Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

22nd September 2025: As expected shareholders voted up the scheme at today's meeting with over 99% of votes cast "FOR" and less than 1% against. In terms of individual shareholders, 91.23% voted "FOR" with less than 9% of shareholders voting against the takeover of GOR by Gold Fields Ltd ("the scheme").

Source: Results-of-Scheme-Meeting.PDF [6:26pm, 22-Sept-2025]

See also: ZSP-Gold-Road-Resources-Ltd-to-be-removed-from-SPASX-200 (1).PDF [5:08pm, 22-Sept-2025]

GOR is being replaced in the ASX 200 index by Catapult Sports (CAT), something CAT shareholders here will be happy to hear.

It's been a good year for GOR shareholders, and the company's SP hit a new all time high today of $3.50 before closing at $3.47.

It's been more than just a good year, here's their chart since they listed back in mid-2006:

They got down to 3 cents/share in April 2009 and again in mid-2013, but it's been a good ride up since then.

Originally known as Faulkner Resources, the company's main activity back in 2005-2006 was strategic acquisition of land and projects in the Yamarna Greenstone Belt. Under the guidance of geologist Russel Davis, Faulkner Resources acquired the Yamarna North and Yamarna South Projects in 2005, which were significant steps in building the company's future asset base. They rebranded the company to Gold Road Resources to focus on gold exploration, discovery, and mining in Australia.

Gold Road Resources discovered the Gruyere deposit in October 2013 and later entered into a joint venture (JV) with Gold Fields in November 2016, selling a 50% stake in the project to Gold Fields to help fund its development. Gold Fields developed the project and have been the project's operators since then, but have always only owned half of it with Gold Road retaining ownership of the other half.

Now, twelve years after Gold Road discovered Gruyere, Gold Fields is buying Gold Road to become 100% owners of Gruyere and all of the land around Gruyere that Gold Road either own outright or own as part of the JV.

It's been quite the journey for GOR shareholders. I've been in and out over the years, mostly out, and I jumped back in on the day this deal was announced back in May this year - and have topped up those positions since then on drops as I have explained elsewhere here.

For me this has been an arbitrage play with GOR trading at less than my estimation of the total value of the deal to GOR shareholders on a per share basis, however I am able to use the franking credits that come with that $0.43694/share special dividend (see here: Determination-to-pay-Special-Dividend.PDF) that will be paid on October 7th (two weeks from tomorrow) and not all shareholders can use those franking credits, so the arbitrage is clearly better if you can use those franking credits and it may not have been worth the effort if you can't make use of them such as if you are not an Australian resident and do not pay tax to the ATO. That's why I haven't held a large GOR position here on SM (not holding any GOR shares here currently) - because we do not get any benefit from franking credits here in our virtual SM portfolios, so there were better opportunities to deploy the limited amount of virtual cash I've got here because of that, however GOR is the second or third largest position in both of my main two real money portfolios (my SMSF and my income portfolio) and has been for most of the past few months, certainly since I added to those positions in July and August when the GOR SP followed the NST share price down.

Of course, apart from that large special dividend, we have the fixed cash consideration and the variable cash consideration components of the cash compensation that GF are paying us GOR shareholders for our GOR shares, and the variable consideration is totally dependent on the NST share price this week (I think it's the VWAP of NST during the last week before the scheme becomes effective, which would be this week), because that variable cash consideration is going to be equal to each GOR shareholder's proportional ownership of NST - because GOR holds 49,258,234 NST shares which they received when NST acquired De Grey Mining (was DEG) earlier this year in an all-scrip deal (paid for by NST shares, not cash), because GOR held 19.99% of DEG when NST acquired DEG. And look at where NST is sitting:

NST closed up +8.21% today @ $22.41. Nice!

It was a reasonable day indeed for most Aussie gold miners - have a look at my Aussie gold sector watchlist and how they all ended the day:

Not bad at all - not much red in that list - just those 5 small explorers / developers at the bottom, and WAF is still suspended of course. I've put a gold coloured rectangle around the 4 ETFs / ETPs that track the physical gold bullion price, and yes, gold is up again, but it's very obvious that the sector is running hot at the moment because gold companies are generally rising a LOT more than the gold price is rising - after all, many of these companies own a LOT of gold, and even though the vast majority of that gold is still in the ground, it's still belongs to them, so we're getting that catch-up now after the gold price outperformed gold stocks for a long time, so now gold stocks are outperforming the gold price - the gold stocks are catching up finally, and it's right across the sector now, the big producers, the mid tier producers, the minnows, and even the small explorers and project developers are in demand.

One of my top picks, Genesis Minerals (GMD), was the day's second best gold sector performer with their share price finishing up almost +14% @ $5.75. They are one of the best growth stories in the sector, already producing gold at two mills (Leonora and Laverton) and set to produce a lot more over the next few years. I keep thinking there's already a heap of future growth already priced in and then they go and rise another 14% !

I'm not complaining, I do hold them in my SMSF (and here).

The only one that beat GMD today was YRL (Yandal Resources) who are a tiny little sub-$50m (or they were on Friday) wanna-be gold project developer who were up today on drilling results despite the grades being fairly average - the headline number was 54m @ 1.2g/t Au from 108m - I reckon the market got excited by the width of the hit rather than the grade, and because it's only a little over 100m below surface, so open-pittable. YRL did mention however that they haven't yet ascertained the true width; they've just used the down hole width for now, and the hole is at a decent angle, as shown below. It looks like a good dicovery on this diagram, especially with today's gold price:

It's that drill hole that starts in the top left corner that they're talking about with the 54m @ 1.2g/t gold, from 108 metres down, hole 25IWBRC0040.

Their shareholders needed some positive news because YRL hasn't had a good year compared to most of the other names on that watchlist - I'll not bother including their chart, but without today's move it was looking fairly ordinary.

I don't hold YRL. But I do hold GOR and NST and GMD - and a few others on that list, and it's been a good day. I think I'll crack open some 2022 Hewitson 'Ungrafted' Grenache and celebrate with a glass or three. Hard to beat a good Barossa red. And we need to celebrate our wins every now and then.

22nd May 2025: As I said a couple of weeks ago in my update to my Gold Road (GOR) valuation, Gold Road (GOR) announced on May 5th that they have agreed to be acquired by Gold Fields Ltd, who are Gold Road's 50/50 JV partners in the Gruyere Gold Mine in WA's eastern central goldfields (i.e. above Kalgoorlie but more towards the NT border).

See here: Scheme Implementation Deed entered into with Gold Fields [5 May 2025]

The offer is all cash, so no shares, which is to be expected from a South African listed company like Gold Fields Ltd (GF). Australian investors generally prefer cash than shares when an overseas-listed company acquires their Australian-listed company.

I raised my valuation for GOR to $3.55 on May 6th because I value this offer @ just over $3.55 based on (1) NST's closing price on Friday 2nd May and (2) where NST closed on that today (May 6th). The reason why NST's SP is relevant is that GOR held 19.99% of De Grey Mining (was DEG.asx, now removed from the list) and the acquisition of DEG by NST in an all-scrip (shares for shares) deal completed in late April, so GOR now hold NST shares instead of those DEG shares that they previously held.

GF is offering: A$2.52 fixed cash consideration less any special dividend paid prior to implementation of the Scheme, plus a variable cash consideration equal to the full value of each Gold Road shareholders’ proportionate holding in Northern Star (NST), calculated by reference to the date the Scheme becomes effective - so valued at A$0.88 per share if the Scheme was effective on Friday 2 May 2025, the last trading day before this agreed scheme was announced by GOR.

So, as at 2 May 2025, the total cash consideration equated to A$3.40 per share.

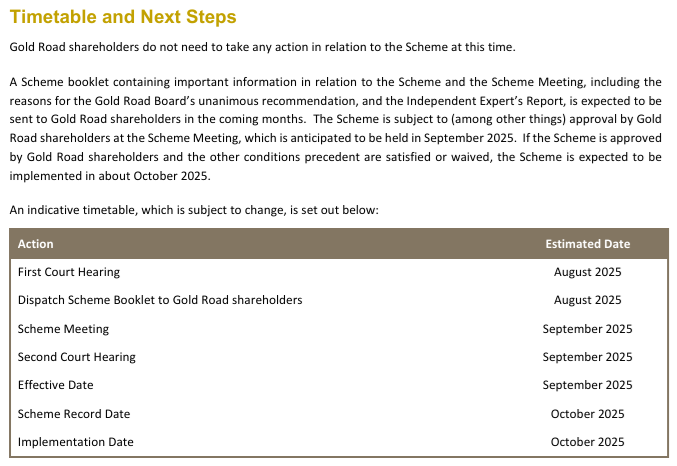

To come up with my new valuation for GOR on May 6th, I added another A$0.15 (i.e. 15 cps) onto that number above ($3.40) and called it A$3.55. That extra 15 cents that I've added is roughly the value of the franking credits that are expected to be attached to the 35 cps FF special dividend (spec div) that GOR are guiding that they intend to pay their shareholders prior to the date this scheme becomes effective, but likely after the date the scheme is voted up at the relevant shareholder meetings of both companies and the scheme becomes unconditional and binding, so a few months away yet. The scheme may not become effective until as late as October this year (I've included an indicative timetable at the end of this straw).

This additional 15 cps is only of value to Australian taxpayers who can use those franking credits to either reduce their own tax payable to the ATO or effect a tax refund from the ATO, and I am one of those people, so the franking credits are of value to me.

Importantly, while GF (Gold Fields Ltd) is going to reduce their fixed cash consideration by the amount of the dividend, which is expected to be 35 cps, GF are NOT going to apply any reduction in respect of those attached franking credits, so the franking credits are additional value that is above and beyond the cash that GF is going to pay GOR shareholders for their GOR shares.

Risks: Three main risks: The first is that the deal falls over, for any one of a number of reasons, including if the deal is blocked by FIRB - because GF is a South African company - however I considered that a very low probability considering that GF already own half of Gruyere, with the other half of Gruyere being GOR's main asset, and GOR's only gold producing asset. Additionally, GF are the OPERATORS at Gruyere already, with GOR being the silent partners.

Yesterday (May 21st), GOR released this: FIRB-Approval-Received.PDF ...so FIRB have stated that they won't block this deal, and I don't see any other regulatory hurdles that need to be jumped over; There's just the shareholder votes now, which should be fine, as nobody seems to think this is a bad deal for either party from what I've read and heard, at least nobody that could become a serious fly in the ointment.

The second risk is that the share price of NST declines significantly between now and the date the scheme becomes effective, which would reduce the 88 cps slice of the cash consideration, 88 cps being the value of those NST shares held by GOR on Friday 2nd May - and NST's SP had already risen another 90 cps in the following two trading days, i.e. up until my Val update for GOR on May 6th.

In terms of that risk, NST have been lower, and today (Thursday 22nd May) they finished higher still, at $20.25 (up +5.36% today), being $1.08 above the $19.17 they closed at on May 2nd, and according to my calculator, for every 10 cents that NST's share price (SP) rises above the $19.17 level they were at on 2nd May, the implied offer price - that GF is prepared to pay for GOR - rises by 0.459 cents. That means the offer value rises by 4.59 cents for every $1 that NST's share price rises above $19.17.

Today's closing SP for NST was $1.08 higher (than the $19.17 close on May 2nd) so that means that the value of GF's offer for GOR is now $3.449572, let's call it $3.45, so 5 cents more than 2 weeks ago. This is because the fixed cash consideration component is $2.52 (less any special dividend paid by GOR) and the other 88 cents (the variable cash consideration component that brought it up to $3.40) was based on the NST share price being $19.17, and they made it clear that the variable cash consideration (VCC) - which they calculated to be 88 cents at that time - would be equal to the full value of each Gold Road shareholders’ proportionate holding in Northern Star (NST), calculated by reference to the date the Scheme becomes effective.

$0.88 into $19.17 = 0.04590505998, let's call it 4.59%, as $19.17 x 4.59% = $0.879903, or 88 cents. So whatever the NST share price is on the day the scheme becomes effective (by the court, after the shareholder votes), you can multiply that NST closing SP on that day by 4.59% (or by 0.0459) and that will give you the variable cash consideration (VCC) component of GF's offer, and that can be added to the $2.52 FCC (fixed cash component) to give you the total offer price, which will be paid in cash less the value of the special dividend that GOR intends to pay to release their franking credits to shareholders.

The amount of the special dividend should not change as it has been calculated based on the amount of franking credits that GOR have got to distribute, and the only thing that would change that is if GOR paid some more tax to the ATO and received further franking credits, or they received a tax refund. I am however ignoring those two possibilities because (a) I have no clue how to factor that in and (b) any extra tax paid or tax refund received would likely have a very small impact on their franking credit balance anyway, so I'm basing my calculations on the estimated 35 cps (cents per share) amount that GOR have guided is likely to be the amount of the special div.

So, if theoretically the scheme became effective today, the implied offer price would be $3.45 (improved 5 cents because of the higher NST share price) plus the value of the franking credits attached to the special dividend, which I estimate to be around 15 cps, so that would be a total of $3.60, and GOR closed at $3.35 today (up +2.13%), so there's still value there, IMO.

In terms of my $3.55 valuation, I won't raise it based on daily movements in the NST SP, I'll just leave it as is, i.e. based on the same $19.17 SP for NST that GF used, but I'm still keeping track of the NST SP to note whether the real value to GOR shareholders in the GF offer to acquire all of GOR is likely to be higher or lower when they do pay the money compared to when they made the offer in early May.

At this point the value is higher based on the NST share price being $1.08 higher today than it was then, but the NST share price could (and will) go higher or lower between now and the scheme implementation date, which is months away.

The third risk is that the estimated 35 cps FF (fully franked) spec div is based on GOR's franking account balance of $163 million as at 2nd May 2025, and they state in the offer document that the final amount of any Special Dividend to be paid is ultimately dependent on Gold Road’s financial performance up until the date the Scheme becomes effective.

However, my view is that the spec div is entirely about releasing those franking credits prior to the change of ownership to a company for which ATO franking credits are of zero value, so the only things that could scuttle the spec div are (a) the deal falling through (v. low probability), or (b) Gold Road finding themselves with insufficient cash to fund the dividend, which isn't going to happen unless something extra-extraordinary was to occur in the next few months, considering GOR are not the operators at Gruyere (GF are) and both GF and GOR want this deal to go through, so neither party are likely to do something really stupid to put the deal at risk.

GOR's franking credit balance is also not going to reduce unless they receive a tax refund between now and then. If anything there's the possibility that they might even generate even more franking credits by paying more tax, although I'm certainly not factoring that in.

The other possibility I should mention is not something I consider a risk, but a possibility with likely positive consequences for GOR shareholders in the unlikely event that it was to occur, and that is that a superior offer is lobbed in by somebody else, however while that is always a possibility, it's unlikely in this particular case because anybody trying to come over the top of GF to acquire GOR are really trying to acquire the silent partner share of Gruyere - a gold mine that GF operate and already own half of, so to come over the top of GF here that hypothetical third party would be immediately establishing a confrontational and hostile relationship with their potential JV partners at Gruyere, which is probably not going to be a very smart move.

So while there could be interest from a third party, in the same way that SLR showed interest in SBM's assets when GMD was buying them a couple of years ago, the reality is likely to be that any third party interest is likely to just be an arbitrage play to try to force GF to up their offer further (as SLR's Luke Tonkin was trying to do with GMD back then).

However GF have already upped their offer from the earlier one in March/April, and they have stated that this one is best and final, subject to the absence of a superior proposal from somebody else, so if a third party tried to come over the top, GF could very well call their bluff and back out (walk away), which would most likely be a bad outcome for GOR shareholders, but that scenario has a low probability of occuring IMO. I don't think we are likely to see any third party action here on this occasion.

This is similar to the RMS takeover of SPR, which is locked in by RMS already owning a bee's whisker under 20% of SPR and owning that stake before they launched their takeover, which Spartan has agreed to.

In GOR's case, it's the fact that it's their Gruyere gold mine JV partners that are acquiring them, and that GF are the operators at Gruyere, that is locking in this deal.

In NST's case, with their takeover of DEG, that was really a size thing; nobody here in Australia could raise over $5 Billion to try to come over the top of NST for Hemi, Australia's largest undeveloped gold project, with NST already being Australia's largest gold miner. And larger overseas players didn't want to take on such a big greenfields project here in Australia, so the NST acquisition of DEG sailed through with zero opposition, and settled late last month.

---

So, while you should never count your chickens before they hatch, I have a reasonable amount of confidence that this T/O of GOR by GF is going to proceed, and I thought there was some arbitrage there a couple of weeks ago, just after the deal was announced, as long as NST's share price doesn't decline significantly over the next few months, as I explained above (and in my Val update earlier this month).

I hold NST both here and in my SMSF, so I was already bullish on NST, so my view is that Northern Star are more likely to be trading higher than lower later this year, so that opinion assisted my investment thesis for the GOR arbitrage trade.

So I bought back into GOR shortly after this deal was announced and I'm already up +9 cps in less than 2 weeks, with the offer value (including the franking credits value) still another 20 cps above GOR's closing SP today, plus an additional 5 cps higher still if you factor in NST's closing share price today (because NST's SP is +$1.08 higher than it was then).

Normally when an all-cash takeover offer is made, and is agreed to by the target company, and everybody expects it to go through, the share price of the target company doesn't move around very much; it would usually trade just below the offer price. However in this case we have that VCC (variable cash component) which is entirely based on NST's SP (because GOR own NST shares that they received for their DEG shares when NST acquired DEG last month). And because of that, the GOR share price is likely to follow NST's SP to some degree now, i.e. go up when NST goes up, and go down when NST goes down, not by the same percentages because GOR only own 3.486% of NST, so there's a correlation there, but it's not 1-for-1.

I could be wrong about that 3.486% number but I reckon it's close, and because GOR (with 1,086,399,060) have less shares on issue (SOI) than NST (with 1,430,447,066) do, I estimate that you have to multiply that 3.486% percentage holding by 1.317 (the ratio of NST's total SOI to GOR's total SOI) to arrive at that 4.59% that GF and GOR appear to have used in their calculations to work out that GOR shareholders owned 88 cents worth of NST per GOR share held when NST's share price was $19.17/share. Actually I'll have a delve into the small print in the offer document to check that...

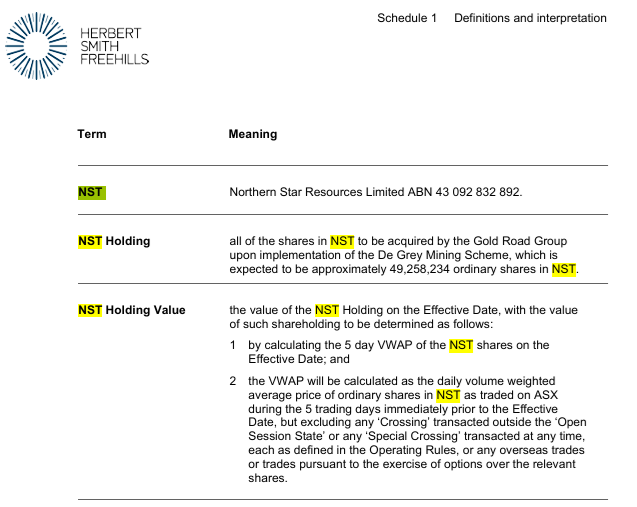

Yeah, their wording is:

Variable cash consideration equal to the full value of each Gold Road shareholder’s proportion of the Company’s shareholding in Northern Star Resources Ltd (Northern Star) based on the prevailing 5-day volume weighted average price (VWAP) immediately prior to the Scheme becoming effective (Variable Cash Consideration). As at 2 May 2025, the value of the Variable Cash Consideration equates to A$0.88 per share.

---

And:

Shareholders should be aware that the value of the Variable Cash Component (and therefore the total Scheme Consideration payable in cash pursuant to the Scheme) will fluctuate based on movements in the value of Northern Star shares up until the date the Scheme becomes effective.

---

Also, a search of "Northern Star" and then "NST" through the 129 page document revealed this on page 62:

So GOR hadn't actually received the NST shares yet when they wrote that - because the NST takeover of DEG had only completed the week that this document was being written - i.e. the last three days of April and first two days of May, but they anticipated being given 49,258,234 NST shares for their 19.99% of GOR. Based on NST's share count today (1,430,447,066 according to the ASX) that would mean GOR would own 3.444% of NST, which is close to my 3.486% estimate above, which I arrived at by working backwards from that 88c value based on a $19.17 NST SP that GF & GOR have used.

I note that NST announced on May 19th that they had completed a $300 Million on-market share buy-back which included 5 days from May 13th to 16th (inclusive) that NST lodged "Update - Notification of buy-back - NST" notices indicating that their share buy-back was active on each of those 5 days, and they also issued a lot of new shares on May 6th to settle the DEG acquisition, so the NST share count was changing between then and now.

But yeah, GOR owns 3.444% of NST and if GOR had exactly the same number of SOI as NST, then the value of that holding would be worth 3.444% of the NST share price for each GOR share on any given day, but because GOR have 0.7595 as many shares on issue as NST, or to put it another way, NST have 1.317 times as many shares on issue as GOR do, the percentage ownership of NST per GOR share is greater than 3.444% of NST's SP because there are less GOR shares to divide that value up between, so that's where the ratio between the SOI of each company comes into play, and I calculate that ratio to be aproximately 1.31668658393 (or 1.317), so if we multiply that 3.444% by 1.317, we get 4.53578%, which is in the ballpark of the 4.59% that they (GF & GOR) appear to be using on the NST SP when it was $19.17 to get an 88 cent value. $19.17 x 4.53578% = 86.95 cents, so one cent less (than 88 cents), so, yeah, in the ball park.

Anyway, hopefully, for those few who have lasted all the way through this long straw, that may help explain why the GOR share price tends to move up when the NST has a decent rise, and vice versa.

Disclosure: Holding GOR and NST.

P.S. Here's their indicative timetable:

08-Dec-2020: Gruyere to Expand with Renewable Energy Hybrid Microgrid

and: APA: APA Makes First Hybrid Energy Microgrid Investment

GRUYERE TO EXPAND WITH RENEWABLE ENERGY HYBRID MICROGRID

Highlights

- Gruyere JV installation of a renewable energy hybrid microgrid will increase the mine’s power capacity to enable plant throughput up to a targeted 10 million tonnes per annum (Mtpa)

- Phase 1 installation of an additional 4MW gas engine by mid-2021

- Phase 2 installation of a 13MW solar farm and 4.4MW battery energy storage system by the end of 2021

--- click on links for the full announcements by GOR and APA ---

[I hold GOR shares, GOR (Gold Road Resources) own 50% of the Gruyere Gold Mine in WA. The other half is owned by South-African-based Gold Fields Ltd.]

Further Reading:

https://goldroad.com.au/wp-content/uploads/2020/10/20201023-Quarterly-Activities-Report-Sept-2020_asx.pdf (23-Oct-2020)

https://goldroad.com.au/wp-content/uploads/2020/10/202010-Diggers-Presentation_ASX.pdf (12-Oct-2020)

https://goldroad.com.au/ (website)

23-Oct-2020: Quarterly Activities and Cash Flow Report - Sept 2020

plus: Quarterly Report Conference Call Presentation - Sept 2020

HIGHLIGHTS

Production and Guidance

- Gruyere produced 55,919 ounces of gold (100% basis) during the quarter (June quarter: 71,865 ounces) in line with updated quarterly guidance of 53,000 to 57,000 ounces. Gruyere is on track to meet 2020 annual guidance of 250,000 to 270,000 ounces (100% basis).

- Gold Road delivered its September 2020 quarter production at an AISC of A$1,488 per attributable ounce (June quarter: A$1,233 per ounce) below the revised quarterly guidance of A$1,540 to A$1,590 per ounce. Annual AISC for 2020 is maintained at between A$1,250 to A$1,350 per ounce(*).

- Gruyere ore tonnes processed totalled 1.9 Mt at a head grade of 1.03 g/t Au and a gold recovery of 91.5%. Plant utilisation was below target at 87% due to additional downtime to configure the milling circuit as the plant transitioned to fresh rock processing and the previously reported failure of a ball mill motor bearing late in the quarter.

- As guided, the September 2020 quarter was higher cost as the operation transitioned from oxide to fresh rock ore processing. The December 2020 quarter is anticipated to be a stronger quarter aligning with annual guidance.

Financial and Corporate

- Gold Road’s gold sales totalled 31,480 ounces at an average price of $2,420 per ounce and included delivery of 8,605 ounces at an average price of $1,790 per ounce into hedges as they fell due. Gold doré and bullion on hand at 30 September 2020 totalled 1,811 ounces.

- Free cash flow of $48.7 million was generated for the quarter, prior to the repayment of debt and includes proceeds from the sale of listed investments. Underlying free cash flow (before sale of investment) for the quarter was $22.2 million (June quarter: $23.8 million).

- The Company ended the quarter in a strong position with cash and equivalents of $103.0 million (June quarter: $109.1 million) and no debt (June quarter: $25 million) as the remaining $25 million of debt was repaid.

- Gold Road announced a dividend policy during the quarter. Subject to Board discretion, it is anticipated that an inaugural dividend will be declared for the six month period ended 31 December 2020(**).

- As part of an ongoing capital management strategy to ensure a liquid and flexible balance sheet, Gold Road increased its revolving corporate debt facilities to $250 million(***). This facility remains undrawn and is reserved for general corporate purposes and potential growth opportunities.

Discovery

- In line with our strategy of making meaningful discoveries, aircore, RC and diamond drilling continued to focus on new targets in the relatively underexplored 100% owned Southern Project Area, including the Savoie, Beefwood, Hirono, and Kingston prospects.

- Assays were returned from Gilmour drilling completed earlier in the year which include 4.0 metres at 16.58 g/t Au and 6.78 metres at 5.33 g/t Au.

Notes:

- (*) Refer to ASX announcement dated 24 September 2020

- (**) Refer to ASX announcement dated 16 September 2020

- (***) Refer to ASX announcement dated 18 September 2020

Introduction

Mid-tier gold production and exploration company, Gold Road Resources Limited (ASX:GOR), presents its activity report for the quarter ending 30 September 2020.

Production is from the Gruyere Gold Mine (Gruyere) which is a 50:50 joint venture with Gruyere Mining Company Pty Ltd, a member of the South African-based Gold Fields Ltd group (Gold Fields), who manage Gruyere.

During the September 2020 quarter, Gruyere delivered production of 55,919 ounces of gold (100% basis) (June 2020 quarter: 71,865 ounces – 100% basis) in line with updated quarterly guidance of 53,000 to 57,000 ounces. This production was delivered at an All-in-Sustaining Cost (AISC) of A$1,488 per attributable ounce to Gold Road (June quarter: A$1,233 per ounce), below revised quarterly cost guidance of A$1,540 to A$1,590 per ounce.

The weighted average Lost Time Injury Frequency Rate (LTIFR) for Gruyere and Gold Road was 3.08 at 30 September 2020. There were no lost time injuries recorded at Gruyere or Gold Road during the quarter.

Production

Gruyere (100% basis)

Mining

Mining totalled 1.9 Mt of ore during the quarter at an average grade of 1.03 g/t Au for 61,443 contained ounces. Ore mining was predominantly from the Stage 1 fresh rock pit. The rate of waste stripping increased during the September quarter with the waste to ore ratio lifting from 1.8:1 (June quarter) to 3.1:1 as the second mining fleet became operational and continued stripping of the Stage 2 pit. Quarter on quarter operational mining costs decreased by $2.4 million as a result of the lower mining volumes, while capitalised mining costs increased by $5.6 million as a result of the greater volumes of pre-stripping in the Stage 2 and 3 cutbacks, with the second mining fleet fully mobilised and operational for most of the quarter.

At the end of the quarter, ore stockpiles remained unchanged at 3.2 Mt at 0.70 g/t Au (June quarter: 3.2 Mt at 0.70 g/t Au).

Processing

Total ore processed during the quarter was 1.9 Mt at a head grade of 1.03 g/t Au, and a gold recovery of 91.5% for 55,919 ounces of gold produced. Ore tonnes processed reduced quarter on quarter as ore processing transitioned into fresh rock ore with lower than planned plant availability.

Plant availability averaged 87% over the quarter. Additional plant downtime was incurred to improve the configuration of the SAG milling circuit, with throughput rates improving in the second half of the quarter after the replacement of the SAG mill discharge grates and screens. Production was interrupted for seven days late in the quarter following a ball mill motor bearing failure. The bearing failure occurred on a restart of the processing facility after a scheduled maintenance shutdown. The ball mill is now fully operational, and no further issues are anticipated.

A programme of mine to mill optimisation commenced late in the quarter with trials on higher intensity blasting of fresh rock ore, and blending of fresh and oxide ore demonstrating increased throughput rates. Implementation of mine to mill optimisation practices, design upgrades to the pebble crushing circuit to improve operability and reliability, and milling circuit process automation will be progressed over the coming six months.

Gold recovery on ore processed during the quarter was down slightly quarter on quarter, as expected, with the increase in fresh rock ore processing. Head grades were in line with expectations and down slightly quarter on quarter.

Processing costs continued to benefit from more efficient reagent usage. These benefits were offset by higher maintenance costs quarter on quarter.

All earth works for the tailings dam lift were completed on schedule during the quarter, with minor works required to complete the raise.

AISC was below revised guidance for this quarter largely due to lower than anticipated capital expenditure completed during the quarter. AISC was higher quarter on quarter due to the increased maintenance and capital costs.

--- click on links above for the full report and presentation ---

[I hold GOR shares in my SMSF.]

16-Sep-2020: Investor Presentation - September 2020 plus Dividend Policy

[ I hold GOR shares in my SMSF.]

10-Sep-2020: Yamarna Exploration Update - September 2020

[I hold GOR shares in my SMSF.]

09-Sep-2020: 2020 Half Year Financial Results Announcement and 2020 Half Year Financial Results

INAUGURAL NET PROFIT REPORTED FOR 6 MONTHS TO 30 JUNE 2020

Half Year Highlights

First Year of Production Completed

- Gruyere maintained a high level of safety performance and suffered no material impact on operations from COVID-19

- Gruyere celebrated its first 12 months of gold production on 30 June 2020, having produced 230,590 ounces (100% basis) since first pouring gold on 30 June 2019

Inaugural Six Month Profit

- Gold produced over the six months to 30 June 2020 was 131,460 ounces (100% basis) at an AISC of A$1,186 per attributable ounce

- Operating cash flow attributed to Gold Road over the six months to 30 June 2020 was $59.6 million*

- Gold Road sold 60,400 ounces of gold at an average price of A$2,237 per ounce over the six month period

- Revenue from gold sales for the half year totalled $135.1 million (30 June 2019: Nil)*

- EBITDA generated over the six month period totalled $61.0 million (30 June 2019: $23.0 million loss)*

- Consolidated Net Profit after Tax for the half year of $23.4 million (30 June 2019: $16.9 million loss)*

- Unsold ounces of 5,330 ounces at end of period due to COVID-19 balance sheet precautions**

Strong Balance Sheet

- Gold Road ended the half year in a strong position with cash of $73 million. Cash and equivalents totalled $109.1 million. Borrowings totalled $25 million resulting in a net cash and equivalents position of $84.1 million**

- Gold Road became debt free*** after repaying $25 million of borrowings on 21 July 2020.

Gold Road Managing Director and CEO Duncan Gibbs commented: “June saw us celebrate our first year of gold production at Gruyere. The journey has been an exciting one and an outstanding performance for an operation in its first year of production. But the journey continues for us as we look to unlock further efficiencies at Gruyere. We are seeing some positive signs in terms of throughput and recoveries, but we are still on the journey of improving plant availability as we continue to transition into fresh rock. The strong cash flow performance at Gruyere has enabled us to pay down all our debt within less than 10 months from declaring commercial production and this leaves us in a very strong position.

Gruyere and Gold Road have experienced no material production impacts as a result of the COVID-19 crisis. I wish to thank the Gruyere team, our employees, contractors and suppliers for their diligence and excellent performance through this difficult time.

Our exploration push continues in the underexplored Yamarna Greenstone Belt. The half year saw us realign strategy to increase the likelihood of us making meaningful discoveries, as befits a company of our size. The relatively shallow aircore drilling completed so far this year will lead to deeper bedrock drilling of new targets over the coming 6 to 12 months.”

Notes:

- (*) Note Revenue, EBITDA, cash flow and NPAT excludes the sale of 5,330 ounces of unsold gold held in bullion and dore at 30 June 2020. Financial results are GOR attributable unless otherwise stated.

- (**) Refer to ASX announcement on 24 July 2020

- (***) Debt free refers to repayment of borrowings.

[I hold GOR shares in my SMSF, along with NST, EVN, SAR, SBM, RRL, RMS and some QAU.]

[Gold Road (GOR) owns 50% of the world-class Gruyere gold mine in central WA, east of Laverton, which was developed in Joint Venture (JV) with the much larger South-African-based Gold Fields Ltd. Gruyere produced first gold in June 2019, so the company - and the JV - is still very young. GOR has provided us with the lowest AISC (cost) guidance for the next 6 to 12 months of ANY of our 25 current ASX-listed gold producers, excluding those who are based off-shore (and have secondary listings on the ASX) and also excluding those (like IGO, SFR, OZL, BHP, etc.) who produce gold as a byproduct of other production or where gold is less than 70% of their total metals production. After those exclusions, you are left with 25 Australian-based pure-play gold producers - see here for the full list (you'll have to scroll down a few posts to find it) - and GOR have the LOWEST current AISC guidance (lowest costs) of all of them, however GOR also produce a lot less gold (being their 50% share of Gruyere production) than most of the rest of the top 12 producers, and they are still a single mine company, so that also needs to be taken into account when comparing them against other gold producers.]

28-May-2020: 2020 AGM CEO Presentation and 2020 AGM Chairman's Address to Shareholders

30-Jan-2020: Quarterly Activities Report and Appendix 5B - December 2019

Great report. Market liked it. GOR was up +11.15% today (up 15 cents) on the back of it, from a $1.345 close yesterday to a $1.495 close today, being the best performing gold miner today by a country mile. And I only just raised my PT ("Valuation") for GOR this week (two days ago) to $1.60, and they're already only 10.5 cents away from reaching it (!) Now if only I owned some GOR shares....

29-Jan-2019: Gold Road Resources (GOR) is an emerging gold producer that may well be (or soon become) a takeover target for a bigger player.

GOR released an announcement today detailing their progress at Gruyere - see here.

Highlights:

- Successful introduction of material through Primary Crusher to Coarse Ore Stockpile

- First ore mined as scheduled

- First gold production remains on target for June 2019 quarter

- Construction is 91% complete and remains on schedule and on budget

The rumour is that Newcrest (NCM), Australia's largest listed gold producer, is running their ruler over GOR. It could just be a rumour of course, and rumours - and takeover speculation in general - are no basis for buying shares, but it's worth noting.

Post a valuation or endorse another member's valuation.