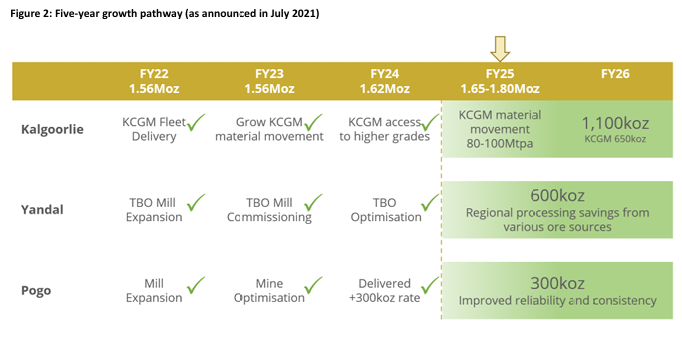

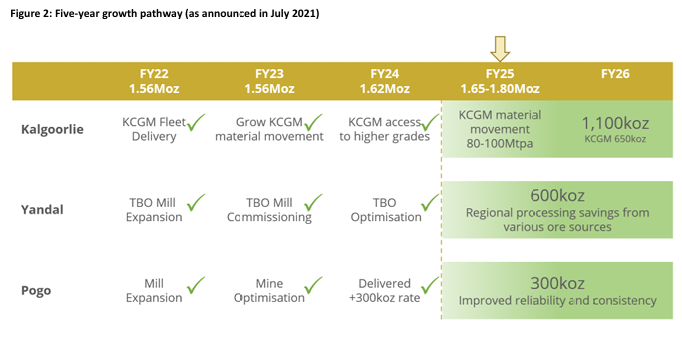

The NST 5-year Growth Plan announced back in July 2021 remains on track, and it didn't include Hemi (the DEG acquisition) which is just going to provide them with even more growth.

KCGM remains on track:

Plenty to like. NST remains a core position of mine here and in my real money portfolios.

I'm not too fussed about this latest quarterly report. Which is why I didn't bother posting a straw about it at the time it was released. Swings and roundabouts. In share price terms they've now dropped -17% from their recent new all-time high, however their share price today is still higher than every price they've ever traded at right up to April 7th (which was less than 4 weeks ago) when they closed at $18.60, which on that day was another new all-time high closing share price. They went on from there right up to an intra-day high of $23.30 on April 22nd, however much of that was tariff-induced fear and panic across markets, and all of the goldies have come back from their recent highs, coz the gold price has come back from $5,350 to around $5,030 (or in US$, from US$3,400 to around US$3,250) per ounce. The gold price hasn't broken that longer-term uptrend yet despite this pullback, and nor has NST.

At over $19/share today I reckon NST are still looking good with plenty more growth to come, net cash of A$181 million, so zero net debt, three different mining centres (so far), highly profitable, and good management.

There's not too much NOT to like.

Other than the dividends being low and unfranked.