22nd May 2025: As I said a couple of weeks ago in my update to my Gold Road (GOR) valuation, Gold Road (GOR) announced on May 5th that they have agreed to be acquired by Gold Fields Ltd, who are Gold Road's 50/50 JV partners in the Gruyere Gold Mine in WA's eastern central goldfields (i.e. above Kalgoorlie but more towards the NT border).

See here: Scheme Implementation Deed entered into with Gold Fields [5 May 2025]

The offer is all cash, so no shares, which is to be expected from a South African listed company like Gold Fields Ltd (GF). Australian investors generally prefer cash than shares when an overseas-listed company acquires their Australian-listed company.

I raised my valuation for GOR to $3.55 on May 6th because I value this offer @ just over $3.55 based on (1) NST's closing price on Friday 2nd May and (2) where NST closed on that today (May 6th). The reason why NST's SP is relevant is that GOR held 19.99% of De Grey Mining (was DEG.asx, now removed from the list) and the acquisition of DEG by NST in an all-scrip (shares for shares) deal completed in late April, so GOR now hold NST shares instead of those DEG shares that they previously held.

GF is offering: A$2.52 fixed cash consideration less any special dividend paid prior to implementation of the Scheme, plus a variable cash consideration equal to the full value of each Gold Road shareholders’ proportionate holding in Northern Star (NST), calculated by reference to the date the Scheme becomes effective - so valued at A$0.88 per share if the Scheme was effective on Friday 2 May 2025, the last trading day before this agreed scheme was announced by GOR.

So, as at 2 May 2025, the total cash consideration equated to A$3.40 per share.

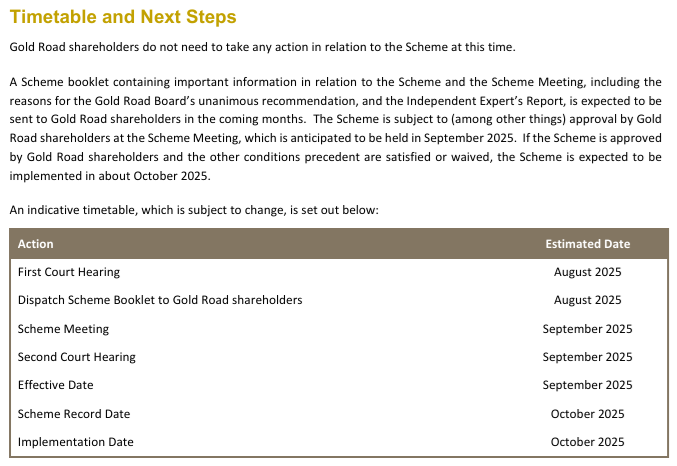

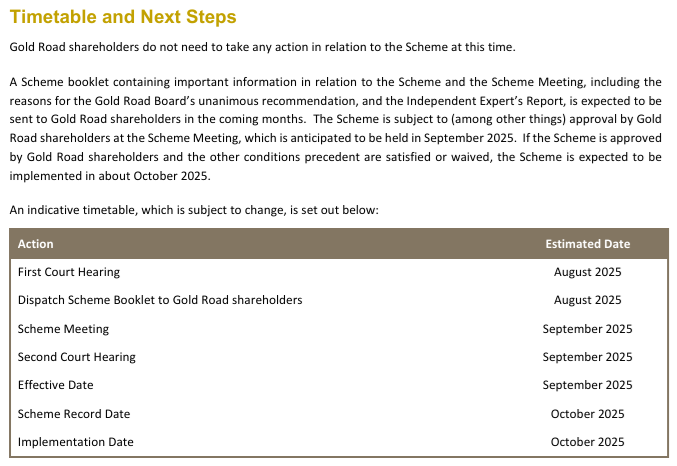

To come up with my new valuation for GOR on May 6th, I added another A$0.15 (i.e. 15 cps) onto that number above ($3.40) and called it A$3.55. That extra 15 cents that I've added is roughly the value of the franking credits that are expected to be attached to the 35 cps FF special dividend (spec div) that GOR are guiding that they intend to pay their shareholders prior to the date this scheme becomes effective, but likely after the date the scheme is voted up at the relevant shareholder meetings of both companies and the scheme becomes unconditional and binding, so a few months away yet. The scheme may not become effective until as late as October this year (I've included an indicative timetable at the end of this straw).

This additional 15 cps is only of value to Australian taxpayers who can use those franking credits to either reduce their own tax payable to the ATO or effect a tax refund from the ATO, and I am one of those people, so the franking credits are of value to me.

Importantly, while GF (Gold Fields Ltd) is going to reduce their fixed cash consideration by the amount of the dividend, which is expected to be 35 cps, GF are NOT going to apply any reduction in respect of those attached franking credits, so the franking credits are additional value that is above and beyond the cash that GF is going to pay GOR shareholders for their GOR shares.

Risks: Three main risks: The first is that the deal falls over, for any one of a number of reasons, including if the deal is blocked by FIRB - because GF is a South African company - however I considered that a very low probability considering that GF already own half of Gruyere, with the other half of Gruyere being GOR's main asset, and GOR's only gold producing asset. Additionally, GF are the OPERATORS at Gruyere already, with GOR being the silent partners.

Yesterday (May 21st), GOR released this: FIRB-Approval-Received.PDF ...so FIRB have stated that they won't block this deal, and I don't see any other regulatory hurdles that need to be jumped over; There's just the shareholder votes now, which should be fine, as nobody seems to think this is a bad deal for either party from what I've read and heard, at least nobody that could become a serious fly in the ointment.

The second risk is that the share price of NST declines significantly between now and the date the scheme becomes effective, which would reduce the 88 cps slice of the cash consideration, 88 cps being the value of those NST shares held by GOR on Friday 2nd May - and NST's SP had already risen another 90 cps in the following two trading days, i.e. up until my Val update for GOR on May 6th.

In terms of that risk, NST have been lower, and today (Thursday 22nd May) they finished higher still, at $20.25 (up +5.36% today), being $1.08 above the $19.17 they closed at on May 2nd, and according to my calculator, for every 10 cents that NST's share price (SP) rises above the $19.17 level they were at on 2nd May, the implied offer price - that GF is prepared to pay for GOR - rises by 0.459 cents. That means the offer value rises by 4.59 cents for every $1 that NST's share price rises above $19.17.

Today's closing SP for NST was $1.08 higher (than the $19.17 close on May 2nd) so that means that the value of GF's offer for GOR is now $3.449572, let's call it $3.45, so 5 cents more than 2 weeks ago. This is because the fixed cash consideration component is $2.52 (less any special dividend paid by GOR) and the other 88 cents (the variable cash consideration component that brought it up to $3.40) was based on the NST share price being $19.17, and they made it clear that the variable cash consideration (VCC) - which they calculated to be 88 cents at that time - would be equal to the full value of each Gold Road shareholders’ proportionate holding in Northern Star (NST), calculated by reference to the date the Scheme becomes effective.

$0.88 into $19.17 = 0.04590505998, let's call it 4.59%, as $19.17 x 4.59% = $0.879903, or 88 cents. So whatever the NST share price is on the day the scheme becomes effective (by the court, after the shareholder votes), you can multiply that NST closing SP on that day by 4.59% (or by 0.0459) and that will give you the variable cash consideration (VCC) component of GF's offer, and that can be added to the $2.52 FCC (fixed cash component) to give you the total offer price, which will be paid in cash less the value of the special dividend that GOR intends to pay to release their franking credits to shareholders.

The amount of the special dividend should not change as it has been calculated based on the amount of franking credits that GOR have got to distribute, and the only thing that would change that is if GOR paid some more tax to the ATO and received further franking credits, or they received a tax refund. I am however ignoring those two possibilities because (a) I have no clue how to factor that in and (b) any extra tax paid or tax refund received would likely have a very small impact on their franking credit balance anyway, so I'm basing my calculations on the estimated 35 cps (cents per share) amount that GOR have guided is likely to be the amount of the special div.

So, if theoretically the scheme became effective today, the implied offer price would be $3.45 (improved 5 cents because of the higher NST share price) plus the value of the franking credits attached to the special dividend, which I estimate to be around 15 cps, so that would be a total of $3.60, and GOR closed at $3.35 today (up +2.13%), so there's still value there, IMO.

In terms of my $3.55 valuation, I won't raise it based on daily movements in the NST SP, I'll just leave it as is, i.e. based on the same $19.17 SP for NST that GF used, but I'm still keeping track of the NST SP to note whether the real value to GOR shareholders in the GF offer to acquire all of GOR is likely to be higher or lower when they do pay the money compared to when they made the offer in early May.

At this point the value is higher based on the NST share price being $1.08 higher today than it was then, but the NST share price could (and will) go higher or lower between now and the scheme implementation date, which is months away.

The third risk is that the estimated 35 cps FF (fully franked) spec div is based on GOR's franking account balance of $163 million as at 2nd May 2025, and they state in the offer document that the final amount of any Special Dividend to be paid is ultimately dependent on Gold Road’s financial performance up until the date the Scheme becomes effective.

However, my view is that the spec div is entirely about releasing those franking credits prior to the change of ownership to a company for which ATO franking credits are of zero value, so the only things that could scuttle the spec div are (a) the deal falling through (v. low probability), or (b) Gold Road finding themselves with insufficient cash to fund the dividend, which isn't going to happen unless something extra-extraordinary was to occur in the next few months, considering GOR are not the operators at Gruyere (GF are) and both GF and GOR want this deal to go through, so neither party are likely to do something really stupid to put the deal at risk.

GOR's franking credit balance is also not going to reduce unless they receive a tax refund between now and then. If anything there's the possibility that they might even generate even more franking credits by paying more tax, although I'm certainly not factoring that in.

The other possibility I should mention is not something I consider a risk, but a possibility with likely positive consequences for GOR shareholders in the unlikely event that it was to occur, and that is that a superior offer is lobbed in by somebody else, however while that is always a possibility, it's unlikely in this particular case because anybody trying to come over the top of GF to acquire GOR are really trying to acquire the silent partner share of Gruyere - a gold mine that GF operate and already own half of, so to come over the top of GF here that hypothetical third party would be immediately establishing a confrontational and hostile relationship with their potential JV partners at Gruyere, which is probably not going to be a very smart move.

So while there could be interest from a third party, in the same way that SLR showed interest in SBM's assets when GMD was buying them a couple of years ago, the reality is likely to be that any third party interest is likely to just be an arbitrage play to try to force GF to up their offer further (as SLR's Luke Tonkin was trying to do with GMD back then).

However GF have already upped their offer from the earlier one in March/April, and they have stated that this one is best and final, subject to the absence of a superior proposal from somebody else, so if a third party tried to come over the top, GF could very well call their bluff and back out (walk away), which would most likely be a bad outcome for GOR shareholders, but that scenario has a low probability of occuring IMO. I don't think we are likely to see any third party action here on this occasion.

This is similar to the RMS takeover of SPR, which is locked in by RMS already owning a bee's whisker under 20% of SPR and owning that stake before they launched their takeover, which Spartan has agreed to.

In GOR's case, it's the fact that it's their Gruyere gold mine JV partners that are acquiring them, and that GF are the operators at Gruyere, that is locking in this deal.

In NST's case, with their takeover of DEG, that was really a size thing; nobody here in Australia could raise over $5 Billion to try to come over the top of NST for Hemi, Australia's largest undeveloped gold project, with NST already being Australia's largest gold miner. And larger overseas players didn't want to take on such a big greenfields project here in Australia, so the NST acquisition of DEG sailed through with zero opposition, and settled late last month.

---

So, while you should never count your chickens before they hatch, I have a reasonable amount of confidence that this T/O of GOR by GF is going to proceed, and I thought there was some arbitrage there a couple of weeks ago, just after the deal was announced, as long as NST's share price doesn't decline significantly over the next few months, as I explained above (and in my Val update earlier this month).

I hold NST both here and in my SMSF, so I was already bullish on NST, so my view is that Northern Star are more likely to be trading higher than lower later this year, so that opinion assisted my investment thesis for the GOR arbitrage trade.

So I bought back into GOR shortly after this deal was announced and I'm already up +9 cps in less than 2 weeks, with the offer value (including the franking credits value) still another 20 cps above GOR's closing SP today, plus an additional 5 cps higher still if you factor in NST's closing share price today (because NST's SP is +$1.08 higher than it was then).

Normally when an all-cash takeover offer is made, and is agreed to by the target company, and everybody expects it to go through, the share price of the target company doesn't move around very much; it would usually trade just below the offer price. However in this case we have that VCC (variable cash component) which is entirely based on NST's SP (because GOR own NST shares that they received for their DEG shares when NST acquired DEG last month). And because of that, the GOR share price is likely to follow NST's SP to some degree now, i.e. go up when NST goes up, and go down when NST goes down, not by the same percentages because GOR only own 3.486% of NST, so there's a correlation there, but it's not 1-for-1.

I could be wrong about that 3.486% number but I reckon it's close, and because GOR (with 1,086,399,060) have less shares on issue (SOI) than NST (with 1,430,447,066) do, I estimate that you have to multiply that 3.486% percentage holding by 1.317 (the ratio of NST's total SOI to GOR's total SOI) to arrive at that 4.59% that GF and GOR appear to have used in their calculations to work out that GOR shareholders owned 88 cents worth of NST per GOR share held when NST's share price was $19.17/share. Actually I'll have a delve into the small print in the offer document to check that...

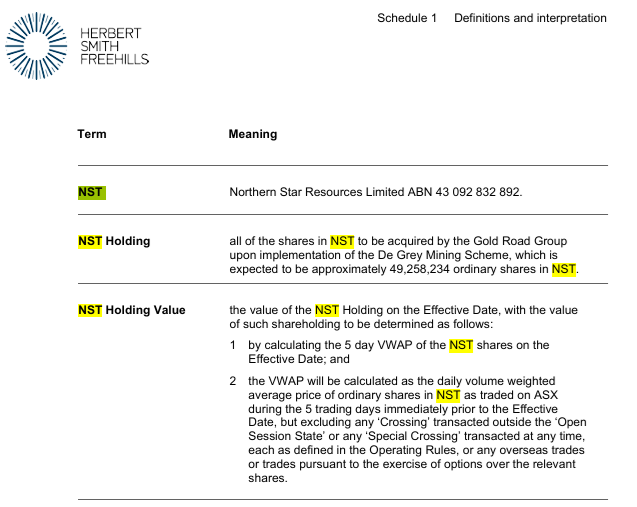

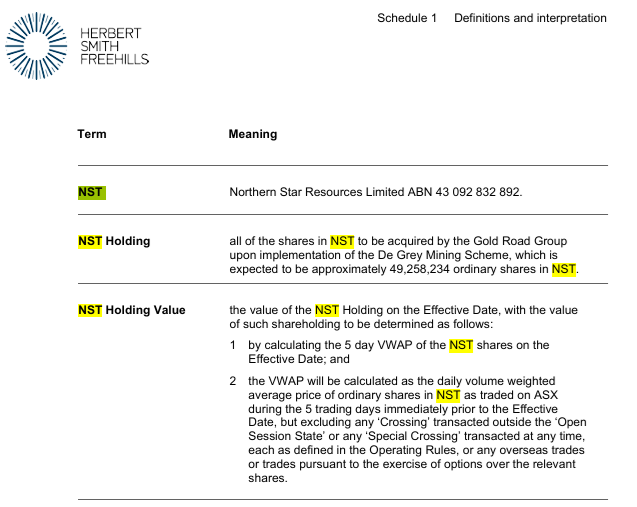

Yeah, their wording is:

Variable cash consideration equal to the full value of each Gold Road shareholder’s proportion of the Company’s shareholding in Northern Star Resources Ltd (Northern Star) based on the prevailing 5-day volume weighted average price (VWAP) immediately prior to the Scheme becoming effective (Variable Cash Consideration). As at 2 May 2025, the value of the Variable Cash Consideration equates to A$0.88 per share.

---

And:

Shareholders should be aware that the value of the Variable Cash Component (and therefore the total Scheme Consideration payable in cash pursuant to the Scheme) will fluctuate based on movements in the value of Northern Star shares up until the date the Scheme becomes effective.

---

Also, a search of "Northern Star" and then "NST" through the 129 page document revealed this on page 62:

So GOR hadn't actually received the NST shares yet when they wrote that - because the NST takeover of DEG had only completed the week that this document was being written - i.e. the last three days of April and first two days of May, but they anticipated being given 49,258,234 NST shares for their 19.99% of GOR. Based on NST's share count today (1,430,447,066 according to the ASX) that would mean GOR would own 3.444% of NST, which is close to my 3.486% estimate above, which I arrived at by working backwards from that 88c value based on a $19.17 NST SP that GF & GOR have used.

I note that NST announced on May 19th that they had completed a $300 Million on-market share buy-back which included 5 days from May 13th to 16th (inclusive) that NST lodged "Update - Notification of buy-back - NST" notices indicating that their share buy-back was active on each of those 5 days, and they also issued a lot of new shares on May 6th to settle the DEG acquisition, so the NST share count was changing between then and now.

But yeah, GOR owns 3.444% of NST and if GOR had exactly the same number of SOI as NST, then the value of that holding would be worth 3.444% of the NST share price for each GOR share on any given day, but because GOR have 0.7595 as many shares on issue as NST, or to put it another way, NST have 1.317 times as many shares on issue as GOR do, the percentage ownership of NST per GOR share is greater than 3.444% of NST's SP because there are less GOR shares to divide that value up between, so that's where the ratio between the SOI of each company comes into play, and I calculate that ratio to be aproximately 1.31668658393 (or 1.317), so if we multiply that 3.444% by 1.317, we get 4.53578%, which is in the ballpark of the 4.59% that they (GF & GOR) appear to be using on the NST SP when it was $19.17 to get an 88 cent value. $19.17 x 4.53578% = 86.95 cents, so one cent less (than 88 cents), so, yeah, in the ball park.

Anyway, hopefully, for those few who have lasted all the way through this long straw, that may help explain why the GOR share price tends to move up when the NST has a decent rise, and vice versa.

Disclosure: Holding GOR and NST.

P.S. Here's their indicative timetable: