Pinned valuation:

25-Nov-2022: I'll make this one brief. 37 cents per share within 5 years (i.e. by November 2027), but ideally I'd like to see them trading at those levels or above within three (so by November 2025). I think they can, and I think they probably will. I am an EGL shareholder both here on SM and in real life as well.

I've articulated some of what I like about the company (and part of the investment thesis) in various straws I have posted here.

Friday 09-June-2023: Update: "Stale" is it?!? Well, OK then. Nah, Yeah! All good. Reactivated. Still holding this one. Still like it a lot. 37 cps by November 2027 - Sure! Yep! ...and then some!

Wednesday 21st February 2024: Update: Marked as stale. All good. No change to my target price. They reported today: Half-Yearly-Report-and-Accounts.PDF and released the following two days ago: EGL-Kadant-PAAL-Agency-Agreement.PDF - no problems with any of that. All good. Onwards and upwards. Still Holding.

Thursday 29th August 2024: Update: FY24 Report All good. I've posted a straw here about there their Full Year (FY2024) results. No change to investment thesis except I can now raise my price target because they've reached my previous one (of 37 cps). Now 42 cps. Onwards and upwards.

Wednesday 26th March 2025: Update: Marked as stale again. No change to 42 cps PT, and that's still for November 2027, as before.

They've been sold down on a single project cost blow-out which they said was due to a failed internal process to keep track of project modifications, and they've since addressed that issue so it can't happen again. Not wonderful, but also not a thesis breaker. Also their H1 results for FY25 underwhelmed, including their full year guidance, so they were sold down again. Volatility presents opportunity.

I do hold EGL and I have high conviction on this one, based on what Jason and Paul did at Tox Free prior to selling that business to Cleanaway in 2018. Cleanaway paid $3.425 per Tox Free share in cash which valued Tox Free's fully diluted equity at approximately $671 million. The total value including Tox Free's net debt was $831 million.

What Jason has done as CEO of EGL is bring much-needed cost discipline and a strong focus on both upselling and cross-selling, along with a laser focus on profitability which means they don't lower their prices just to keep busy - they maintain margins and build safety margins into their tenders. This has been most evident in EGL's improved margins over the past couple of years.

In terms of that laser focus on profitability and good margins, the laser strayed somewhat on that one project over in Singapore where there were delays and cost blowouts in the delivery and installation of two gas turbine silencers and an exhaust gas system for a client. EGL said that much of the additional costs related to modifications that became necessary to allow these large units to be transported from the port to the client's site in Singapore, rather than the installation itself, however EGL's internal systems failed to keep track of those additional costs and pass them through to the client. All fixed now apparently, but it was a big job, and they did lose money on it, so lessons have been learned through that experience clearly.

This was EGL's Baltec Inlet & Exhaust Systems (Baltec IES) division, and there were no such issues across any of EGL's other divisions, and I have reason to believe that the issues they experienced in Singapore are unlikely to be repeated with Baltec IES in the future, so my view is that my investment thesis is still solid, despite this hiccup.

As far as their future growth possibly slowing, I think I need to give them another year or two to see if that is indeed the case or whether FY25 is just an aberration in an otherwise stellar growth trajectory. I'm leaning towards the latter right now.

Interesting move today:

They were up +8.89% today, but that's just 2 cents/share up, and there's a 2 cent gap between the highest bid and the lowest offer so they could have gone either way in the CSPA at 4:10pm.

The more interesting thing for me is that the heavy selling volume appears to have moved up to 26 cents. In fact the 4 sell offers @ 26 cents account for 83.8% of ALL of the volume on the sell side. That's significant!

Of course, that will likely all change when trading resumes in the morning, but when you combine the short term uptrend shown on the right of that graph (19 to 24.5 cps) with that large sell volume moving up and away from the last traded price, it certainly suggests that sentiment towards EGL might be swinging from negative to a bit more positive now.

Time will tell. I'm not buying here. I have enough. 22.5 cps and below was the time to be loading up IMO.

Disclosure: Holding, both here and IRL.

21st August 2025: Updating Price Target post FY25 Results:

I'm lowering my price target to below EGL's current price. I've lost conviction in this company based on their latest reported numbers.

I sold my EGL & 27c/share yesterday - it was only a small position - and I sold my larger position here on SM at today's 26c/share closing price, so I no longer hold any EGL. I shared my reasons in a straw last night, which I'll copy in here below now:

20-Aug-2025: Having been through EGL's FY25 results (Appendix 4E, 20/08/2025 – Annual Report to Shareholders, FY25 Financial Results Presentation) - I saw a few orange flags there, particularly the precipitous drop-off of their Clean Air division EBITDA (-50.9% yoy) which they are blaming on challenging lithium markets - I would hope that division has a much broader addressable market than just the lithium sector.

We know about their cost blow-out with Baltec IES, but a -19.1% EBITDA decline on the back of a +31.9% increase in revenue in Baltec means a major margin compression there.

EGL Energy was good, and EGL Waste was terrific to finally see some traction there after bugger all happening there in prior years, however I also took note of @Wini's comments about their declining cash balance (they have no cash now) and 20% of their revenue sitting as work in progress not aligning with what management are saying: that over 50% of revenue is now recurring maintenance.

"This feels like aggressive revenue recognition to me, overstating earnings through the P&L."

See Wini's post on EGL here: https://strawman.com/forums/topic/10752#post-37413

This looks interesting to me:

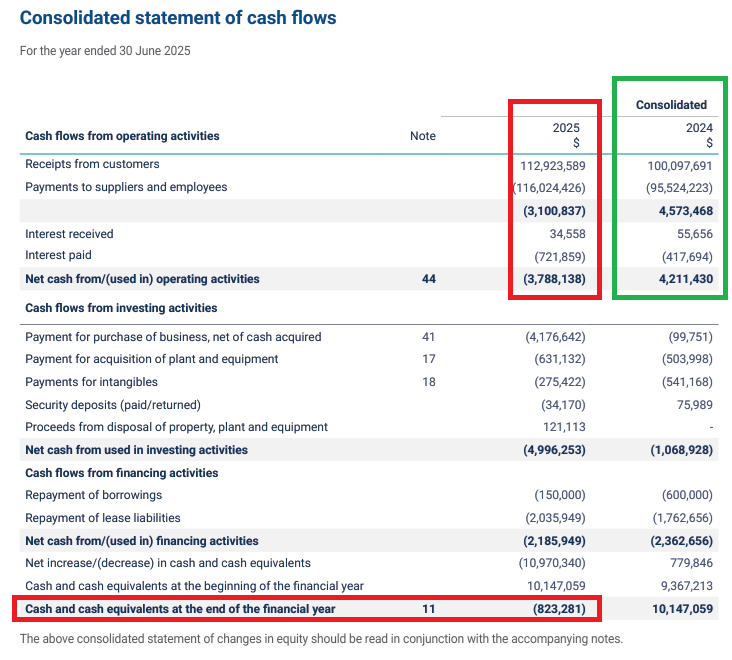

Revenue growth but payments to suppliers and employees was greater than total receipts from customers resulting in a $3.8m loss from operating activities vs a $4.2m profit the previous year.

Also they had a negative cash position at June 30 vs over $10m in the bank the previous year. So they will likely need to raise money to shore up their balance sheet. Or at least that's how it looks to me.

I prefer companies of this small size to be in a net cash position and EGL are no longer in that position.

I sold all of my remaining EGL @ $0.27 this arvo (Wednesday) and was considering doing the same here, but would have only got $0.255 here because that's where they closed. [Have now sold them here also - on Thursday].

I think EGL has a good story and will likely be worth substantially more in future years, but my faith in their management has diminished today, so I moved to the sidelines IRL and will likely do the same here this week also. I think there are better opportunities out there for that capital at this point in time, and too many unknowns and eventualities that could drive the EGL SP back down in the near term, in my opinion.

Perhaps teething problems, but also perhaps aggressive revenue recognition to inflate yoy comps, and while I do see over $4m spent on a business purchase (in the table above), I think it was a mistake to rely on the use of an overdraft to do that rather than to raise capital including via issuing new shares. I can only think they thought their share price was too low and they wanted a higher share price before announcing a CR.

Anyway, sidelines for me with EGL and my real money portfolios, and likely also here on SM shortly.

And the margin compression in some sectors is a concern too for a business that was apparently so focused on maintaining margins and not taking on any work that might rely in losses or low profit margins. Thats what Jason Dixon was saying in his meetings with us here but I don't see that in these results across their various divisions.

That said, now that I'm out of EGL, their EGL Waste business will probably shoot the company to the moon.

Additional:

P.S. They appear to have rolled EGL Water into EGL Waste now. I think EGL Energy is their main baseline ARR business - won't shoot the lights out but decent margins and dependable. EGL Waste (inc. EGL Water, inc. their PFAS removal tech) is the exciting part, but I feel the revenue and earnings are going to be lumpy, certainly not straight line growth. I have real questions around EGL Clean Air and Baltec IES in terms of maintaining margins and discipline, remembering that the owners of that IES business that got rolled into EGL are still there and are still major shareholders of the company.

Ellis and Denise Richardson sold Baltec IES to The Environmental Group (EGL) in October 2013 alongside others, and post-acquisition Ellis was appointed as Managing Director at EGL as well as their Board Chairman, and while his roles changed over the years (as detailed below), he remained an EGL director until he resigned in March 2021. He is also EGL's largest shareholder, currently holding 10.38% of the company's shares. Denise owns another 8.71%.

Their daughter - I believe, although I haven't been able to confirm that relationship - Ms Lynn Richardson, remains a Non-Executive Director (NED) and EGL's Non-Executive Chairperson. Lynn formerly served on the executive committee of Baltec IES, contributing strategically to its growth before the acquisition of Baltec by EGL. Lynn holds EGL shares via Richmarsh Investments Pty Ltd (which she controls) —approximately 3.57 million voting shares. Ellis owns more than 10x that many, 38,016,832 EGL shares (10.38% of the company, EGL's largest shareholder).

According to ChatGPT, in 2020, Lynn issued a notification stating she no longer acts "in concert" with Ellis or Denise Richardson.

In terms of the timeline:

- EGL acquired Baltec IES in late 2013 from Ellis and Denise Richardson, and others; Lynn Richardson also worked at Baltec IES prior to the acquisition;

- Ellis Richardson became EGL's Managing Director and their Executive Chairman at the same time (in Nov 2013);

- Lynn Richardson became an EGL Director on May 21st 2015, and was elected their Board Chair on November 23rd 2017;

- Ellis as EGL's Chair then replaced himself as MD with Dean Dowie as EGL's new Managing Director effective 1 July 2019, however Deano only lasted 7 months in the top job - until 24th February 2020 when EGL announced they had appointed Mr Andrew Arapakis as their new CEO & MD, but then on March 26th 2020, one month later, EGL announced, "...that as a result of the COVID-19 pandemic Mr Andrew Arapakis will no longer be joining the Company as CEO. Given the present COVID-19 pandemic and resultant economic environment the Company has moved to elect Mr Ellis Richardson as interim Managing Director. Mr Dean Dowie will revert to an executive director role as previously advised, effective immediately." Deano quit the Board later that year, in November 2020;

- Ellis Richardson was therefore re-elected to the MD position at EGL for the second time on March 26th 2020;

- Lynn Richardson issued that "no longer acting in concert with Ellis and Denise Richardson" notification or letter in 2020; and

- Jason Dixon (ex-Tox Free) took over as EGL's new CEO in Feb, 2021, with Ellis Richardson stepping down as MD at that time (Feb '21), then quitting the Board in March, 2021, however Ellis remains EGL's largest shareholder today (with 10.38%). Denise Richardson is EGL's third largest shareholder with 8.71%, and EGL's Chairwoman, Lynn Richardson (shown below) owns about 0.94% of the company through Richmarsh Investments.

So, my point is that as the original Baltec IES vendors AND as EGL's largest shareholders, the Richardson's hold a fair bit of sway within the company, so I'm not overly convinced that Jason Dixon's management (as EGL's CEO) fully extends to their Baltec IES division.

And I'm therefore questioning just how "quality" the management team really is at EGL when I look at that massive cost blowout in the past FY with Baltec, and Baltec's big profit (EBITDA) reduction despite earning significantly more revenue during the year, resulting in a significant margin compression.

I also question the rationale behind the acquisition of Airtight Pty Ltd, "a leading Australian air pollution services provider focused on mid-tier customers" for $12m in April 2023 (upfront consideration of $7.0m cash plus up to $5.0m earnout based on FY24 earnings) when EGL's Clean Air division produced this result in FY25:

They have used the current downturn in the lithium market as the main reason for that huge drop in EGL Clean Air revenue, but they never made it clear when they were bolstering their "Air" division via acquisition that it was so dependent on the lithium sector. The impression they gave me at that time was that the Clean Air division provided cross-selling opps across their other divisions and their gear was in high demand across numerous sectors. Apparently not.

So, yeah, there are a number of things - orange flags if you like - that have caused me to review my investment thesis on EGL and then sell out of EGL, for now.

The main ones are less trust in management in terms of what they say, and also doing what they say they are going to do, and honest reporting without fudging the numbers, with leads directly to the question of just how "quality" is this management team really? - Quality management being a "must" for my high conviction investee companies.

So, I reckon I'll bench EGL for now and watch them for a while, like a couple of years, and I might put them back on my playing field at some point in the future. For now, they're on the bench. And I'm on the sidelines. Just to mix up some metaphors.

Disc: Not holding.

@Bear77 some good points on the EGL risks, definitely a surprise to see cash on hand decrease from $10M to 800K. The part I am most concerned about is the cashflow position was semi hidden, headlining NPAT of $4.3M is all well and good but cash is king.

I just finished listening to the call and some of these concerns were addressed. On the call they were very upbeat about the business, so either nothing to worry about or some very good poker players.

They did address the margin compression, and elaborated about the Pelican point project which was a one off bespoke type project where they did at cost+margin contract, which naturally had low margin as it had minimal risk. This got them them the revenue target but the EBITDA margin compressed. It sounded like it was a bit of a favor project to an existing client at a regional site rather than chasing low margin work. I would have liked to see the impact of the singapore cost blowout project broken out to see how much of a driver it was in reducing margin, but this was glossed over as they have learnt from it etc. I am assuming that this project net negative. So two one-offs impacting margins.

A question on the cash flow came up and they said it was mainly related to invoice timing and that $2m had already come in in July from this, this does track as they had $19M in trade receivables.

There is definitely a lot higher risk profile with this one than there was a year ago. I will give it the half year to see if the cash balance recovers with the invoice cycles or if Wini is right and this is a really just a low margin engineering company with dressed up revenue.