@Strawman , was a bit concerned that I have missed something on powercloud with your commentary, so went back through my notes on powercloud since the acquisition, most of which I have posted previously:

- Have not found any management commentary that mentions that the powercloud turnaround and integration had encountered unexpected issues. The announcements that I have, have all reported positive progress. The feeling I got then was that HSN went in with eyes wide open, planned for that with a "reasonable" investment cost number (relative to acquisition cost). The impression from management commentary thus far is that things have come out better than expected ... have no further detail to work from to get a better assessment of this view, unfortunately

- ~$20m of investment over and above the upfront acquisition price was flagged in the acquisition announcement and I can't find any commentary to suggest that costs went above this - the last powercloud investment cost reported that I could find was $13m in the 1HFY25 results, so the powercloud turnaround costs did not trouble me. If it exceeded the $20m, I would expect management to have reported that to the market ...

- Having said this, management had telegraphed that the powercloud acquisition would drag the FY24 results down, and so it did.

The 1HFY25 results were weak from my perspective, driven primarily by (1) lower license fees v strong 1HFY24 license renewals which only renew in 3-7 year cycles (2) upgrade delays which shift revenue into 2HFY25 (3) continued powercloud investment. But 2HFY25 was looking good based on the Jan YTD numbers, new logo wins and deferred upgrades happening, if I recall, which gave management confidence to reaffirm FY25 guidance.

Amortisation has been in the $35m to $40m range - FY22 $32.1m, FY23 $33.2m, FY24 $37.2m, FY25 should be closer to $40-42m I suspect, with powercloud included. Agree with your comment on this being a "technical cost". The rise has been steady-ish and to date, hasn't looked troubling.

Absolutely a small price to pay for highly sticky customers and good quality recurring income!

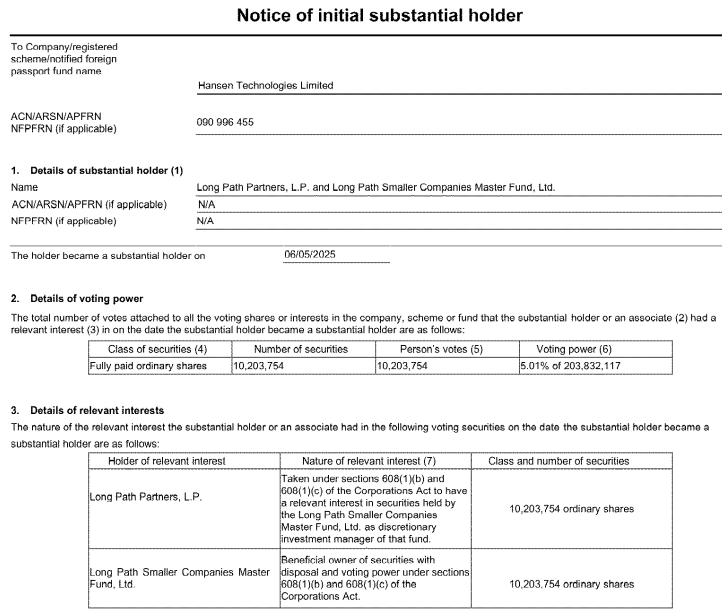

Hoping that Pine Tree is still holding HSN - always comforting news when fundies buy in (thanks @Slew! ), especially coming off the back of the 5.01% stake from Long Parth Partners earlier this month.

Discl: Held IRL and in SM