Hi @Nnyck777 - I've just updated my RMS price target ("Valuation" - although in my case I don't do valuations, I just set price targets based on realistic expectations that I have - which do take into account whether a sector is in favour or in the doghouse with the market, and the individual company's position within that sector relative to their peers, plus the outlook for both the sector and that company within it). I've added a fair bit to the bottom of that which I hope answers your questions about why I rate RMS highly.

Also, seeing as I am the only member here at this point who actually has a "valuation" number for RMS, the consensus view appears to be based solely on my own price target ("valuation") so now the consensus (once it updates) will reflect that RMS is actually undervalued by the market (in my view) rather than overvalued.

In terms of shorters, I think they'd be brave to be shorting RMS at this point. If they were going to short a gold producer, you'd assume they'd have a negative view on the gold price trajectory from here, at least in the short to medium term, so the obvious play is to short one or more of the higher cost producers who are going to be more negatively impacted by a falling gold price, not a low cost producer like RMS who will still be making money even if the gold price halved from here.

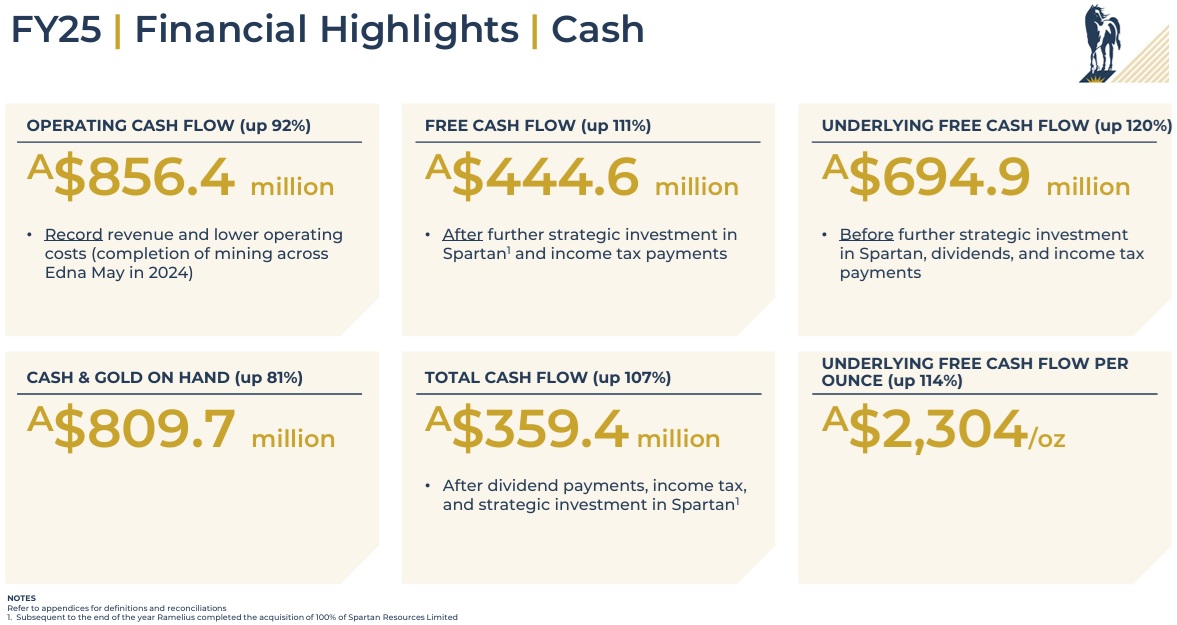

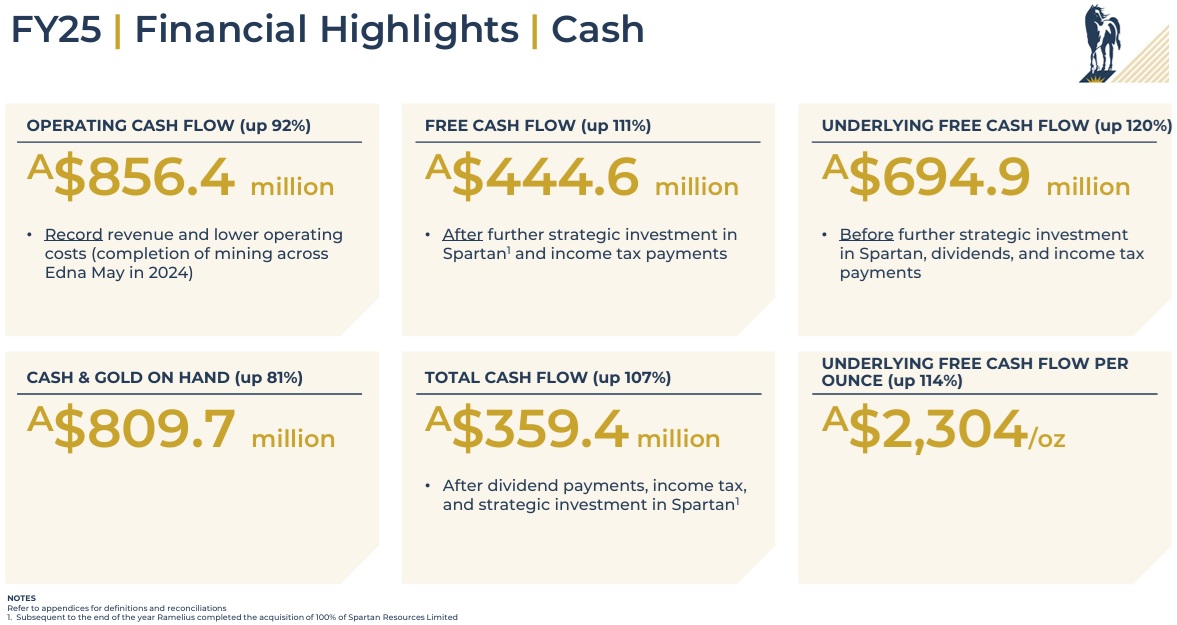

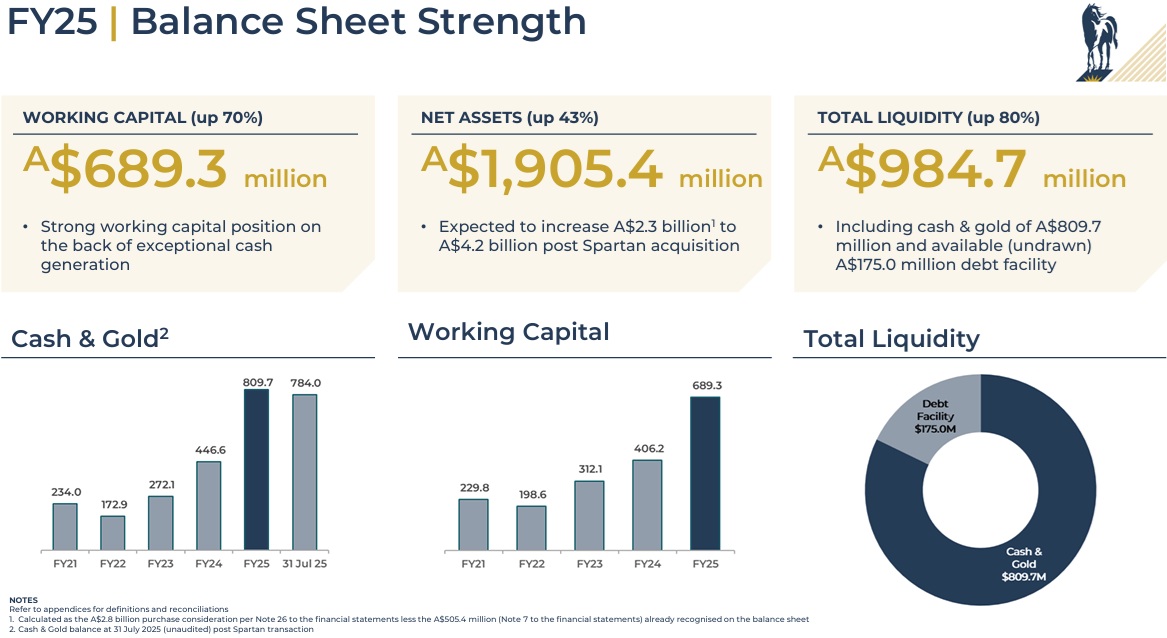

RMS' EBITDA margin in FY25 was 68% and they have low costs (A$1,551/oz AISC), zero debt and they had over A$800 million of cash and gold on June 30th:

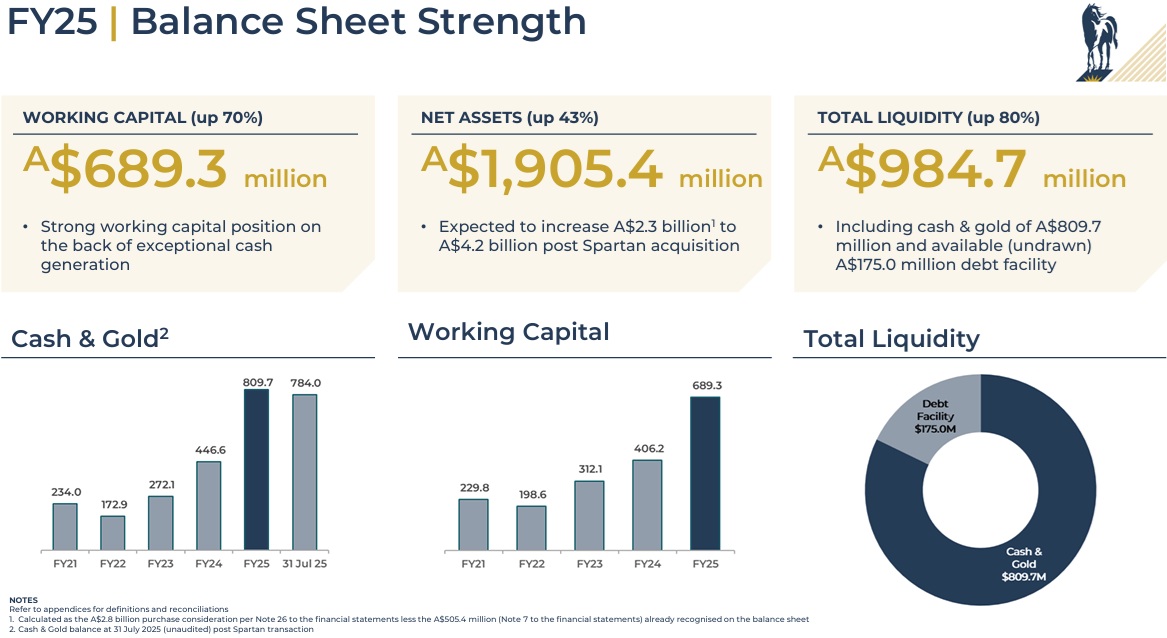

They have a very strong balance sheet and the capacity to make another acquisition or two if they want to:

I'm not saying they will make another acquisition, but they have that optionality if a good enough opp comes their way. They have good form for creating shareholder value through both organic and inorganic growth, so I don't mind how they do it. Their future looks very bright to me either way.

Discl: Holding.