No real surprises in this 4c. As flagged in previous announcements heading rapidly towards expansion globally (UK, EU, Central America). Deregulation in the US offers another potential geographic vertical

The UK funding for their new facility in Scotland will reduce CAPEX burden somewhat, but still something to be wary of.

MDMA starting to show early traction.

all in all broadly good news and sets things up for a good EOFY 2026 report, a huge increase in SP and the gold cup for speculative stock pick of 2026!! In response to this the SP is down ….

Quarterly Activities Report Period Ending 31 December 2025

Key Highlights

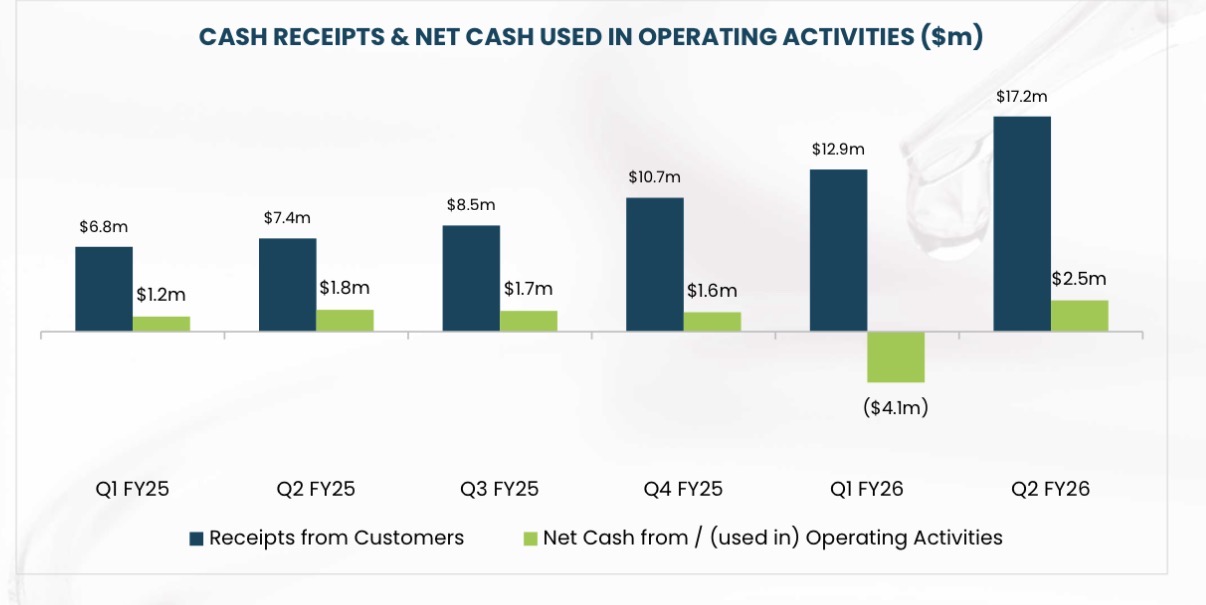

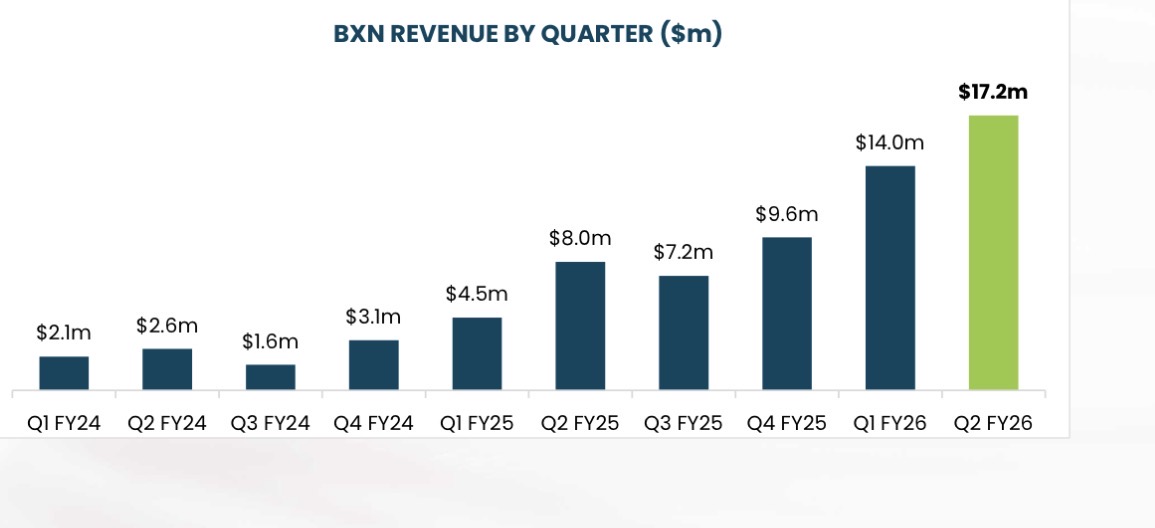

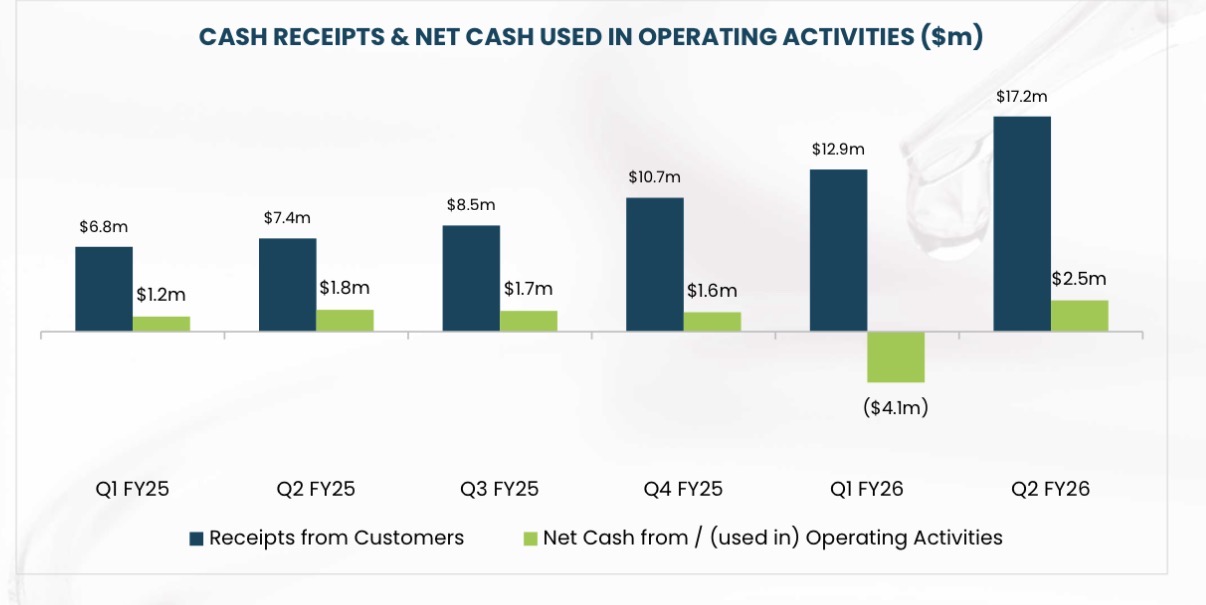

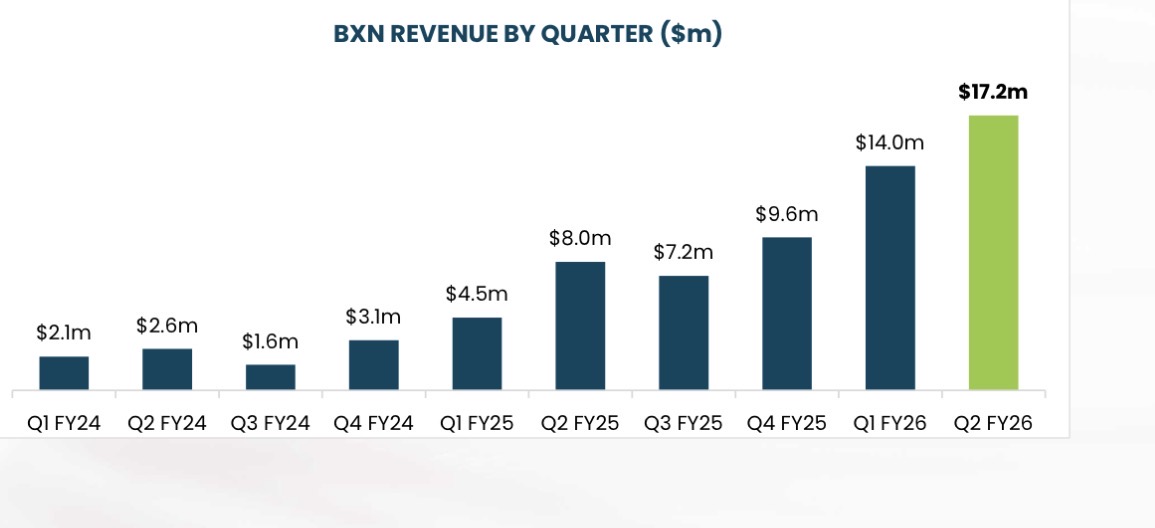

• Record $17.2 million quarterly revenue, a 112% increase on Q2 FY25 and a 21%

increase on Q1 FY26

• Record $18.4 million quarterly Cash Receipts, representing a 149% increase on Q2

FY25 and a 43% increase on Q1 FY26.

• $2.5 million positive Q2 cash flow from operating activities

• Completed dual listing on the Frankfurt Stock Exchange (ticker: PR8.F) on 13 October

2025, enhancing liquidity and access for European investors

• Executed exclusive import, manufacture, and supply agreement with Curaleaf

International for the Que Medical Inhalation Device in Australia

• Released first Australian-made GMP MDMA capsules for supply to clinical trials in

Victoria and authorised prescribers in Queensland, fulfilling orders for over 400

patient doses

• Ranked in the Deloitte Technology Fast 50 Australia 2025 on 24 November 2025,

recognising 452% revenue growth from FY22–FY24 in the Healthcare Technology / Life

Sciences category

• Second shipment of Australian-manufactured GMP MDMA capsules to Victoria’s

Eastern Health, supporting a public health clinical trial for treatment-resistant PTSD

co-occurring with borderline personality disorder

• Secured manufacturing and supply agreement with Remidose, positioning Bioxyne

as a first mover in Costa Rica and Panama, with potential annual revenue exceeding

A$1 million following regulatory approvals

• Secured £848,250 (approximately A$1.6 million) in non-dilutive funding from South

of Scotland Enterprise to establish a new GMP manufacturing facility in the Scottish

Borders

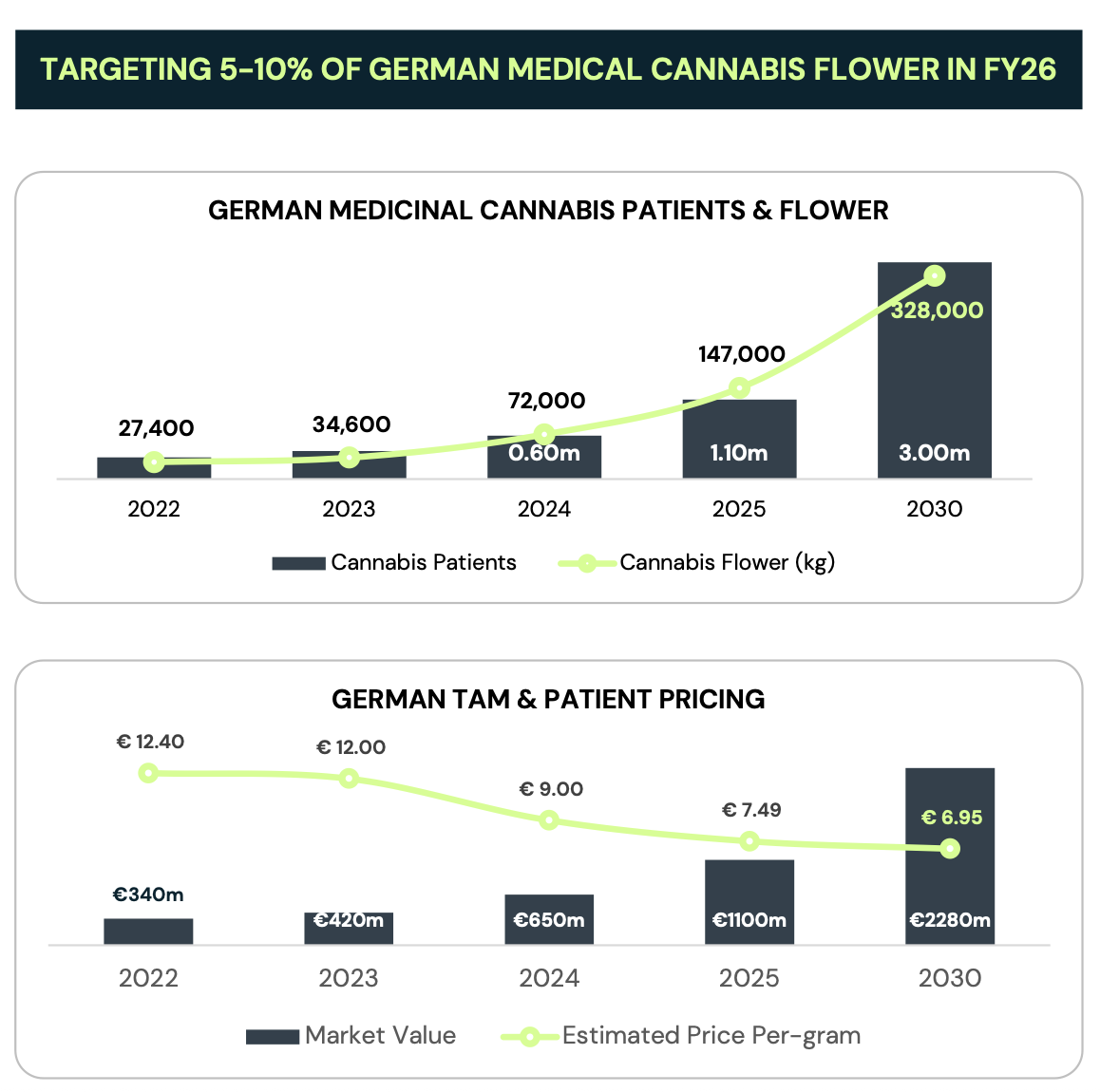

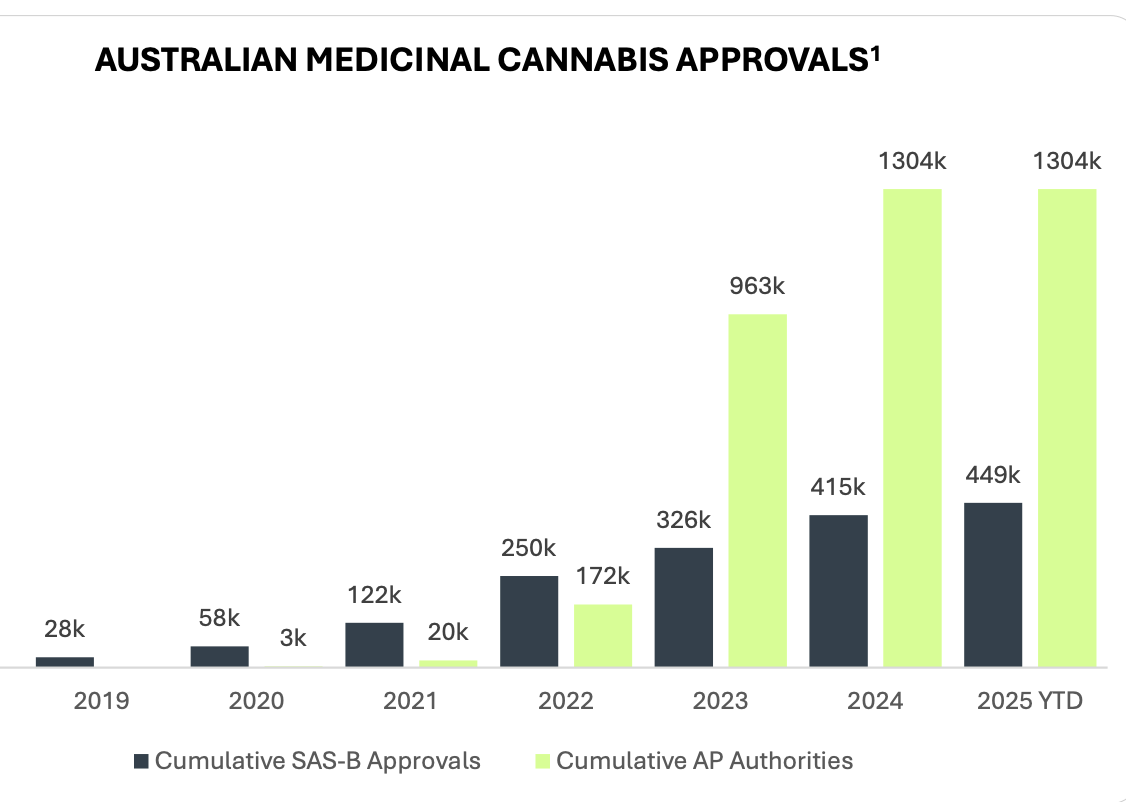

• Positive regulatory developments in key markets, including potential US rescheduling

of cannabis to Schedule III, ongoing reforms in Germany, and the UK's medicinal

cannabis framework

• $7.6 million cash on hand at 31 December 2025