Nice positive 4C update from ALC today. Key takeaways from me:

- Good feeling that ALC is increasingly gaining momentum - steady flow of contract announcements, changing of language to “expansion” is translating to cash flow and should translate to EBITDA

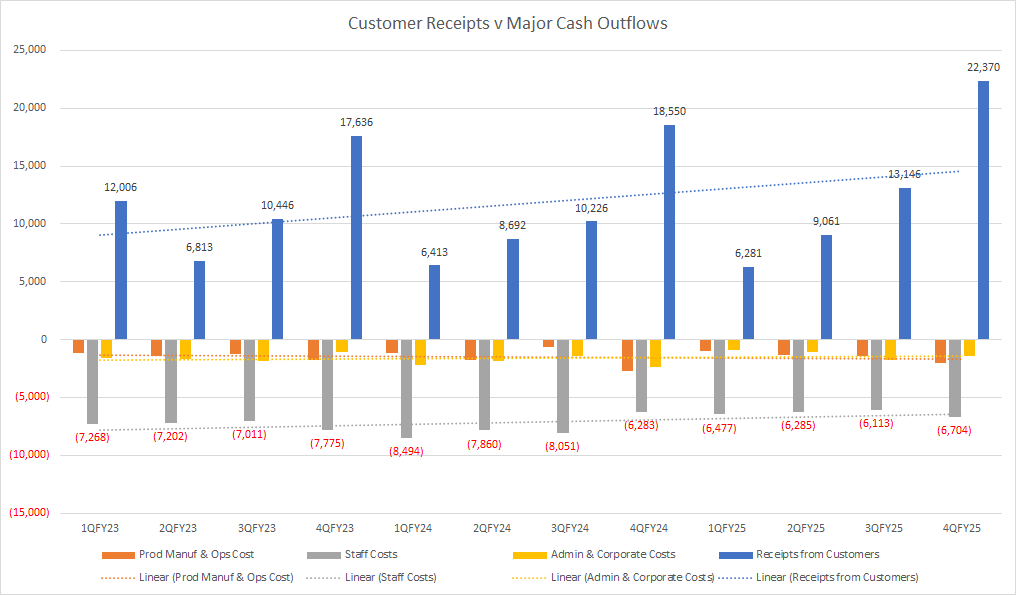

- Really good to see the positive trend and inflection into FY25 positive operating cashflow

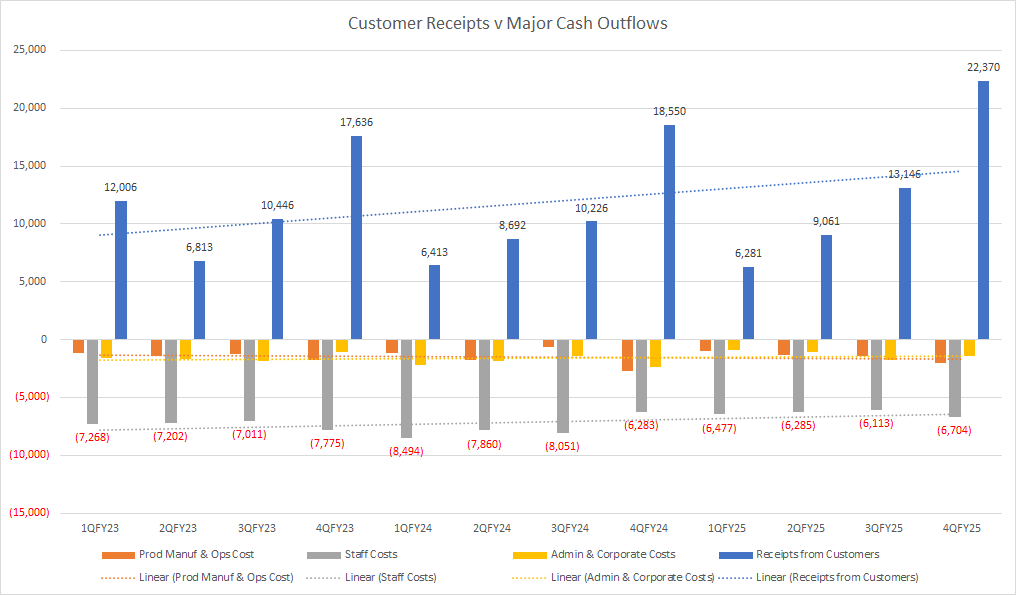

- Major expenses appear to remain on-trend, and thus look like they are under good control

Onward and upward, it would seem!

Discl: Held IRL and in SM

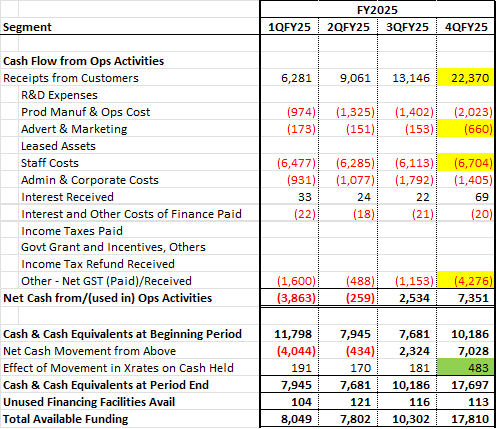

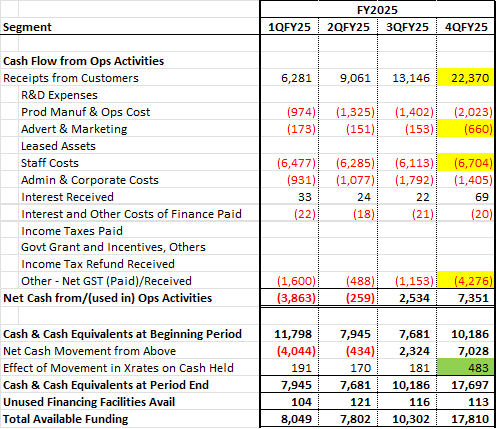

Kate provided good context around the Q4 cashflow which included acceleration of (1) payment of 50% of short term incentives for staff and (2) payment of VAT/GST, both typically paid in Q1. Noticeable Q4 spikes in these cash lines vs previous quarters which should start 1QFY26 cashflows in a good position.

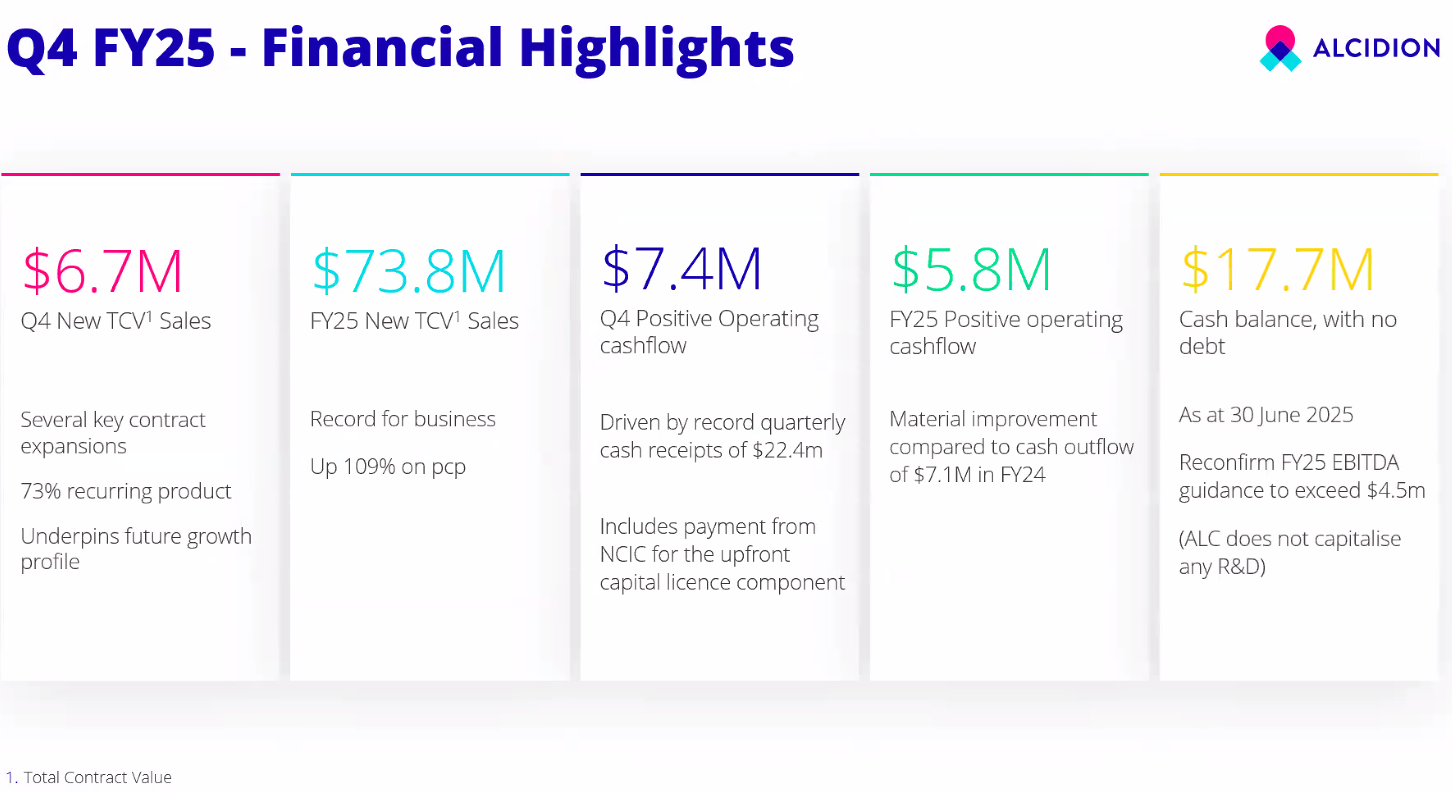

One to watch out for is that ~$8m of the cash receipts for the Quarter were for NCIC capital licenses - this will not recur in Q4FY26 for NCIC, will need to factor this when analysing Q4FY26 cashflows. This caused a bit of distortion with HSN’s 1QFY25 results, so am more weary of these 1-off capital licence sugar hits.

Not inconceivable that ALC used the capital license sugar hit to make earlier payments against STI’s and the VAT, so net, net, the Q4 cash flow result is still a pretty good one. All 3 lines should normalise in the coming quarters.

We had chatter on the forums around the impact of forex on ALC’s revised guidance a month or so back - there is a $0.3m positive FX movement this Quarter, not unexpected given the fall in the AUD in recent months.

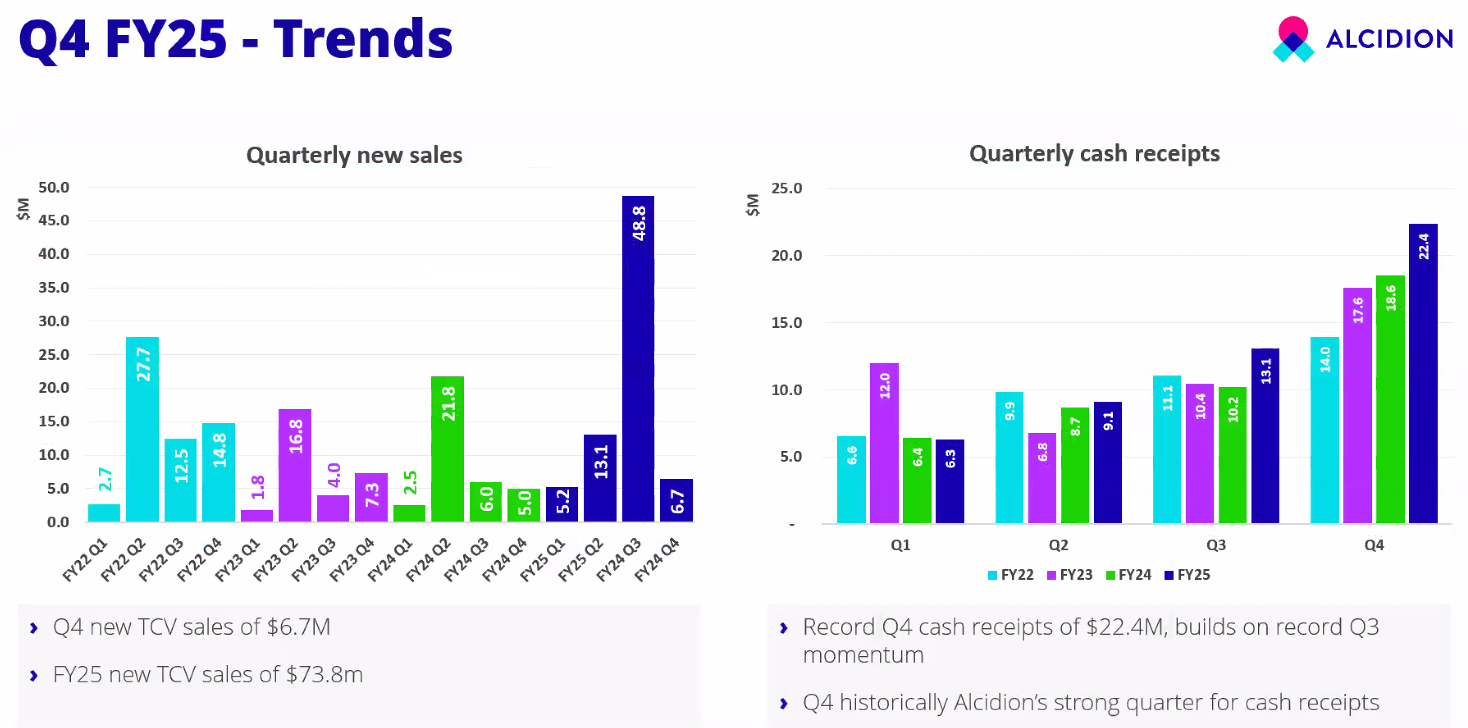

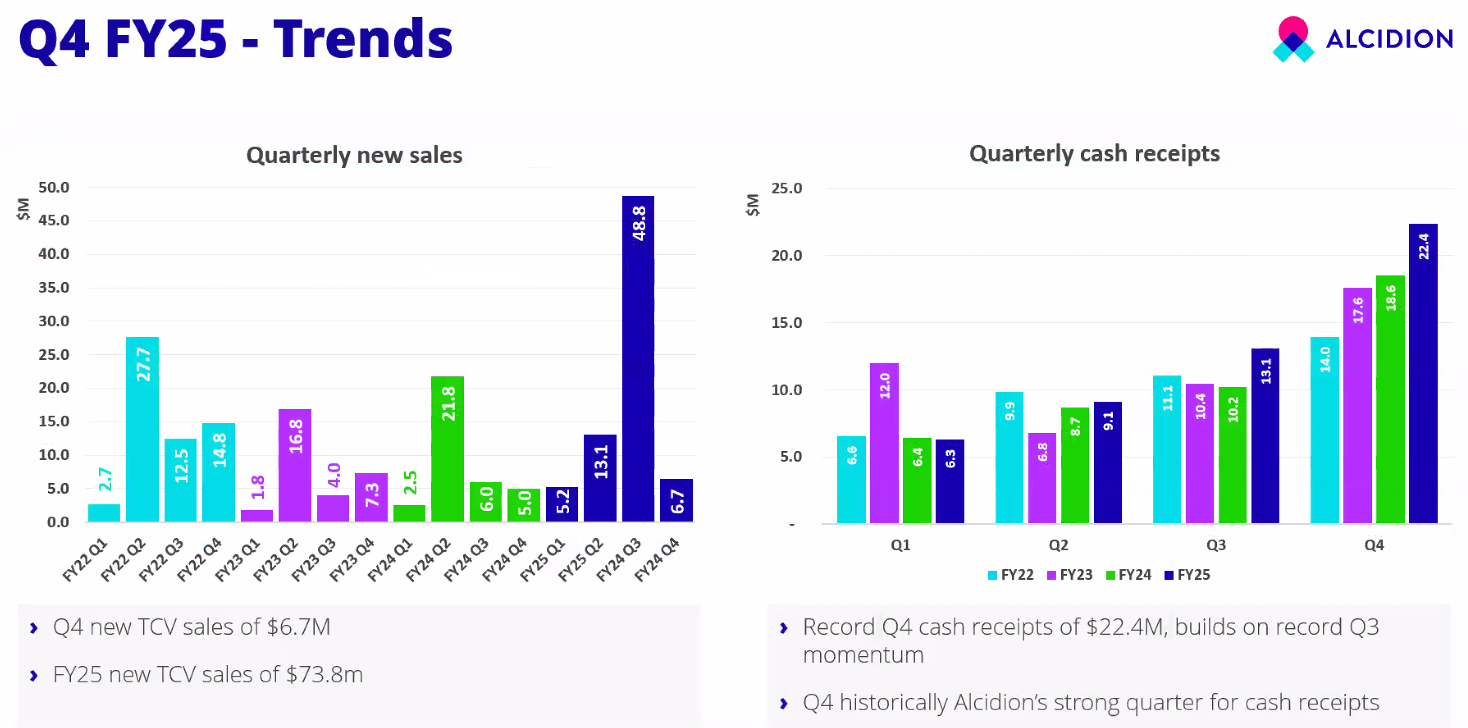

While high Q4 cash receipts is expected, seasonally, what was nice to see is all of FY25 cash receipts swing upwards from FY24.

A sharp above trend uptick in cash receipts which is very nice

No concerns from the key expense lines (1) Prod Manuf/Ops Cost rose to support increasing revenue/cash receipts (2) Staff costs increased as noted above, but is mostly in line with the decreasing/flat trajectory - this feels under control and (3) Admin & Corporate costs fell QoQ - this has also remained flat, on trend

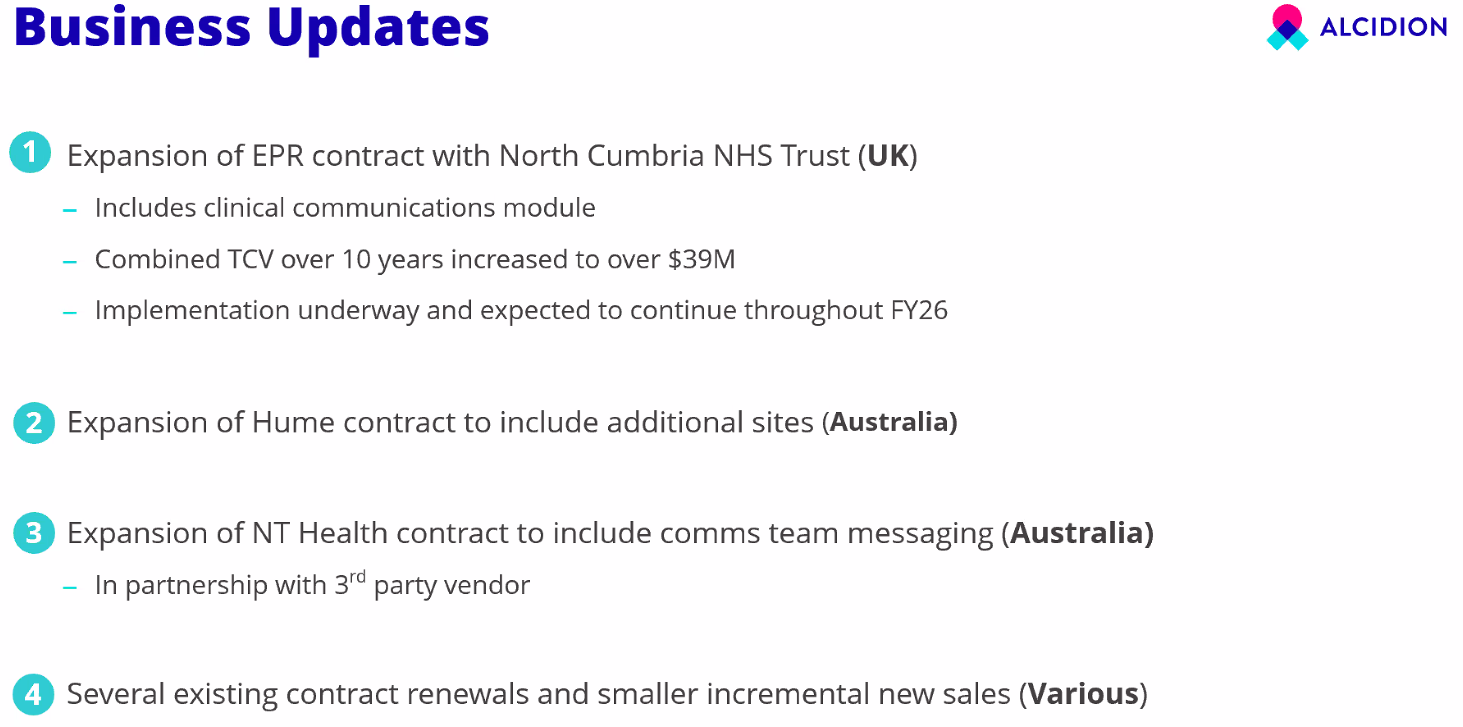

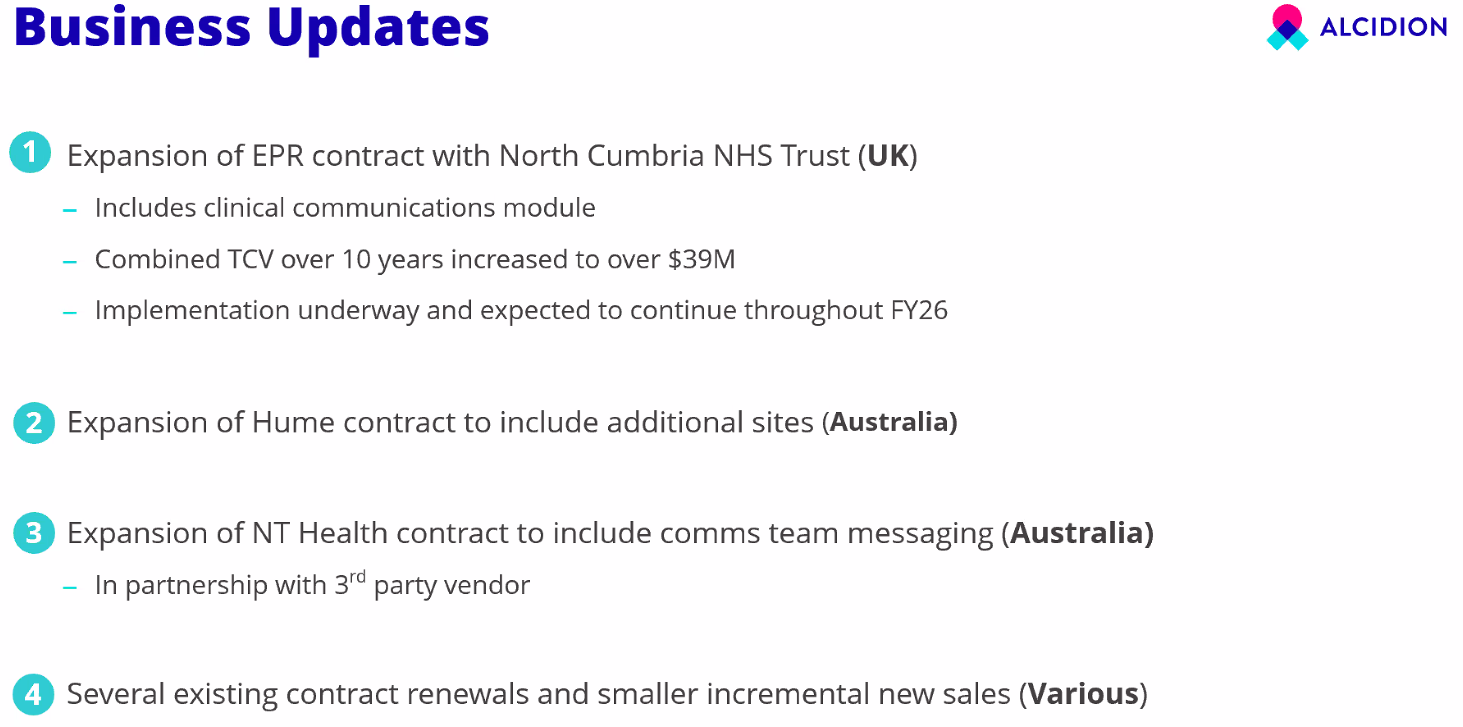

“Expansion” of contracts - a clear positive change this Quarter, indicating that the upselling strategy is gaining traction.

Good mix of expansion and new contracts across FY25 - modular platform is providing the flexibility to tailor solutions for digital health deployment across different customer budgets, readiness.

In response to a question, Kate confirmed that the materiality threshold for contract announcements is around $4m.

There was some mention of implementation delays in UHS and 2 other contracts, but Kate reported that ALC was ready to go, customer-end readiness/issues mostly - given the magnitude of change the ALC implementations will introduce, it is absolutely better to get it right late, than to get it wrong early, both from ALC and the customer’s perspective. Nothing worse than bad rap from a problematic deployment from both.

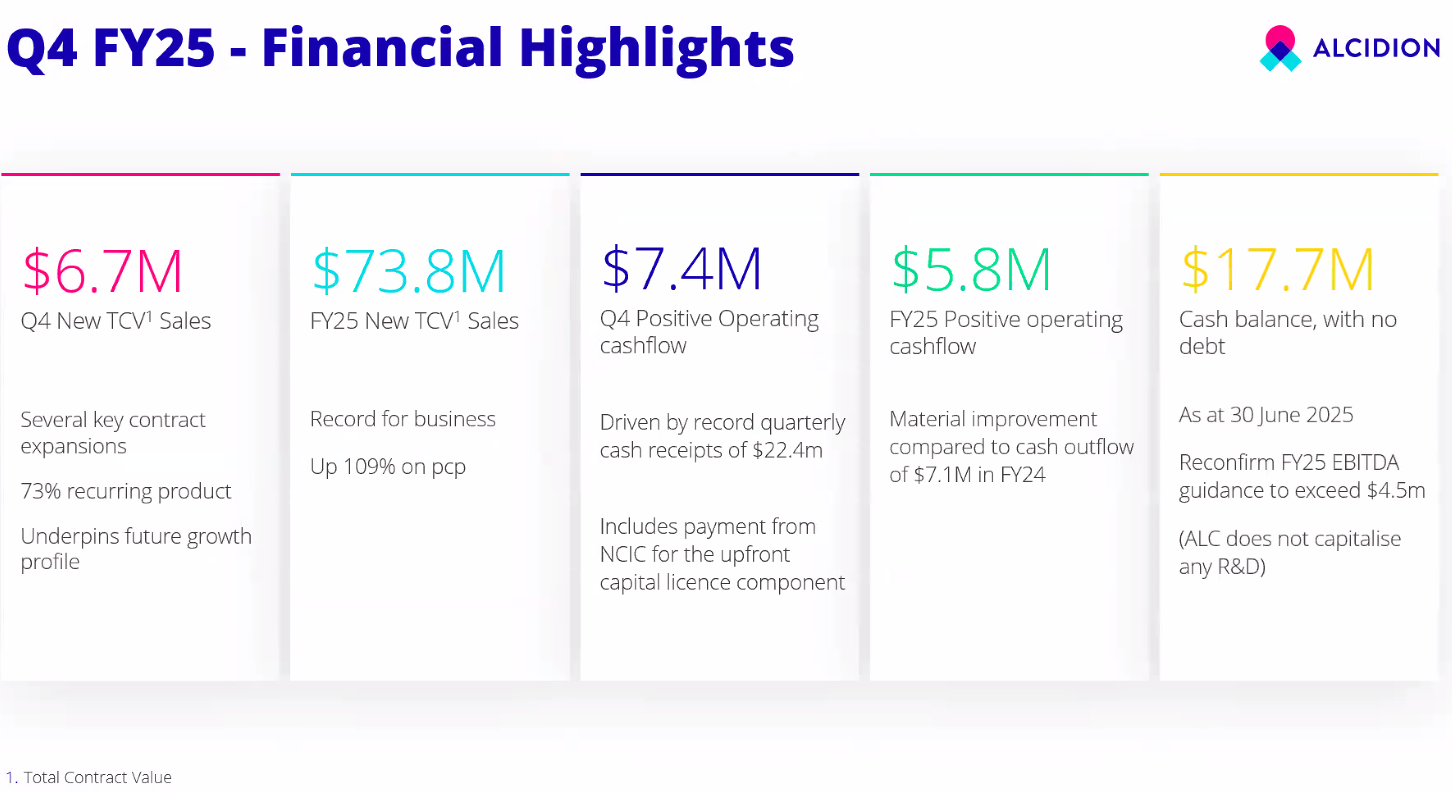

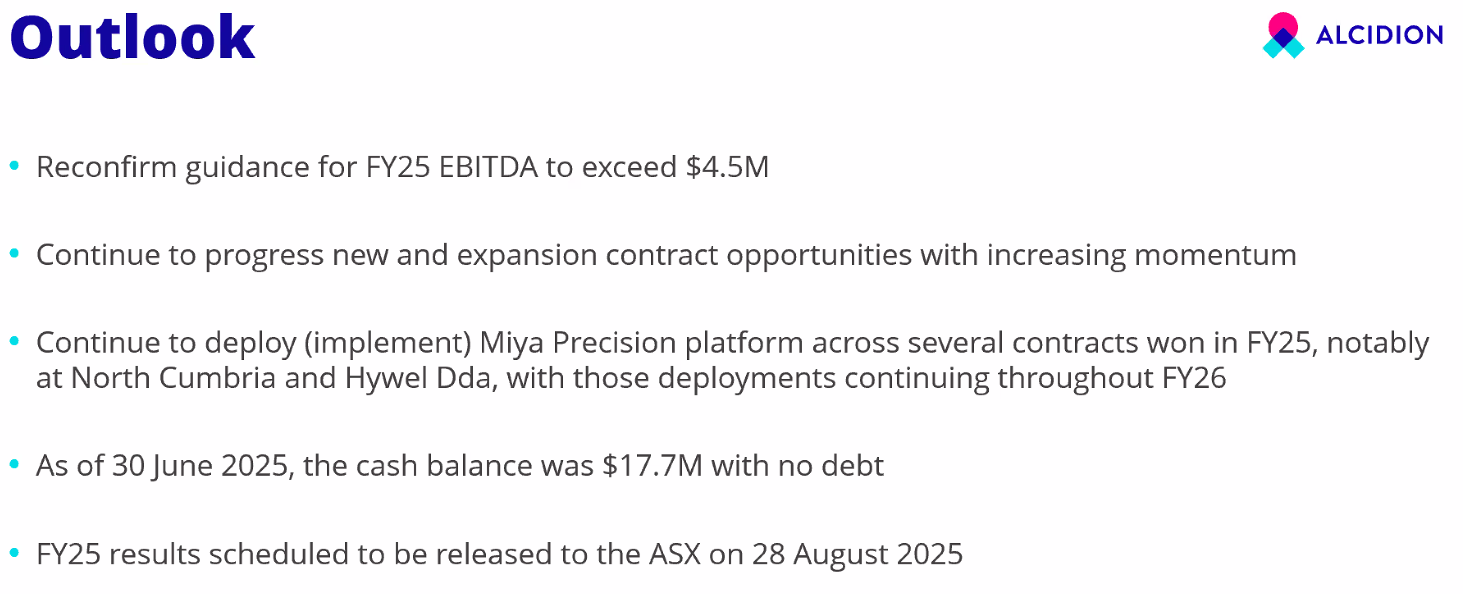

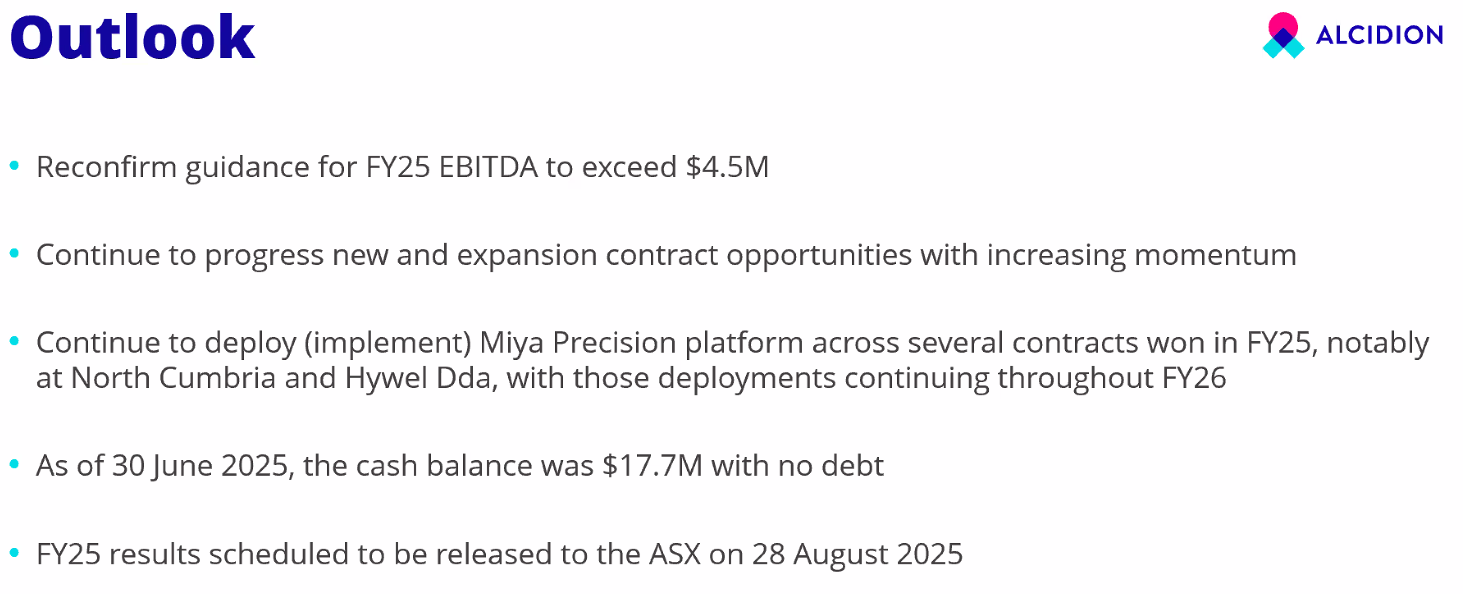

Nothing new with Guidance as this was telegraphed earlier, but always good to see the re-affirmation.

Cash balance of $17.7m with no debt is not shabby at all.

Other Points from Questions

- 27% non-recurring revenue, one-off implementation costs, in the first slide is from Q4 TCV wins only - does not reflect the full-year recurring revenue %

- 15% of the ALC staff base work on delivery projects - a good data point

- Seeing continued NHS commitment to digitalisation - waiting for Phase 2, which focuses on implementation, which is due in Sep 2025

- NCIC upfront license capex $8m, billed in Qtr

- Regional expansion - currently, revenue is roughly half UK, half ANZ - looking at Canada, Middle East as the 2 markets for expansion, South East Asia remains on the radar on a opportunistic basis

- Kate made the point that healthcare organisations are struggling worldwide, ALC is well placed, but they need to manage the balance and focus on upsell opportunities at existing clients, current UK/ANZ focus vs new customers in new regions - makes sense to me, given where things are at presently