Pinned straw:

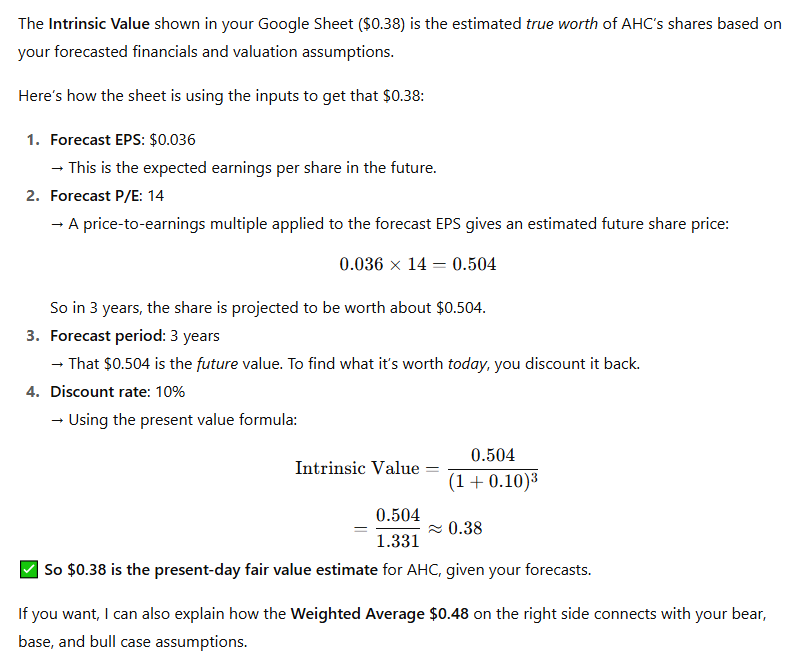

Under accounting standards, the incremental $2.5 million must be expensed through the income statement rather than adjusted through goodwill. While this will reduce statutory net profit as at 30 June 2025, it has no impact on EBITDA.

I'm going to nerd out a little bit here, but this is up there with lease accounting as an example of how bean counters can't get out of their own way. Initially you can provide for the earnout based off a balance of probabilities assessment and that doesn't go through the P&L (the other side of the entry is goodwill on the Balance Sheet), but a subsequent adjustment goes through the P&L? That doesn't make any sense to me. Dude, you got the acquisition accounting wrong, you should be able to fix it. Bean counters would argue that goodwill is sacrosanct and shouldn't be changed on a whim, but that ignores the fact goodwill gets impaired all the time - indeed a reduction in the earnout could be a catalyst for just such a thing. Statutory Accounting often never made a lot of sense to me.

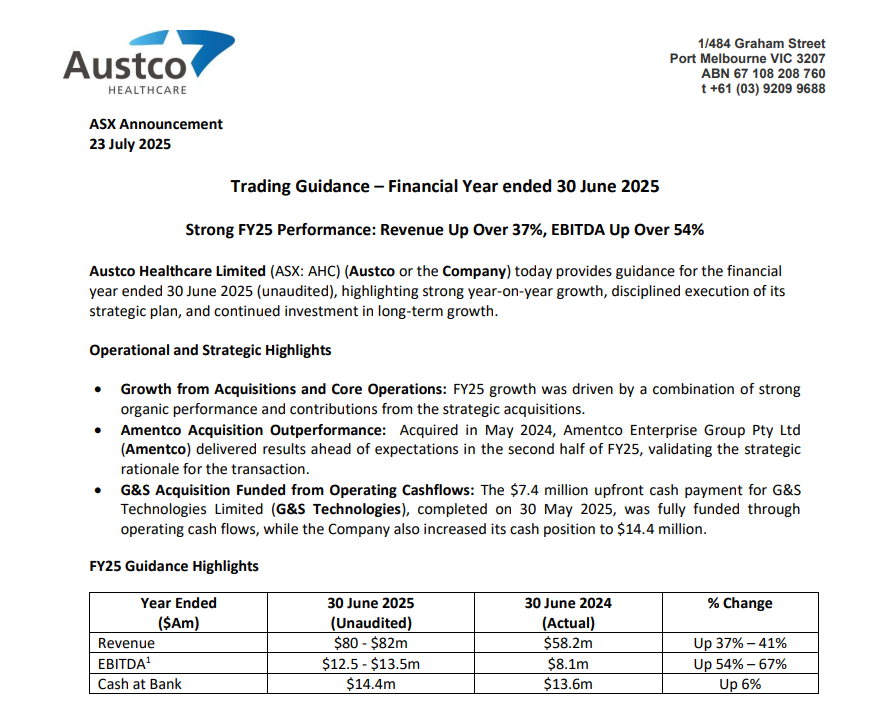

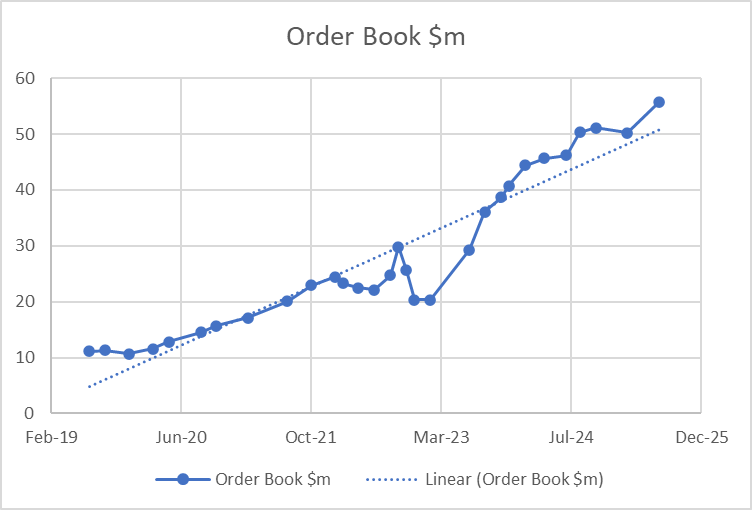

The key takeaway is that it's a good thing they are incurring this expense, it means the acquisition is performing significantly better than they expected. It is cash (and maybe equity) but it's also one-off. Overall, an excellent result. It's impressive they held cash steady from 31 December, despite paying $7.4 million in May for G&S Tech in May and suggests they are converting EBITDA to cash efficiently. Order book up despite a record $13.2 million of revenue booked in June. What's not to like?

[Held]

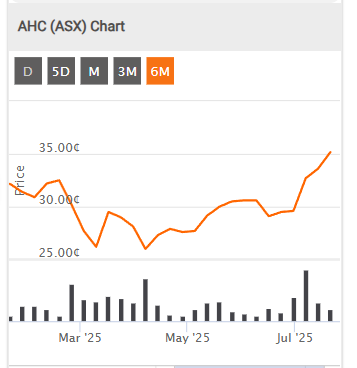

Crackerjack guidance upgrade from AHC.

I'll have to thank @Wini for putting this one on my radar years ago now which I bought then soon after sold. About 18 months ago I realised the error of my ways and bought back in again. At the time this was a big step for me as I had not bought back into a company I had sold out of before. I managed to overcome that cognitive bias. Management seemed to have nailed the capital allocation thing, paying sensible multiples for acquisitions that are turbo charging growth.

Love it. Happy to hold this one.