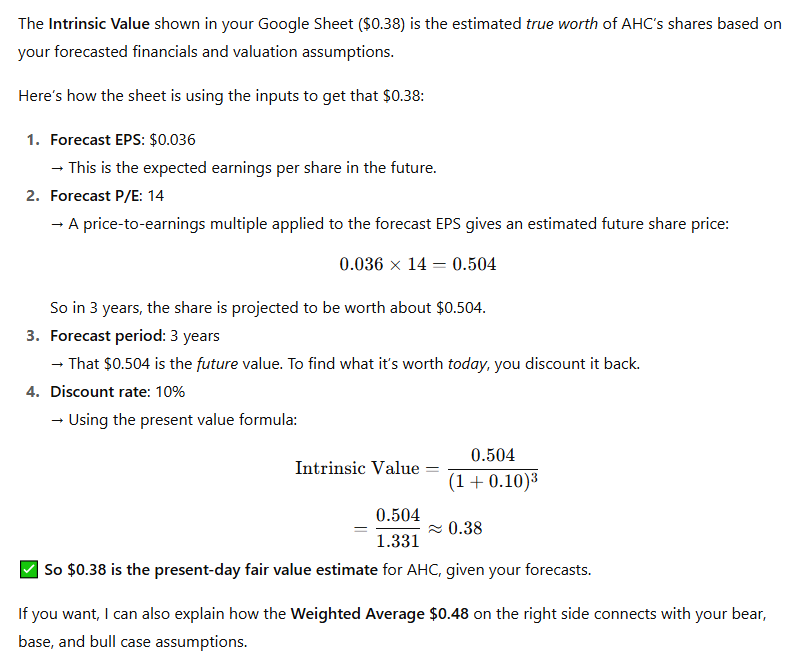

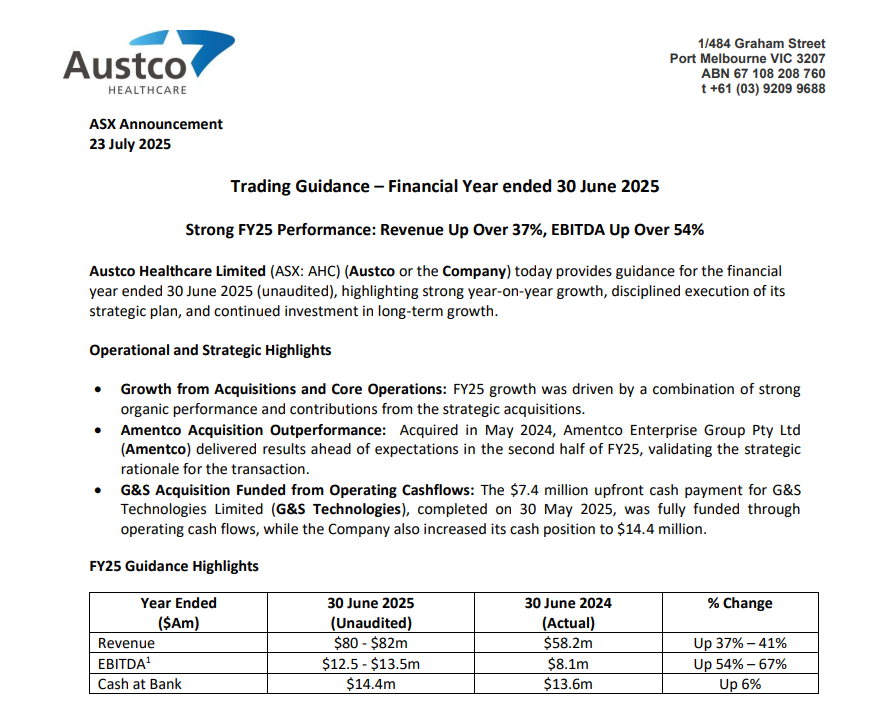

Updated calculation 12th Aug. 2025

My valuation Calculation from 3 weeks ago Just to clarify the projected Share Price $0.504 ( say an eps growth 12% pa)

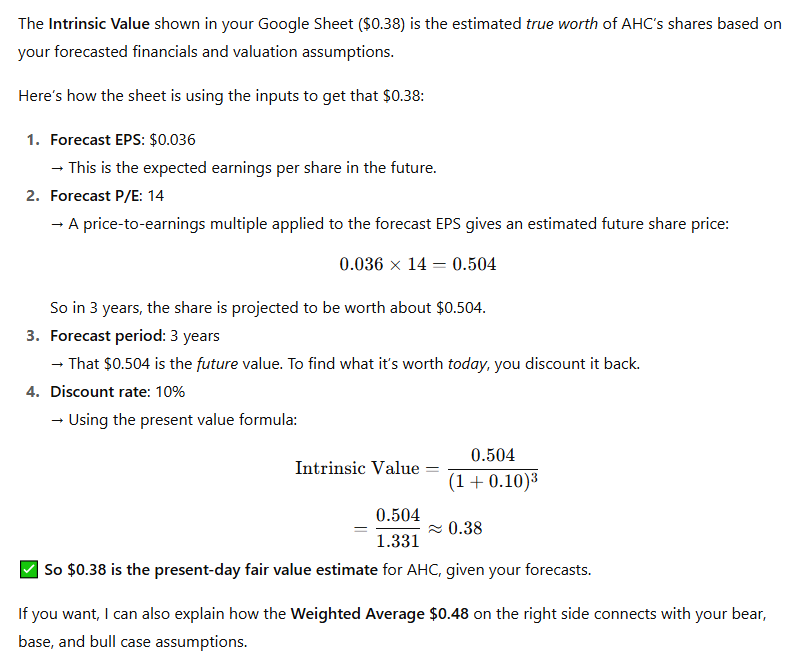

The Intrinsic Value shown in your Google Sheet ($0.38) is the estimated true worth of AHC’s shares based on your forecasted financials and valuation assumptions.

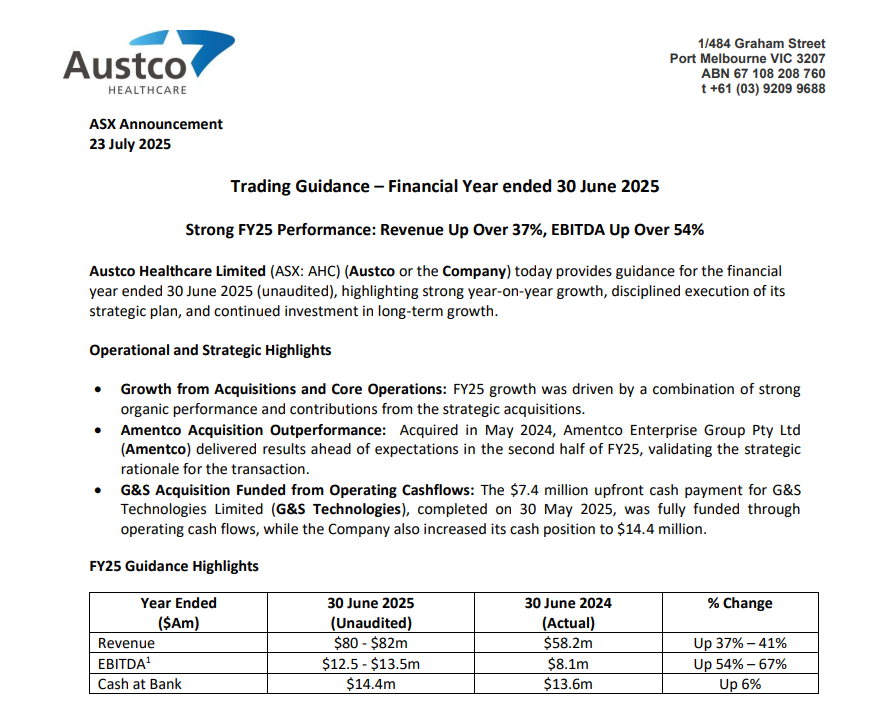

https://hotcopper.com.au/threads/ann-austco-healthcare-trading-update-and-guidance-upgrade.8677109/

think, AHC should be able to scale up the model: support for over 5,000 healthcare facilities worldwide.

Unfilled Contracted Revenue Unfilled contracted revenue currently stands at $55.8 million, up from $50.2 million reported in February 2025. The increase reflects the addition of G&S Technologies to the Group since the last update, as well as continued strong operational performance, including a record revenue delivery of $13.2 million (unaudited) in June 2025. Amentco Earn-Out Adjustment The earn-out period for the acquisition of Amentco concluded on 30 June 2025.

Based on the strong performance of Amentco, Austco now expects a final earn-out payment of approximately $8.4 million, exceeding the previously accrued amount of $5.9 million. Under accounting standards, the incremental $2.5 million must be expensed through the income statement rather than adjusted through goodwill. While this will reduce statutory net profit as at 30 June 2025, it has no impact on EBITDA.

Austco retains the option to settle up to 50% of the $8.4 million earn-out in Austco shares, with the balance in cash. A decision on the option to settle is expected following on or around the release of the audited Full Year Results.

CEO Commentary Commenting on the performance, Clayton Astles, CEO of Austco, said: “FY25 was a transformative year for Austco. We delivered strong double-digit growth, successfully integrated acquisitions, and executed our strategy with discipline. Our ability to fund acquisitions through operating cashflow while maintaining a strong balance sheet reflects the resilience and scalability of our business model. With robust contracted revenue and momentum across key markets, we enter FY26 with confidence.”

The Company expects to release its audited Full Year Results and Appendix 4E on 26 August 2025. Authorised for release by the Board of Austco Healthcare Limited.

Austco Healthcare Limited (AHC) is an international provider of healthcare communication solutions, including nurse call systems, mobile communications, and clinical workflow management. Founded in Australia, the company has expanded its presence globally, with subsidiaries in six countries and support for over 5,000 healthcare facilities worldwide. Austco's competitive advantage lies in its advanced IP-based nurse call systems,

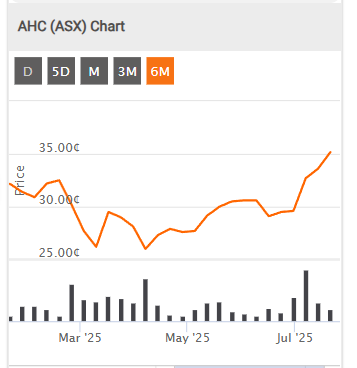

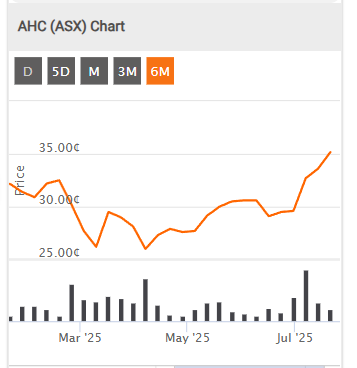

Chart shows a great trend here:

Return (inc div) 1yr: 81.40% 3yr: 54.60% pa 5yr: 40.97% pa