@BkrDzn Do you have a view as to whether today's Gold-Mining-and-Processing-Update.PDF from HRZ is as you'd expect, better or worse? They are creating cashflow, but there have been some delays and they do mention a couple of issues ("Cost performance in the June half has been impacted by the establishment of stockpiles, lower than expected grade performance in the early stages of mining at Boorara and higher strip ratio.")

They also mention that, "With continuous ore production and haulage now achieved at Boorara and grade control drilling at the operations well advanced, along with lowering strip ratios while grades improve, the operations are now well set-up for stronger cost performance and cash flow generation in the December half 2025." ...so flagging a softer current (June) Qtr and a stronger December Qtr.

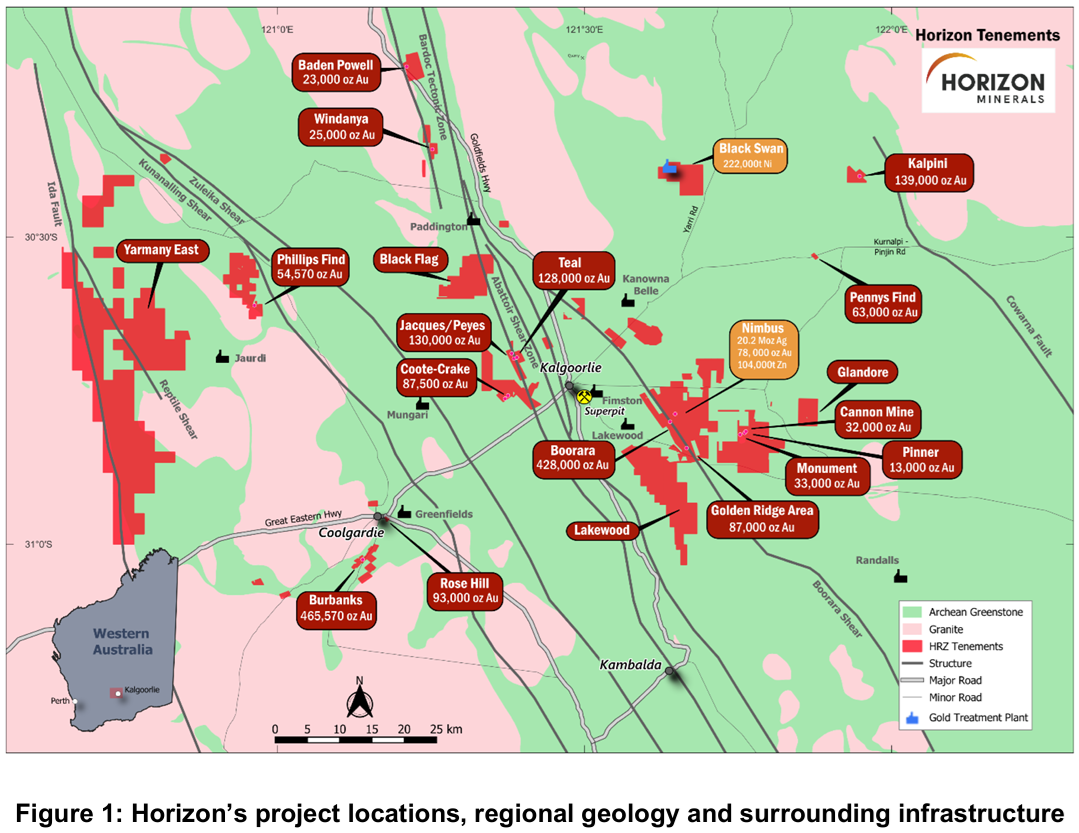

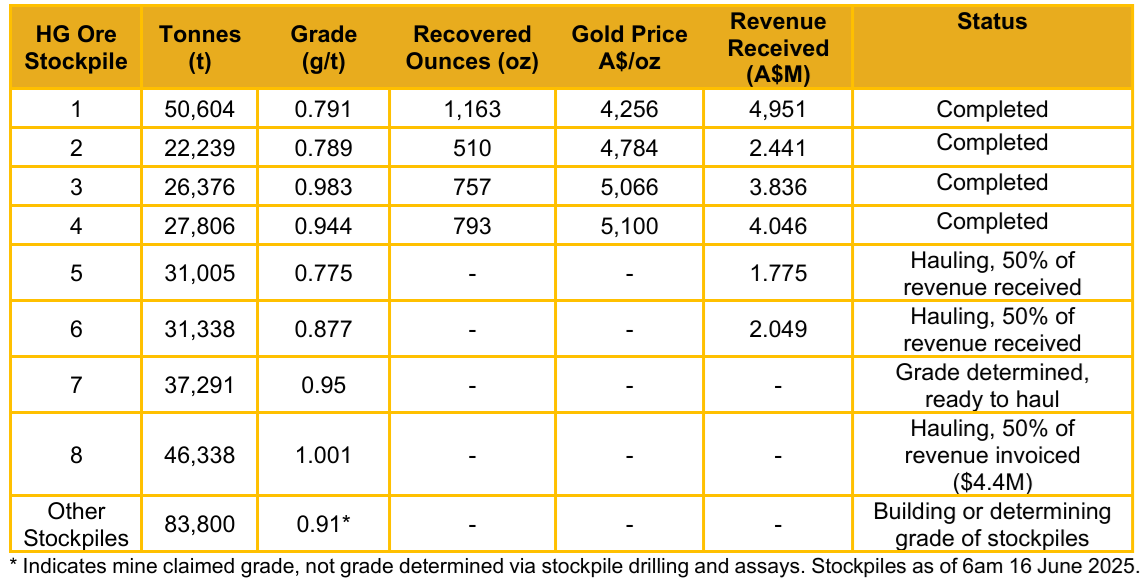

I found this graphic particularly interesting:

That's a LOT of tenements with gold in them! However, to date, the revenue dollars are not huge, but it's still early days.

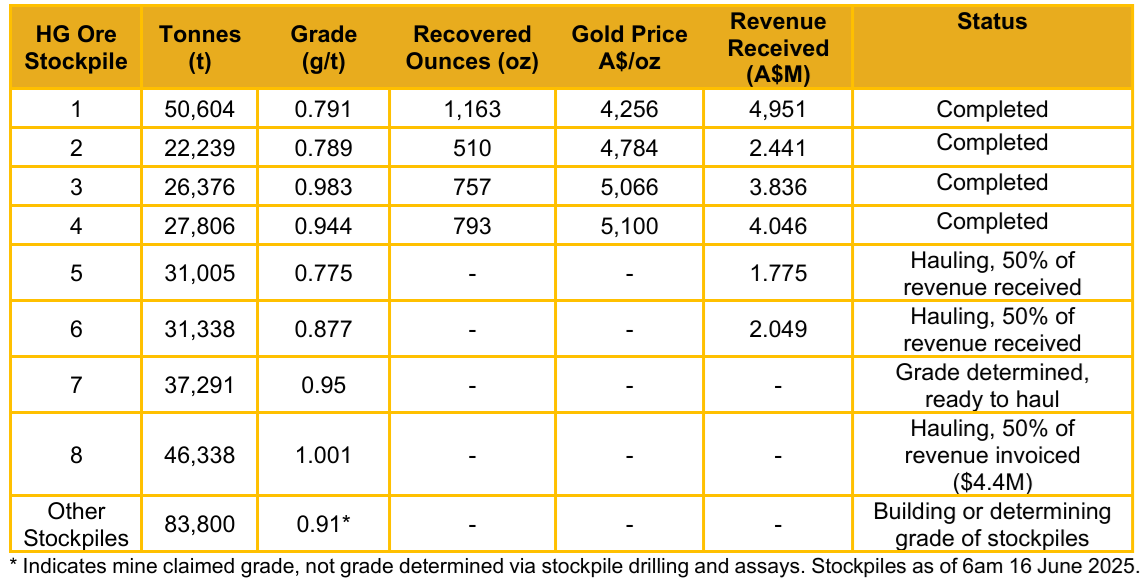

I'm assuming that the top number (row one) in the "Revenue Received (A$M)" column in the table above is supposed to be 4.951, not 4,951 as stated, because if that comma is correct, they are claiming to have generated almost $5 Billion dollars of revenue out of High Grade Ore Stockpile 1 at Boorara, which is not very believable for a company with a market cap under $200 million.

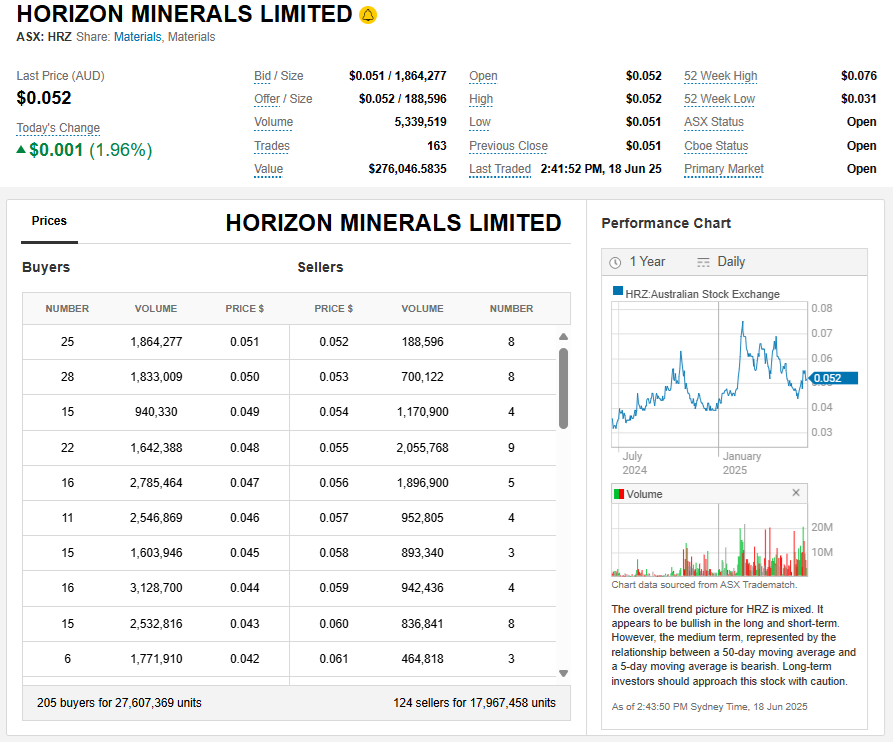

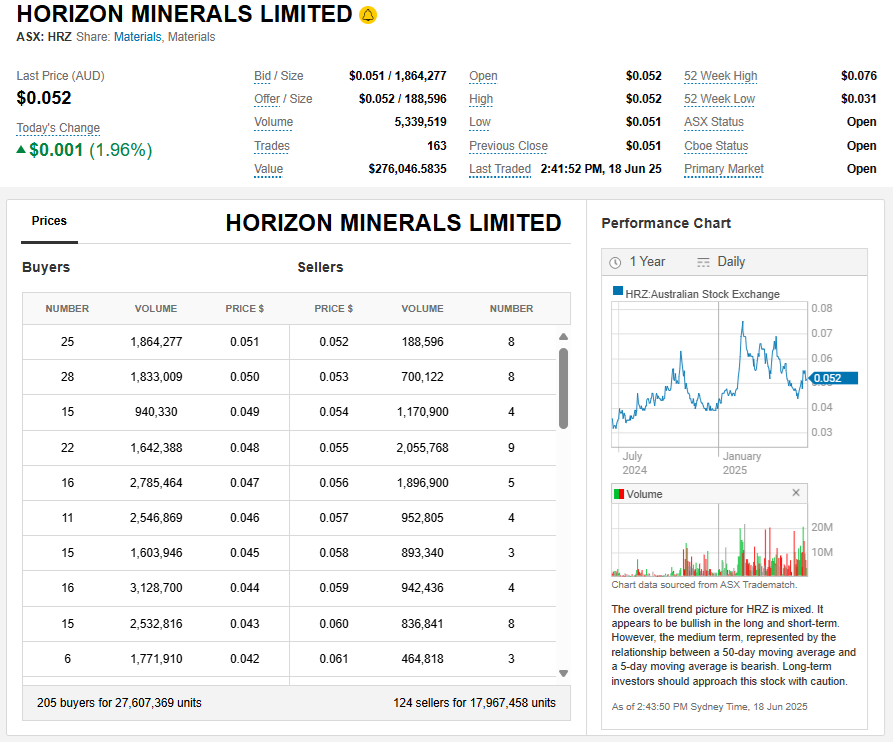

The share price hasn't reacted overly positively to this update, being either flat or up one tenth of a cent throughout the day so far:

Choppy, but the overall trajectory across the full 12 months is up, as you'd hope it would be. What sort of exit strategy would you suggest for HRZ if you don''t mind me asking @BkrDzn - And I know I've only been holding them for a week or two, but having re-read your report I'm thinking about whether it's best to plan to exit or reduce once they achieve part, most, or all of their potential, understanding that will take time to achieve. I'm trying to view them without factoring M&A into the picture, but obviously there are a plethora of possible outcomes, as well as twists and turns along the journey to be expected. I guess what I've started thinking about is whether they are spreading themselves a bit thin and trying to do too much in too many different places at the same time.

Using different toll treatment options is a positive, in that they are reducing trucking distance as well as establishing diversification of partner options, but I'm wondering if there are also negatives in that diversification. I guess it all depends on the competency of HRZ management and their ability to keep all of the plates spinning at the same time while keeping their eyes on the bigger picture and what they are trying to achieve longer term. I reckon I need to do more work on their management and their respective backgrounds and track records elsewhere to build greater conviction.

Disc: Holding, but not adding yet.