Pinned straw:

Interesting moves by LYL today after their report - they got sold down -6.3% to $11.46 in the morning from yesterday's $12.23 close and then finished the day up +2.94% @ $12.59, so that's a +9.86% recovery from their day low to their closing price of the day - and they closed on their day high, so once the report had been digested there were buyers in the market, remembering that they can be a fairly illiquid stock because of the high insider ownership plus the small size of the company.

The market went from appearing to be disappointed with their result to taking them back up to an 11 month high - the last time they were at $12.59/share was mid-September last year, so it seems like I got that one right too. I'm also happy to be out of AD8 now, even more so when reading other commentary which mostly aligns with my own thinking on Audinate, which I shared on Monday morning after reading their report and selling out at $5/share.

EGL is another story - a few orange flags there, particularly the precipitous drop-off of their Clean Air division EBITDA (-50.9% yoy) which they are blaming on challenging lithium markets - I would hope that division has a much broader addressable market than just the lithium sector.

We know about their cost blow-out with Baltec IES, but a -19.1% EBITDA decline on the back of a +31.9% increase in revenue in Baltec means a major margin compression there.

EGL Energy was good, and EGL Waste was terrific to finally see some traction there after bugger all happening there in prior years, however I also took note of @Wini's comments about their declining cash balance (they have no cash now) and 20% of their revenue sitting as work in progress not aligning with what management are saying: that over 50% of revenue is now recurring maintenance.

"This feels like aggressive revenue recognition to me, overstating earnings through the P&L."

See Wini's post on EGL here: https://strawman.com/forums/topic/10752#post-37413

This looks interesting to me:

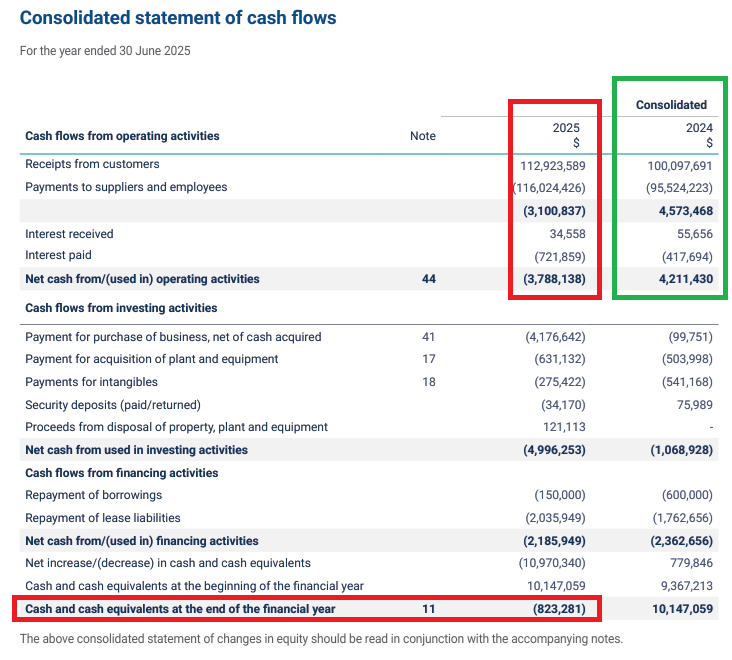

Revenue growth but payments to suppliers and employees was greater than total receipts from customers resulting in a $3.8m loss from operating activities vs a $4.2m profit the previous year. Also they had a negative cash position at June 30 vs over $10m in the bank the previous year. So they will likely need to raise money to shore up their balance sheet. Or at least that's how it looks to me. I prefer companies of this small size to be in a net cash position and EGL are no longer in that position.

I sold all of my remaining EGL @ $0.27 this arvo and was considering doing the same here, but would have only got $0.255 here because that's where they closed. I think EGL has a good story and will likely be worth substantially more in future years, but my faith in their management has diminished today, so I moved to the sidelines IRL and will likely do the same here this week also. I think there are better opportunities out there for that capital at this point in time, and too many unknowns and eventualities that could drive the EGL SP back down in the near term, in my opinion. This is actually the wrong thread for this analysis actually - or opinion - so I'll copy it across to EGL.

Anyway, LYL was good, and tomorrow I've got NST and NWH.