A strong FY result from Aussie today, with shares up 20% as a result. Record revenues and earnings, driven by resi growth, enterprise wins and Symbio’s (ongoing) integration.

A summary below (thanks to my fav PA):

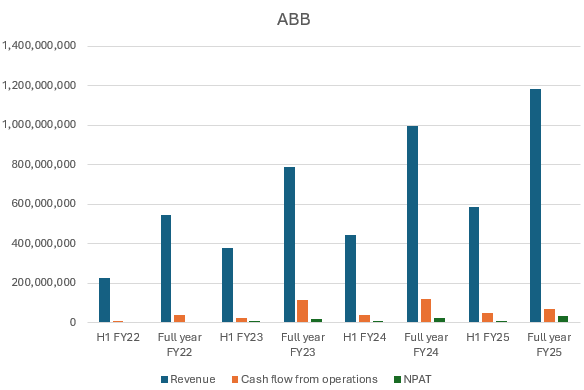

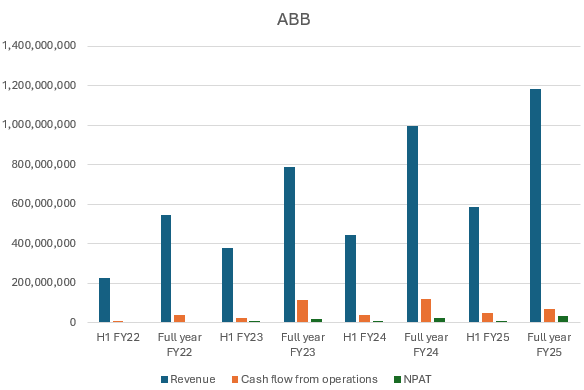

• Revenue: $1.187b (up from $999.7m in FY24).

• EBITDA: $138.2m (vs $120.5m in FY24).

• Gross Margin: 36.7% (up from 36.1%).

• Operating Cash Flow: $68.4m (down from $116.7m)

• Broadband connections: 788,411, up 15% YoY (ex-Origin & satellite).

• Mobile services: 216k, almost doubled share of broadband bundles.

• NBN market share: 8.4%.

• Customer satisfaction: 8.4/10; complaints at 3.5 per 10,000 services.

Last year I remarked that the business was starting to spit out cash for the fun of it. This result was no different, but they doubled down – investing in fibre, repaying debt, paying a maiden (fully franked) dividend and buying back shares. Not bad for a reseller of NBN (tongue in cheek).

All divisions are growing strongly, residential in particular I found to be impressive. In % terms:

• Residential 11% increase YoY

• Business 14% increase YoY

• Wholesale 101% increase YoY, but most of the growth here related to Symbio services moving to the Aussie platform (remains ongoing)

• E&G 23% increase YoY

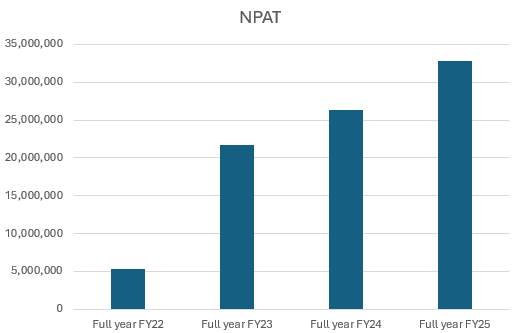

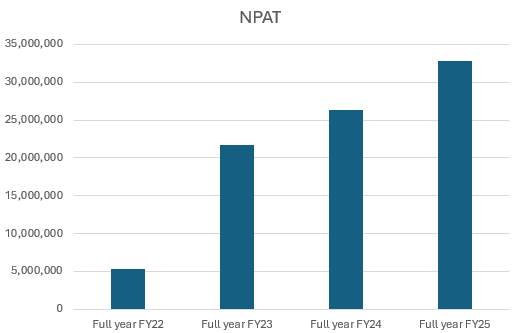

Who would have thought in FY22, Aussie’s growth story would be reflected like the below – consistent YoY and HoH growth:

What I was most pleased about is the clear evidence of operating leverage (yet again). E&G for instance observed a revenue increase of 9.8m, with costs increasing half of that, while resi revenue increased 91.7m, with costs only increasing 64m. This business continues to scale attractively, reaping the benefits of the fibre rollout.

They once again were named the Most Trusted Telco in Australia (Roy Morgan, 4th year running).

Management rolled out a ‘Look-to-28 Strategy’:

• Targeting >$1.6b revenue by FY28, with residential <60% of total revenue.

• Increase NBN market share, with the aim of surpassing 11% of all NBN services

• Investments in fibre, higher-speed NBN readiness, and AI-enabled customer tools.

• Expansion of MVNO mobile offering under new 5-year Optus deal.

• Becoming the preferred provider for managed telco and voice solutions in Australia (E&G)

• Symbio acquisition integrated; delivered $39.4m EBITDA (pro forma).

Aussie also entered into a six-year agreement to provide wholesale services to More and Tangerine, adding 250k + connections. As part of the agreement, they sold Buddy Telco for an estimated 8m (to be completed in H2). Buddy was performing admirably, having reached 14k customers in its first year and starting FY26 off well with another 2k customers. But these connections will remain on the ABB network under the Wholesale Services Agreement. Going the other way are 5.88m ABB shares being issued to More (subject to escrow). Losing Buddy is disappointing, but ABB will save a buck for the investment being sunk into the brand/service and they will get an estimated 8m as payment. It has presumably also helped them get 250k services + in the door with a six-year deal, the transaction of which is 12% accretive to underlying EPS on a pro forma basis.

Risks, you ask? They exist. Both founders are out the door, despite Phil remaining as a Non-Executive Director. My entire thesis was based on Phil being at the helm – he is a winner and a hustler. I suffered a bit of thesis creep to be honest; I couldn’t bring myself to selling a business that continued to thrive based on the strong foundations set. No guarantee this continues, and risk here has increased, even with his ongoing involvement (for now). Debt remains, but less of it, with the net debt position at a net leverage ratio of 0.93x. More attractive than last year, but still something to consider. Next is valuation: a current P/E of around 50x and a forward P/E of 28x requires growth; any slip up is near certain to see the share price punished. Despite higher EBITDA and NPAT in FY25, cash flow from operating activities decreased – impacted by higher payments to suppliers and employees, the acquisition integration, increase in trade and receivables (makes sense with longer payment cycles from E&G) and a favourable one-off working capital movement which didn’t repeat this FY. The waters get a bit murky for estimating FCF for my DCF as a result, but a thumb suck attempt gets me fair value at around $3.70. They aint cheap, but man the business has turned out to be a cracker.

Aussie is guiding for EBITDA of 157-167m, which would be an improvement of 14-21% on FY25 figures.