“Shoot First, Ask Questions Later”

Today, probiotic brand $BIO announced its 4C. I took one look at it, and seeing a favourable “buy/sell” queue at the market open, sold my entire RL position, and I’ve just put in the order to sell on SM too.

Why would I do such a thing? I didn’t even have time this morning to attend the Webinar (although I would ideally have preferred to have done so, and I will watch the recording when its available)?

To answer that question, I’m not going to do a complete analysis of the quarter. Most things appear to be going well, with a logical progression of things I’ve written about at great length before. So, to save everyone’s time, I'll get to the point.

Reason 1: Inventory.

Reason 2: Inventory – how it was accounted for in the 4C.

Basically, a “Red Flag” (two actually) for me was raised today, in an area I have covered amply in previous straws. So, I was looking out for it.

Basically, Q4 saw a large build in inventory. Of this, $1.643m was accounted for as Operating Cashflow, and $1.295m as Investing Cashflow.

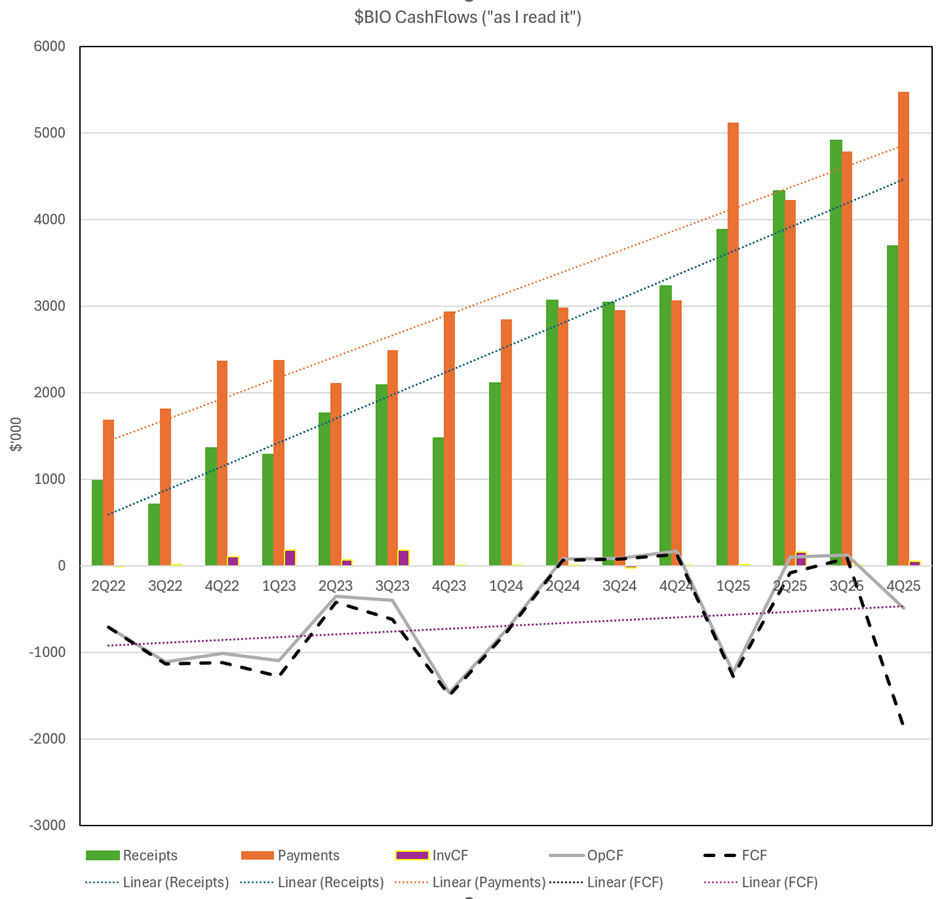

So, let me plot the 4C in two ways. Figure 1, “as reported”, and Figure 2, “as I read it”.

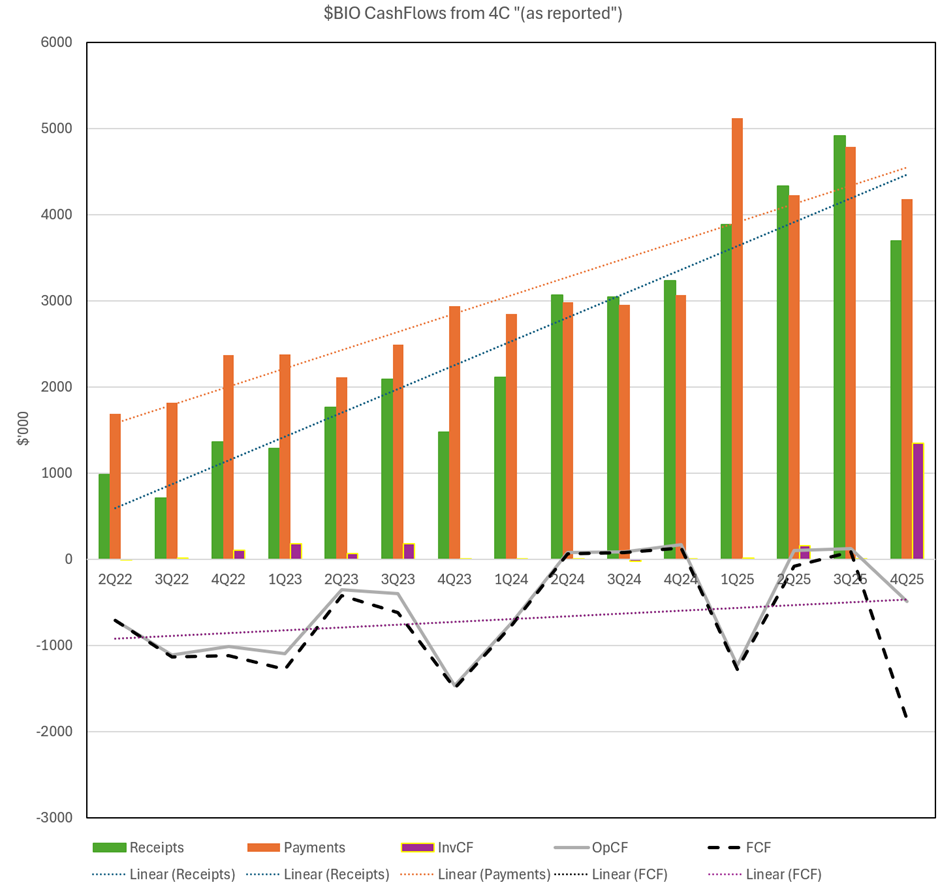

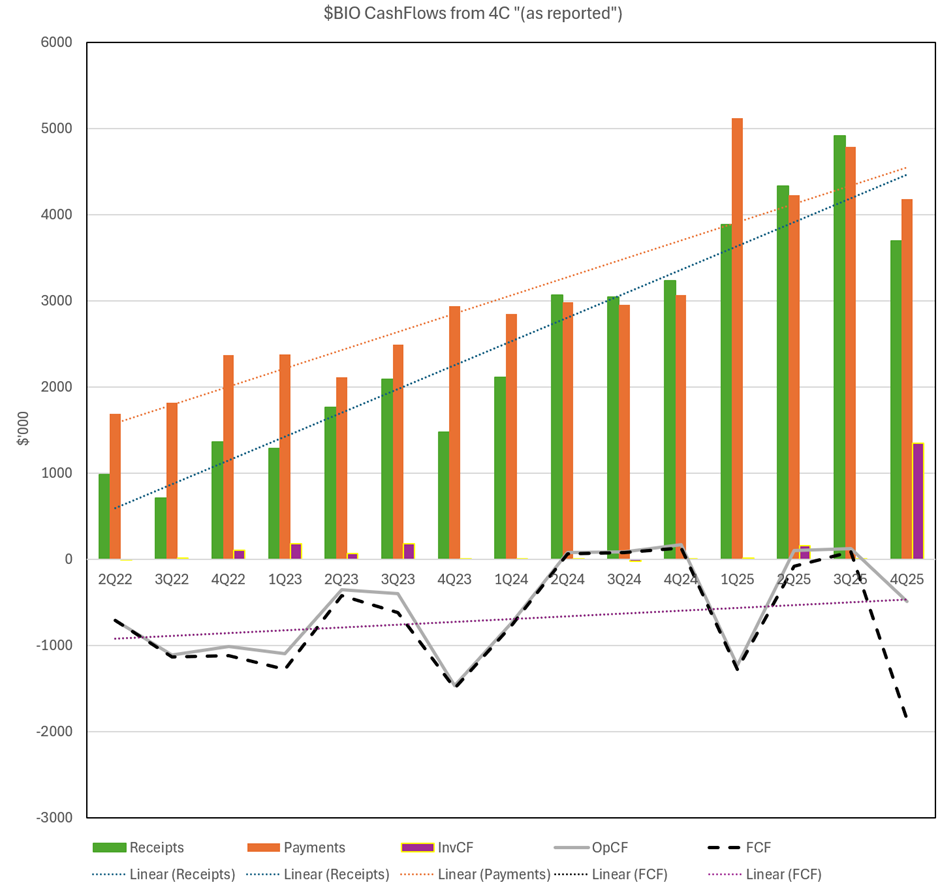

Figure 1: $BIO Cashflows from 4C (“as reported”)

Source: 4C report

Looking at the fifteen 4C report since IPO, prior to today, all inventory building has been classified as an “Operating Cashflow”, which is pretty normal – particularly in what I consider as a fast moving consumer goods operation.

So, one might think (and I certainly do) that putting a material chunk of inventory into “Investing Cashflow” for the first time ever would warrant an explanation. Well, here’s what was said.

- In the headlines … crickets. Oh, but “Net Operating Cash Outflow of $485 in Q4” OK, that’s not a problem because Q4 tends to be the weaker quarter for receipt.

- In the body of the report: “Within the quarter Biome made key strategic investments to support medium to long-term growth in both Australian and international markets. The highlights were the launch of Biome’s new range of products, Activated Therapeutics, an inventory-build to support FY26 growth, an investment in key international markets and the Activated Probiotics Symposium, a once-in-three-year customer education event.” [my emphasis added]

- … and a little later …… “The Company also drew down $1.3m from the NAB trade finance facility for investment in additional inventory to fund future sales growth and to maintain gross margin.” [my emphasis added]

- … and later still … “Payments for inventory and fulfillment was $1.643m, plus an additional $1.3m investment in safety stock. The company will maintain its working stock circa $3m while actively managing its level of safety stock, taking into consideration expected future sales growth, and seasonal, logistic and production factors.”

I don’t like the reporting of inventory build in this way. Building inventory, including safety stock, is completely normal and continuing part of any operation. And generally, as sales grow, the inventory and working capital to support it also grows. Safety stock (certainly as I have taught to over 600 MBA students over a decade) is an important working capital component of an operation. It has to be managed carefully, and it a critical and unavailable part of any operation.

Importantly, inventory also grows as a company expands to more regions (as $BIO has), as you need to hold more pools of inventory close to the market to support sales and customer service.

And inventory also grows the more product lines you have. (Again, as $BIO has, particulary with the whole new Activated Theraputics range.)

Therefore one of the key measures you have to monitor in the growth of any fast moving consumer goods company, is the growth of inventory. Because it consumes more and more cash as sales grow, geographies are expanded, and product variants proliferate. This has been a failure moce for many high growth FMCG businesses in the past, and no doubt it will continue to be in the future.

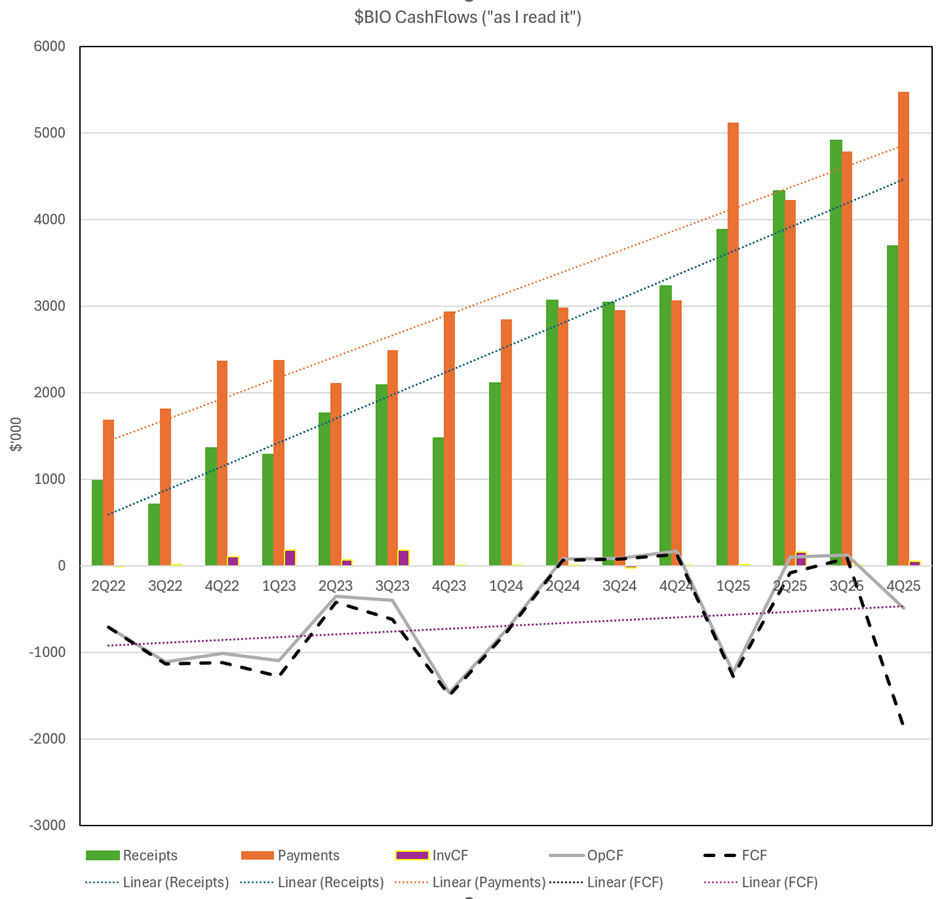

So, I don’t consider the inventory build as an Investing Cashflow. I see it as an inevitable part of the operation. And so, I have restated the 4C chart “as I read it” below in Figure 2.

Figure 2: $BIO Cashflows (“as I read it”)

This now gives a very different view as to the respective slopes of the “receipts” and “payments” dotted trend lines driving “Operating Cashflow” as I have redefined it. It is a very different picture between Figure 1 and Figure 2.

And for me that’s what today’s report is obfuscating. The operating leverage is not as strong as it has hitherto appeared. But this wasn’t a shock for me, I have been monitoring this factor over several 4Cs, and if you go back and read some of my earlier Straws, you will see I called it out. But I did not expect to see the magnitude of today’s number.

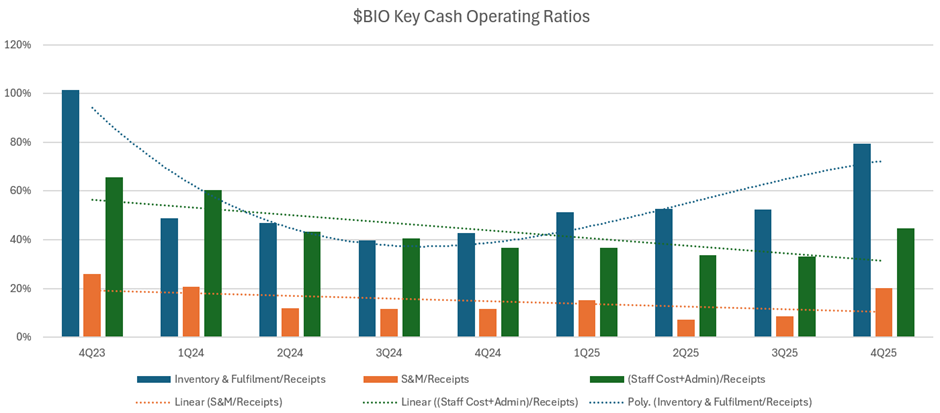

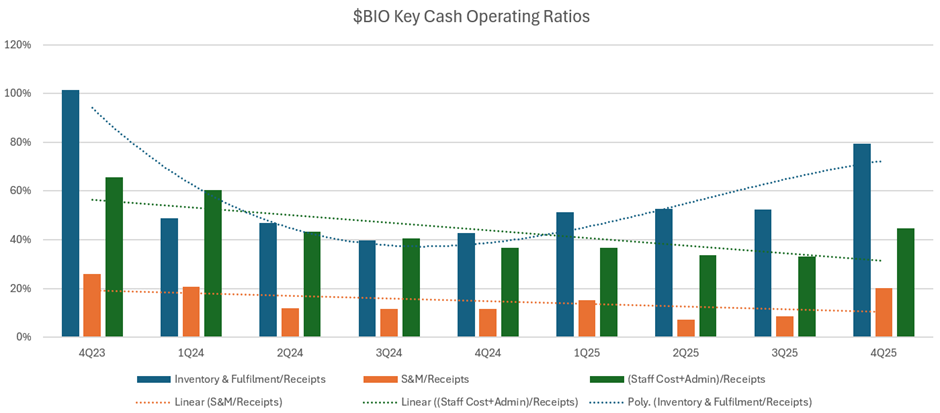

To provide another lens on this, in Figure 3 below I have plotted some other operating ratios.

Figure 3: Key Operating Ratios

Source: 4C reports. Note - all inventory build has been classified as “Operating Cashflow” for the purposes of this report (This differs from the reported basis).

What this picture tells me, is that up until mid-FY24, $BIO’s operations appeared to be scaling quite nicely. However, more recently, the trends have flattened out and – certainly on some metrics – seem to be going backwards.

This is critically important. Because it means that the bigger $BIO is getting, the weaker the cash operating margins are becoming. That’s why it is a thesis breaker for me.

I first invested in $BIO in July 2024, just before the 4Q25 report. My thesis was based on a view that the business would develop more favourable economics as it scaled. Five quarterly reports later, and on each of the three operational ratios plotted above, the opposite has happened.

When I invest, I am investing in an “economic engine” and I want to see – over a series of reports – evidence that the economic engine is building and becoming stronger. I can’t see that here, and therefore I am out.

“Shoot First – Ask Questions Later”

But I didn’t do all this analysis before selling this morning. All I saw was that inventory was up significantly, and that a large chunk of it has been classified as an “Investing Cashflow” with a rationale I found unconvincing and unprecedented.

(As this point, I will recall $FNP or $NOU as it is now called - those who have followed my work over the years might recall it. I have written about this before, because it was an example of a low margin foods business that got into all sorts of trouble with inventory management as it tried to scale. It was my worst $ASX investment ever, and I have written at length about it before. The big lesson I took from that event was how important it is to track inventory metrics in high growth, consumer good manufacturers. I didn’t then, and I paid dearly for it. Now I am not saying $BIO is another $FNP/$NOU. Definitely not. But when I see adverse inventory trends, as well as “reporting oddities”, that’s a double red flag for me.)

So for me it was a case of “shoot first, and ask questions later.” I have exited my full position for more or less what I paid for it. Whew.

Have I over-reacted? Quite possibly. But today’s report adds to a trend that goes against everything I know (and teach) and have experienced to my personal financial detriment.

I hope I am wrong and that over coming reports the business continues to go from strength to strength. If the facts prove me wrong, then I’ll be happy to get back onboard. But I think that, even in the success case, this is going to be a slower burn than I had initially hoped. That, combined with its microcap "fragility", fundamentally changes the risk-reward equation for me.

Finally, I didn't need to do all the analysis that I've presented in this post, because I was looking for the effect. Why? I had three questions on my risk register:

Q1: Is the quality of growth in Australia holding up, as the business matures in this market?

Q2. How dilutive to the operating leverage is getting going in NZ, UKI and Canada all at the same time?

Q3: Is the Activated Therapeutics line (a profileration of SKUs which I view as departing from the core science thesis), actually a good idea? More SKUs, more operational complexity, more inventory etc.

I don't know the answer to these questions. But the summative effect doesn't look good to me....at least in the short term.

Disc: Not held in RL and SM