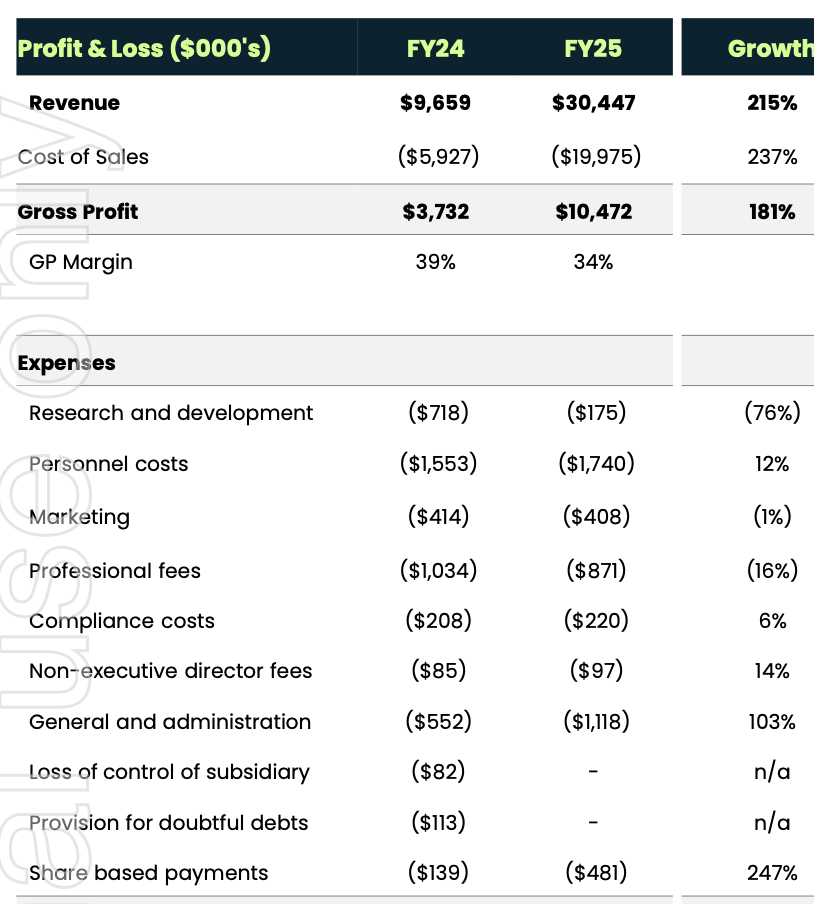

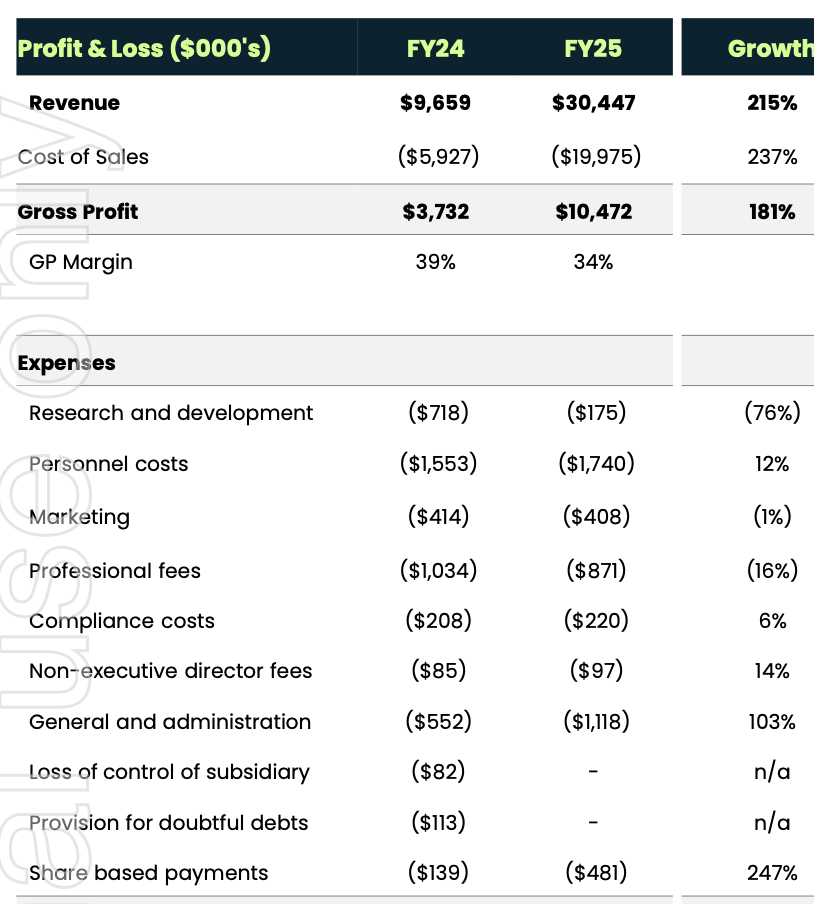

BXN makes its money by pharmaceutical manufacturing, which expanded by over 800% year-on-year. As a result, as flagged in their recent 4c, life is pretty rosy:

They primarily operate as a contract manufacturer for medical cannabis companies, charging per-unit fees for their sophisticated manufacturing services. This approach allows them to generate consistent revenue while minimizing the risks associated with brand development and direct patient sales. (sourced from TAMIM - and would love the opportunity to ask this directly in the next SM interview- nudge nudge)

Consequently, their contracts insulate them from the price pressures that the end-sellers will increasingly face. Of course, those contracts expire, and come up for re-negotiation.

The bull case:

Revolves around a return to normal margins and a huge increase in volume (capacity upgraded already).

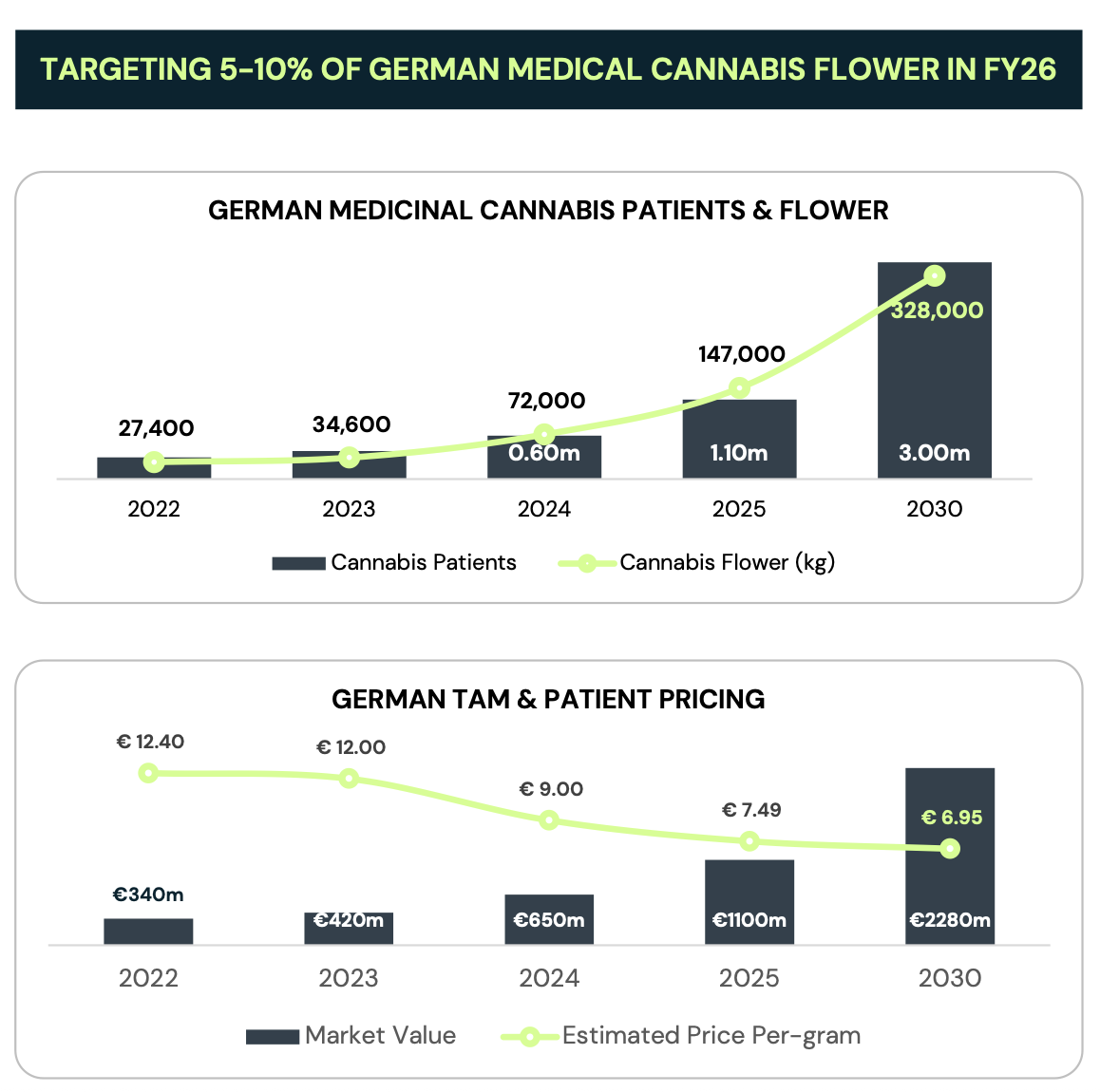

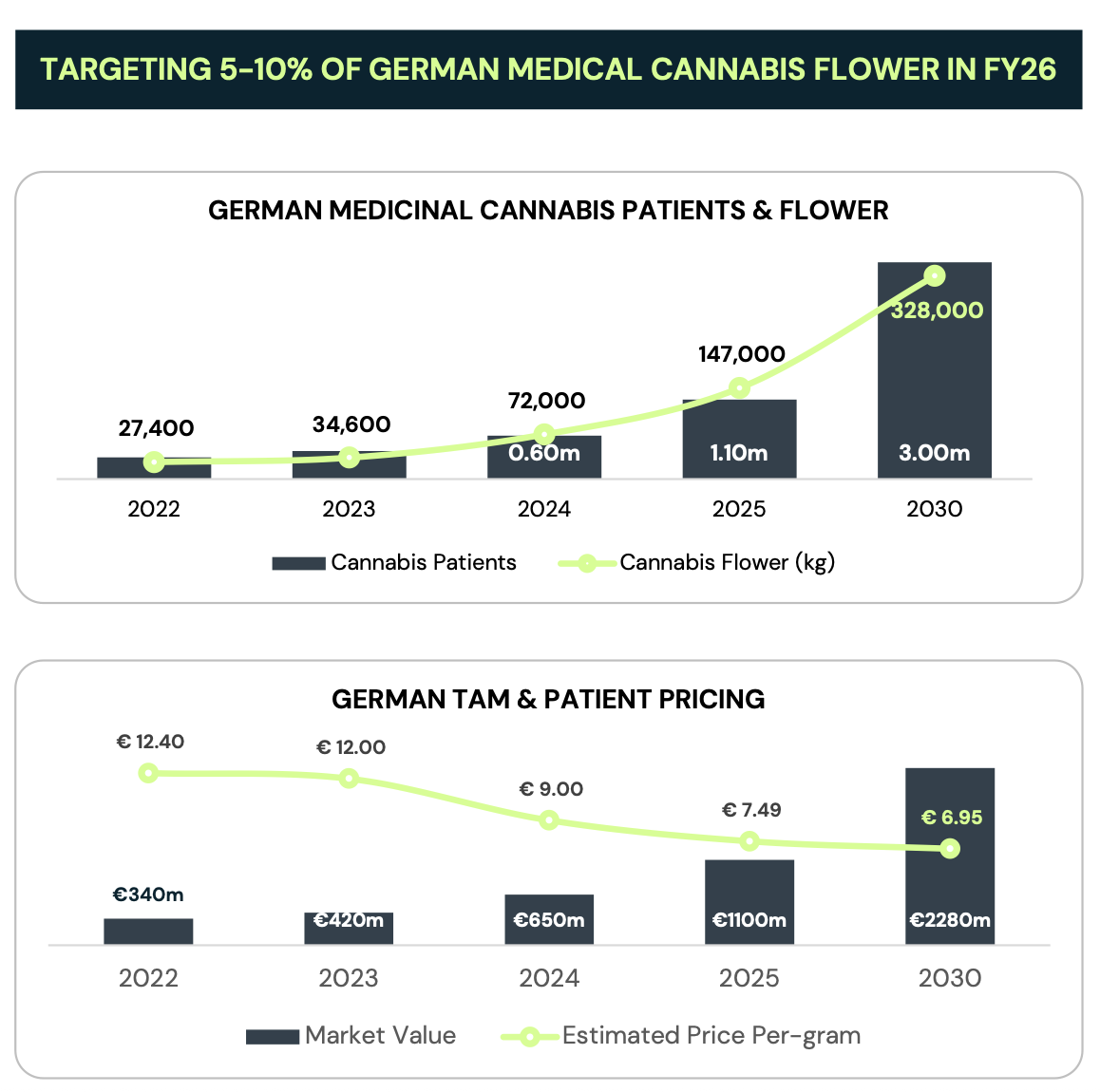

The story is all about the EU - mostly Germany - and the UK. Germany has 5m regular cannabis users, the UK 2m. BXN aim to supply 5-10% of the German flower market next year: 0.05 x 147k =7.35 kg = 7.35 metric tons! or $11.5m of revenue. This aligns with their updated revenue guidance of FY2026 of $65-75m and EBITDA of $11.5-13.5m. All figures AUD.

It is probable that input costs may decrease as new suppliers come on line (Asia) and competition heats up.

So the bear case:

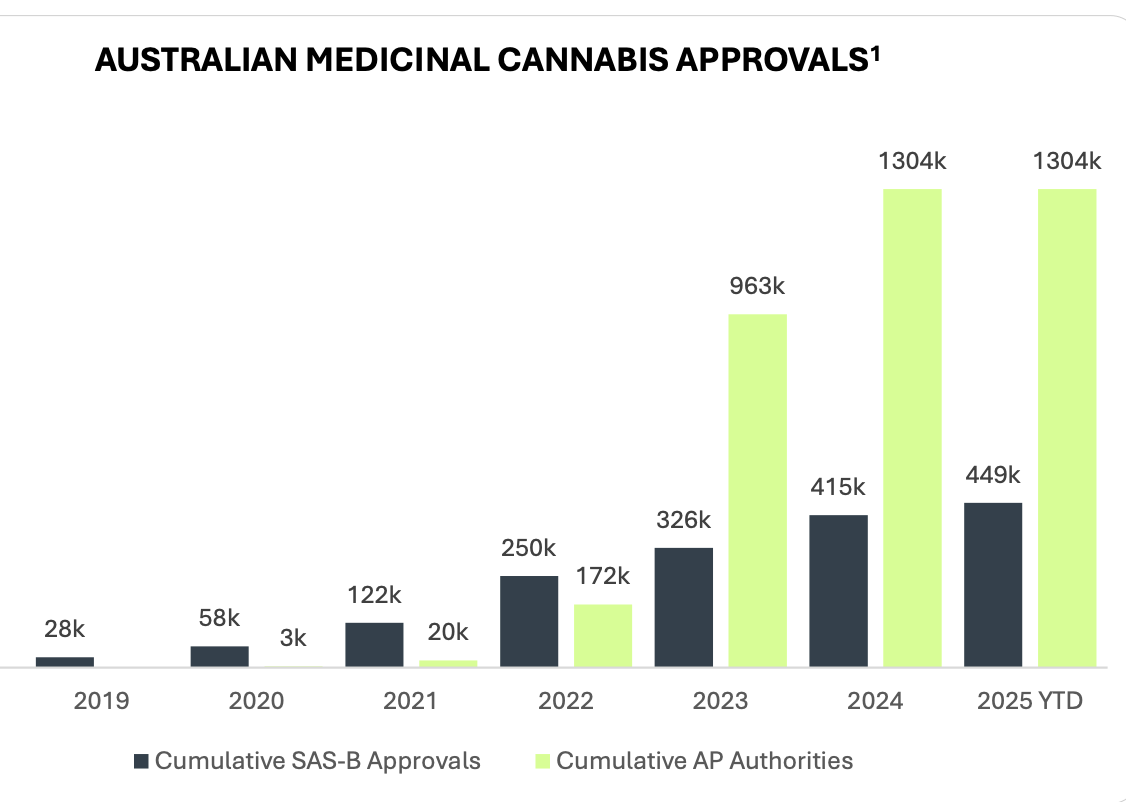

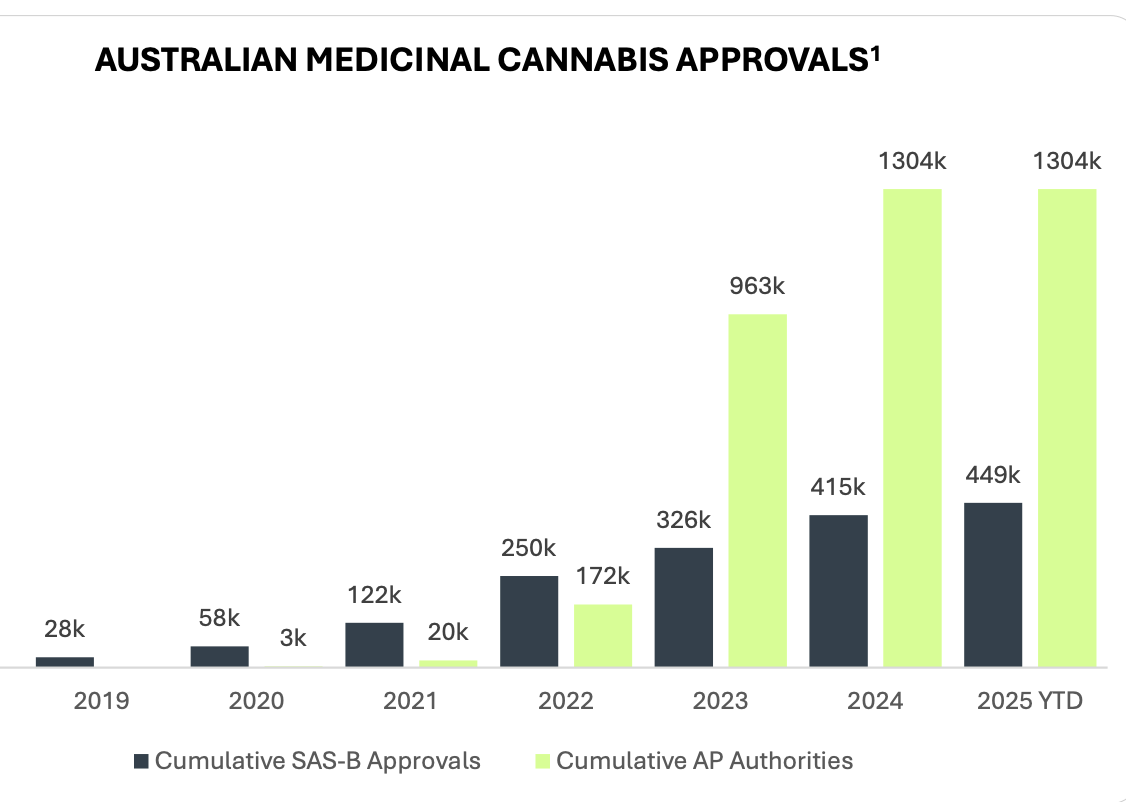

....and the sudden sell off I suspect is because of a) profit taking, b) margin compression for the last year c) a saturating Australian market and d) execution risk.

It is an evolving business model, but I believe they have demonstrated they can carve out a niche for themselves and are doubling down on it.

b)This primarily explained by the increase in costs in "general and administrative" but this should be viewed in the light of expenditure to increase capacity. So that shouldn't be a concern.

They are also not shy of increasing the share count (see bottom line of expenses), and I think there are another 150m options and share based payments still to come, representing ~7%.

Lastly, if you look at the patient pricing expectations for the German market above, Price per gram is expected to decline and it is possibly a worse outlook in other countries from what I can discover. Those reductions in margins for the seller are going to be part of any future fee-per-unit contract negotiations.

c) saturating Australian market ?

this is no doubt why they are expanding oversees!

On balance though, I can't see any real reason for the sell off, I am reasonably happy with my medium term thesis, though any of the above risks could come to pass. That doesn't even include regulatory risk etc, see bear case/risks in previous posts.

HELD IRL and SM

link to report https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02986630-2A1617950&v=c2533a54e2514fb77a8f93f84db686e1125273e9