HSN

HSN

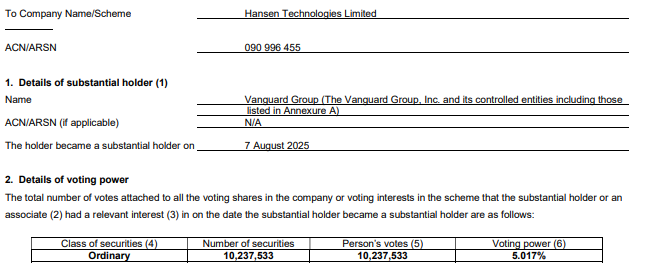

Vanguard 5.017% Stake

Pinned straw:

Hi @jcmleng - I thought Vanguard ONLY did ETFs - one of the largest ETF providers globally and their founder, Jack Bogle, is credited with being the inventor of ETFs - I was unaware that Vanguard did any discretionary investing outside of ETFs - as the world's original promoter of ETFs - Jack used to say "Why look for a needle in a haystack when you can just buy the whole haystack?"

If that's still the case, Vanguard's position movement could just be the result of passive fund flows.

12

@jcmleng Having been bullish and on the verge of buying in at circa $4 last year, I am now, once again kicking myself.

Coulda, shoulda, woulda.

Well done to those that did.

9