As @BkrDzn commented here recently @skaex the Lassonde Curve might just be ignored by the market with gold up where it is and this one being such a straightforward project in terms of relatively simple upgrading of an existing GNG-built gold mill (and GR Engineering have always been damn good gold mill designers and builders). Actually, I can't remember whether @BkrDzn was talking about Meeka when he said that or another gold project developer, but it stuck with me - as it makes sense. Probably about a different company actually.

The Lassonde Curve is actually what the Money of Mine (MoM podcast) logo is based on:

Source: https://www.youtube.com/@Moneyofmine

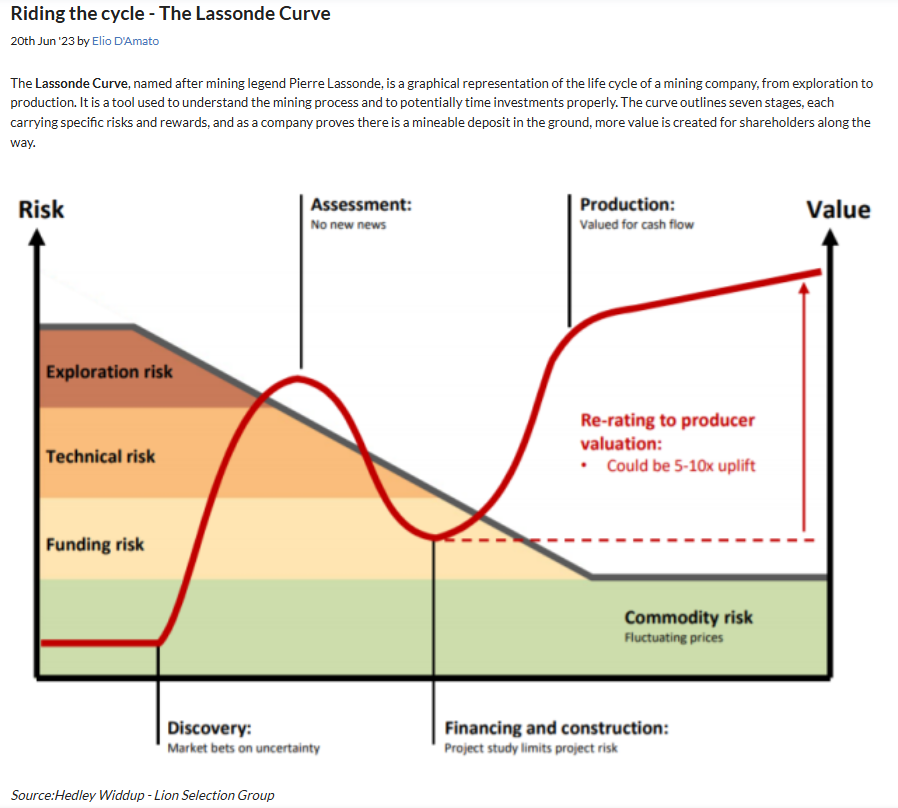

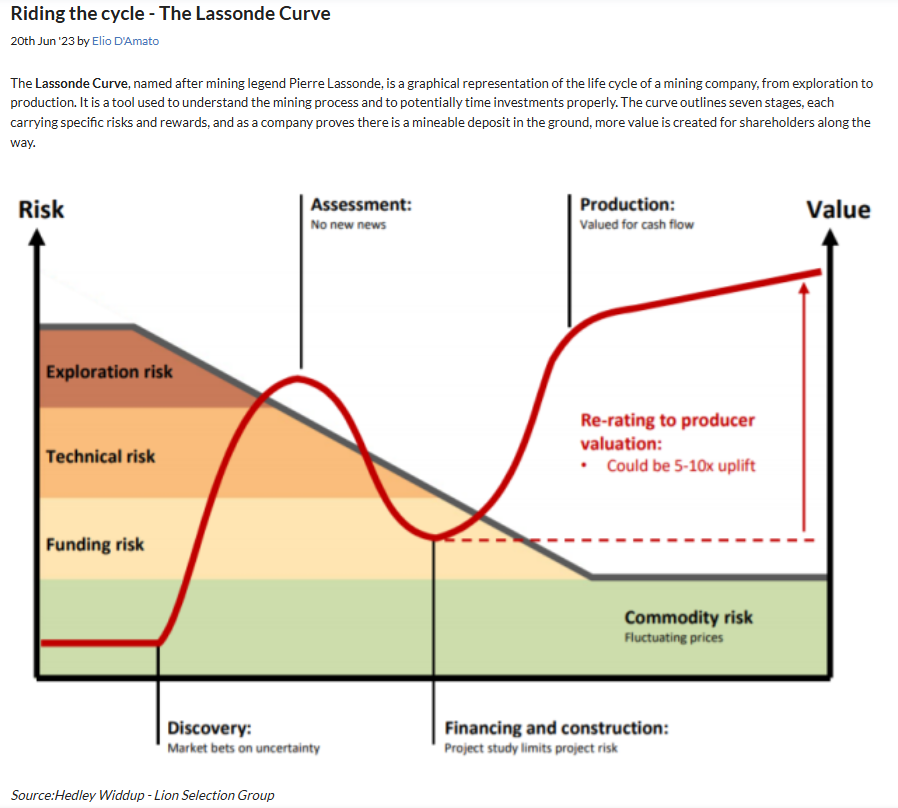

Here's how Hedley Widdup from Lion Selection Group (LSX.asx) explains it:

Source: https://www.stockopedia.com/content/riding-the-cycle-the-lassonde-curve-970139/

That one has a continuing SP rise after a company begins producing ("Valued for cash flow") however Hedley has explained that from that point onwards the share price is going to mostly follow (a) the commodity price, and (b) the success or otherwise of the ramp-up and production numbers for that particular project. For better or worse.

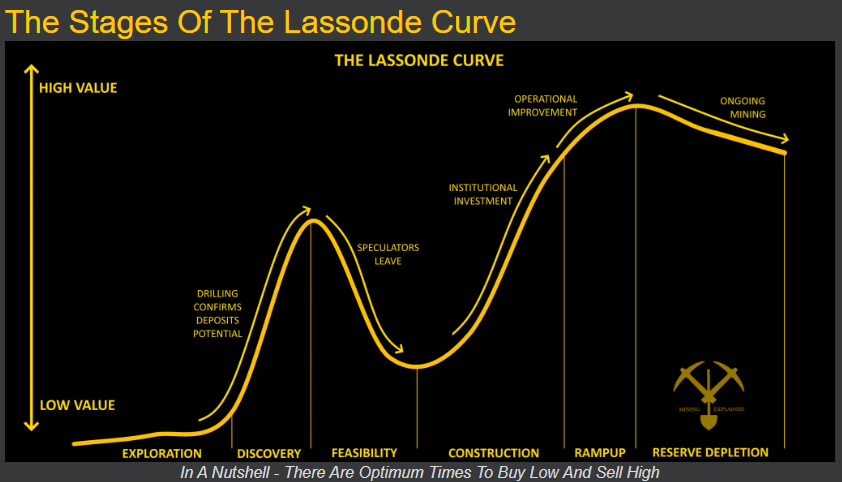

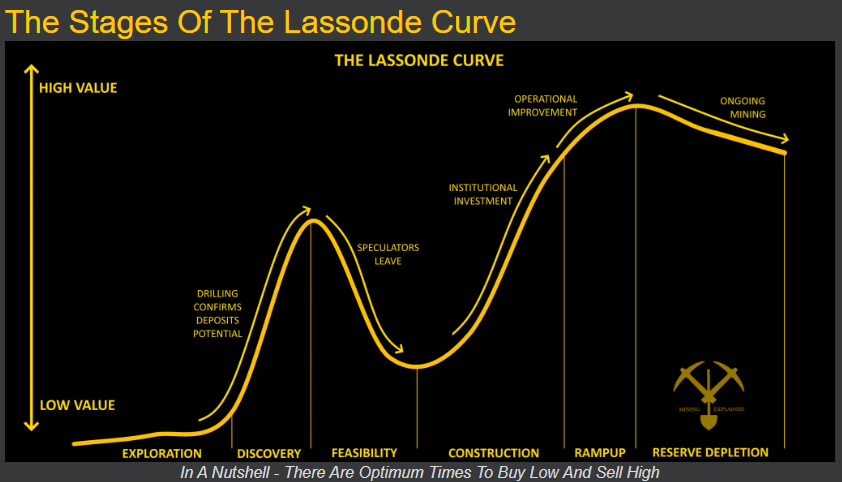

Here's another explanation:

Source: https://miningexplained.com/the-lassonde-curve/

And this explanation is better IMO, in that we see the continued rise during ramp-up, assuming it all goes as expected, and then a drop-off after the plant reaches nameplate capacity and is operating in a steady state - the "Ongoing Mining" phase. That last drop off is typical in my experience, however, again it will depend a fair bit on both relevant commodity price movements and company specific news.

The SP fall can be much worse, with BGL being a good example of that, or it can actually continue to rise instead of fall, as with Hedley Widdup's image in his explanation further up in this post.

My point however is that with the gold price making regular new all-time highs and every minor gold price pull-back being followed up shortly afterwards with another leg up, the perception of risk in some of those Lassonde Curve phases might actually be a lot lower at this point, so the Lassonde Curve might well be less applicable at the moment.

The risk is still there, but may just largely be ignored by many punters, in the current environment.

That said, I have trimmed some MEK this afternoon at 18 cps and rotated that capital across into AAR (Astral) who are due to deliver their Feasibility Study shortly which should result in a material positive catalyst for their share price, as @BkrDzn has explained here recently. Absolutely Not guaranteed of course, but that's the theory I'm working on.

That said, I've let most of my MEK run, so it's still the second largest position in my 5-stock speccy gold project developer companies portfolio, with AAR now being slightly larger, as of this arvo.

The other three companies in that particular portfolio are HRZ, NMG and GG8. GG8 had more great drilling results today.

All high risk because of what they do and where they are in their journey.

My gold producers are held elsewhere in my two larger portfolios.

Of those 5 developers mentioned above, there's only one currently in/on my Strawman.com scorecard / portfolio, and that's MEK, and I am leaving that position as is for now.

As you say @skaex the risk associated with MEK reduces with each step now.