Lazy copy and paste from latest Merewether Capital report (https://www.merewethercapital.com.au/wp-content/uploads/2025/06/MC-May-25-Report.pdf)

ERD is a provider of enterprise fleet telematics solutions, beginning life in New Zealand with a hardware product focused on regulatory compliance for Road User Charges. While still enabled by hardware, ERD has broadened its software solutions to capture driver safety, Chain of Responsibility obligations, fleet operating productivity and asset maintenance.

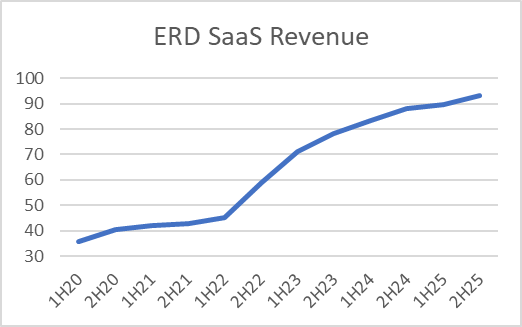

With a full-service enterprise fleet software platform, ERD generates 95% of its revenue from software as a service subscriptions which has steadily grown over time (benefiting from a large acquisition in FY22):

Despite solid revenue growth over the last five years, the share price has not reciprocated, falling to a low of 40c in 2023 after peaking above $5 back in 2021.

It’s a story familiar to many tech stocks through 2022/23 as the market’s appetite for companies to burn cash to chase higher growth rates quickly dissolved. ERD lost $48m in FY22 and $35m in FY23 and with a dwindling share price and weak balance sheet the company was forced into a highly dilutionary capital raise at 70c in 2023 (made even worse by the Board knocking back a takeover bid a few months prior for $1.30!).

Like peers who suffered similar fates, ERD made the tough decision to move on key executives including CEO/Founder Steve Newman, with the new executive team committing to a cost base rationalisation to move the business back to generating cash flow again.

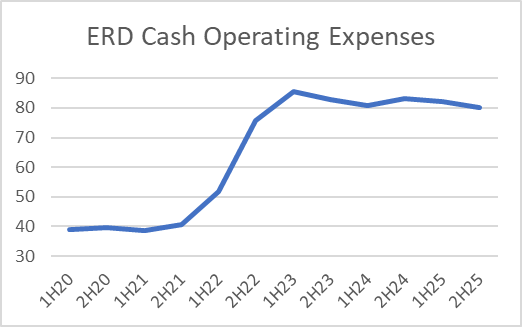

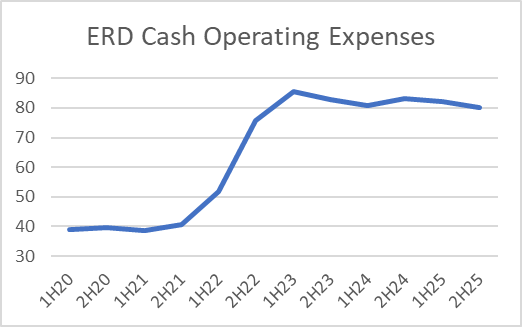

ERD capitalises some expenses such as software development and customer acquisition costs which can make the operating cost base in the profit and loss statement a bit misleading, but looking purely at the cash being spent each year it is clear to see how the cost base rationalisation has played out over the last few years:

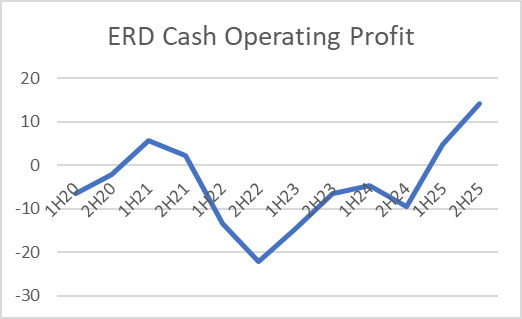

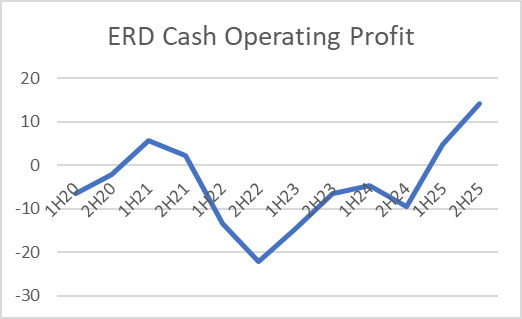

Steadily growing revenue and a flat cost base has led to the key thing we look for in an investment; the jaws of operating leverage opening and more of each incremental dollar of revenue falling to the bottom line:

Impressively, the rapid inflection in cash operating profit shown above has been achieved despite the significant headwind of ERD needing to embark on a large capital expenditure program to replace ageing 2G and 3G hardware units in Australia and New Zealand as telcos shut down their legacy networks.

ERD has spent $17m over the last two years as part of the upgrade program, with a final $13-15m to be spent before December 2025 when the final network is planned to shut down. The finalisation of the 4G upgrade program will not only provide a further tailwind for cash profit growth but will also free up ERD’s internal resources to shift focus back to new customer growth.

At a current enterprise valuation of ~$295m, ERD trades on just over 1.7x annualised recurring revenue and 15x cash operating profit (11x when adjusted for the 4G upgrade program) which is a very cheap valuation for a high margin (75-80% gross margin), recurring revenue (95% subscription revenue) business that has now inflected to cash profitability.

With management committing to growing cash profitability with a continued focus on cost discipline I expect the market to begin to see the value in ERD given a growing cash profitability has been the catalyst for significant re-rates in several ASX technology businesses in recent years such as Gentrack, Bravura, Energy One and Catapult.