I attended the $AVH webinar this morning. @jcmleng I assume you saw it too?

While there wasn't much new information from last week's results, I found it useful and have 2 additional significant takeaways:

1. Existing and new clinical data expected in the next year will really drive US sales, including account conversions.

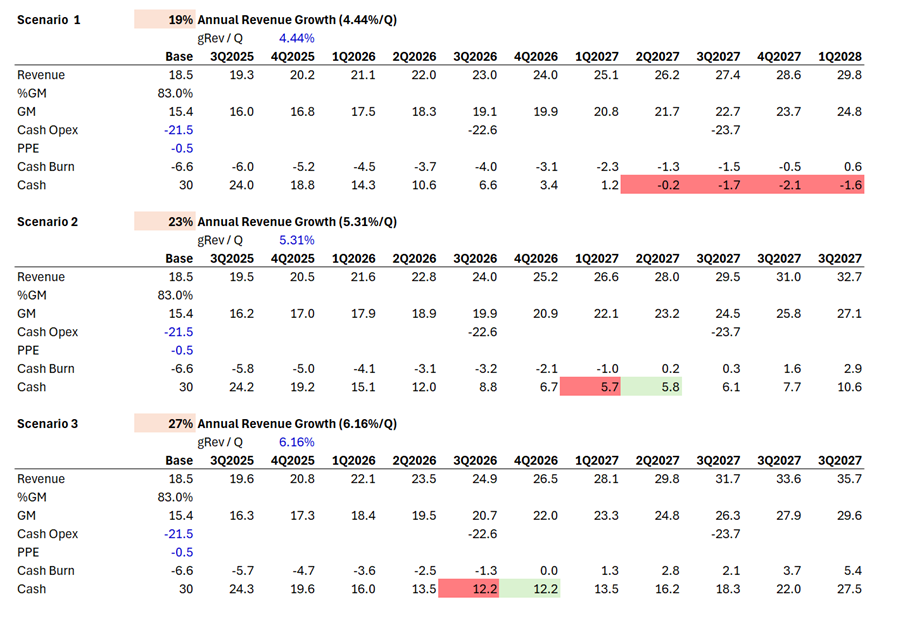

2. Additional Insights on Cash Position - even though there is every likelohood (based on my analysis) that management misses Q2 2026 cash breakeven, the $30m funding should be ample, unless revenue growth only makes the bottom end of guidance. Some details disclosed by the CFO really helped me to firm up my own model and foreacsts.

In detail then:

1. Existing and new clinical data expected in the next year will really drive US sales, including account conversions.

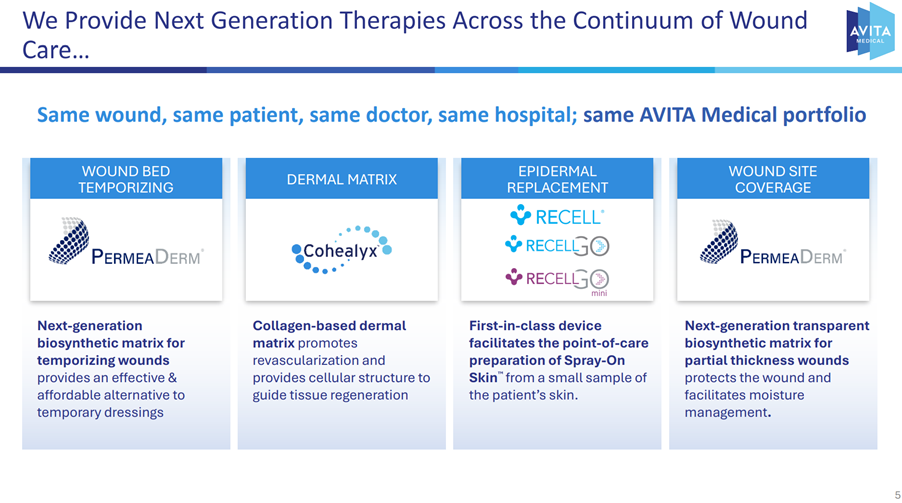

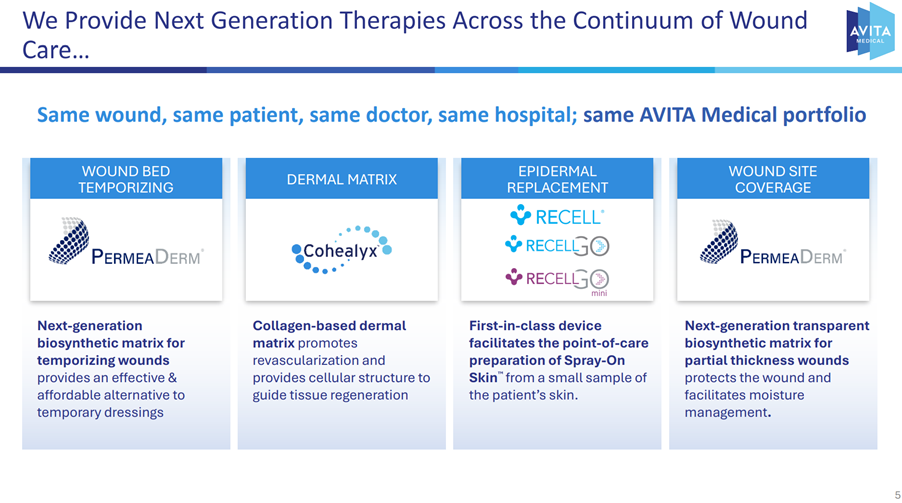

I think it was the best (clearest) summary I've heard Jim give of the products from a surgeon's/patient's perspective, as well as restating the economics.I've dropped a couple of the key slides at the end of this Straw. (If they don't publish a recording of the webinar and if there isnt a transcript, then I can post a link to an audio recording I made if anyone wants it.)

With the focused (i.e. small) clinical studies for Cohealyx (# days better than competing dermal matrices) and Permaderm (cost vs. allograft standard of care) and the recent British Burns Association study on 6300 patient for the -36% less time in hospital for ReCell (to drive burns market penetration up from 20-30% to much higher), the sales reps are going to be armed with compelling data to convert accounts across all levels of burns and trauma acute care. $AVH really could pull off a very potent "one stop shop".

There are significant risks here for $IART and $PNV. $ARX is less exposed (as they have a more diversified product range and have more for internal reconstruction as well as more chronic wound management). Of course, each of these are driving and will be promoting their own clinical data. However, I think $AVH might overall have the edge here.

The emerging $AVH clinical strength combined with the slowing $PNV international sales has significantly undermined any chance I have of a developing a renewed thesis in $PNV. Initially, given 2H stabilising growth in Q2, I was open to taking a fresh look when I get to see the FY financials in a week or two, given that $PNV is now starting to through off cash. But I'm not sure I can have any conviction until I see evidence that Cohealyx doesn't start making headway in the US!

Returning to the $AVH webinar, there were a few positive nuggets (June = highest quarter-end month; July best first-month-in-a-Q in a year) as well as the e-ordering frequency for the large Cohealyx account is a positive (i.e., it wasn't just initial stocking of a new product, the surgeons are using it.) Remember, Cohealyx is only getting started.

2. Additional Insights on Cash Position

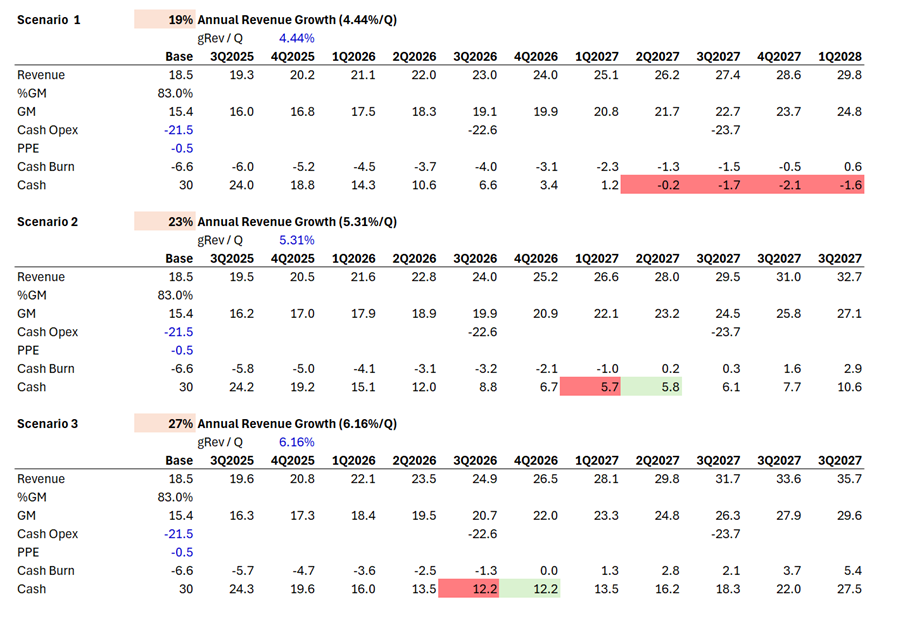

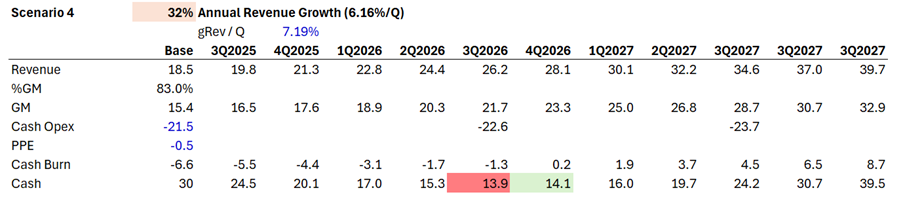

On cash, the CFO gave a nice simple calculation on cash flow as follows:

Rev. $18.5m/Q at %GM 83% (midpoint) = $15.4m as the starting point for last Q.

Cash Expenses: $21.5,/Q - holding steady for the next year, (but I'll then escalate by 5% from Q3 2026 and again by 5% from Q3 2027)

To this, I've added an allowance for investing cash of $0.5m per Q, which is lower than historical, but my sense is that they are really tightening the screws. (CFO was slient on this). For example, putting on ice altogether a go-to-market for vitligo, for which they have FDA approval. That to me is a measure of how focussed they now are.

From this, I've generated a few simple scenarios for quaterly cash burn as follows, with the bottom line of each table shoing cash balance. I've ignored them throwing in $9-10m receivables into the mix, because every business needs working capital!

It is possible that I've been a bit bearish on %GM, but I think that as Cohealyx and Permaderm grow, as licensed products, they will drag down the %GM, as we saw in this Q with the pressure on Recell sales.

The CFO today allowed me to sharpen up my own view, which says they'll make CF break even some time between 4Q 2026 and 1Q 2028.

This confirms my ingoing bias, that they don't leave a lot of fat in their guidance calculations (hence, the set-up for disappointments) .

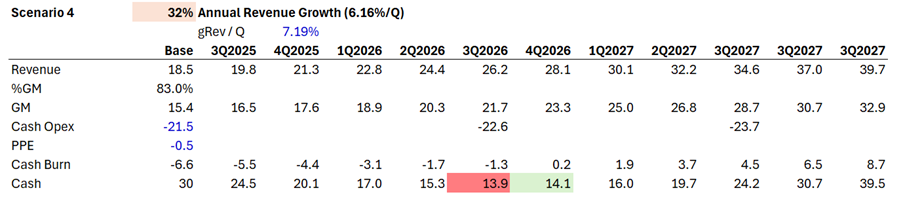

Now that said, it is entirely possible that revenue growth EXCEEDS the guidance range. If you are bullish on the clinical data and their ability to sell that into their US customers, then a 32% revenue CAGR would not be out of line with this sector, and it pulls CF break even forward by another quarter.

Management are saying they will ge tto CF breakeven earlier than all of these scenarios. So what do I have to believe to trust that? Any of the following will do:

- They are even tighter in screwing down investing capex

- Revenue rebounds more strongly in Q3 2025 and Q4 2025 after the CMS/MACs reimbursement issue is solved

- As Recell rebounds, they get a higher %GM, more like 85% in line with history

- I've not accounted for price rises being pushed through in 2026 and 2027, so this is a material lever (e.g., $PNV pushed through +10% last year, but they are much cheaper per treatment and having more pricing headroom.) i.e. my modelling is unbalanced, as I've put 5% annual inflation on Opex.

OR

- Management are rubbish at giving guidance and will miss this one again.

In any event, a $30m cash position looks good in all but the lowest of the scenarios I've generated.

My Key Takeways

It was good to get a second soak of this information today. I've sharpened my view on their cash flows, and amassing $30m is probably going to be god enough.

For me the upside catalysts in the Q3 2025 report will be:

- Revenue growth rebounds, above guidance midpoint with anecdotes of acceleration

- Confirmation that CMS/MACs remediation is complete

- Progress on recruitment in Cohealyx and Permaderm mini-trials

- Some further quantification on early uptake/ account conversion / re-ordering of Cohealyx, including material orders (e.g., $0.3m per account in a month)

A positive report on the above would - I strongly believe - mark a significant, tangible step forward in the "turnaround". Absence of good news on 3 out of 4 would likely trigger my exit.

Disc: Held in SM and RL

----------------------------------------------------------------

Appendix - 2 Key Slides Explaining the Product Portfolio from the Surgeons/Patient's Perspective