Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

ERD out with a very poor update today, compounded by the fluff headline "EROAD strengthening focus on ANZ opportunities".

Why is ERD focusing on Australia and New Zealand? Because the US segment which came about from a large acquisition in 2021 continues to be a struggle, with a large customer churning to a competitor and sparking a write-down of ~$150m.

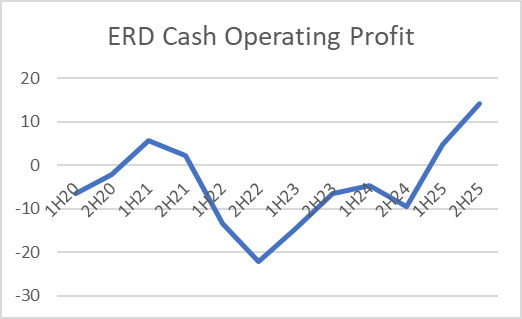

The US has been challenging for some time and a return to strong growth was not part of my original investment thesis. ERD's top line has been modest growth for some time, but management had done well to rationalise the cost base which had resulted in what I thought was a sustainable cash profit base to build from:

ERD management is now guiding to $197-203m revenue for FY26, below the previous $205m forecast but still ahead of FY25's $194.4m. In FY25 ERD achieved a 12% free cash flow margin before the cost of a 4G upgrade cycle, and are now guiding to 5-8% for FY26.

It appears as if ERD management's cost discipline which had served them so well to returning the business to cash profitability was discarded to chase higher growth and as @Strawman wrote recently a management team chasing growth is often the fastest way to destroy shareholder value.

There may be light at the end of the tunnel for shareholders as the Co-CEO overlooking the US segment has now been pushed out of the business and perhaps some cost discipline will return.

Disclosure: Merewether Capital Inception Fund exited it's ERD position today.

Keen to get some thoughts on Ron Shamgar's analysis below. Is this level of upside likely to eventuate?

$ERD is Catapult $CAT 2.0

But similar point in time when $CAT was $2.00 vs

today $6.30

- Hardware / SaaS play

- Profitable and FCF

- Growth accelerating

- eRUC tailwind makes it “toll like” biz (think Cabcharge back in the days etc)

- Very cheap and due for massive re rate!

We think it has 2-3x upside from here on execution

Next 12-18 months

Eroad non sensitive announcement- NZ govt plan to transition all vehicles to Road User Charging - expanding Eroad’s market.

AFR suggests Australia also keen:

disc: held

by Tamim - 19 Jun 2025 | Stock Insight

Cash Is King Again

Perhaps the most important takeaway from the FY25 result is this: EROAD is now generating real, repeatable free cash flow. Gross FCF improved tenfold year-on-year, and once adjusted for the 4G/5G hardware upgrade cycle (known internally as Project Sunrise), the business is delivering an 8-10% FCF yield.

Source: EROAD FY25 Results

This puts the EROAD in rare company for a small-cap technology stock: profitable, growing, and cash-generative.

Moreover, capital expenditure, once a source of concern, is no longer a drag. FY25 capex fell to $13.4m (from $32.2m), with a sustainable range of $14 to 18m flagged going forward. This drop is attributed to more efficient hardware, better billing cycles, and a growing mix of software-based upsells.

In a post-ZIRP world where investors care deeply about capital allocation, EROAD is finally speaking the right language.

Strategy and Execution in Sync

Beyond the numbers, it’s clear that management has found its rhythm.

- High asset retention across all regions: 92.5% group-wide.

- Enterprise segment now 54% of ARR with a 7% YoY increase in enterprise customers.

- ARR tailwinds include: a $1.1m cross-regional expansion from a major NZ client into Australia, $7.2m in NZ upsells, and $4.9m in new US enterprise deals.

Last

$1.37

Change

-0.050(3.52%)

Mkt cap !

$256.7M

Avg daily traded (3-month): $16,277 (low liquidity)

Disc: Not held..... Well done to the holders here.

Eroad Board Bio's

Susan Paterson - Chair, Independent Director, Auckland (appointed Chair July 2023)

Susan is a professional director with more than 25 years Board/Chair experience in NZX/ASX listed companies, private companies, government entities and not for profits. With a pharmaceutical and management background and MBA (London Business School) she has worked in a range of consulting and management positions throughout New Zealand and internationally. Susan is an appointed Officer of New Zealand Order of Merit (services to governance) and was awarded Chartered Fellow status by the Council of the Institute of Directors. Susan is Chair of the EROAD Board and a member of the Finance, Risk and Audit and People & Culture and Nominations Committees.

Cameron Kinloch - Independent Director, Texas (appointed March 2024)

Based in Texas, Cameron has deep experience in Board governance as well as an extensive executive management career as a Chief Financial Officer and Chief Operating Officer in high-growth companies. In these roles, she has driven strategic and scalable growth and has led numerous successful capital raises, M&A and IPO processes across a wide range of industries. She is currently Chief Financial Officer at Weights & Biases, an enterprise software company, and is a Director at Copper Cow Coffee, a sustainably sourced coffee producer. Cameron is a member of EROAD’s Finance, Risk & Audit Committee and Nominations Committee.

Barry Einsig - Independent Director, Pennsylvania (appointed January 2020)

Located in Pennsylvania, Barry brings considerable transport knowledge of the North American market as well as global automated and connected vehicle expertise. He has held other leadership positions within the transport industry and advised Singapore’s Ministry of Transportation on their Highly Automated Vehicle Programme. In addition, Barry reviewed work undertaken by the Transportation Research Board and created patent-approved technology used in Public Safety Networks. He holds a Bachelor of Science (Environmental Biology). Barry is Chair of the Technology Committee and a member of the Nominations Committee.

Sara Gifford - Independent Director, Massachusetts (appointed April 2022)

Based in Boston, Sara brings extensive experience in fast-growing software companies, logistics, transportation, large scale product implementation, and sales. She has business experience in North America, Europe, Southeast Asia, Australia, and NZ. Sara served as the Chief Solutions Officer and executive board member of Quintiq and is a director of North American company Spiro, a customer relationship management and sales enablement company, and is the co-founder and director of Activote, a non-partisan application enabling voting in North America. Sara is Chair of the People & Culture Committee and a member of the Technology and Nominations Committees.

David Green - Independent Director, Auckland (Appointed July 2023)

David is a professional director and former executive with extensive management and governance experience in the banking and finance sector. Throughout his career he led large teams delivering solutions for customers across a wide range of industry sectors in Australia, New Zealand, the Middle East and Asia. David has considerable experience leading change programmes, building positions of market leadership and working with regulators. He has been awarded fellowships by the Chartered Accountants Australia and New Zealand (CA ANZ) and the Institute of Finance Professionals in New Zealand (INFINZ). David is Chair of EROAD’s Finance, Risk & Audit Committee and a member of the People & Culture and Nominations Committees.

John Scott - Independent Director, Auckland (Appointed 2025)

Based in New Zealand, John brings extensive experience in global technology, digital transformation, and business strategy. He was the CEO of Invenco and a key executive at Navico, both innovative technology companies that have grown into international success stories from their New Zealand origins. With a strong background in technology, product innovation, and business transformation, he has led high-growth teams, scaled global businesses, and driven strategic change. His expertise in product development, sales and marketing, supply chain management, and governance will be a valuable addition to EROAD’s Board. John is a member of the Technology Committee.

Despite ERD generating modest revenue growth in recent years, it has been achieved in the face of a tough operating environment for their core enterprise logistics customers. Trade disruptions, fuel costs, insurance premiums and labour shortages are all contributing as headwinds to transport companies and brings risk to ERD’s new customer growth and existing customer churn.

Another key risk is a challenging US segment where growth has stalled in the last twelve months:

Some of this slowing growth comes from a strategic decision to focus on larger enterprise customers in the US and allow small/medium customers to churn away. However, the majority of US customers came from the acquisition of Coretex in 2021 (which saw the large spike in hardware units seen above) and the integration of the Coretex business and customers has not gone smoothly.

However, I believe these risks are more than compensated in the current price, and they are potentially offset by the promise of the nascent Australian segment. Australia lost $2.9 operating profit in FY25, but revenue grew 28% and the segment is quickly scaling towards profitability and will soon be a contributor to overall group.

Lazy copy and paste from latest Merewether Capital report (https://www.merewethercapital.com.au/wp-content/uploads/2025/06/MC-May-25-Report.pdf)

ERD is a provider of enterprise fleet telematics solutions, beginning life in New Zealand with a hardware product focused on regulatory compliance for Road User Charges. While still enabled by hardware, ERD has broadened its software solutions to capture driver safety, Chain of Responsibility obligations, fleet operating productivity and asset maintenance.

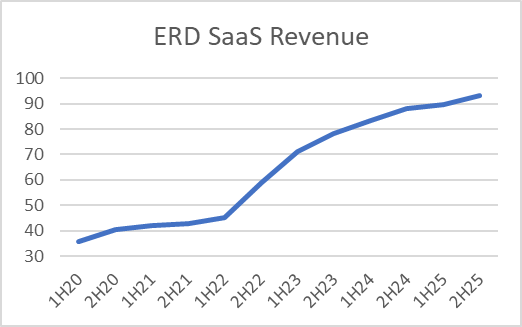

With a full-service enterprise fleet software platform, ERD generates 95% of its revenue from software as a service subscriptions which has steadily grown over time (benefiting from a large acquisition in FY22):

Despite solid revenue growth over the last five years, the share price has not reciprocated, falling to a low of 40c in 2023 after peaking above $5 back in 2021.

It’s a story familiar to many tech stocks through 2022/23 as the market’s appetite for companies to burn cash to chase higher growth rates quickly dissolved. ERD lost $48m in FY22 and $35m in FY23 and with a dwindling share price and weak balance sheet the company was forced into a highly dilutionary capital raise at 70c in 2023 (made even worse by the Board knocking back a takeover bid a few months prior for $1.30!).

Like peers who suffered similar fates, ERD made the tough decision to move on key executives including CEO/Founder Steve Newman, with the new executive team committing to a cost base rationalisation to move the business back to generating cash flow again.

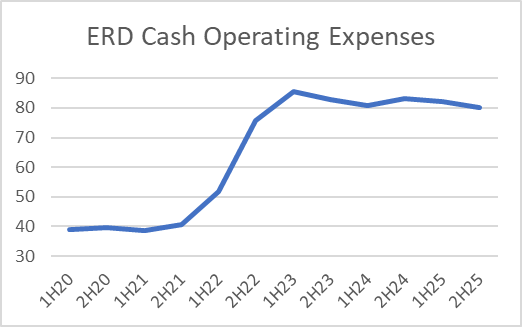

ERD capitalises some expenses such as software development and customer acquisition costs which can make the operating cost base in the profit and loss statement a bit misleading, but looking purely at the cash being spent each year it is clear to see how the cost base rationalisation has played out over the last few years:

Steadily growing revenue and a flat cost base has led to the key thing we look for in an investment; the jaws of operating leverage opening and more of each incremental dollar of revenue falling to the bottom line:

Impressively, the rapid inflection in cash operating profit shown above has been achieved despite the significant headwind of ERD needing to embark on a large capital expenditure program to replace ageing 2G and 3G hardware units in Australia and New Zealand as telcos shut down their legacy networks.

ERD has spent $17m over the last two years as part of the upgrade program, with a final $13-15m to be spent before December 2025 when the final network is planned to shut down. The finalisation of the 4G upgrade program will not only provide a further tailwind for cash profit growth but will also free up ERD’s internal resources to shift focus back to new customer growth.

At a current enterprise valuation of ~$295m, ERD trades on just over 1.7x annualised recurring revenue and 15x cash operating profit (11x when adjusted for the 4G upgrade program) which is a very cheap valuation for a high margin (75-80% gross margin), recurring revenue (95% subscription revenue) business that has now inflected to cash profitability.

With management committing to growing cash profitability with a continued focus on cost discipline I expect the market to begin to see the value in ERD given a growing cash profitability has been the catalyst for significant re-rates in several ASX technology businesses in recent years such as Gentrack, Bravura, Energy One and Catapult.

EROAD achieves positive free cash flow in FY24 AUCKLAND, 23 May 2024:

Transportation technology services company EROAD Limited (NZX/ASX: ERD), with its purpose of ‘delivering intelligence you can trust, for a better world tomorrow’, today released its financial results for the 12 months ended 31 March 2024. All numbers are stated in New Zealand dollars (NZ$) and relate to the 12 months ended 31 March 2024 (FY24), unless stated otherwise. Comparisons relate to the twelve months ended 31 March 2023 (FY23).

Financial Highlights

• Achieved positive Free Cash Flow (to the firm) of $1.3m in FY24 compared to negative free cash flow (to the firm) of $29.9m in FY23. This improvement is the result of growth in units, price increases and cost control.

• Revenue increased to $182.0m for FY24 from reported revenue of $174.9m in FY23 and normalised revenue of $165.3m in FY23. This represents a 10.1% increase against normalised revenue for the prior comparable period, normalising for the one-off acquisition accounting adjustment of $9.6m in FY23 relating to the Coretex merger. Growth in revenue was delivered across all markets.

• Annualised Monthly Recurring Revenue increased by $24.1m (15.7%) to $177.8m in FY24 from $153.7m in FY23, reflecting growth across all markets and support by favourable foreign exchange.

• EBIT of $0.8m in FY24 compared to $1.7m in FY23. Normalised2 EBIT increased to $4.4m in FY24 up from $(4.5)m in FY23. Normalised for 4G hardware upgrade costs of $3.6m in FY24 and integration costs of $3.4m and one-off acquisition revenue of $9.6m in FY23.

Note that shares are up about 10% in the last few days. Take-over target anyone?

Not held anymore

2 heads are better than one, right? Am I right?

Dear Shareholders,

Positive HY Results

We are pleased to announce today that our HY results demonstrate that we are delivering on our targets, reinforcing that the new organisational strategy launched in March this year is translating into improved financial performance. On the back of this result, we are reconfirming our full year guidance of $175m - $180m, and forecasting we will reach free cash flow positive on a consistent basis in the latter part of calendar year 2024.

This result has been underpinned by a lot of hard work and a relentless, disciplined focus on both the bottom and top lines: A 13% increase in normalised revenue, reduced cash burn down 79%, and identified a further $8.5m in annualised costs to be removed from the business. More details of the HY results can be read in the HY24 Results Presentation.

OPEN HY24 RESULTS PRESENTATION

Positioning for Growth

We have key enterprise customer wins, renewals and expansions totalling over 14,000 connections between 8 customers globally. In North America we have also reached the milestone of 100k connections, establishing a credible foothold in a large market that is pivotal to achieving enduring shareholder value.

As part of our growth strategy we are pleased to announce a technology collaboration with Microsoft, enabling us to use generative AI to assist product development. While the entire global roadmap will benefit, our Cold chain product CoreTemp, which uses advanced algorithms to predict the core temperature of products, is the first product priority as we look to enhance its existing advanced predictive analytics through AI. The cold chain market has over 400,000 trailers in North America alone, and expanding our position through enhanced product development is a key pillar to our strategy. To further our cold chain position, we have also forged a data sharing partnership with OEM ThermoKing.

Optimistic for the future

EROAD has a bright future. We have laid the foundations for continued growth in New Zealand and Australia, and to target high-growth opportunities in North America. We have quality products in place, including new developments in sustainability management that increase EROAD’s exposure to the strong growth in business needs as climate change imperatives drive public and private sector decision making.

Lastly, we have a great mix of relevant skills and experience in our Board and Executive teams, a sound strategy, good energy and a clear sense of purpose to deliver great outcomes for customers and shareholders. We remain committed to continue delivering results in line with or above guidance, and we trust that these efforts will be recognised by the market in due course.

As always, thank you for your continued support.

Susan Paterson, Chair & Mark Heine, CEO

Direct links to reports and presentations:

Was caught holding this one on the way down in 2022 and now hope for some kind of turnaround miracle that may (or may not) happen.

Held IRL.

Another interesting twist in the tale with the founding CEO back on deck as an "independent consultant".

----

The Board of leading transport telematics company, EROAD, today announced it has appointed former founding EROAD CEO Steven Newman as an independent consultant to its Technology Board Committee.

The Board members of EROAD’s Technology Committee are Barry Einsig as Chair, Sara Gifford, and Selwyn Pellett. Steven stepped down as the EROAD CEO in April 2022 and retains a significant shareholding interest (12%) in the business. Steven is returning to consult to the Technology Committee, which will help guide the technology underpinning of EROAD’s new strategy. EROAD Chair Susan Paterson explained, “As communicated in recent market and shareholder updates, EROAD is focused on the execution of its new strategy and is making compelling progress to reposition the business and accelerate growth in all our markets.” “Ongoing investment in technology enhancements will be an important strategic component. Steven Is bringing his skills and experience to our Technology Committee to help guide that strategic investment and ensure it delivers.”

Mark Heine, EROAD CEO, said, “As a business with technology at our core, it makes strategic sense for our Technology Committee to involve Steven. It's also personally pleasing to be able to welcome Steven back to the EROAD business. He brings with him a deep knowledge of EROAD, and the technologies needed to meet our diverse customers’ needs.”

Steven said “I’m excited by the opportunity to contribute once again to a great New Zealand technology business. My role will be to assist the Technology Committee on its Charter and with the technology requirements and dependencies for delivering on customer needs.”

The Technology Committee has a Charter to focus on assisting the Board with oversight of: • Product management,technology and innovation strategies; • Plans and operations related to hardware, product and platform innovation; • Information security, cybersecurity, data privacy and third-party technology risk management; • Key product and ecosystem partners, and significant investments in support of new or existing customers and internal systems. The appointment of Steven to the Technology Committee has been in discussion for several months and predates the Volaris NBIO. Authorised for release to the NZX and ASX by the Chair of the EROAD Board.

---

Not sure if this development sends the signal that unless any takeover offers are in "too good to refuse" territory, the business would like to continue operating as a standalone entity and pursue its growth strategy. Of course, the update does say this pre-dates the bid.

ERD shares have come out of the trading halt after the board meeting, and the board has knocked it back.

Here is the full text of the letter sent to Volaris -

725 Ann Street Fortitude Valley Queensland 4006 Australia

Attention: Troy O’Connor, Portfolio Manager Volaris Group

12 July 2023

RESPONSE TO NON-BINDING PROPOSAL FOR THE ACQUISITION OF EROAD LIMITED

Dear Troy, On behalf of the EROAD Limited (“EROAD”) Board, we thank you for the confidential, indicative, nonbinding and incomplete proposal to acquire all of the shares in EROAD, which you would prefer to implement through a scheme of arrangement (the “Proposal”) dated 22 June 2023.

We would also like to take this opportunity to welcome Volaris Group as a shareholder, and we look forward to your support as we continue to deliver on EROAD’s strategy. We note that under the Proposal, you have offered EROAD shareholders NZ$1.30 per share in cash consideration which implies an EV / FY24 revenue (guidance) of c.1.2x. The Board of EROAD has established a Sub-Committee, who have met on several occasions and carefully considered the Proposal along with Goldman Sachs as our financial adviser and Chapman Tripp as our external legal counsel. The Board appreciates there are strategic benefits that EROAD could offer to your portfolio, including the attractive long-term growth prospects.

After careful consideration, the Board has determined that the Proposal materially undervalues EROAD’s business. The Proposal therefore falls below the level at which the Board would be prepared to grant access to due diligence information, or to engage in negotiations on a scheme implementation agreement.

The Board remains committed to value maximisation and acting in the best interests of EROAD and our shareholders. We look forward to engaging with you as one of EROAD’s substantial shareholders.

Yours sincerely,

Susan Paterson Chair,

EROAD Limited

NZSA is recommending a partial takeover.

Interesting perspective here, though it still seems like a less probable outcome - https://www.nzshareholders.co.nz/scrip-article/eroad-could-a-partial-takeover-offer-be-the-best-outcome-for-all/

It is giving me pause for thought though. Thoughts, others?

FY23 Results are out.

While it looks okay at a glance, I have a few issues with it.

- 6-9% revenue guidance for FY24 is too slow. Has been a distinct shift from the 10-30% growth talk from just a couple of years back

- Cashflow neutral in FY25 and then positive in FY26. That's pretty far off for a company that burned $11m in 2H ($36m for the year) with about $27m of combined debt and cash headroom.

- 3G is being shutdown in NZ and Aus, and the company needs to replace 80k units in a bit over a year (or revert to 2G). Awful headwind.

I'm glass half empty on this one.

Revenue above guidance, EBIT and cash flows improving, ARR up 14%.

Guiding for 6-9% revenue growth in current year, and positive (normalised) EBIT.

Using a very crude P/S metric, they are on 0.35x (pretty low) and the growth potential in the US remains attractive.

But it's always a bit discomforting when you have consultants brought in (Goldman Sachs in this instance) to help you with your business. The US hasnt been great so far. Great to see costs being cut, but with $10m taken out last year, and another $10m this year, it's pretty aggressive. Either the bloat was massive, or such a cut will have some impact on growth. Even with this they don't expect to be FCF positive until FY26.

No longer held.

ASX announcement here

I can't think of an example where a company's shares did well after management uttered the dreaded phrase "strategic review"

They also don't expect to be cash flow positive until FY26.

Thesis pretty much busted at this stage. Time to sell.

EROAD's half year results suggest the fleet vehicle hardware/software provider may not be happily trucking along.

The good news was record revenue of NZ$85.4m and a positive EBIT of NZ$1.0m, albeit both propped off by a one-off non-cash accounting adjustment of NZ$7.0m relating to the Coretex acquisition. Props once again to EROAD's detailed disclosures, which are generally very transparent.

However, the dreaded initiation of a "strategic review" was just one of a series of announcements that suggests EROAD may have missed the left turn at Albaquerque.

While the business has a large number of trials under way, these can take years to convert to sales and organic growth is stuck in the slow lane. Revenue per unit has at least stopped the decline seen in the past few halves but is also not growing and, therefore, isn't helping to offset surging inflation.

It wasn't given top billing but management snuck in an admission that the targeted NZ$250m of revenue by FY25 wasn't going to be achievable.

The balance sheet looks increasingly vulnerable to another capital raise and when asked when cash flow sustainability might be achieved management described it being as beyond FY24, which brings to mind a certain Talking Heads song.

Ironically I was moving yesterday and so wasn't able to dial into the AGM (but read the transcript). I would be interested to hear from anyone who did.

[on watchlist]

A much needed bounce in eRoad shares this morning (up 7%) after the company signed a new 5-year agreement and tightened its FY23 guidance.

Full details here, and it was also good to see a major client renew.

Previous guidance was for FY23 revenue of NZ$150-170m, but the company now reckons they'll do NZ$154-164. If you just take the midpoint of guidance, it's basically unchanged, but nevertheless represents 39% growth from FY22.

EBIT guidance remains unchanged at -NZ$5m - 0, with cost reduction initiatives offsetting some cost pressures. Inflation is soaring in the US (see below), so probably no surprise.

Also noteworthy that eRoad is speaking of ongoing supply chain disruptions, especially with regard to critical electronic componentry. Their response is to order ahead of time and bulk up inventory -- that'll have implications for cash flows but is very prudent to my mind.

I can see what you mean @endean in terms of how the CEO's comments of a "successful" acquisition and raise may seem insensitive to those that participated in the raise at higher prices. Although, from a cost of capital perspective, it is hard to argue. Whether or not it was fair depends on whether you think the current market price is reasonable or not.

I'd also say it's too early to tell whether or not Coretex was a good purchase. For whatever it's worth, the new CEO seems very bullish on what it means for eRoad.

It was a positive that the Chairman did at least acknowledge the share price performance right at the start:

And, at a high level, I think the business seems to be doing well, at least on the revenue front:

For FY23 they are calling for $150-170m in revenue for the current year (growth of 39% at the midpoint), with a FY2025 target of $250m.

This year they expect to get within $5m of breakeven at the EBIT line. Note that the EBITDA drop (seen above) was largely due to one-off acquisition costs and was only a 5% drop when normalised for this. And the reduced margin is a function of increased investment spend (including R&D and sales & marketing).

It was encouraging to hear the Chairman say:

So, as a thumb suck, if they do get NZ$250m in revenue by FY25 (A$224m), I think A$30m in NPAT is quite doable by FY2025, or about 27cps. If they do that, a PE of >10 at that time will be enough to underpin a 10% CAGR for shareholders. And, you could well argue, that if they did indeed such strong sales growth and a pivot to profitability, the PE would likely be much higher.

Currently, they are on a P/S of 1.5x on a forward basis or 2x on a trailing basis. This ratio can be very limited, but at face value it doesnt seem much for a company with a strong market position, high retention, strong sales growth, ample funding and apparent industry tailwinds.

The loss of the founder/CEO, following a rough patch in North America, has put a lot of investors off. Understandably. But if they can scale well and get anywhere near their growth targets, shares are very cheap at present in my opinion.

Let's see what they say when we catch up with the CEO and CFO next month.

Today's AGM presentation and speeches are here

Assuming A$230m in FY25 revenue and A$30m in NPAT.

On 111m shares on issue, that's an EPS of 27cps.

I'll give that a PE of 20 -- which seems pretty modest for a business that would have grown the top line at around 30%pa and swung into profitability -- which gives a FY25 price target of $5.40.

Discount back by 10%pa to get an intrinsic value of $4.05

I cant make this unfortunately, but if anyone would like to meet up with the new eRoad CEO Mark Heine, you can register for a Zoom chat tomorrow, Thursday 21st July 10.30am NZT (which is 8:30am AEST).

click here.

I'll also reach out to see if he'd like to join us for a Strawman meeting.

Wow, a near 20% fall in eRoad shares at present.

What's going on? No news that I can see...

Interesting to note that this fall has been effected by 29 individual trades, totalling $42k. The largest of which was a trade for just under $8k.

I get it, prices are determined at the margin. But literally 0.02% of shares on issue have been traded and that's caused the market value of eRoad to drop by more than $43 million. Amazing stuff.

The company just reported NZ$115m in revenue and is expecting FY23 revenue of NZ$160m (at the midpoint of guidance) and "at least" $250m by FY25. The current ARR is NZ$134m.

94% customer retention, with 91% of revenue SaaS subscription based.

It's true that the business is still loss making as it ramps up R&D, sales & Marketing and other growth initiatives. But even with these added costs, the company is right on the cusp of break even.

These are interesting times :)

IMO more bad than good, the chart below has rev, cfo and PBT for last 6 halves, I generously adj for costs of acquisition $7.6m in pbt and cfo for last half.

Cortex for 4 months pushing up rev, although there is some underlying growth, high single digit from what i can see. NA still struggling, NZ strong. there were some bullish comments made by mgt on future rev growth FY23 est $150-170m that is 5-19% adj for Cortex, and rev of $250m by 2025, looks crazily ambitious at this stage. market will probably pay little attention to this until we some some traction esp in NA. the big negative-- ebit (normalised!) FY23 expected to be loss $5m to $0 as more investment required.

interim CFO and CEo at this stage. some large cts up for renewal this year. Uncool tech catching a bid, PPH APX IFM...? hope is not a strategy!

disc hold v small pos IRL

The market continues to shun eRoad shares. No doubt there's still some concern over the CEO stepping down.

I did take some solace in the fact that Steven made some positive comments in the update and said that he and the outgoing CFO remain "committed and confident significant shareholders". Not that that guarantees anything, but I'll take it :)

The quarterly update today (see here) was actually pretty decent I thought, with the addition of 5258 units being the strongest since the company listed (normalising for the Coretex acquisition).

A picture is worth a thousand words:

(To normalise for Coretex, i just removed the 66,889 units they inherited in the Dec 21 quarter)

On an annualised basis, the number of contracted units grew by 10.3%. Not massive, but far from terrible. And with a number of pilot programs underway -- accounting for almost 26,000 units in the US and 2000 in Aus -- the sales pipeline looks pretty solid.

I'm assuming the business will deliver around A$33m in EBITDA for FY22, which puts them on a EV/EBITDA ratio of about 9x. Not too demanding at all.

Disc. Held.

Leadership and Quarterly Operational Update

13 April 2022

https://www.asx.com.au/asxpdf/20220413/pdf/457z7dhgt2g2r0.pdf

- Chief Executive Officer search well advanced with an appointment expected in the next few months;

- EROAD grew by 5,258 units (annualized growth of 10.3%) during the fourth quarter of FY22 reflecting growth in all markets, in particular North America and New Zealand;

- Strong Enterprise pipeline in North America, with eight pilots underway representing close to 26,000 units; and

- Coretex integration is on track with sales activities for the Coretex 360 platform and Corehub hardware solutions underway in North America.

Leadership Update

As announced on Friday, Mark Heine, EROAD’s General Counsel and Company Secretary, has been appointed as Acting Chief Executive Officer while the EROAD Board concludes the final stages of the process to appoint a new Chief Executive Officer. The Board restarted the search process last year which had been paused due to COVID travel restrictions and while the Coretex acquisition was being negotiated. This process is expected to complete within the next few months.

Steven Newman founder, former Chief Executive Officer and Board member said:

“It has been a great privilege to lead and grow EROAD for 14 years from pre-revenue to annual recurring revenues of greater than $100 million. Providing world class transportation telematics solutions to more than 200,000 connected vehicles used daily by over 8,000 customers across New Zealand, North America and Australia.”

“EROAD is well set up for an incredible future having recently acquired Coretex, another great Kiwi company. The EROAD team is over 650 strong, and together this incredibly talented team is capable of driving the company forward to accelerate EROAD’s rate of growth and emerge into a major player in global transportation telematics.”

“I wish the new Chief Executive who is expected to be announced in the coming months the very best and will support their transition into the role. Colette and I remain committed and confident significant shareholders.”

Quarterly Operational Update

EROAD grew by 5,258 units in the three months ended 31 March, ending the quarter at 208,697 units reflecting growth in all markets, particularly in North America and New Zealand. The integration of the Coretex business remains on track with sales activities for the Coretex 360 platform and Corehub hardware solutions underway in North America as EROAD’s next generation product platform. EROAD is confident that the advantages of the transaction identified through due diligence remain as evidenced by the quality of the North American enterprise sales pipeline that the company anticipated at the time of the acquisition.

CEO is one of the large shareholders and founder. I am eager to hear what others think about this news.

ASX announcement is a bit ambiguous to me.

- If succession planning was ongoing since 2020 then why did the market was not informed about it ( or have i missed memo?)

- CEO Steps down ( is he still serving eroad in any other capacity?)

- Is he finishing up with EROAD - if so, when?

- Was there any reason for stepping down?

The 3 months through to the end of December 2021 saw eRoad increase the number of units contracted by over 53%. That's huge, but mainly the result of the Coretex acquisition in November last year.

Stripping that out, contracted units grew 2.9% for the quarter. That was driven by a strong result from NZ (up 3.8%) and AU (up 16.8% due to Ventia roll out) segments, with North America again going backwards (down 1.6%).

But Coretex does need to be considered. It really changes the group's American market position and boosts units in this segment from 25% to 42% of the total. Coretex associated units increased by 1.3% in December alone for North America. Overall, that's a 1.1% increase across all geographies, which is around 13.5% on an annualised basis (ignoring any seasonality).

Coretex has also signed contracts for a further 2,600 units to be deployed in the 4th quarter and is presently progressing through enterprise client opportunities which are at a pilot stage and represent a further 23,000 units.

The Clarity Dashcam performance is especially pleasing, with 1,106 new units sold in the quarter -- a 26% lift, albeit off a low base. (note that device numbers here are included in the total contracted units figures).

One area of concern is that although the US saw a organic sales of 2,091 for the quarter, there was a net loss of 574 units (excluding Coretex) due to the loss of another enterprise customer (accounting for 650 units), where the two parties were unable to reach "mutually agreeable renewal terms". The result was also impacted by driver shortages, fleet reductions and the broader macro conditions in the US.

All told, i think this was a decent update, although it'd be really nice to see a sustained organic improvement (ex Coretex) in North America.

ASX announcement is here

Review Best ELD for Owner-Operators in 2021

https://matrackinc.com/best-eld-devices/

Eroads Main Competitors

· Samsara – founded 2016. Proposed IPO https://www.sec.gov/Archives/edgar/data/1642896/000119312521334578/d261594ds1.htm#fin261594_a3

· Trimble – (Nasdaq: TRMB)

· Qualcomm – (Nasdaq: QCOM)

· Keeptruckin - Private

Hi

Listened to ERD result and my impressions are that we are in a pivotal year for ERD. the result itself was a mixed bag , IMO, and little to get you very excited taken on face value. The bullish points for me were that Cortex appears to be firing along in NA, so thats good. ERD has upped R&D expenditure (mostly capitalised) to 28% of sales. obviously spoke up benefits of this spend.

of interest was the CEO talking about the complexity of customer requirements in gaining share. This is where a customer wants specific capabilities that ERD must build or acquire. Partnerships look like the preferred path and nailing these will be important in growing. The Cortex acquisition is thought to fill some of these holes as well.

Another bull point was the CEO spoke about 15% growth expected for the industry and that ERD wants to better that rate, that would be a great outcome.

ARPU and retention were again ok without being exciting.

Overall my feeling is that the next year will be pivotal for ERD. a big R&D spend plus Cortex need to deliver. i think the market will tire of excuses if no significant momentum in sales is achieved by end of next year.

DISc held SM/IRL

EROAD's response to the NZ Commerce Commission issues over the EROAD/Coretex merger can be found here: https://comcom.govt.nz/__data/assets/pdf_file/0024/269601/EROAD-Submission-on-the-Statement-of-Issues-1-November-2021.pdf

It's a good read just to get a deeper understanding of the telematics landscape in NZ

A quick recap - the Commerce Commission's key concern is the lessening of competition in eRUC systems in NZ

From an outside perspective, it appears that EROAD has a very strong rebuttal. It's key point is that eRUC should be not classified as its own market, as it's just one feature of the wider Telematics market. Customers choose a telematics solution based on a broad set of features, and eRUC is not a be-all and end-all.

In particular, points 16-19 highlight how they've lost RFPs and had customers churn to competitors without an eRUC feature. This highlights that "electronically-assisted RUC", which is a prevalent feature among the competition, is a viable substitute.

I'm not sure if the NZ Commerce Commission considers broader implications or whether they focus solely on immediate domestic issues. Blocking this merger would likely be against its long term interests in maintaining vibrant competition in New Zealand. The merger will establish a strong NZ headquartered company with scale and strength to compete on the global stage, and with significant skin-in-the-game to serve the local market. Consolidation will happen sooner to later, and if ERD and Coretex are picked off by larger competitors over time, the NZ market will likely become de-emphasised due to its small TAM.

A decision is due by 23 November. Link to the case can be found here: https://comcom.govt.nz/case-register/case-register-entries/eroad-limited-coretex-limited

I'm not much of a Technicals guy but the general momentum for EROAD hasn't been a positive one of late. Has been declining steadily since highs back in late July/early August.

Sentiment around this stock seems to have shifted which was amplified by their Q2 FY22 results - see a great overview from Strawman Emperor here.

Looks like there is a bit of resistance at around the $4.70-$4.80 level, however if that gets broken it may slip further back to 2020 levels.

Edit: Plenty of support now around $4.90.

Again, I'd like to stress, I am not a technical analysis guru (@carl capolingua), nor is this a buy, hold, sell recommendation. I'm just stating that at this stage it may take a bit of positive news for sentiment to turn around; namely traction or some wins in the US.

Happy to hear other's thoughts opinions or views on this.

Disc. Held in SM Portfolio, yet to get in IRL - will continue to watch closely.

Hi Strawthatbroke.

That excellent update is a verbatim update from Maven funds.

Im not sure how it got on to Simply wall st, but given Maven is a paid service I feel Strawman should probably ask Matt Joass whether he approves of its being reproduced in this arena.

Don’t want to sound all sniffy about it but even if he is cool with it being copied onto this site, at least the attribution should be correct!!

eRoad's second quarter, ending Sep 30, revealed a 1.8% increase in contracted units -- which, let's face it, wasn't huge.

Drilling down into the detail, this was largely a reflection of the loss of a US customer (which was reported back in July) who aligned to a competing system after being taken over. If you exclude this, total unit growth would have been around 3.1%. Still, not massive.

This was driven by NZ which added 2892 units (about the same as Q1) and Australia which added 1291 units (30% more than in Q1).

But, even ignoring the loss of a US customer, it wasnt a great quarter for the North American segment. eRoad sold 845 new units, but had 929 returns. The company said this was largely due to on going covid impacts of driver shortages and customers lossing contracts -- but 30% of the returns are due to customers switching to a competitor.

That isnt encouraging.

The company also spoke of challenges in attracting employees (especially devlopers) and the impact this is having on costs.

The company reckons it still has a "solid pipeline" of North American prospects, and expects increased sales momentum following the release of its Android based platform and the cross-sell / up-sell opportunities resulting from the Coretex acquisition.

On a stand alone basis, ignoring the coretex acquisition which should complete this year, the company is calling for 10-13% revenue growth and steady EBITDA margins. Covid delays in all geographies have dampened things, but eRoad said it expects increased sales momentum in FY23.

I still see shares as about 'fair' but am somewhat concerned by the lack of traction in the US. Conditions there are no doubt tough due to the ongoing supply chain issues, and i'm happy to cut them some slack on that front. But if we dont see some sustained sales growth there soon I might have to consider the original thesis busted.

To be the devils advocate for the electric vehicle/petrol tax excise thesis considering this seem to the primary long term bull case for some.

What are the chances Eroads distance travelled and driver monitoriting just becomes icnorporated as afeature of electric cars instead of an add on? I imagine most goverments would have the same issues re petrol excise and could mandate it.

You could find this is the stop gap measure that is used for the past i.e. petrol cars instead if the excise tax is done away with and older cars need monitoring. Obviously this is not an issue in the very near term and I'm a holder but something I think about. Obviously trucking is the main game near term, just thinking longer term.

Coretex Acquisition – Thoughts from the Webinar held today (3pm NZ time, 26-Jul-21).

EROAD Chair and CEO both very extremely positive on this acquisition. It might seem silly to expect anything else, particularly as they are still raising money to fund it. However, they have been looking at Coretex for several years and see this as a very complementary and highly strategic merger.

They seemed at pains to avoid buzz words like “transformational” but were unable to describe it as being anything else as it accelerates their growth by about 2 years.

They estimate this will turn 2 top 25 players (EROAD & Coretex) in the US market into top 10 combined operator. Being top 10 is not a huge draw in any market but the US haulage telematics industry is huge and has 20% CAGR as it digitises. Separately, this market is subject to further positive tailwinds from improving technology (EV’s) driving different road toll methodologies.

Consideration in cash & shares assuming full contingent consideration payable is ~ AU$177 which is 34% of the current Market Cap ~ AU$521 (@ share price $6.30) and lifts all key metrics (Revenue, EBITDA, AMRR & Units installed) by 48-52%.

EROAD will also go from net cash to net debt to fund the cash component of this transaction but the debt servicing sounds well covered by EBITDA.

While there is some overlap in what each company does, Coretex 1) brings deeper penetration into EROAD’s key target market of the US and 2) adds entry into three specialised transit verticals - refrigeration, concrete and waste.

Bottom line – any “transformational” acquisition should be viewed with scepticism and there is no shortage of execution risk here. For me it largely comes down to faith in management’s strategy and ability to execute and I have a lot of that so I have drank the kool-aid an it tastes good to me.

Disc: Held

Thanks @ Deano1971

Good to see TMF raising the profile of Eroad.

Eroad is actively participating in discussions with the NZ Government's future plans on Road User Charging.

Whilst a long term investment, the rewards could be significant as EVs become more common and Governments around the world grapple with how they can raise fuel taxes to fund roads as fossil fuel usage declines.

Eroad is aiming to play an integral role in monitoring NZ road usage via it's cutting edge Telematics and become the standard other countries should follow. Only time will tell but if it can achieve this it has the potential to be very rewarding investment.

I'll be watching the share price in the lead up to the capital raise but I'll more than likely participate in the SPP.

I own Eroad in my RL portfolio and in Strawman.

Lots to digest with eRoad this monring.

FY22 Q1 Update

Starting with the quarterly results for the 3 months to June 30, eRoad reported a 3.3% lift in contracted units from the preceeding quarter. Asset retention remained strong at >95%.

Australia was the clear standout, with unit growth of 31% from the March quarter (albeit off a low base, AU represents just 3% of all contracted units). Really good to see.

NZ, the largest segment by far, grew units by around 3%, while the US was pretty much flat -- quite disappointing. The company said it had a couple of enterprise prospects in trial phase which represents 1,500 units (about 4% of the current installed base in America), with a number of mid-tier pilots also underway.

Unfortunately, a good part of these (if converted) will be offset by the upcoming loss of a US enterprise customer which currently has 1700 units. The reason being they were acquired by another company and will be aligning their tech with that of their acquirer.

The Clarity Dashcam product -- launched in October last year -- has seen strong growth,growing from ~1000 units to ~3000 units over the quarter. That's encouraging.

On a stand alone basis, the previous guidance for FY22 remains unchanged. That is, 13% top line growth.

BUT, the other big bit of news is the acquisition of Coretex...

Coretex Acquisition

Coretex is a "telematics vertical specialist provider" also founded in New Zealand (basically, they do a range of vehicle tech solutions, ranging from telematics for cement trucks, cold storage transport, watse collection vehicles as well as the same sort of offering as eRoad for general fleet management. You can learn more on their website here).

They also operate in NZ, Australia and the US, and have a total of 64,000 units (about half of what eRoad presently has). The company is expected to deliver NZ$50-53m in Annualised Monthly Recurring Revenue (AMRR) in FY22, up from NZ$42.7 in FY21 (~20% growth) which compares to NZ$88.4m for eRoad in FY21.

Acclerates eRoads growth by 2 years, expanding into new verticles, expanding customer base and boosting tech development. The biggest gains will be seen in the Australian and US segments, which will see revenue boosted by 6x and 2x respectively. After the transaction, eRoad's US customer base will grow from 28% to 43% of the total, with Australia going from 2% to 6%.

The proposed transaction will cost NZ$127.7m and a further NZ$30.6m if certain performance hurdles are met. At current FX rates, that converts to AUD$148m, or about 31% of eRoad's market cap.

This will be funded by the issue of NZ$96m worth of new shares to Coretex at NZ$6 each (compared to last closing price of AUD$5.78), NZ$64.4m institution raise at NZ$5.58, NZ$16m as a share purchase plan for existing shareholders, with the rest from existing cash balance.

Really great to see very small discount to the market price (only around 7% at current FX rates for the insto raise, and no discount for the share issue to Coretex).

The price doesnt seem too onerous, assuming synergies can be realised and growth maintained. Assuming the conditional component is paid out, you're looking at a total cost of NZ$188.3m, which represents a 3.7x EV/AMRR multiple, or a 11.7x EBITDA multiple, or 4x revenue -- not terrible given the expected 20%-odd growth in AMRR for Coretex, as well as touted integration benefits. Still, revenue growth has been about 10%, and a big lift in R&D and covid related impacts do suggest lower levels of growth between FY20 and FY22

Summary

This is a big acquisition, and will certainly take time to properly digest. It wont be until FY23 that they expect to see an accretive impact to earnings. If growth stalls, the price paid will be seen as rather expensive.

The US is a huge market, but growth has taken a real knock from covid -- far more than the other segments. If growth doesnt return, and soon, it'll be a big blow to the investment thesis.

At the same time, this is a sector that is expected to grow significantly in the years ahead and the combined entity appears to have great products, good penetration and (exlcuding recent US performance, which is ostensibly covid related) good sales momentum. The economics are also attractive, and customer lock-in is meaningful. Both companies appear to be led by capable, experienced and aligned people and both have been investing heavily in new products and growth.

I remain bullish and am a happy shareholder. But will be keen to see the realisation of integration benefits and a return to growth in the US.

You can read the investor presentation here

E-Road's investor presentation released today included some targets for unit growth in the coming 18 months.

Specifically, over the coming 18 months, they are looking to grow NZ units to 100,000 (~14% growth), US units to 50,000 (41% growth) and Australian units to 10,000 units (247% growth, off a small base).

I have taken their latest reported Average Monthly Revenue Per Unit (ARPU) in each market, converted to NZ dollars and annualised, and then multiplied by the target units to come up with an estimate for recurring revenue.

(Of course, this wont account for shifts in the product mix and pricing, or changes to FX rates, but hopefully gives some sense of the quantum of growth.)

I get about $108m NZD, which is 25% growth from the current level. They have said previously they expect the EBITDA margin to be maintained in FY22 and improve slightly in the following year (even though they are ramping up R&D). So if we assume 35% that's a figure of roughly NZ$38m (compared to NZ$30m last year).

I think this is quite acheivable and in line with my prior expectations. There's a good runway for growth here, and attractive unit economics at play (especially for a business that isnt pure software).

If the business can attract even a 5x ARR multiple in 18 months time, shares are probably about fair value. But I think there's certainly more upside if they scale well and achieve good penetration of the Australian market.

Astute investors may have noticed that this quarter is the first time the company has started reporting unit sales of their new Clarity Dashcam product. This is an important product for a few reasons.

- This is a big product for North America. Insurance premiums are reduced when a vehicle includes a dashcam to monitor accidents. The investment payback is very high for potential customers.

- Management has previously hinted at a cost of around NZ$30-40/month for a North American customer. The addition of 1000 dashcam units, roughly translates to an ARR increase of NZ$400k. Nothing to be sneezed at.

- The value proposition for customers in Aus/NZ is not as strong. It's a more health and safety feature in these markets - example, to understand reasons for the harsh braking from a driver.

- Longer term, management sees the dashcam as a central component of their platform, not just an accessory. Vision when combined with increased compute on the device, algorithms and the existing GPS/accelerometer data - will open up the possibilities of processing and collecting a range of new data insights.

There's a good explanation of Eroad's product and business model found on the podcast here from about the 23 min mark.

https://www.intelligentinvestor.com.au/investment-news/stock-take-travel-stocks-mining-stocks-and-eroad/149313

Eroad (ASX:ERD) is a kiwi technology company that provides compliance and telematics software to the road transport sector in Australia, NZ and the US.

There's a raft of products, but in general they connect GPS, dashcam and other sensor data to proprietary cloud based software that helps manage truck fleets, improve driver compliance, safety and efficiency and a whole lot more. You can see the full raft of services on their website.

It listed on the NZX in 2014 and then on the ASX in September 2020.

Over 120,000 vehicles use it's software and it is looking to double this in the coming years.

It dominates the NZ market, and the size of the market is set to grow as transport fleets continue move away from inefficient paper based log-books and systems. But the real growth engine is the geographic expansion into the USA and more recently Australia.

eRoad already have some demonstrated traction in the US. Close to a third of all its units are in this market and the business is generating double digit revenue growth here.

Importantly, the business is now profitable and demonstrates high retention (95%) and steadily increasing ARPU as existing clients expand their use of eRoad products.

The business enjoys a 33% EBITDA margin, generates free cash flow and has been investing heavily into new products and offerings. It has around $12m in net cash.

There's a good indutsry tailwind, attractive economics, a strong competitive position and capable management. You'll get a good sense of things reading their investor presentation from their ASX listing last year.

I think there's a lot to like here.