Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Going to refine my valuation for my stock pick for 2026

Bear case (~2–3c): ~15%

• Risks: regulatory slippage in key markets (Germany/UK), slower‑than‑expected MDMA/cannabis demand, margin pressure, over‑investment in inventory/UK capex leading to poor cash conversion or a dilutive raise.

• Even with recent outperformance, small-cap cannabis/psychedelics names can de‑rate hard if a single contract, trial, or regulatory timeline disappoints.

Base case (~7–9c): ~45%

• Anchors on them roughly delivering FY26 guidance of A$65–75m revenue and A$11.5–13.5m EBITDA, with reasonable cash conversion and no major dilution.

• This is supported by:

• FY25: upgraded revenue guidance from A$25m to A$28m and then delivering ~A$29–30m (4–6% beat).

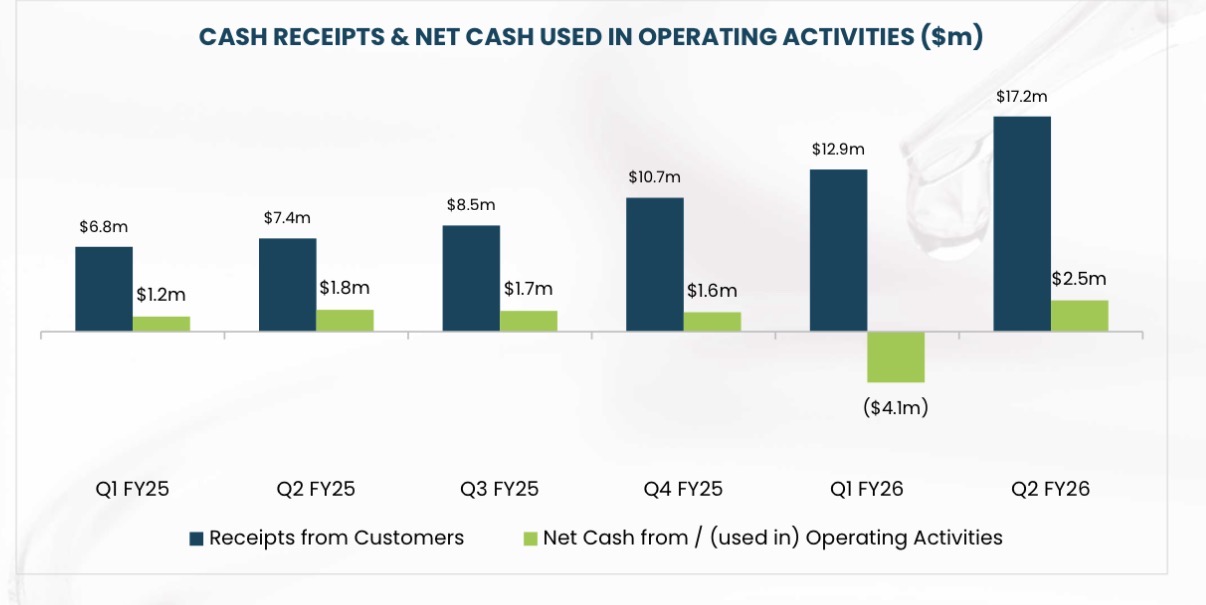

• A string of positive quarters with strong revenue growth, four consecutive positive operating cashflow quarters into FY25, and now a Q2 FY26 4C showing +A$2.5m operating cashflow.

• Management reaffirming FY26 guidance and demonstrating some conservatism historically (guidance upgrades after beats rather than aggressive top‑down targets).

Bull case (~12–17c): ~40%

• Requires: consistent guidance beats (as in FY25), faster ramp of psychedelics (MDMA/psilocybin) and devices, smooth UK facility execution, and stronger‑than‑expected Europe/Central America uptake. The big point here is I expect UK and Europe to be the driver of the bull case

• Their recent pattern – upgrade FY25 guidance and then exceed it, followed by record Q1 and Q2 FY26 numbers – raises the plausibility that current FY26 guidance could again prove conservative if execution and regulatory backdrops remain supportive - which I expect to be the case

Assisted by AI, of course!

held: 2.7% of my portfolio outside of Super/Maven funds. So really, really small.

No real surprises in this 4c. As flagged in previous announcements heading rapidly towards expansion globally (UK, EU, Central America). Deregulation in the US offers another potential geographic vertical

The UK funding for their new facility in Scotland will reduce CAPEX burden somewhat, but still something to be wary of.

MDMA starting to show early traction.

all in all broadly good news and sets things up for a good EOFY 2026 report, a huge increase in SP and the gold cup for speculative stock pick of 2026!! In response to this the SP is down ….

Quarterly Activities Report Period Ending 31 December 2025

Key Highlights

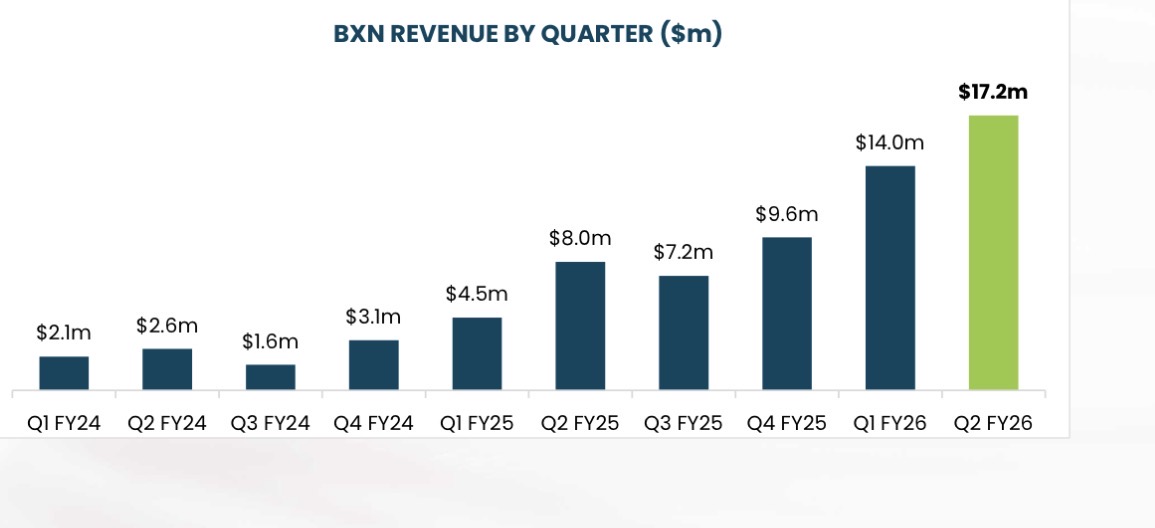

• Record $17.2 million quarterly revenue, a 112% increase on Q2 FY25 and a 21%

increase on Q1 FY26

• Record $18.4 million quarterly Cash Receipts, representing a 149% increase on Q2

FY25 and a 43% increase on Q1 FY26.

• $2.5 million positive Q2 cash flow from operating activities

• Completed dual listing on the Frankfurt Stock Exchange (ticker: PR8.F) on 13 October

2025, enhancing liquidity and access for European investors

• Executed exclusive import, manufacture, and supply agreement with Curaleaf

International for the Que Medical Inhalation Device in Australia

• Released first Australian-made GMP MDMA capsules for supply to clinical trials in

Victoria and authorised prescribers in Queensland, fulfilling orders for over 400

patient doses

• Ranked in the Deloitte Technology Fast 50 Australia 2025 on 24 November 2025,

recognising 452% revenue growth from FY22–FY24 in the Healthcare Technology / Life

Sciences category

• Second shipment of Australian-manufactured GMP MDMA capsules to Victoria’s

Eastern Health, supporting a public health clinical trial for treatment-resistant PTSD

co-occurring with borderline personality disorder

• Secured manufacturing and supply agreement with Remidose, positioning Bioxyne

as a first mover in Costa Rica and Panama, with potential annual revenue exceeding

A$1 million following regulatory approvals

• Secured £848,250 (approximately A$1.6 million) in non-dilutive funding from South

of Scotland Enterprise to establish a new GMP manufacturing facility in the Scottish

Borders

• Positive regulatory developments in key markets, including potential US rescheduling

of cannabis to Schedule III, ongoing reforms in Germany, and the UK's medicinal

cannabis framework

• $7.6 million cash on hand at 31 December 2025

Is BXN a Buy at these levels or Bye see u later! - 1 Oct announcement below

Business has cash in bank..

has the USA pharmaceutical restrictions hurt the aspirations here?

BXN trying to put the holders at ease .. i guess .. BXN still bearish Tuesday 7th Oct

BXN makes its money by pharmaceutical manufacturing, which expanded by over 800% year-on-year. As a result, as flagged in their recent 4c, life is pretty rosy:

They primarily operate as a contract manufacturer for medical cannabis companies, charging per-unit fees for their sophisticated manufacturing services. This approach allows them to generate consistent revenue while minimizing the risks associated with brand development and direct patient sales. (sourced from TAMIM - and would love the opportunity to ask this directly in the next SM interview- nudge nudge)

Consequently, their contracts insulate them from the price pressures that the end-sellers will increasingly face. Of course, those contracts expire, and come up for re-negotiation.

The bull case:

Revolves around a return to normal margins and a huge increase in volume (capacity upgraded already).

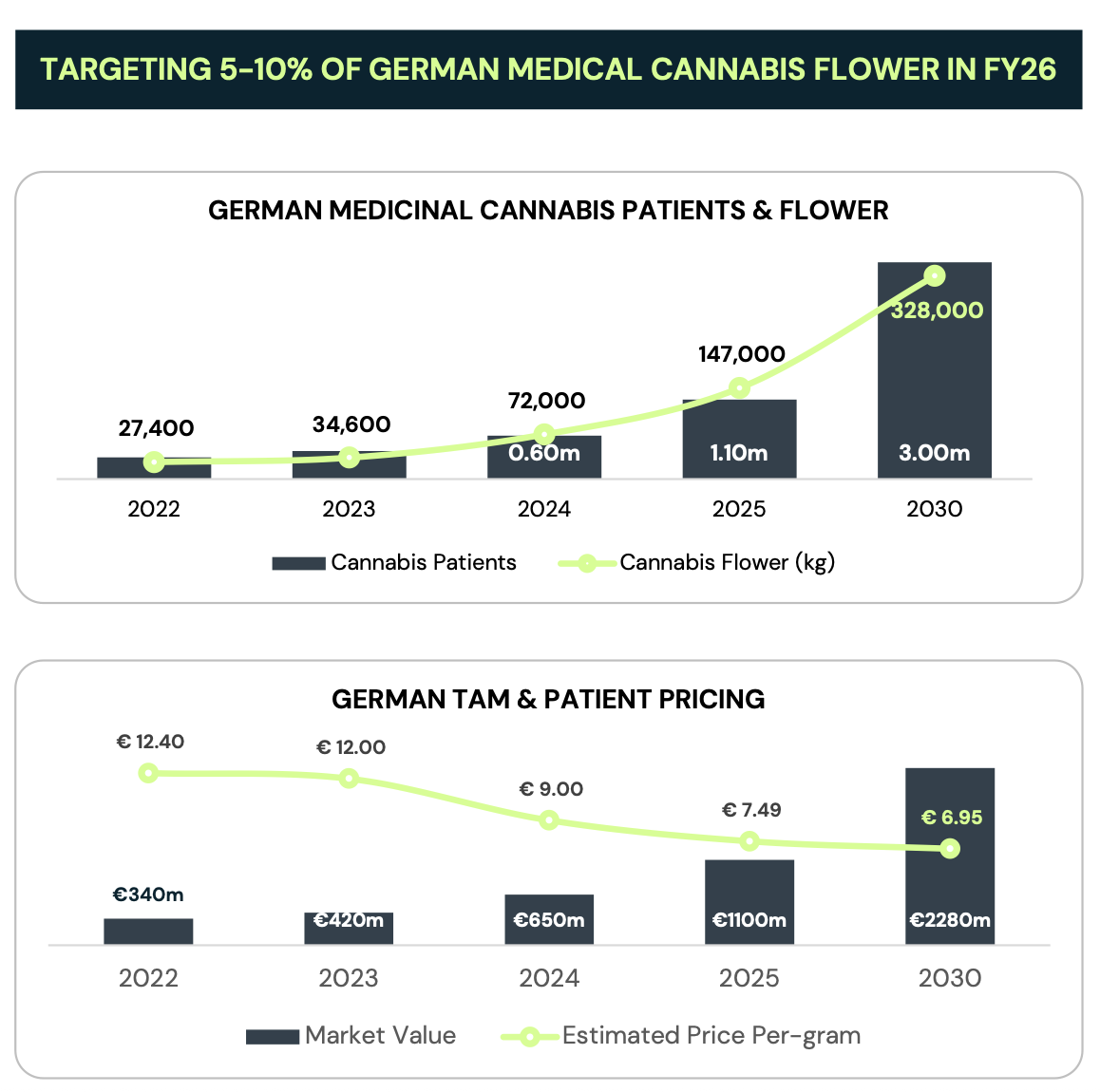

The story is all about the EU - mostly Germany - and the UK. Germany has 5m regular cannabis users, the UK 2m. BXN aim to supply 5-10% of the German flower market next year: 0.05 x 147k =7.35 kg = 7.35 metric tons! or $11.5m of revenue. This aligns with their updated revenue guidance of FY2026 of $65-75m and EBITDA of $11.5-13.5m. All figures AUD.

It is probable that input costs may decrease as new suppliers come on line (Asia) and competition heats up.

So the bear case:

....and the sudden sell off I suspect is because of a) profit taking, b) margin compression for the last year c) a saturating Australian market and d) execution risk.

It is an evolving business model, but I believe they have demonstrated they can carve out a niche for themselves and are doubling down on it.

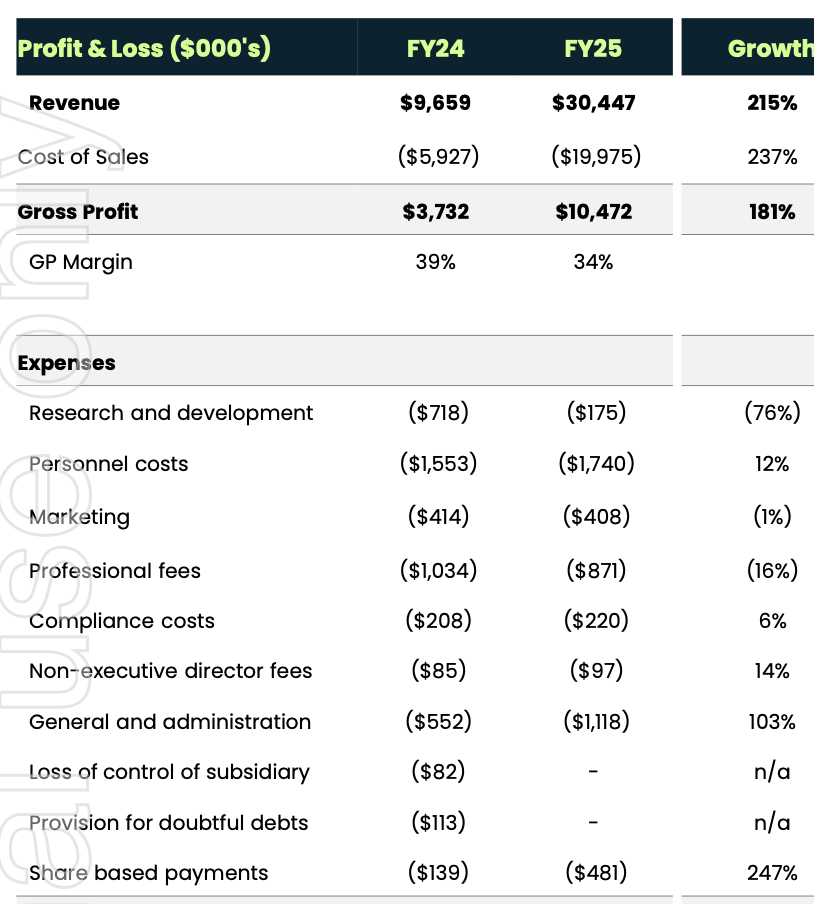

b)This primarily explained by the increase in costs in "general and administrative" but this should be viewed in the light of expenditure to increase capacity. So that shouldn't be a concern.

They are also not shy of increasing the share count (see bottom line of expenses), and I think there are another 150m options and share based payments still to come, representing ~7%.

Lastly, if you look at the patient pricing expectations for the German market above, Price per gram is expected to decline and it is possibly a worse outlook in other countries from what I can discover. Those reductions in margins for the seller are going to be part of any future fee-per-unit contract negotiations.

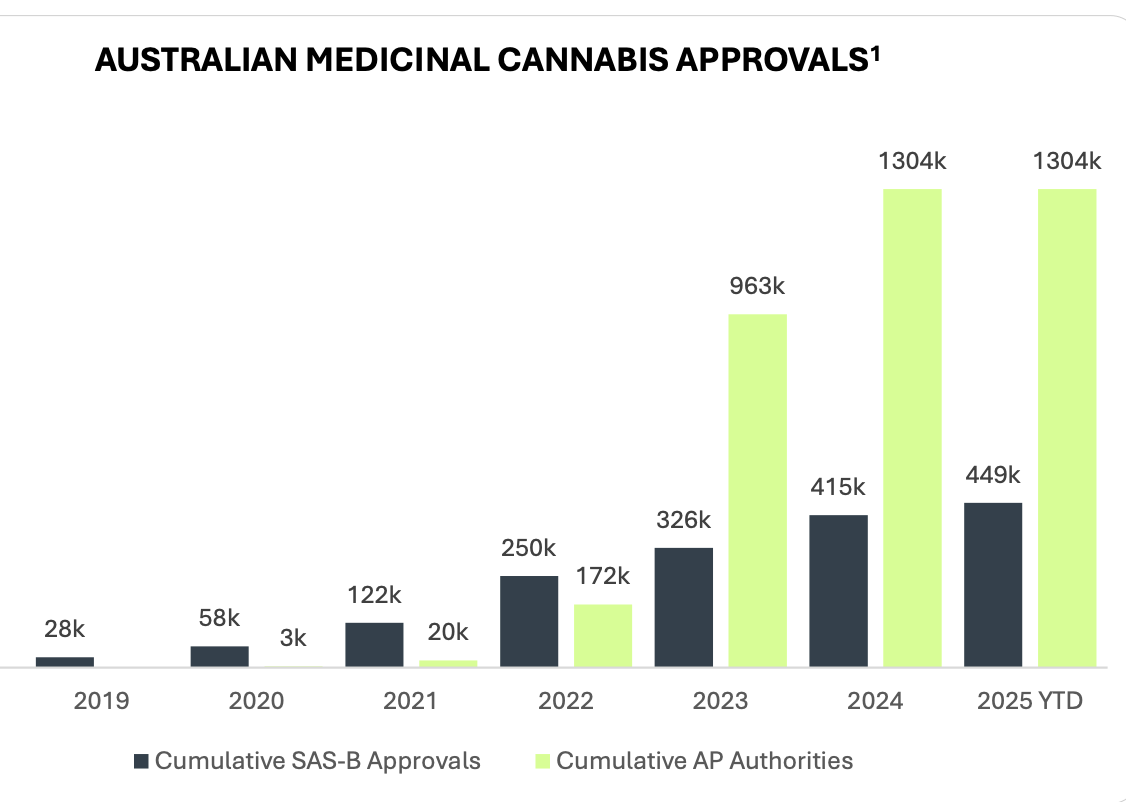

c) saturating Australian market ?

this is no doubt why they are expanding oversees!

On balance though, I can't see any real reason for the sell off, I am reasonably happy with my medium term thesis, though any of the above risks could come to pass. That doesn't even include regulatory risk etc, see bear case/risks in previous posts.

HELD IRL and SM

Bioxyne just confidently announced a >100% growth projection for FY26 in both revenue and EBITDA.

Seems pretty cheap if that's the case? NPAT was $5m and market cap is $120m....

A few sporadic thoughts I dropped down on their webinar. I won't re-hash previous points made just areas where there is more in depth information or an insight I hadn't realised before:

significant steps achieved:

Capacity after new upgrades is 30m tonnes pa. For reference the entire Australian market is 100 tonnes

Australian market growing 20% pa. and currently has 1 million patient. Bioxyne has a 30% market share. Product mix here is 30% flower, 30% pastilles 30% other. It would be good to get a clearer idea of margin by category.

BXN Source their flower from ~ 10 national and international cultivators. Has been a difficult process to be able to identify growers with adequate capacity and quality control. A barrier to entry for competitors

EU GMP recognition really opens the doors to ramp up production and flower sales to Germany and the UK

Some margin compression occurring in the German market but pie is huge and growing. Margins generally are expected to remain stable as sales are structured on commission of margin, headcount remains low and have significant moat over competitors from economies of scale.

UK still has a few regulatory hoops to be jumped through but they have partnered with the UKs leading medical marijhuana chain of clinics which services 60,000 patients. Expect hurdles to be cleared in next few weeks, initial 2.5 mill AUD order to be shipped, and anticipate this will be exhausted within 3 months - so more orders coming.

In negotiations with other prescribers....watch this space.

Have identified a site in the UK, in negotiations, hopefully 1 year rent free, applied for 20% UK government grant/rebate, expected CAPEX 1mill AUD. Unclear timeline as permitting commercial negotiations etc

Czechia: CAPEX $500k, change in government expected so may delay progress of packing plant build out.

in meantime enough capacity in AU to cover short term expectations.

Questions:

acquisitions unlikely in next 12/12 as organic growth opportunities are ample

CAPEX (see above) should be limited - need for further working capital was not addressed but 7.6m in bank and CF+ve.

FY26 guidance will be issued in August. not so subtle hints that there will be good news on this front.

Psychedelics:

no real prospect of significant revenue stream in next 5-10 years as trials grind along, data is gathered and biases overcome. Potential similar path to medical marijhuana but some time away. Being a lead provider of product to trial and experimental sites is a sticky revenue source as must have same product characteristics, legal recognition etc so if this nut is cracked, very few challengers.

In conclusion, short to medium term thesis remains very much intact.

What could bust this? Many things including regulatory backlash and over-reach, but for me - primarily margin compression. I anticipate BXN are going to rapidly expand revenue, have a lumpy bottom line due to CAPEX requirements to fulfil the increase in orders and will become increasingly recognised by the market; resulting in a significant increase in SP due to increased earnings and a multiple expansion. However, the old "your margin is my opportunity" may be the largest problem. I think they have a Moat on scale and regulatory hurdles. If there is significant evidence of margin compression this would cause me to have doubts, even if the top line is increasing rapidly.

I'm going to reach out to tour their manufacturing facility in Brisbane if anyone wants to come along. Hopefully we will get a goodie bag of free samples.

@Strawman any progress lining up a meeting ?

I checked Tamin's positive Takeaway here: Valuation 8cps and a possible Fy26 15cps.

Beyond Cannabis: Exploring Psychedelics

Perhaps most intriguingly, Bioxyne is positioning itself at the forefront of the emerging psychedelics market. They’ve already signed their first commercial contract for MDMA capsules used in PTSD treatment, seeing significant potential in this nascent therapeutic space.

Challenges and Opportunities

The medical cannabis sector remains volatile, with historical investor skepticism due to previous market failures. Bioxyne must continue to differentiate itself by emphasising its unique regulatory advantages, manufacturing expertise, and clear strategic vision. Apart from regulatory risks, the market is growing fast, with Germany legalising in 2024 and already running over $1B in sales and eclipsing Australia.

A Unique Investment Proposition

What sets Bioxyne apart is its approach to medical cannabis manufacturing. Like Foxconn in electronics, they’re building a business model centered on becoming the go-to manufacturing partner in a complex, regulated industry.

Their competitive advantages are multifaceted:

– Comprehensive regulatory licenses

– Advanced manufacturing infrastructure

– Highly skilled operational team

– Ability to manufacture multiple product types

– Efficient, scalable production processes

Looking Ahead

As the medical cannabis and psychedelics markets continue to mature, Bioxyne appears well-positioned to capitalise on growing demand. Their strategy of focusing on manufacturing excellence, rather than direct consumer sales, provides a more stable and potentially more profitable approach to this emerging industry unlike many peers who are yet to turn profitable.

With projected revenues approaching $100 million in 2-3 years, a lean cost structure, and expanding international footprint, Bioxyne represents an intriguing opportunity for investors seeking exposure to the specialty pharmaceutical and medical cannabis sector.

The TAMIM Takeaway

BXN ticks all the boxes we look for in a company:

⁃ Industry leader

⁃ Founder led and alignment with shareholders

⁃ High growth and profitable

⁃ Strong cashed up balance sheet and Free cashflow generation.

⁃ Track record of under promising and over delivering.

⁃ Significant room for growth in a large TAM

⁃ Under the radar with no institutional ownership or broker research – yet!

⁃ Large discount to our 8 cents valuation next year and potentially 15 cents if they can achieve $100 million of sales.

___________________________________________________________________________________________________

Disclaimer: Bioxyne (ASX: BXN) is held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.

You beat me to it @raymon68

Nothing that hadn't been flagged before, but good to see all the same.

For some reason Optus has given me a 3 month trial to the pro version of Perplexity, so I uploaded the most recent financials and asked some questions:

Bioxyne Limited (ASX:BXN) Key Financial Metrics

1. Return on Invested Capital (ROIC)

- Latest ROIC estimates for Bioxyne vary by source and calculation period. The most frequently cited trailing-twelve-month (TTM) figures and recent quarterly or annual figures are:

- TTM ROIC: 32.66%–36.34%

- Recent analyst metrics report figures as high as 51.5%–82.47% for recent periods, which is an indication of very high capital efficiency.

- Note: Discrepancies exist depending on the source, quarter/annualization, and adjustments for one-off items.

2. Internal Rate of Return (IRR)

- IRR for a public company like Bioxyne is typically not disclosed as a single company-wide figure, as it is a project-specific metric. Instead, investors analyze returns via ROIC, ROI, and historical share performance.

- Publicly available materials do not disclose an explicit IRR for Bioxyne's overall operations or segments. Evaluation of project IRRs would require a breakdown of project capex and related cash flows, which are not currently public.

- For a proxy, you could analyze multi-year cash flow streams against capital deployed and estimate effective IRR on major capex programs, but this is not published by the company or analysts.

3. Operating Margin

- Operating Margin (TTM, as of July 2025): 28.6%

- Previous year (FY24) Operating Margin: approximately -14.7%, reflecting the transition from loss to profitability.

- Recent quarterly and TTM increases reflect a substantial positive shift as major investments begin delivering scalable returns.

PeriodOperating Margin (%)FY24-14.7TTM (2025)28.6

4. Additional Profitability Metrics

MetricValueReturn on Equity (ROE)51.99%

Return on Assets (ROA)18.7%

Gross Profit Margin (H1 FY25)50%

EBITDA Margin (H1 FY25)30%

5. Highlights

- FY25 unaudited revenue was $29.3M, a 215% YoY increase.

- Quarterly operating cash flow turned positive, with four consecutive positive quarters by Q4 FY25.

- Capital expenditure for FY25 was $2.4M (YTD), supporting strong production growth.

- The company has moved from negative to strongly positive margins and returns, reflecting a successful scaling of pharmaceutical manufacturing and international expansion.

Summary:

Bioxyne has transitioned from negative margins and capital returns in prior years to industry-leading profitability and efficiency, as shown by high operating margin, ROIC, and positive operating cash flows. Explicit IRR figures are not available, but significant improvements in ROIC and cash flow point toward strong project returns.

https://www.perplexity.ai/search/i-want-to-work-out-some-financ-TEvIW1PSR1i29.R8AycySg

The SP has run up a bit since my entry point but am currently happy to see how this story turns out.

Can BXN scale -up the model here?

Outlook The Company is focussed on:

• Growing its manufacturing customer base in Australia, the UK and Europe;

• Substantially exceeding FY25 revenue performance in FY26;

• Gaining EU GMP certification in Czechia for distribution to European markets; and

• Launching its medicinal cannabis products in the UK and European markets with local partners. The Board intends on providing FY26 guidance at the release of the FY25 results next month.

Revenue Group revenue (Figure 1) attributable to significant outperformance from BLS Australia and now enhanced by increased manufacturing capacity. The additional €3.2 million contract with Farmakem and Adrex will underpin growth into FY26. The Company is continuing to negotiate multiple additional contracts in both Australian and overseas markets, which will drive revenue expansion in FY26.

Outlook The Company is focussed on: • Growing its manufacturing customer base in Australia, the UK and Europe; • Substantially exceeding FY25 revenue performance in FY26; • Gaining EU GMP certification in Czechia for distribution to European markets; and • Launching its medicinal cannabis products in the UK and European markets with local partners. The Board intends on providing FY26 guidance at the release of the FY25 results next month.

BXN seems to be delivering. Great for very early holders.

Return (inc div) 1yr: 900.00% 3yr: 43.28% pa 5yr: 30.92% pa

Thursday 24th July:

Last

5.0¢

Change

0.003(6.38%)

Mkt cap

!

$101.7M

BXN has outperformed its growth forecasts over the last 12 months. In 2024 our goal was to become the leading medical cannabis manufacturer.

Micro cap;

'A microcap stock is a public company that has a market capitalization of roughly $50 million to $250 million. Companies with a market capitalization of less than $50 million are typically referred to as nanocap stocks'

Last

4.1¢

Change

0.001(2.50%)

Mkt cap !

$88.75M

BXN is up sharply in the last week: >50%. Of course that’s on minimal volume given its nanocap status and illiquidity.

I had fondly imagined that my recent straw had convinced other members of the merits of the investment case.

Alas, it’s just me and @AbelianGrape as holders (at least in the Strawman portfolio).

looking forward to the results.

I’ve increased my holding in BIOXYNE.

They have recently upgraded the FY earnings guidance which did not come as a surprise. In addition they have succeeded in getting licences to supply THC/CBD products into the UK, Singapore, Canada and the EU. It wasn’t that long ago that bringing weed into Singapore got you a death sentence, so I’m not too sure this is going to provide much of a kicker to revenue. Canada is no doubt well supplied by local and US cannabis suppliers. However, they do have an established brand and business (on Amazon) in the UK and have also just announced a $5.6m deal to supply a German distributor with “flower”. That’s buds to those of us more used to buying it the old fashioned way.

All of their revenue bar $1million comes from Australia currently. They have invested for growth with recent increases in capacity for the production of both flower and pastilles.

I have included 2 slides from today’s presentation that show the progress and the opportunity.

*What could go wrong?

The US experience is a bit different but is not pretty. There, manufacturers sell flower to retailers, who sell it to the general public. In Australia, the UK and the EU (I’m unclear if that is the whole of the EU, but certainly major economies) these THC products are prescription only. So, in the US it has been a race to the bottom, with multiple business failures and no one having a decent margin. The barriers to entry and compliance constraints are so far limiting the number of players in this space in Australia. BXN is the market leader and economies of scale being what they are, should be able to maintain a small moat. It will informative to see what the bottom line looks like come results season.

Currently, BXN have a gross margin of 50% which is healthy and should allow for a reasonable ROIC. I’d love some more detail around these numbers. I would anticipate this margin can be sustained in Australia and replicated, if not improved upon in the UK - they also have their Dr Watson brand which should increase margins there.

There are also the psilocybin and MDMA arms of the business that are currently only involved in clinical trials in Australia.

*Deep dive into the product suite:

Strawman members will be reassured to know that I take my research very seriously. Purely in the interests of due diligence, I registered as a patient (insomnia, back pain, I once got rejected by a girl I fancied when I was 15 and have PTSD etc) and have subsequently tested the majority of the BXN products.

After a few weeks of somnolence and moderate disorientation, I realised that I am not the target market and have discontinued frequent use. Additionally, I recently received a bulk package of “TV snacks” from Amazon that I have no clear recollection of ordering and do not usually enjoy eating. Mysteriously, I have also gained 6kg.

BXN released its quarterly today and I think it shows the thesis is intact. They had a CR of $3m during this period to accelerate the build out of increased manufacturing capacity. I hope that is the last one required.

$7.2 million Q3 Revenue - 352% increase on Q3 FY2024

$8.5 million Q3 Cash Receipts - 14% increase on prior quarter and 238%

increase on Q3 FY2024

Year to date Revenue of $19.7 million - up 213% on YTD Q3 FY2024.

On track to exceed FY2025 revenue forecast of $25 million

Positive Q3 cash flow of $1.9 million with increased investment in working capital to fund growing sales

Capital raise in Q3 of $3.0 million (before costs)

Cash on hand $6.5 million

Increased manufacturing capacity from investment in plant and equipment of $0.9 million during Q3

New $7 million manufacturing and supply contract executed for FY2026

They restated expected full year revenue of $25m.

Australia is tracking well and the goal is to get GMP certification for their Czech manufacturing plant to serve the EU and UK customers.

i have some concerns about trying to expand in too many geographical sites at once, but if they can execute as intended the future looks bright.

Held. Watching intently.

Looks like BXN will have a couple of other revenue streams come the end of the year

Having light heartedly responded to @juneauquan's post about this company, I have by a curious twist of events ended up looking at it again. I have just gone through the process of becoming a patient for CBD gummies for insomnia after various people had recommended them and was interested to see who the manufacturer was for the pharmacy I am buying them from. Turns out to be Bioxyne, via it's 100% holding in Breathe Life sciences.

Bioxyne is tiny, it has a MC of $55m.

It had previously issued shares at a phenomenal rate to keep itself alive expanding the count from ~600m in 2022 to four times that in 2024. Ouch. But in the last few months it has turned the corner in quite spectacular style.

It has had various iterations over the last 10 years but is now firmly in the THC/CBD manufacturing business, and that has gone quite well of late. It received a GMP licence from the TGA to manufacture THC gummies (as well as MDMA and psilocybin products) in Jan 2024. It also has a manufacturing facility in the UK and Japan and serves those markets and an import and packaging plant in the Czech republic. It is not only a B2B manufacturer but also has its own wellness direct to consumer brand DrWatson (see UK below).

The medical marijhuana market is predicted to grow at a CAGR of 30% until 2030.

It released a very positive quarterly in Jan 2025 and an update to guidance. If you like pictures these are the two that matter

Just assuming no further increase in revenue and annualising the last quarter gives you about $30m in cash receipts and positive Operating cash flow of $6m. They are, however looking to expand manufacturing capacity in anticipation of further contract wins which may increase costs significantly in the short term but have 2.7m of cash which may be enough.

GM appears to be 20% which isn't bad for a manufacturing business.

They haven't given a geographic breakdown of revenues.

Potential other sources of income include their DrWatson brand of CBD oil and mushroom products sold DTC and on Amazon in the UK EU and Japan. They have flagged a potential ramp up of manufacturing in the EU to supply that market.Lastly, there is the potential for revenue streams from the MDMA and psilocybin arms which look to be some way off currently, though they are the only GMP approved manufacturing facility in Australia currently and can consequently supply medical trials.

It's clearly a high risk play in a variety of domains: regulatory risk, execution risk and capital allocation risk to name but a few.

Having just written all this up I realise I should just have waited a few days until the Half yearly comes out, sigh.

Not held yet, but really very interested.