Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Discl: Held IRL 1.10% and in SM

Noting 2 recent Substantial Holder sales of ALC into relative price strength. Doesn't look worrying given the small % sales but good to keep a close watch over it.

Firstly, a 0.74% sale of ALC from previous Chief Medical Officer and Co-Founder of ALC, Malcolm Pradhan, taking his holdings from 8.67% down to 7.92%.

Secondly, AustralianSuper has reduced its shareholding of ALC by 1.8% from 11.45% to 9.43% after ~3 years of no movement.

Discl: Held IRL 1.27% and in SM

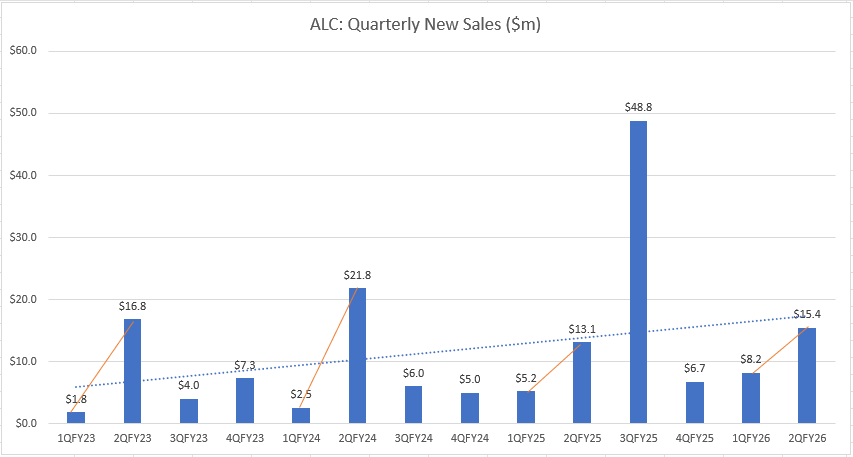

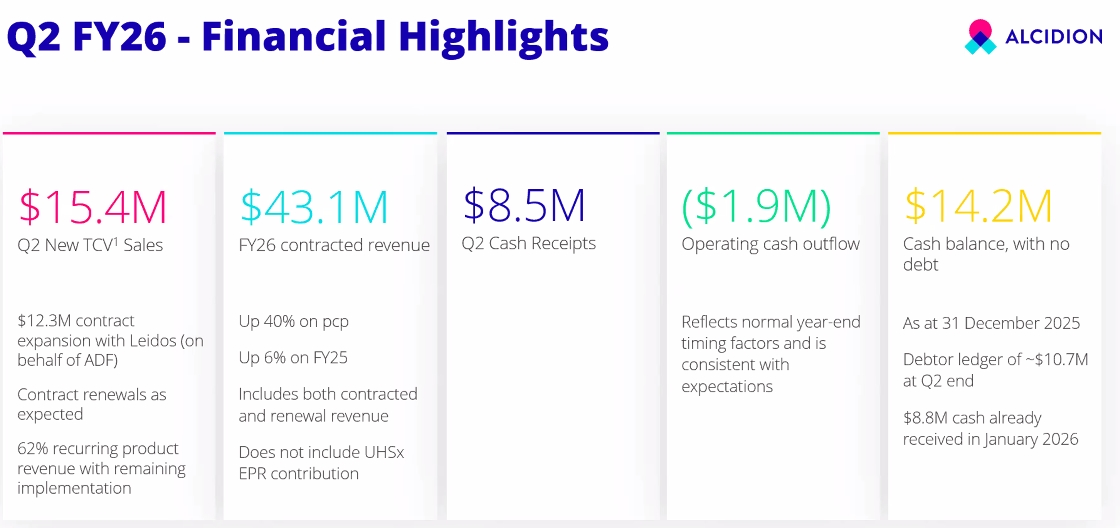

Not a bad 4C from ALC today, mindful that 1H is seasonally flatter than 2H. In reviewing the results, I took the approach of comparing 1H-2H trends in the past 3 years to put this 2QFY26 results in better perspective.

QUARTERLY SALES

- New TCV sales of $15.4m, $12.3m of which is Leidos JP20260 project related which was previously announced

- Excludes the sales from the whopper UHSussex deal, where the contract is currently being negotiated

- The sharp rise in 2Q Sales vs 1Q in FY26 is consistent with that of the past 3 years, but is that little bit more impressive given the higher 1QFY26 sales vs the past 3 years, so no concerns here

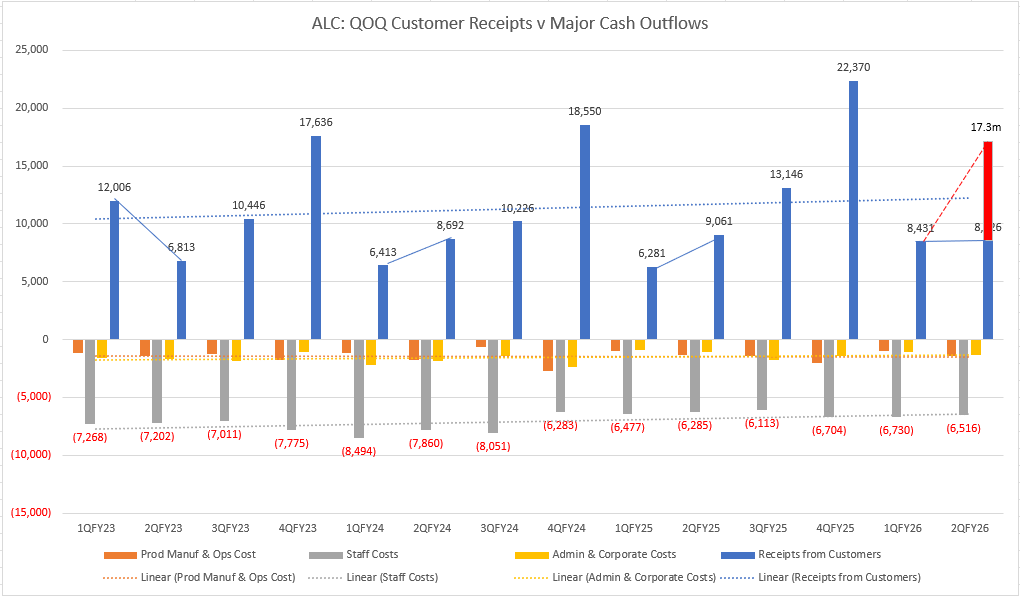

CASH FLOW - No Concerns

- ($1.9m) operating cash flow, $8.5m cash receipts was noticeably flat QoQ vs the past 2 years, but this is purely timing-related

- When adding the $8.8m cash that was collected in early Jan that tipped past 2Q, the cash receipts position (and by extension, the Operating cashflow position) is actually a marked improvement from the past 2 years

- Cash outflows are in line with seasonal 1Q-2Q trends:

- Ops Cost - jump QoQ is consistent with previous 1Q-2Q

- Staff Costs are on trend and generally declining - increased 3.7%, salary increases at ~inflation rate

OTHER KEY FINANCIAL POINTS

FY26 Contracted Revenue is up 40% on pcp but is already up 6% on FY25 at 1H, with a sesonally stronger 2H and the UHSussex deal yet to be accounted for - that is impressive

Cash balance $14.2m, no debt.

NEW SALES

- New sale not previously reported - 3 year Patientrack renewal with NHS Lanarkshire, about ~$1m

- Further info on UHSussex deal:

- 3rd EPR contract for ALC

- UHSussex was a Patientrack customer, with limited existing stakeholders - the EPR deal was won with significantly more stakeholders having to select ALC, reinforcing the significance of ALC winning this deal via a competitive tender in an existing customer

- Kate provided heavily caveated high-level guidance that UHSusex would likely be structured similar to the North Cumbria deal ie (1) ~$2m implementation cost over 24M (2) payment of 7 year licenses upfront (3) the rest being ARR

- The deployment of UHSussex will use existing resources coming off other deployments, may add 1-2 FTE in the UK for deployment, and ~1 FTE for ongoing support, marginal incremental cost is expected

- The UK is now reaching the end of the current 4-year NHS funding cycle, with the new funding cycle kicking in the new UK FY - Trusts are working out the funding possibilities

NEW MARKETS UPDATE

No real updates (1) Middle East - confirmed that there is at least a Patient Flow market, progressing conversation with potential partners (2) Canada - understanding market opportunity and targetting EPR customers

Discl: Held IRL and in SM

Appears to be a nice win from ALC:

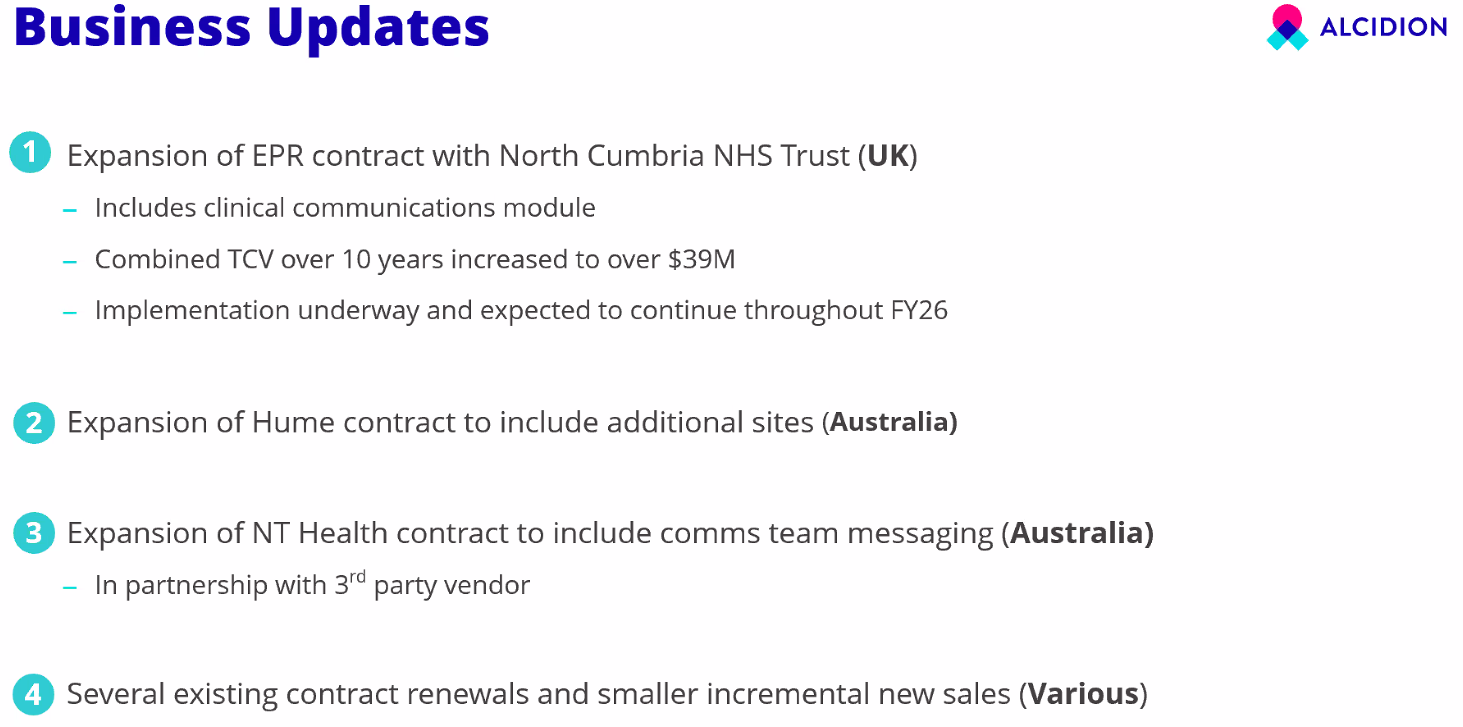

- Very decent 18% TCV uplift from the original NCIC deal of $37.5m in Feb 2025

- Is a great data point that the NCIC deployment should be going OK - companies almost never uplift an IT contract pre-go-live, if the deployment is not going well

- Adds Electronic Document Management System (EDMS) capability into the Miya Precision ecosystem

- Provides another data point on the interoperability of Miya with 3rd party vendors - a good thing

What I am not fully clear with is:

- ALC’s net revenue from the uplift given that Mizaic is a partner with the solution, so a larger chunk of that uplift should logically go to Mizaic

- Margins thereof - should be high as the cost should mostly be around the development work to integrate to/from MediViewer

- Contract upsell opportunities arising - the para below says MediViewer is in 20 trusts today, but it does not say which of the 20 are existing ALC customers - if none are, then MediViewer interoperability could open some new doors or open smaller contract uplifts, if they are existing customers

But any win is a nice win!

Discl: Held IRL and in SM

Had a flick through of the ALC Investor Roadshow Presentation issued by ALC today. I don't normally expect to find anything new but this time, found a few new slides on the Medium Term Growth Strategy and Outlook, slides 27 to slide 32.

It puts a bit more flesh on themes Kate presented at the FY25 results, and looks like the Growth Strategy dry run that is due to be presented at the AGM.

As Phil Collins would sing “I can feel it (M&A) coming in the air tonight, Oh Lord .... "

Finally got a chance to have a closer look at ALC's FY25 results.

Discl: Held IRL and in SM

SUMMARY

There were significant positives in the ALC FY25 results, easily the most positive in quite a few half’s.

- A steady cadence of new contracts were signed in FY25, including the huge North Cumbria 10-year $39m deal - revenue grew 10% to $40.8m, ARR, which excludes capital license revenue, has risen 31% to $28.5m,

- Maiden full-year NPAT 1.65m, maiden full-year EBITDA positive $4.84m, positive EPS of $0.12 - this included a tailwind of $0.9m of forex gains, without which, both NPAT and EBITDA would still have been positive for FY25

- YoY Gross Margin expanded from FY24 86.1% to FY25 88.2% - driven by strong margin of 89.1% in 2HFY25 - given how operating leverage is kicking in, these appear sustainable

- Record year for (1) TCV (2) 2HFY25 highest revenue

- Balance sheet is strong - $17.7m cash, no debt - no concerns other than it might give rise to “M&A ideas”

- Record positive operating cashflow for FY25 of $5.8m, Net positive cashflow for FY25 of $4.9m - driven by record 2HFY25 collection, No capitalisation of R&D spend

- From my own calculations of Rule of 40 - it was big YoY jump of 17.2% from FY24 (6.2%) to FY25 11.0%

- With each new contract win and successful deployments, the Miya Platforms referenceability improves, improving the win probabilities

- Market tailwinds around the increasing urgency for healthcare to move to digitalisation to enhance efficiency remain intact

- Expansion has been flagged (1) Geographically to Canada, Saudi Arabia and the UAE and (2) Adjacent verticals into Aged Care and Community Care

If I had to point out a negative, it would be that the revenue now includes clearer visibility of “lumpy recurring” capital licenses. As these do not recur annually in a linear manner, only when contracts are renewed, and then not for all contracts necessarily, it does add a degree of lumpiness and unpredictability to the revenue stream. This is the same challenge with HSN’s earnings. But all revenue is good, so will just need to adjust expectations to this new reality.

HOWEVER, I have to admit being less excited about ALC turning this corner vs my other holdings. I think this is because ALC growth is now more “steady” than “fast”. It does feel that ALC is now on the cusp of scaling, although it will be more paced/steady and new-contract dependent, rather then rocket-like.

Investment Thesis Is Intact

Having turned the corner and now turning profitability, it does feel like the troubles in the past few years are behind ALC.

Kate summed it up nicely: “ALC has been right-sized and scaled to enable a matured, repeatable model to (1) add new capabilities (2) add new geographies”

This slide is a good summary of why my thesis of ALC is very much intact and I do want to remain invested.

ALC is current a shy of 1% holding in my portfolio, which reflects my excitement and expectations.

Will wait for Kate to reveal the ALC Growth Strategy towards the end of Sept and work out if I should increase exposure thereafter. Am particularly keen to better understand ALC’s expansion plans in term of geographies (Canada, Saudi Arabia & UAE have been flagged) and adjacent verticals (Aged Care, Community Care).

Detail is per below:

------------------------

Revenue and Profitability

The HoH and YoY charts show the following trends:

- Total revenue rose sharply in FY25 with the $8.4m of North Cumbria capital licenses

- Maint & Support revenue was flat HoH and YoY - the contracted revenue from the new sales wins in FY26 have not yet fully kicked in given the timing of when the contracts were executed - only the Hume contract contributed in full in FY25

- ARR has increased 31% to $28.5m - this is before any contribution from FY26 sales - this will underpin the higher proportion of recurring revenue for future periods

- Capital license revenue was broken out for the first time this FY - a good thing from a transparency perspective, but this is “lumpy recurring”, it will recur at contract renewal, rather than annually - this “lumpy recurring” is what the market is still trying to work through with HSN’s results

- The fall in Product Implementation revenue was expected with the winding down of the Leidos Implementation Phase in 1HFY25 - this will pick up in FY26 from the full-year services contributions from the North Cumbria deployment

- Technical Services revenue will remain flat - this is for annual services contracts

- Direct costs have remained very flat

- This has contributed to gross margins increasing to 88.2%

Costs have gone down (1) Fixed costs by 10% (2) Direct costs by 7% as a result of the change in ANZ contracts - this is on a nice flat/downward trajectory

Staffing levels are expected to be similar in FY26, with employee spend mostly focused on Sales & Marketing this year to drive further revenue growth

Which enable ALC to achieve its maiden full-year NPAT and EBITDA.

- 2HFY25 was another half-year record for revenue at $23.1m

- First FY that UK income contribution is higher than ANZ at 63% UK: 37% AU

- Capital Licenses are excluded from Recurring Revenue and Recurring Revenue %

Rule of 40

Used EBITDA and Maintenance & Support, Annual Licenses recurring revenue, in line with how ALC defines recurring revenue, to calculate the Rule of 40

Rule of 40 - big jump of 17.2% from FY24 (6.2%) to FY25 11.0%

Given the current trajectory on Direct Costs, Total Expenses and Total Revenue, expect the Rule of 40 to steadily rise

Contracted and renewal revenue to be recognised in FY26 is $34.0m, representing 83.3% of FY25 Total revenue

- Exploring new geographies - Canada (similar maturity to the UK), Saudi Arabia, UAE (similar maturity to ANZ)

- Exploring applicability of Miya platform applicability to adjacent platform verticals - Aged Care, Community Care

- The UK is moving out of an EPR focus - last major tenders expected in the next 1-2 years

- One of the 3 pillars of the NHS 10 year plan is to move from analogue to digital - this is a key tailwind for ALC, hence the investment in the UK leadership to position for this

- Unclear what funding is to be allocated to this pillar and over what timeframe

- Focus is very much on Patient Flow - ALC well placed for this with constantly increasing referencebility

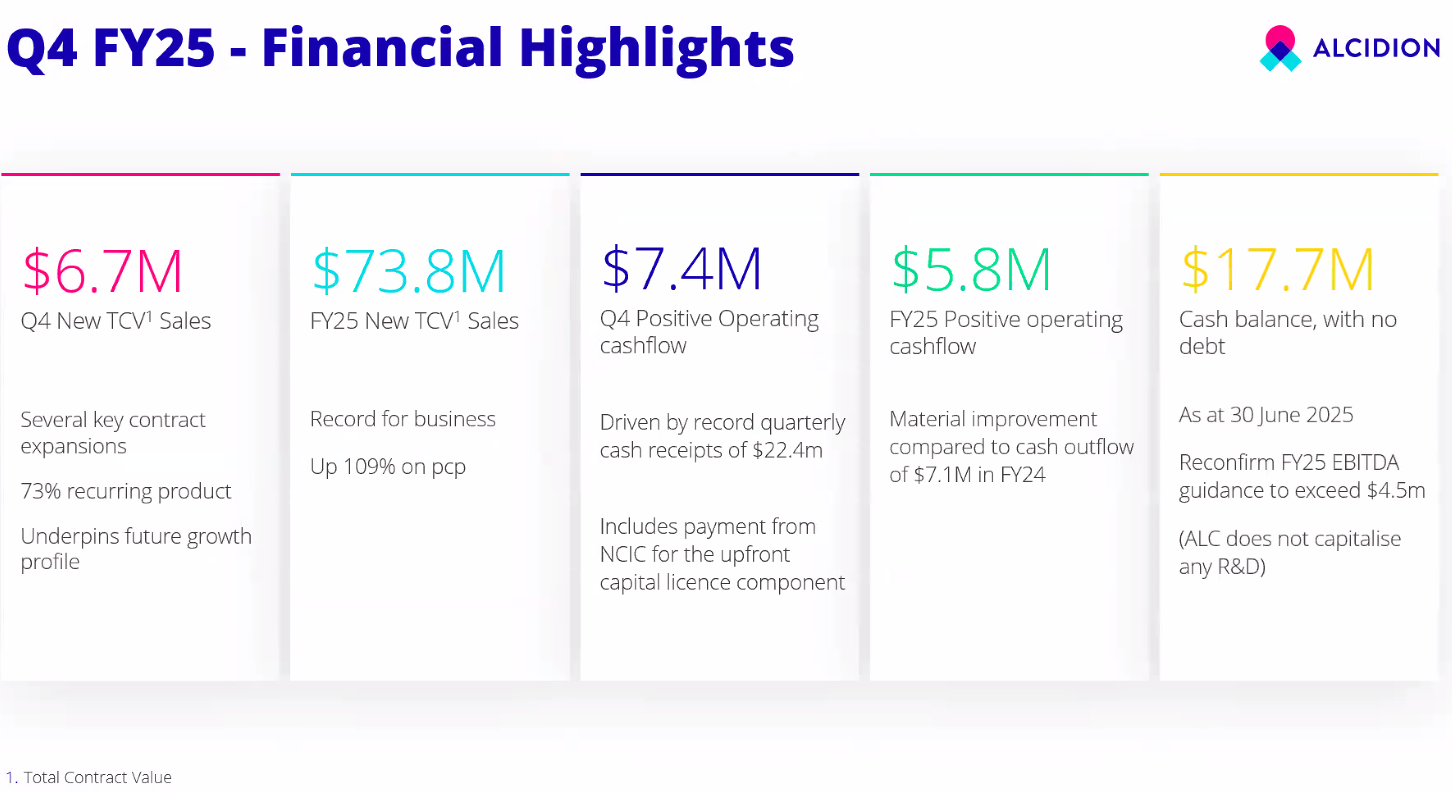

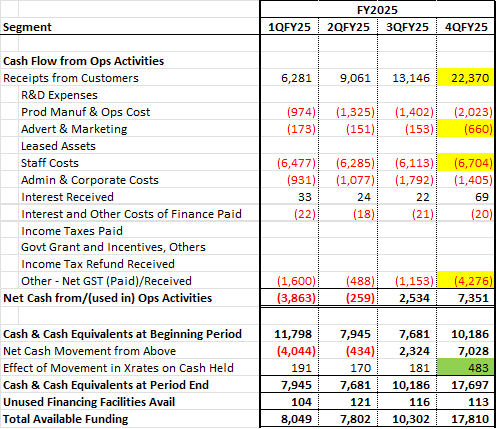

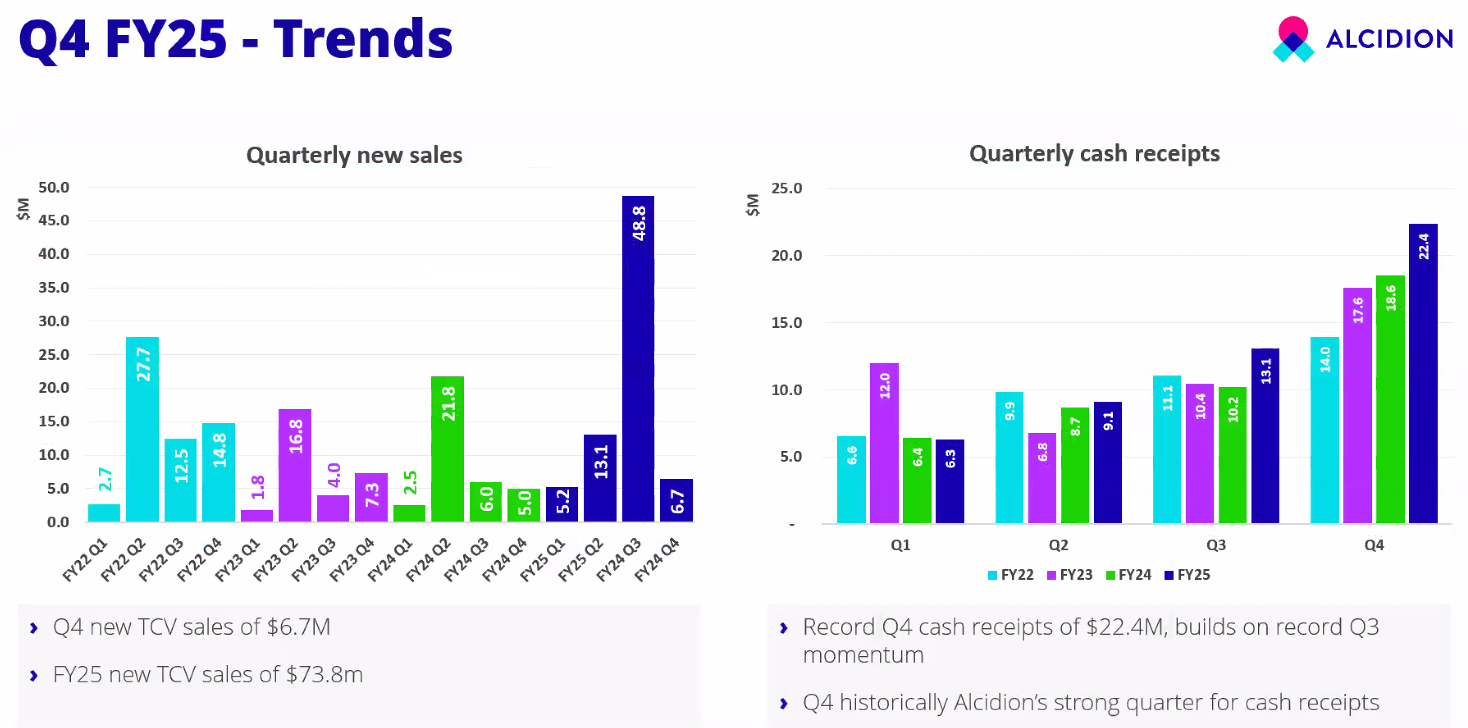

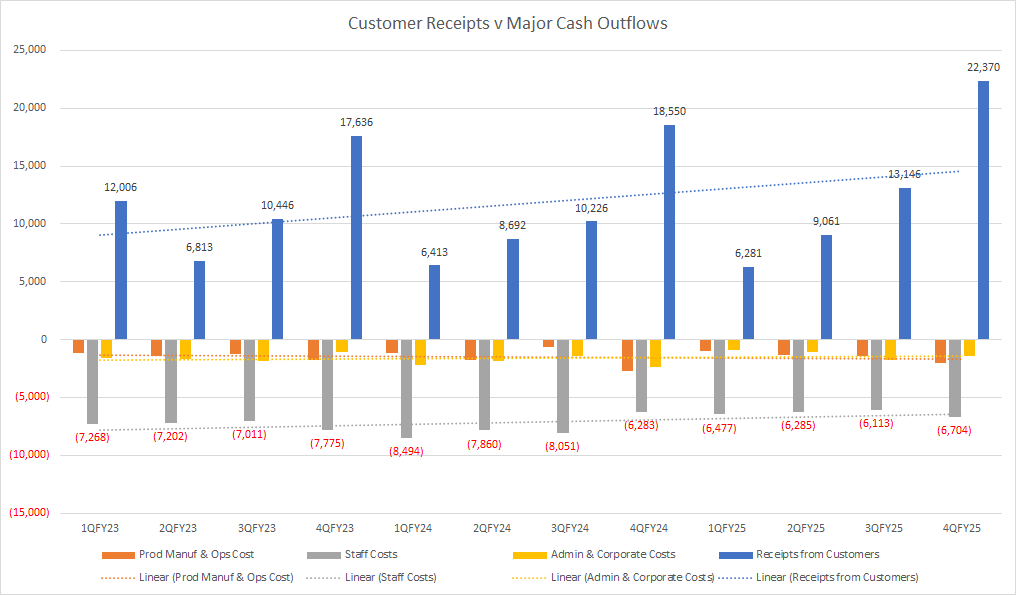

Nice positive 4C update from ALC today. Key takeaways from me:

- Good feeling that ALC is increasingly gaining momentum - steady flow of contract announcements, changing of language to “expansion” is translating to cash flow and should translate to EBITDA

- Really good to see the positive trend and inflection into FY25 positive operating cashflow

- Major expenses appear to remain on-trend, and thus look like they are under good control

Onward and upward, it would seem!

Discl: Held IRL and in SM

Kate provided good context around the Q4 cashflow which included acceleration of (1) payment of 50% of short term incentives for staff and (2) payment of VAT/GST, both typically paid in Q1. Noticeable Q4 spikes in these cash lines vs previous quarters which should start 1QFY26 cashflows in a good position.

One to watch out for is that ~$8m of the cash receipts for the Quarter were for NCIC capital licenses - this will not recur in Q4FY26 for NCIC, will need to factor this when analysing Q4FY26 cashflows. This caused a bit of distortion with HSN’s 1QFY25 results, so am more weary of these 1-off capital licence sugar hits.

Not inconceivable that ALC used the capital license sugar hit to make earlier payments against STI’s and the VAT, so net, net, the Q4 cash flow result is still a pretty good one. All 3 lines should normalise in the coming quarters.

We had chatter on the forums around the impact of forex on ALC’s revised guidance a month or so back - there is a $0.3m positive FX movement this Quarter, not unexpected given the fall in the AUD in recent months.

While high Q4 cash receipts is expected, seasonally, what was nice to see is all of FY25 cash receipts swing upwards from FY24.

A sharp above trend uptick in cash receipts which is very nice

No concerns from the key expense lines (1) Prod Manuf/Ops Cost rose to support increasing revenue/cash receipts (2) Staff costs increased as noted above, but is mostly in line with the decreasing/flat trajectory - this feels under control and (3) Admin & Corporate costs fell QoQ - this has also remained flat, on trend

“Expansion” of contracts - a clear positive change this Quarter, indicating that the upselling strategy is gaining traction.

Good mix of expansion and new contracts across FY25 - modular platform is providing the flexibility to tailor solutions for digital health deployment across different customer budgets, readiness.

In response to a question, Kate confirmed that the materiality threshold for contract announcements is around $4m.

There was some mention of implementation delays in UHS and 2 other contracts, but Kate reported that ALC was ready to go, customer-end readiness/issues mostly - given the magnitude of change the ALC implementations will introduce, it is absolutely better to get it right late, than to get it wrong early, both from ALC and the customer’s perspective. Nothing worse than bad rap from a problematic deployment from both.

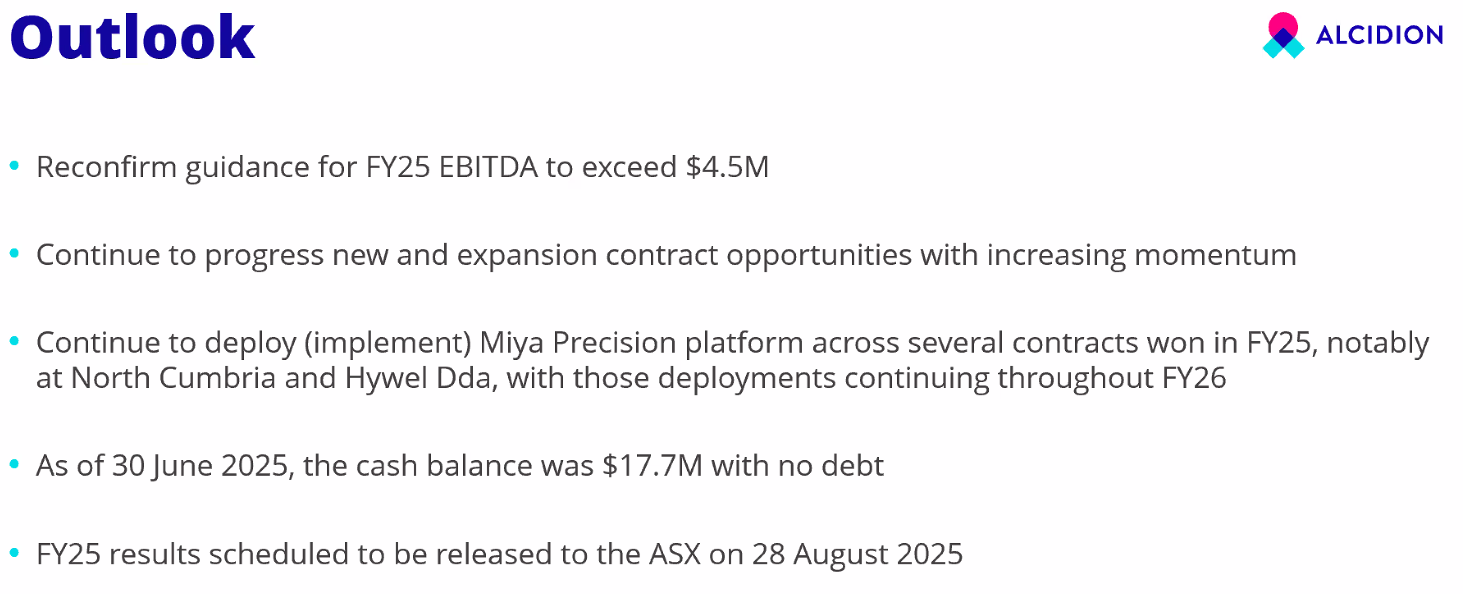

Nothing new with Guidance as this was telegraphed earlier, but always good to see the re-affirmation.

Cash balance of $17.7m with no debt is not shabby at all.

Other Points from Questions

- 27% non-recurring revenue, one-off implementation costs, in the first slide is from Q4 TCV wins only - does not reflect the full-year recurring revenue %

- 15% of the ALC staff base work on delivery projects - a good data point

- Seeing continued NHS commitment to digitalisation - waiting for Phase 2, which focuses on implementation, which is due in Sep 2025

- NCIC upfront license capex $8m, billed in Qtr

- Regional expansion - currently, revenue is roughly half UK, half ANZ - looking at Canada, Middle East as the 2 markets for expansion, South East Asia remains on the radar on a opportunistic basis

- Kate made the point that healthcare organisations are struggling worldwide, ALC is well placed, but they need to manage the balance and focus on upsell opportunities at existing clients, current UK/ANZ focus vs new customers in new regions - makes sense to me, given where things are at presently

Kate sold 5.0m shares from her holdings of 43.6m shares at $0.085, about 10% of her holdings. She still holds 3.2% of ALC, so still good skin in the game.

Not ideal but after 6+ years, she is perhaps entitled to reap some reward for the toil ... this (and Trump) could improve my top up price!

Held: IRL and in SM

Held: IRL and in SM

SUMMARY

With a positive overall quarter, while growth is no longer at eye-watering levels, it does feel like there is steady positive revenue and contract momentum, mostly around Miya Precision/Patient Flow, amidst a relatively stable cost base.

- 2 new 5-year Miya Precision Patient Flow contract wins, 2 renewals, $13.1m sales

- $0.26m net cash outflow from operations, significant $3.0m improvement on cash outflow YoY ($3.37m) and QoQ ($3.86m)

- FY25 contracted revenue $30.8m, exceeding the $28.0m indicated contracted revenue outlined at the FY2024 results announcement - excluding North Cumbria, in final stages of contract

- Confident of a stronger 2HFY25, maintaining FY25 guidance of EBITDA breakeven and cashflow positive

- Cash balance of $7.7m, no debt

OPERATIONS

- $13.1M of new and renewal sales, with the majority being from new customers, with approximately $4.5M expected to be recognised as revenue in FY25.

- Q2 new sales comprised 88% recurring product revenue and 12% non-recurring services (primarily product implementation) revenue

- 2 new 5-Year contracts for Miya Precision via competitive tender:

- Five-year partnership with Northern Adelaide Local Health Network (NALHN) for use of Miya Precision platform to assist with patient flow and clinical operations including messaging, $4.5m TCV over 5 Years

- Peninsula Health in Victoria, which will see our technology help to improve patient flow throughout the hospital whilst assisting clinicians with mobile access to patient records, $3.7m TCV over 5 years

- Won all competitive tenders in Patient Flow in the last 12 months

- These new partnerships continue to validate the strength of our patient flow offering where we now have a material presence across the Australian acute healthcare market.

- 2 renewals:

- Extended ongoing relationship with Sydney LHD, which utilises Alcidion’s Miya Precision virtual care and remote patient monitoring offering

- Signed a two-year renewal for our PCS PAS module with Northumbria NHS Foundation Trust.”

- North Cumbria contract in final stages - this will be a material contract, once signed

FINANCIALS

Modest operating cash outflow of $0.26M, a material improvement on the same quarter last year (outflow of $3.4m), driven by an uplift in cash receipts from new business coupled with continued strong cost management disciplines.

Cash receipts in H1 FY25 were $15.3M with an operating cash outflow of $4.1M, an improvement of $7.3M over the H1 FY24.

Heading into the second half of the financial year, FY25 contracted revenue stands at approximately $30.8M, which does not include any contribution from the North Cumbria contract or other new deals that may occur before the financial year end.

- Exceeds the $28.0m of contracted revenue excl North Cumbria indicated in the FY2024 results announcement

The increased rate of larger contract signings has been the result of the execution of evolving and maturing pipeline opportunities, several of which are still progressing through the tender stage and into the selection stage of the procurement cycle.

We maintain our position of EBITDA breakeven occurring upon achieving revenue of approximately $36.0M and as result of our continued sales progress we expect to be EBITDA and cashflow positive for FY25

Just announced, I'll take this as well!

Would have been better if this was a Trust in the UK, but this looks like a reasonable sized deal to add to the North Adelaide deal last week.

This might warrant taking ALC out of the doghouse, at least for a bit of walkabout ...!

Discl: Held IRL and in SM

Daniel Sharp, ALC Director bought 250,000 shares.

Sounds like a lot but outlay was ~$13k, didly squat, similar to Kate's outlay.

On the back of Kate buying, has this been a Board-wide action to shore up confidence by having each director purchase SOME shares, I wonder?

This feels like another half-hearted, no conviction purchase. Better than zero, thats for sure, but doesnt quite move the dial for me.

Discl: Held IRL and in SM

Following @mikebrisy 's notes, I did a bit of googling to try to get my head around ALC's NHS opportunity. Some notes to add to the pot which was interesting for me, but may be old news for others:

- There are currently 215 NHS Trusts (googled "number of nhs trusts in england")

- A total of 189 trusts have now introduced new EPR systems, meeting the UK Govt's 90% target by end 2023 (189/215 = 87.9% but lets ignore the % for a moment!)

- Therefore 26 Trusts have yet to introduce new EPR systems

- The next target is for 95% of trusts to have an EPR in place by March 2025. The remaining hospitals are expected to go live the following year. https://www.ukauthority.com/articles/nhs-england-hits-national-target-for-epr-roll-out/ (there are many articles, carrying plus minus the same story, stats etc)

- "NHS England is investing £1.9 billion to support hospital trusts to either adopt a new or improve their existing systems. Last year it spent over £400 million to support 150 NHS trusts, and a further £500 million is due to reach trusts this year" (which @mikebrisy has pointed out, there HAS BEEN spend activity)

- To hit the 95% March 2025 target, 204 of the 215 Trusts must have an EPR in place by Mar 2025, so 15 more to go-live in the next 12 months, then 11 Trusts from Mar 2025/2026

- Because the budget is both for new and improvement of existing systems, that STG500m must fund 15 new Trust implementations and presumably, improvements to EPR systems in some portion of the189 trusts that already have EPR's

- There was a STG700m budget cut in 2023 which is presumably the driver to push out the end date to 2026 (and possibly beyond) . HSJ had the following article July 2023 which I could not access, other than the headline:https://www.hsj.co.uk/technology-and-innovation/digitising-all-trusts-by-2025-unachievable-after-700m-cut-government-admits/7035234.article

May 2022 Article below - behind a paywall, managed to dump this out before the super-quick free trial cut me out. While dated, of interest is the list of 27 Trusts, who at May 2022 do not have an EPR. This number coincidentally lines up with the 26 Trusts which need to implement an EPR in 2024-2026 from above, which we can infer from the Nov 2023 announcement.

Essentially, the list of 27 Trusts below, plus minus, is the remaining universe for ALC to implement an EPR in the next 1-2 years. We do not know which of these Trusts ALC are bidding for/chasing and we do not know the contract size of each Trust.

I think I am going to use the list of Trusts below and work out where each Trust is in the procurement process. Kate mentioned that there is quite a lot of transparency in the NHS Procurement process, so theoretically, we should be able to find out the procurement status of each trust that has at least started the procurement process. Each of the 27 Trust which awards to someone other than ALC in the coming months means there is one less Trust for ALC to win. This then puts a bit of a boundary around trying to define the NHS universe that ALC is chasing and how big the remaining opportunity is likely to be.

Would be good if everyone could post any EPR-related updates to the 27 Trusts below as the list must narrow in the coming months.

For me, this extra bit of information more or less lines up with what Kate has been saying, but I previously had no numbers against which to evaluate the extent of the opportunity/ies, the procurement and budget issues and ALC traction.

In summary:

- There has been budget cuts which has impacted the procurement processes and pushed out the overall Govt EPR timeline to 2026

- 26-27 Trusts need new EPRs, 15 by Mar 2025, 11 by "sometime 2026" - this is ALC's maximum possible uiverse

- Each award of these remaining 26-27 Trusts to anyone other than ALC, reduces ALC's maximum universe - this gives us a reasonably finite boundary against which to monitor ALC's contract success and momentum over the next 12-18M

- If 15 Trusts need to go-live by Mar 2025, the fastest EPR implementation that I can google was 5-6 months and the STG500M budget unlocks soon, ALC contract wins need to be rolling in by 4QFY24/1QFY25 and implementation must start 1QFY25, 2QFY25 at the very latest

- If ALC's contract traction remains muted in the next 3-4 or so months, it would mean that ALC's opportunity shrinks to the last remaining 11, by which time, the show could well be over ...

-----------

Almost 30 NHS trusts do not have comprehensive electronic patient records amid a renewed push by government to get electronic systems into all NHS hospitals, according to HSJ research. A total of 27 trusts - across 20 integrated care systems - reported not having EPRs in place when asked by HSJ (see box below). While some of these may use smaller-scale electronic systems in individual departments, several trusts continue to rely on largely paper-based patient records.

NHS England is also pushing for ICSs to reduce the number of EPRs within an ICS to help data flow more freely between organisations when needed and saving time for clinicians who do not need to learn how to use different EPR systems.

Miriam Deakin, director of policy and strategy at NHS Providers, said getting EPRs into trusts was a “significant task” and added it will be “challenging” for the NHS to meet the government’s target.

HSJ asked every NHS trust in England if they have an EPR, and – if not – whether it was currently procuring an EPR.

Although 28 trusts told HSJ they did not have an EPR — representing around 14 per cent of all trusts (excluding ambulance trusts) — HSJ understands that NHSE believes the number of trusts without adequate EPRs is between 35-40.

The regulator is thought to be aiming for trusts to be using EPRs which would achieve a level 5 HIMSS rating, which is an international standard for hospital IT. It is not known how many trusts’ EPRs would achieve a level 5 rating currently.

Several major teaching hospitals are among the 28 trusts which told HSJ they do not yet have an EPR.

This includes Liverpool University Hospitals Foundation Trust, Nottingham University Hospitals Trust, and Norfolk and Norwich University Hospitals FT.

LUHFT said it was currently procuring an EPR as part of a national programme launched last year to improve EPR procurement. In 2019-20, the trust pulled out of its EPR procurement after naming Intersystems as preferred provider.

NUHT said it was using “elements” of one EPR and had “plans to purchase the remaining elements in the next two years”, while NNUH is working on an joint EPR procurement with Queen Elizabeth Hospitals

All the trusts are outside London except Barking, Havering and Redbridge University Hospitals Trust and the Royal National Orthopaedic Hospital Trust.

Rory Deighton, acute lead at NHS Confederation, said trusts’ efforts to roll out EPRs quickly and effectively have often been “hampered by inadequate levels of available capital funding”.

He said the upcoming NHS digital health plan should “commit to providing leaders with the necessary support to roll out comprehensive EPR systems”.

Every trust which responded to HSJ’s questions said they were either in the process of procuring one, or developing a business case to secure funding in order to launch a procurement.

Several trusts indicated plans to run joint procurements for EPRs or align themselves with other trusts in their ICSs.

For example, University Hospitals Plymouth Trust said it was “working with our ICS colleagues, and under the leadership of the ICS, to set out our case for a future EPR for UHP and the wider system”.

Another trust, Stockport FT, said it had “started activities to progress with this key digital ambition for the organisation, working with our ICS, regional and national colleagues”.

Two trusts in Cheshire, Mid Cheshire Hospitals FT and East Cheshire Trust, said they had run a joint electronic patient record procurement and had chosen Meditech as their preferred provider.

The government has sought to get trusts to use electronic patient records since the early noughties, but its flagship programme to deliver this in the 2000s — the National Programme for IT — failed to incentivise trusts to adopt EPRs amid questions over their quality.

Ms Deakin, NHS Providers’ policy director, said procuring and implementing an EPR is “expensive and time consuming, but trusts know it carried real potential benefits for patient care and safety”.

She added: “Trust leaders know that it’s vital to get EPRs right but they are delivering this while overstretched staff are working flat out to tackle backlogs and deliver care to patients as quickly as they can.”

An NHSE spokesman said: “The NHS is focused on supporting local care systems so that 90 per cent of trusts have an EPR in place by December 2023 in line with the long-term plan ambition.”

Earlier this week staff raised patient safety concerns after four hospitals in Manchester suffered a “total IT failure”.

The trusts which told HSJ they lacked an EPR

- Doncaster and Bassetlaw Teaching Hospitals FT

- Worcestershire Acute Hospitals Trust

- Mid and South Essex FT

- Royal Orthopaedic Hospital FT

- Northumbria Healthcare FT

- South Tees Hospitals FT

- Torbay and South Devon FT

- University Hospitals Plymouth Trust

- United Lincolnshire Hospitals Trust

- Dartford and Gravesham Trust

- Barking Havering and Redbridge University Hospitals Trust

- Royal National Orthopaedic Hospital Trust

- Queen Elizabeth Hospital King’s Lynn FT

- James Paget University Hospitals FT

- Norfolk and Norwich University Hospitals FT

- Queen Victoria Hospital FT

- Robert Jones and Agnes Hunt Orthopaedic Hospital FT

- Stockport FT

- Northampton General Hospital Trust

- Sherwood Forest Hospitals FT

- Nottingham University Hospitals Trust

- Royal Cornwall Hospitals Trust

- North West Anglia FT

- Airedale FT

- Mid Cheshire Hospitals FT

- Liverpool University Hospitals FT

- East Cheshire Trust

Source: Information obtained by HSJ

Source Date: April and May 2022

From <https://www.hsj.co.uk/technology-and-innovation/revealed-the-27-trusts-still-without-an-electronic-patient-record/7032511.article>

My notes from this arvo's chat with Kate Quirke, ALC CEO. Have rearranged the notes into logical headers as a lot of ground was covered in the call.

My Thoughts Reflecting on the Call

- Institutions are still backing ALC - Aust Super and new Substantial Holder, Salter Brothers Emerging Companies took a 5.11% stake 2 days ago.

- Walked away from the meeting not feeling that there has been permanent or structural change and that today’s challenges appear “transitional” (for 12-18M) rather than permanent.

@nerdag 's bullish thinking is increasingly resonating. Salter Brothers clearly acted on this.

The only way forward is up (by how much is another question altogether), with a base revenue position of ~$120m over the next 5 years anchoring the viability of ALC. This does not feel like a $0.00 company at all, which is the max loss from here.

Might actually be a very good time to average down - buy when everyone else is fearful. It feels like we are in peak pessimism mode now on what FEELS like a transitonary problematic period.

Discl: Held IRL and in SM

-------------

Summary of Meeting

- A mixed feeling of “defiance” and “resignation” is the feeling I walked away with

- Defiant - ALC is clearly going through a rough patch, as is every other competitor, but Kate remained clear and had high conviction that there is a lot of growth ahead once ALC gets past the current NHS challenges - she flagged another year

- Resignation - doing all they can within what is controllable, will need to be patient for the NHS spend to be unlocked, resigned to the negativity in the meantime, weathering it as best as it can

Overall Challenges

- Confluence of micro and macros issues, compounding each other

- Challenge is acknowledged and FY2024 will not be a good year

- All competitors face the same pressures as everyone is impacted

- Another year to run, after which ALC’s focus will move from Tier 0 hospitals to the more matured Tier 2 hospitals

Downsizing

- Taken $6m out of the cost base

- Comfortable with executing the downsizing now as the focus in the last 18M was on developing repeatable processes as ALC scales, which is bearing fruit with the downsizing

R&D

- R&D has not been sacrificed with the downsizing as - resources to support the ADF contract reached end-of-delivery, creating capacity post downsizing

Cash Position & Cash Forecasting

- $120m of contracted revenue in the next 5 years, business is now rightsized

- Have the ability to forecast cash flow pretty well, very little bad debts

- Expect to sign more contracts

- Capital raise was an “insurance policy” prior to downsizing

- Cashflow positive target will be met after incorporating the cost of downsizing redundancies

UK NHS Activity

- Significant uptick in tender activity

- Budget is severely constrained this year to recover from Covid spend, budget for the next year is looking to be in catch-up mode

- As ALC’s buyers are government buyers, they are driven by/guided by what spend is permitted

- Buying cycle is long as ALC is focused on meeting the needs of Doctor’s and Nurses to increase their efficiency as their primary objective, not the Patient’s needs (who benefit from better service from the NHS)

- The NHS is still a key ALC revenue stream:

- Very significant growth opportunity in a sizeable market funded by the government

- Sale of additional modules to existing NHS customers

- Largest employer in the UK

- Good launch pad to other countries eg. Canada

ALC Platform Competitive Advantage

- ALC’s platform & modular approach allows it to position against the current “moment in time EPR focus” as well as the changing NHS focus over the years - ability to mix and match modules to solve healthcare problems

- ALC has, and will continue to detect emerging trends in healthcare challenges and build the platform response early - the Silverlink acquisition and integration into Miya precision allowed ALC to position itself to solve the current EPR challenges that the NHS is facing

- Have already built in AI into the ALC platform for many years and will continue to incorporate elements of AI

M&A

- A lot of increased M&A activities/opportunities, but is not ALC’s focus at the moment, still very much focused on organic growth and demonstrating the value from the ALC platform

- ALC is at a reasonable level of scale already, presently

Competition

Nerve Centre in the UK

- Main ALC competitor in the NHS, a small company based in the Midlands and is doing well in the UK

- ALC is more focused in the North of the UK

- Nerve Center is only now just building a Patient Admin module - need a proven reference case in NHS tenders

- ALC has the advantage of a ready-to-go platform and has modules in areas where Nerve Center does not

Telstra Health in Australia

- “Copying” ALC

- Is trying to be all things to all people - still trying to work out its unique proposition

- Acquired a lot of companies, has a different architecture, different technology stack

Other Opportunities Discussed

- Management of Medications - lots of localisation and legislative requirements required, EPR players in Australia already have a module for the large hospitals, remain open to this

- Aged Care - very poor state of IT, but profit margins in the sector are too thin to make investing worthwhile

On Hindsight

- Would have executed downsizing earlier but they had to find the right balance against the then-reality of NHS moving at pace - classic IT company conundrum

- Would have combined Silverlink and Miya solutions earlier

- Better marketing of the business and value proposition and would have spent more time in marketing to counter the massive marketing teams that ALC’s competitors have (their competitors are also laying off people)

Post a valuation or endorse another member's valuation.